The BBVA share

Global economic growth may have slowed slightly in the third quarter of 2018 to rates somewhat below 1% quarterly. Although the pace of expansion remains robust, it is geographically less synchronized, with the strength of the United States economy that contrasts with the moderation seen in China, Europe and some emerging economies. The fact that both the Federal Reserve (Fed) and the ECB have taken steps toward the normalization of their monetary policy and, although they continue to support activity, this process has led to an increase in financial tensions in the emerging economies due to the appreciation of the dollar and the reduction of liquidity. However, the rebound in financial tensions has been especially concentrated in the more vulnerable emerging countries, with a clear difference between them. The main risk continues to be protectionism, despite the fact that the direct effect on global growth of the measures taken could be limited, the indirect impact of lower confidence and financial volatility could be felt in the coming quarters and increase uncertainty.

Most stock-market indices showed a downward trend during the first nine months of the year 2018. Thus, the Stoxx 50 and the Euro Stoxx 50 fell by 3.5% and 3.0%, respectively, year-to-date; while in Spain, the Ibex 35 lost 6.5% over the same period. In contrast, in the United States the S&P 500 index gained 9.0% in the last nine months (up 7.2% in the third quarter).

In this context, the BBVA share closed September at €5.49, a fall of 22.8% for this year.

BBVA share evolution

Compared with European indices (Base indice 100=30-09-2017)

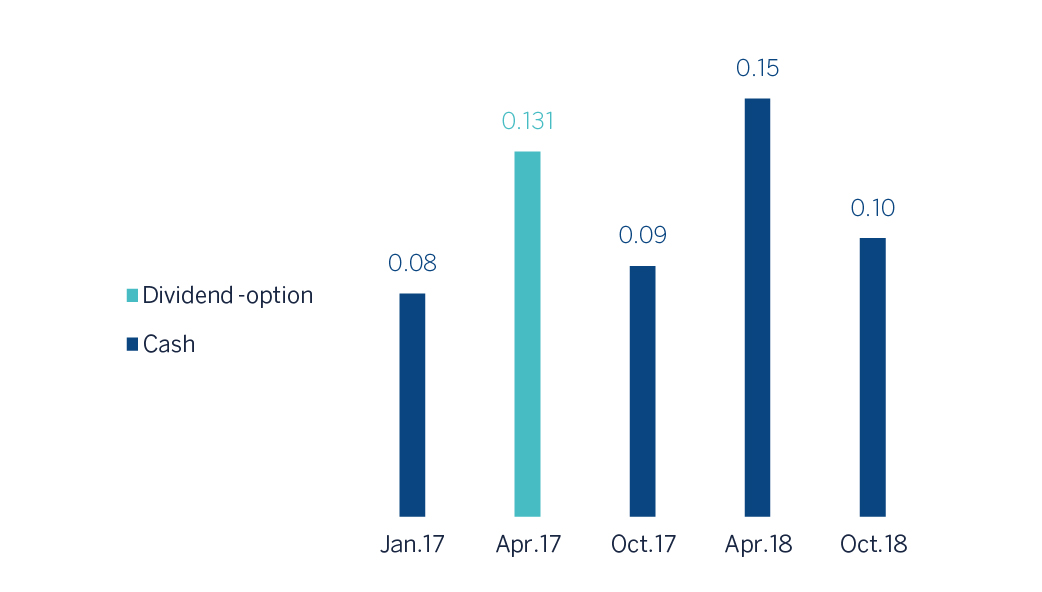

Regarding shareholder remuneration, on October 10, BBVA paid in cash a gross amount of €0.10 per share on account of the 2018 fiscal year. This payment is consistent with the shareholder remuneration policy announced by Relevant Event of February 1, 2017, that envisages, subject to the pertinent approvals by the corresponding corporate bodies, the payment of two dividends in cash, foreseeably on October and April of each year.

Shareholder remuneration

(Euros-gross/share)

Group information

- Generalized growth in recurrent revenue for almost all geographic areas.

- Operating expenses remain under control.

- Lower amount of impairment on financial assets not measured at fair value through profit or loss.

- The result of corporate operations amounted to €633 million and includes the capital gains (net of taxes) arising from the sale of approximately 68.2% of BBVA's equity stake in BBVA Chile.

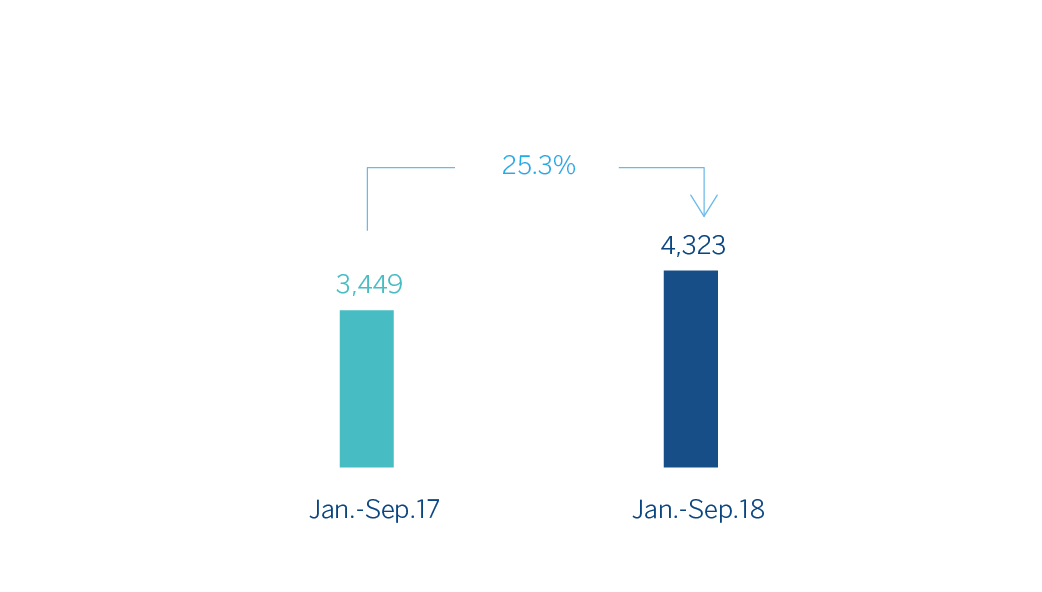

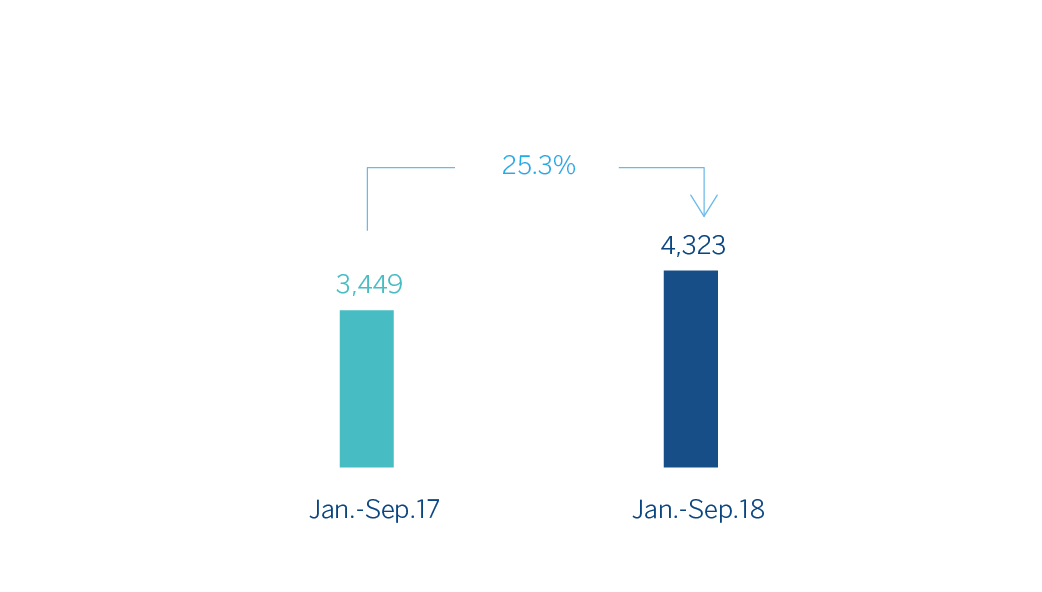

- The net attributable profit was €4.323 million, 25.3% higher than in the first nine months of the previous year. Net attributable profit excluding results from corporate operations stood at €3,689 million, 7.0% higher.

Net attributable profit (Millions of Euros)

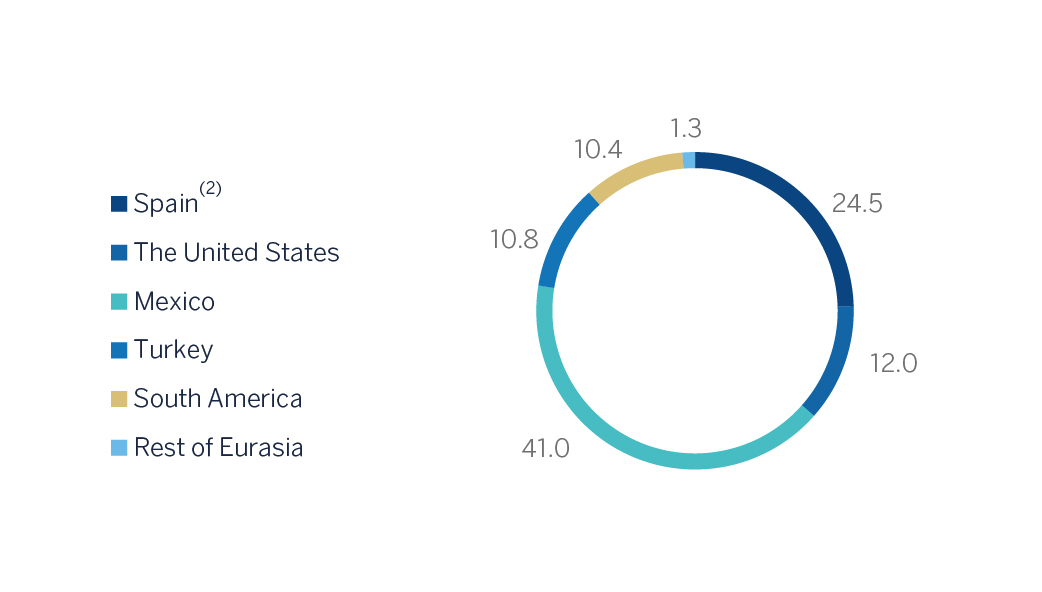

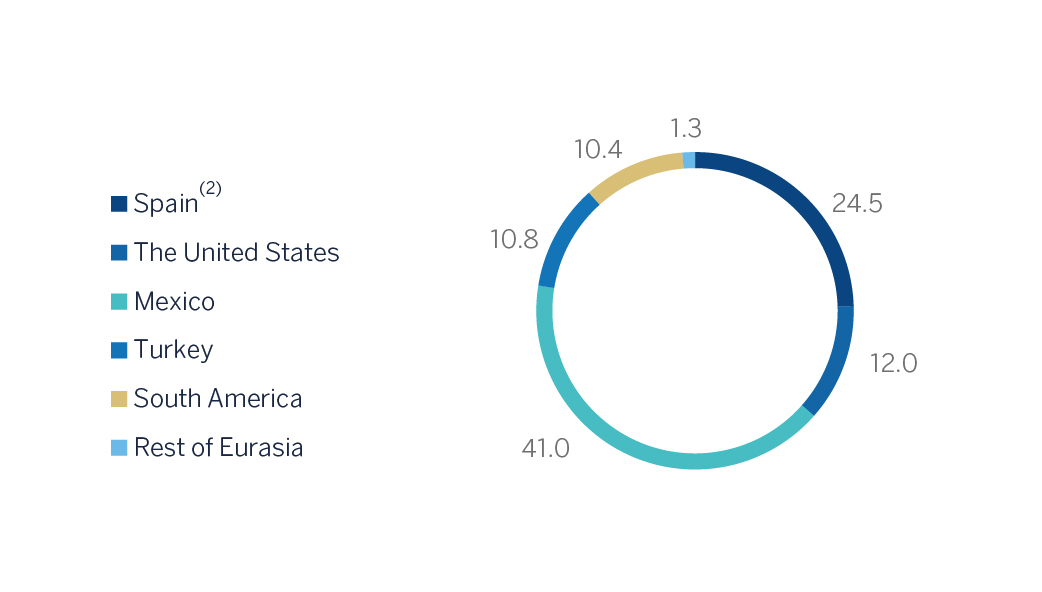

Net attributable profit breakdown(1) (Percentage. January-September 2018)

(1) Excludes the Corporate Center.

(2) Includes the areas Banking activity in Spain and Non Core Real Estate.

- Lower volume of loans and advances to customers (gross). However, there was growth in United States, Mexico and South America (excluding BBVA Chile).

- Non-performing loans continue to improve.

- Within the off-balance-sheet funds, mutual funds continue to perform positively.

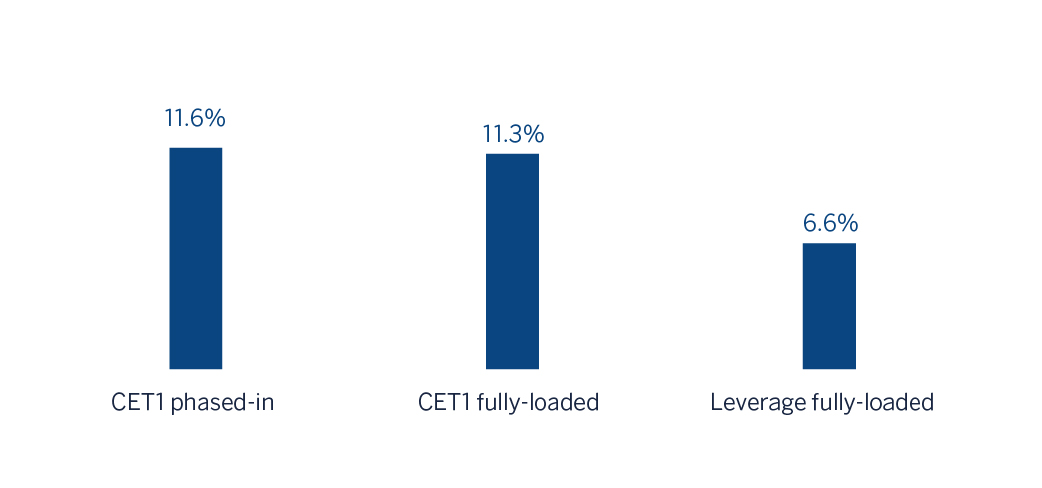

- The capital position is above regulatory requirements.

- BBVA has placed an issuance of €1 billion in of preferred securities contingently convertible into newly issued ordinary shares of BBVA. The remuneration has been set at 5.875%, matching the cheapest obtained by BBVA for this type of issuances.

Capital and leverage ratios (Percentage as of 30-09-2018)

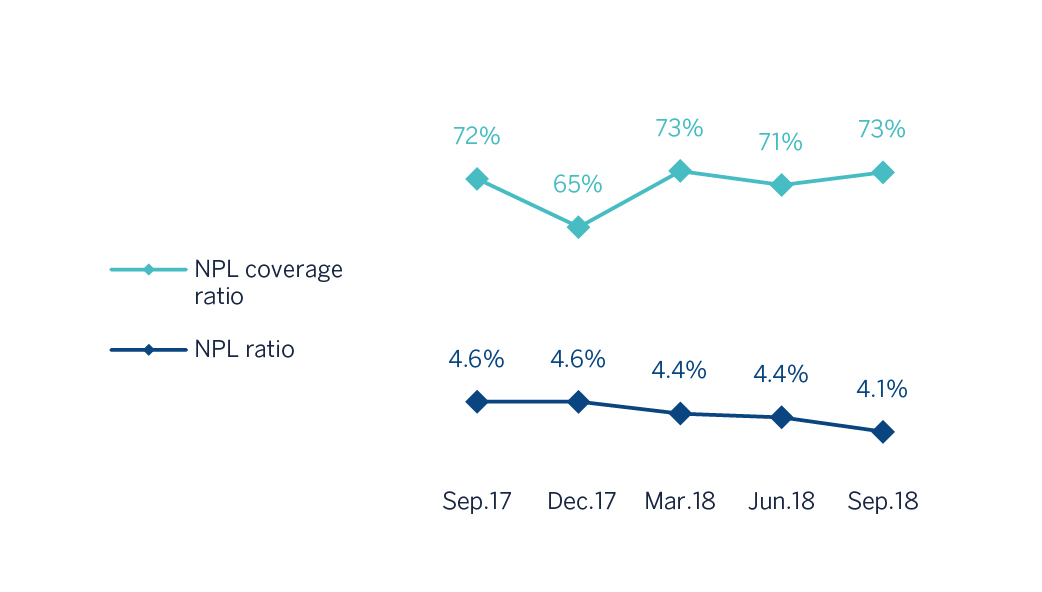

- Solid indicators of the main credit-risk metrics: as of 30-September-2018, the NPL ratio closed at 4.1%, the NPL coverage ratio at 73% and the cumulative cost of risk at 0.90%.

NPL and NPL coverage ratios (Percentage)

- The financial statements of the Group for the third quarter includes, on one hand, the negative impact derived from the accounting for hyperinflation in Argentina (- €190 million) in the net attributable profit, and on the other hand, the positive impact on equity of €104 million.

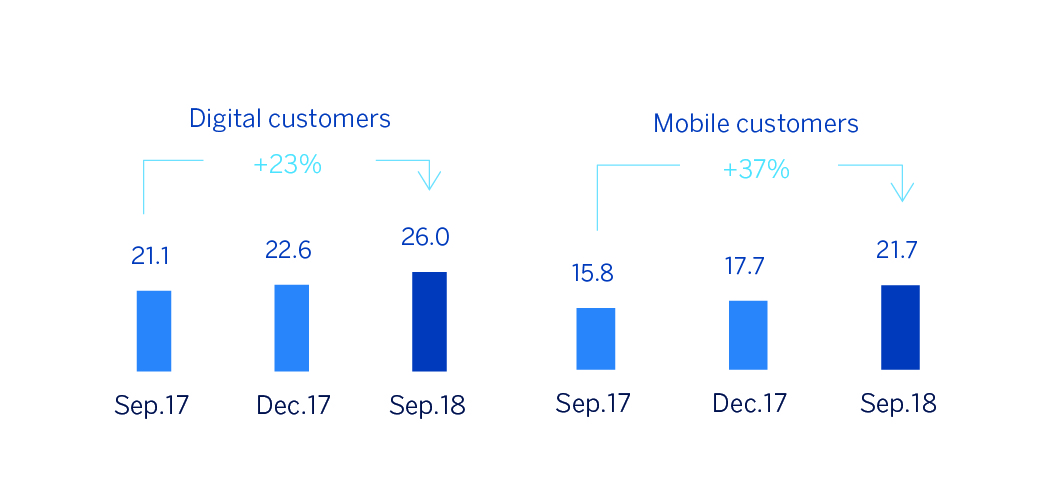

- The Group's digital and mobile customer base and digital sales continue to increase in all the geographic areas where BBVA operates with a positive impact in efficiency.

Digital and mobile customers (Millons)

- On October 10, BBVA completed the sale agreement to Cerberus of 80% of the joint venture to which BBVA had transferred its real estate business in Spain. The Group's financial statements for the third quarter of 2018 do not include the impacts of this operation.

- BBVA has signed the sale to Blackstone of its 25.24% stake in Testa, valued at €478m, which is expected to close during the last quarter of the year.

- The figures corresponding to the first nine months of 2018 are prepared under International Financial Reporting Standard 9 (IFRS 9), which entered into force on January 1, 2018. This new accounting standard did not require the comparative information from prior periods, so the comparative figures shown for the year 2017 have been prepared in accordance with the IAS 39 (International Accounting Standard 39) regulation in force at that time.

- The impacts derived from the first application of IFRS 9, as of January 1, 2018, were registered with a charge to reserves of approximately €900m mainly due to the allocation of provisions based on expected losses, compared to the model of losses incurred under the previous IAS 39.

- In capital, the impact derived from the first application of IFRS 9 has been a reduction of 31 basis points with respect to the fully-loaded CET1 ratio of December 2017.

Results

- Generalized growth in recurrent revenue for almost all geographic areas.

- Operating expenses remain under control.

- Lower amount of impairment on financial assets not measured at fair value through profit or loss.

- The result of corporate operations amounted to €633 million and includes the capital gains (net of taxes) arising from the sale of approximately 68.2% of BBVA's equity stake in BBVA Chile.

- The net attributable profit was €4.323 million, 25.3% higher than in the first nine months of the previous year. Net attributable profit excluding results from corporate operations stood at €3,689 million, 7.0% higher.

Net attributable profit (Millions of Euros)

Net attributable profit breakdown(1) (Percentage. 1H 2018)

(1) Excludes the Corporate Center.

(2) Includes the areas Banking activity in Spain and Non Core Real Estate.

Banking activity in Spain

Non Core Real Estate

The United States

Mexico

Turkey

South America

Rest of Eurasia

Contact

Shareholder attention line

Shareholder attention line902 200 902

912 24 98 21

Subscription service

Subscription service  Shareholder Office

Shareholder Office Contact email

Contact email