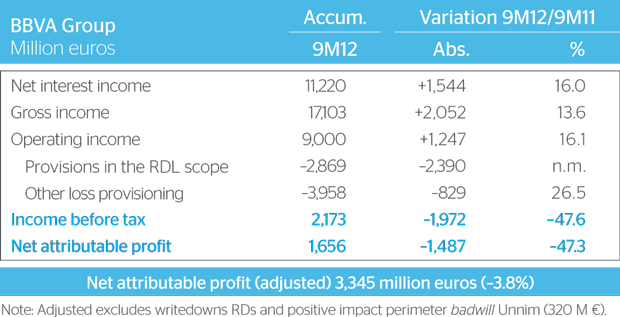

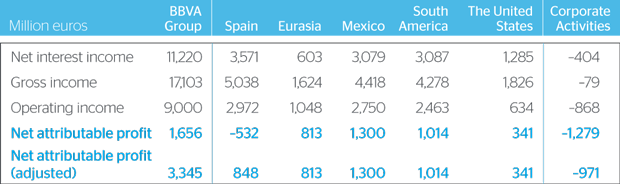

The BBVA Group's earnings for the first nine months of the year amounted to €1,656 million (down 47.3%), after allocating two thirds of the provisions required under the Royal Decrees introducing a financial reform to address real-estate risk in Spain. Excluding the provisions required by this legislation and the positive impact of goodwill from Unnim, the adjusted earnings would have amounted to €3,345m (down 3.8%).

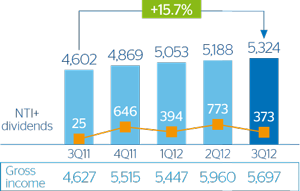

Growth in revenue was underpinned by a balanced diversification between emerging and developed markets, which accounted for 57% and 43% of gross income, respectively. Moreover, revenues rose more sharply than expenses, thereby enabling BBVA to maintain its leading position in terms of efficiency (ratio of 47.4%).

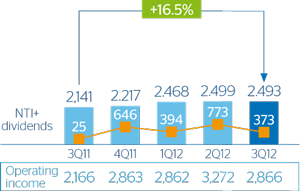

The strong operating income, which is critical for absorbing loan-loss provisions, amounted to €9,000 million between January and September, 16.1% higher than in the same period of 2011.

BBVA has allocated two thirds of the provisions required under the financial reform (Royal Decree-Law 2/2012 and Royal Decree-Law 18/2012), with €1,568 million still pending for the fourth quarter.

Spain: Includes Unnim financial statements (July 27). The area gained market share in lending (111 basis points) and in deposits plus promissory notes (195 basis points). The NPL ratio was 6.5% after the inclusion of Unnim, while the coverage ratio improved to 59%. The net attributable profit was a negative €532 million, but not including the impact of the financial reform it would have been a positive €848 million.

Eurasia: Eurasia's contribution continues to grow. Gross income rose 22.2% to €1,624 million, stemming from Turkey (41%), Asia (31%) and the rest of Europe (28%). Net attributable profit was up 13.0% to €813 million.

Mexico: BBVA Bancomer, leader in the Mexican financial market, reported high revenue figures. Risk indicators were kept in check, with an NPL ratio of 4.1% and a coverage ratio of 107%. The area earned €1,300 million (constant) during the period (up 4.0%).

South America: Benefitted from buoyant financial activity in the region. The loan book increased 19% year-on-year and customer deposits were up 20.1%. The region also improved efficiency and posted excellent risk indicators. Net attributable profit increased by 24.1% (at constant exchange rate) to €1,014 million.

United States: Impairment losses on financial assets continued to improve, with an NPL ratio of 2.4%. Net attributable profit increased by 29.3% (at constant exchange rate) to €341 million. United States: Impairment losses on financial assets continued to improve, with an NPL ratio of 2.4%. Net attributable profit increased by 29.3% (at constant exchange rate) to €341 million.

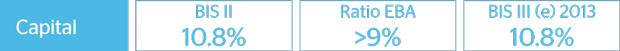

BBVA comfortably passed the theoretical stress test carried out by Oliver Wyman, once again underlining its capacity to generate capital, even in very adverse economic scenarios.

The highest-quality capital was in excess of 9% according to the criterion of the European Banking Authority (EBA), and is in line with its recommendation. The ratio according to the current Basel standards was 10.8%.

The Bank carried out several debt issues on the wholesale markets in the third quarter. These liquidity levels put the Bank in a comfortable position to drive future activity.

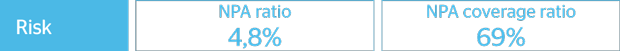

Risk indicators in check. In September, the NPL ratio for the BBVA Group was 4.8%, while the coverage ratio stood at 69% after incorporating Unnim. The NPL ratio in Spain is 403 basis points lower than that of the Spanish banking system as a whole.

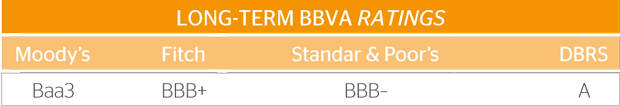

Over the last 12 months, BBVA has been affected by the successive rating downgrades for the Kingdom of Spain. However, the rating agencies have acknowledged the Group's strengths and its geographical diversification.