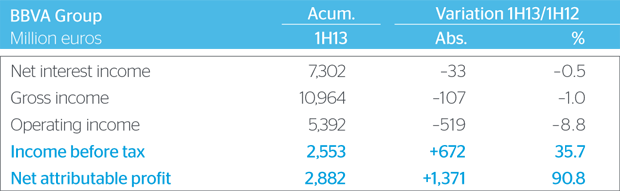

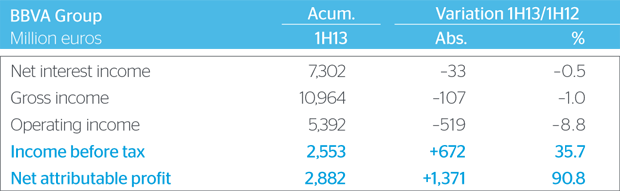

BBVA earned €2,882m from January to June 2013 (up 90.8%), driven by recurring revenue and the sale of non-strategic assets.

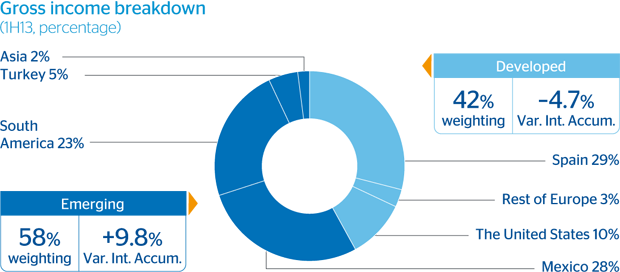

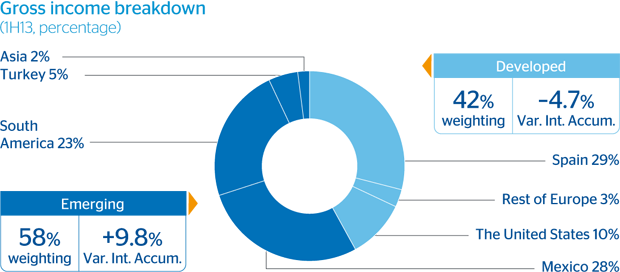

Earnings showed the resilience of revenue, which since the start of the crisis has amount to around €5,000m each quarter in any scenario, thanks to BBVA's diversified model and the contribution from emerging markets. Gross income for the first half of the year stands at €10,964m.

Geographical diversification

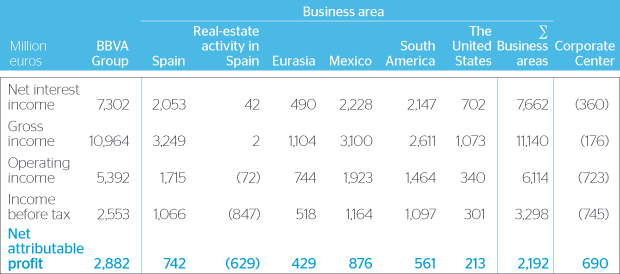

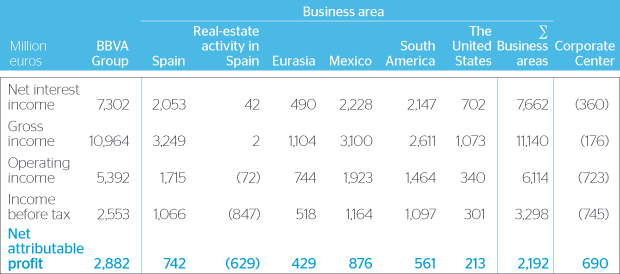

Spain: Banking activity in Spain does not yet reflect the start of economic recovery. Revenue was penalized by reduced activity volumes, low interest rates and the elimination of the floor clauses from consumer mortgage loans. However, BBVA gained market share (190 basis points) and successfully completed the integration of Unnim. The NPA ratio stood at 4.7%, with a 45% coverage ratio.

Real-estate business in Spain: The sale of real estate continued to grow at a strong pace, with 6,617 units sold in the first half of the year, while net exposure to the developer sector continued to decline (down 15.2% since December 2011). Loan-loss provisions were significantly lower than in the first half of 2012.

Main items on the income statement by business area (1H13)

Eurasia: Turkey has consolidated its position as the driver of growth thanks to the strong performance of Garanti, the leading bank in this market. However, the area posted lower net attributable profit (down 25.8%), due partly to the lower contribution from the Chinese bank CNCB as a result of the higher provisions required by local regulation.

Mexico: Strong rate of growth in business activity in both the loan book (up 6.9%) and in customer funds (up 6.8%). Gross income grew by 7.1% compared to the first half of the previous year. Risk indicators remained stable, while the NPA ratio stood 4% and the coverage ratio at 109%.

South America: Double-digit growth in the loan book (up 16.9%) and customer funds (up 26.3%). Margins also grew at very high rates, above 15%. Asset quality was once again outstanding, with an NPA ratio of 2.2% and a coverage ratio of 136%.

United States: Strong activity, with margins affected by an environment of low interest rates and lower income from fees and commissions. The NPA ratio declined to 1.5% and the coverage ratio improved to 118%.

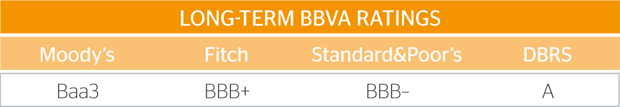

Solvency and liquidity

The BBVA Group's solvency continues to strengthen. The core capital ratio increased to 11.3% according to current Basel regulations. The leverage ratio according to the CRV IV directive (Basel III) stands at 4.8%, compared to a minimum requirement of 3%. BBVA was the first European bank to reinforce its Tier I capital position with the issuance of $1,500m in a new type of contingent convertible securities into ordinary shares.

In the first half of the year, BBVA placed €6,000m in debt issues on several markets and reduced the liquidity gap by more than €15,000m.

The performance of risk indicators continues to be influenced by the situation in Spain and maintained the trend seen in previous months in all geographical areas. Excluding the impact of real-estate activity, the NPA ratio stands at 3.8%.