4.6.1. General characteristics of securitizations

4.6.1.1. Purpose of securitization

The Group’s current policy on securitization involves a program of recurrent issue, with an intended diversification of securitized assets that adjusts their volume to the Bank’s capital requirements and to market conditions.

This program is complemented by all the other finance and equity instruments, thereby diversifying the need to resort to wholesale markets.

The definition of the strategy and the execution of the operations, as with all other wholesale finance and capital management, is supervised by the Assets & Liabilities Committee, with the pertinent internal authorizations obtained directly from the Board of Directors or from the Executive Committee.

The main purpose of securitization is to act as an instrument for efficient balance-sheet management, as a source of:

- Liquidity at an efficient cost, complementing all the other finance instruments.

- Freeing up regulatory capital, through the transfer of risk.

- Freeing up potential excesses of generic allowances for losses, provided that the volume of the first-loss tranche and the effective risk transfer so permit.

4.6.1.2. Functions pursued in the securitization process and degree of involvement

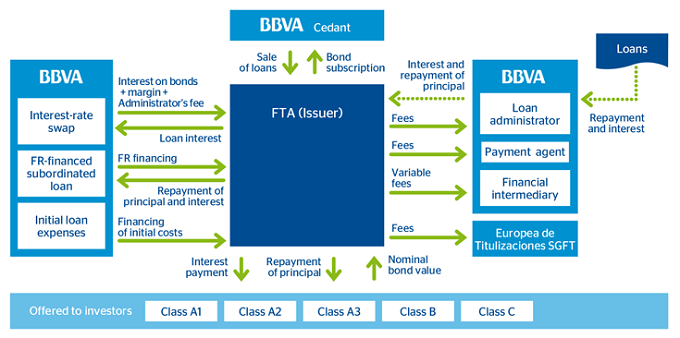

The Group’s degree of involvement in its securitization funds is not normally restricted to the mere role of assignor and administrator of the securitized portfolio.

Group’s degree of involvement

The Group has commonly assumed such additional roles as:

- Direct counterparty of the swap, given that the Group’s rating permits this through the Spanish Banking Association’s Framework Contractual Agreements for Financial Operations (CMOF) with the securitization fund.

- Payment Agent.

- Provider of the treasury account.

- Provider of the subordinated loan and of the loan for start-up costs, with the former being the one that finances the first-loss tranche, and the latter financing the fund’s fixed expenditure.

- Administrative agent of the securitized portfolio.

The Group has not assumed the role of sponsor of securitizations originated by third-party institutions.

The Group’s balance sheet maintains the first-loss tranches of all securitizations performed.

It is worth noting that the Group has not modified its model for the generation of securitization operations since the credit crunch, which began in July 2007. Accordingly:

- There has been no transfer of risk through synthetic securitizations. All operations have involved traditional securitizations with simple structures in which the underlying assets were loans or financial leasing.

- It has not been involved in recurrent structures such as conduits or SIVs. All its issues have been one-offs, with no mandatory commitments for asset repackaging or the replacement of loans.

4.6.1.3. Methods used for the calculation of risk-weighted exposures in its securitization activity

The methods used to calculate risk-weighted exposures in securitizations are:

- The standardized approach: when this method is used for fully securitized exposures, in full or in a predominant manner if it involves a mixed portfolio.

- The IRB approach: when internal models are used for securitized exposures, in full or in a predominant manner. Within the alternatives of the IRB approach, use is made of the model based on external ratings.

4.6.2. Risk transfer in securitization activities

A securitization fulfills the criterion of significant and effective transfer of risk, and therefore falls within the solvency framework of the securitizations, when it upholds the conditions laid down in Rules Fifty-five and Fifty-six in the Solvency Circular.

4.6.3. Investment or retained securitizations

The following table presents the amounts in terms of EAD of investment and retained securitizations by type of exposure, tranche and weighting ranges that correspond to securitizations that, in the case of those originated in the Group, fulfill the criteria of risk transfer as of December 31, 2012 and 2011.

2012

(Million euros)

|

|

|

|

EAD broken down by ECAI tranches | |||||

|---|---|---|---|---|---|---|---|---|

|

|

|

|

Standard | Advanced | ||||

| Securitization type | Securitization type | Tranche | 20% | 40%; 50%; 100%; 225% 350%. 650% | 1,250% | RW<15% | 15%<RW<1,250% | 1,250% |

| Investment | Balance sheet exposure | Preferential | 5,783 | 0 | 0 | 20 | 0 | 0 |

| Intermediate | 0 | 263 | 0 | 0 | 578 | 0 | ||

| First-loss | 0 | 0 | 23 | 0 | 0 | 30 | ||

| Offbalance sheet exposure | Preferential | 0 | 0 | 0 | 0 | 0 | 0 | |

| Intermediate | 0 | 0 | 0 | 0 | 0 | 0 | ||

| First-loss | 0 | 0 | 0 | 0 | 0 | 0 | ||

| TOTAL | 5.783 | 263 | 23 | 20 | 578 | 30 | ||

| Retained | Balance sheet exposure | Preferential | 24 | 0 | 0 | 91 | 0 | 0 |

| Intermediate | 0 | 154 | 0 | 0 | 1.692 | 0 | ||

| First-loss | 0 | 0 | 198 | 0 | 0 | 313 | ||

| Offbalance sheet exposure | Preferential | 0 | 0 | 0 | 0 | 0 | 0 | |

| Intermediate | 0 | 0 | 0 | 0 | 0 | 0 | ||

| First-loss | 0 | 0 | 0 | 0 | 0 | 0 | ||

| TOTAL | 24 | 154 | 198 | 91 | 1,692 | 313 | ||

The increase observed in the exposure calculated by the standardized method is due to the incorporation of the Unnim securitizations.

The reduction in the EAD weighted at 1,250% is due to a change of criteria for these exposures, which are now deducted directly from the capital base calculated through the 50% deductions in Tier I and Tier II.

The securitizations calculated under the advanced method have increased due to the repurchases made during the year. There has also been a deterioration in the rating for securitizations based on the internal rating scale of the model, which has increased their weighted risk exposure.

2011

(Million euros)

|

|

|

|

EAD broken down by ECAI tranches | |||||

|---|---|---|---|---|---|---|---|---|

|

|

|

|

Standard | Standard | ||||

| Securitization type | Securitization type | Tranche | 20% | 40%; 50%; 100%; 225% 350%. 650% | 1,250% | RW<15% | 15%<RW<1,250% | 1,250% |

| Investment | Balance sheet exposure | Preferential | 5,295 | - | - | 670 | - | - |

| Intermediate | - | 90 | - | - | 15 | - | ||

| First-loss | - | - | 175 | - | - | 52 | ||

| Offbalance sheet exposure | Preferential | 0 | - | - | 0 | - | - | |

| Intermediate | - | 0 | - | - | 0 | - | ||

| First-loss | - | - | 0 | - | - | 0 | ||

| TOTAL |

|

|

175 | 670 | 15 | 52 | ||

| Retained | Balance sheet exposure | Preferential | 304 | - | - | 1,175 | - | - |

| Intermediate | - | 196 | - | - | 25 | - | ||

| First-loss | - | - | 119 | - | 0 | 109 | ||

| Offbalance sheet exposure | Preferential | 0 | - | - | 0 | - | - | |

| Intermediate | - | 0 | - | - | 0 | - | ||

| First-loss | - | - | 41 | - | - | 0 | ||

| TOTAL | 304 | 196 | 160 | 1,175 | 25 | 109 | ||

4.6.4. Originated securitizations

4.6.4.1. Rating agencies used

The rating agencies that have been involved in the Group's issues that fulfill the criteria of risk transfer and fall within the securitizations solvency framework are, generally, Fitch, Moody’s, S&P and DBRS.

In all the SSPEs, the agencies have assessed the risk of the entire issuance structure:

- Awarding ratings to all bond tranches.

- Establishing the volume of the credit enhancement.

- Establishing the necessary triggers (early termination of the restitution period, pro-rata amortization of AAA classes, pro-rata amortization of series subordinated to AAA and amortization of the reserve fund, amongst others).

In each and every one of the issues, in addition to the initial rating, the agencies carry out regular quarterly monitoring.

4.6.4.2. Breakdown of securitized balances by type of asset

The next tables give the current outstanding balance, non-performing exposures and impairment losses recognized in the period corresponding to the underlying assets of originated securitizations, in which risk transfer criteria are fulfilled, by type of asset, as of December 31, 2012 and 2011.

2012

(Million euros)

| Asset type | Current balance | Of which: Past-due exposures (1) | Total impairment losses for the period |

|---|---|---|---|

|

|

|

|

|

| Commercial and residential mortgages | 4,884 | 381 | 5 |

| Credit cards | 0 | 0 | 0 |

| Financial leasing | 402 | 32 | 22 |

| Lending to corporates or SMEs | 694 | 74 | 13 |

| Consumer finance | 577 | 45 | 24 |

| Receivables | 0 | 0 | 0 |

| Securitization balances | 0 | 0 | 0 |

| Other | 0 | 0 | 0 |

| TOTAL | 6,557 | 532 | 64 |

2011

(Million euros)

| Asset type | Current balance | Of which: Past-due exposures (1) | Total impairment losses for the period |

|---|---|---|---|

|

|

|

|

|

| Commercial and residential mortgages | 5,249 | 460 | 6 |

| Credit cards | 0 | 0 | 0 |

| Financial leasing | 575 | 56 | 0 |

| Lending to corporates or SMEs | 1,021 | 100 | 23 |

| Consumer finance | 1,009 | 75 | 12 |

| Receivables | 0 | 0 | 0 |

| Securitization balances | 0 | 0 | 0 |

| Other | 0 | 0 | 0 |

| TOTAL | 7,855 | 693 | 41 |

The Group has not securitized positions in revolving structures.

In 2012 and 2011, there were no securitizations that fulfill the transfer criteria according to the requirements of the Solvency Circular, and, therefore, no results were recognized.

BBVA has been the structure of all transactions effected since 2006 (Unnim transactions excluded).

The next table gives the current outstanding balance of underlying assets of securitizations originated by the Group, in which risk transfer criteria are not fulfilled. These therefore do not enter within the solvency framework of securitizations; the capital exposed is calculated as if they had not been securitized:

(Million euros)

|

|

Current balance | |

|---|---|---|

| Asset type | 2012 | 2011 |

| Commercial and residential mortgages | 11,414 | 23,684 |

| Credit cards | 0 | 0 |

| Financial leasing | 31 | 18 |

| Lending to corporates or SMEs | 5,509 | 6,285 |

| Consumer finance | 1,300 | 1,933 |

| Receivables | 0 | 0 |

| Securitization balances | 0 | 0 |

| Covered bonds | 4,402 | 0 |

| Other | 96 | 124 |

| TOTAL | 22,752 | 32,044 |

The fall on the previous year is due to the repurchases made during the year.