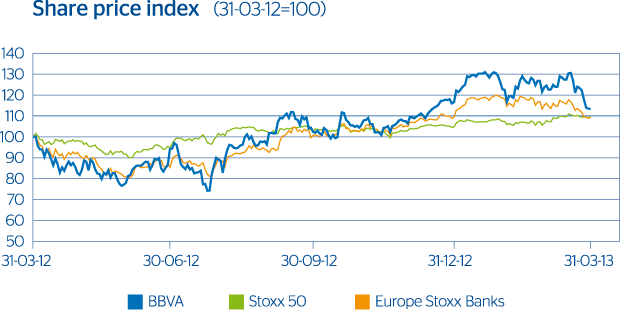

From the point of view of the markets, the quarter started with a positive general mood and a drastic reduction in the perception of risks in the euro zone. This has been possible thanks to the decisive action taken by the European Central Bank (ECB) in mid-2012. However, the political uncertainty in Italy following the general election in February and the collapse of the banking system in Cyprus in March have brought a renewed focus on the area's political and systemic risks.

Against this background, the general European index Stoxx 50 closed March with a quarterly gain of 4.7%. In contrast, the Ibex 35 and the euro zone bank index, Euro Stoxx Banks, ended the period in the red (down 3.0% and 8.8%, respectively), partly reflecting the negative market bias toward the peripheral countries and the financial sector.

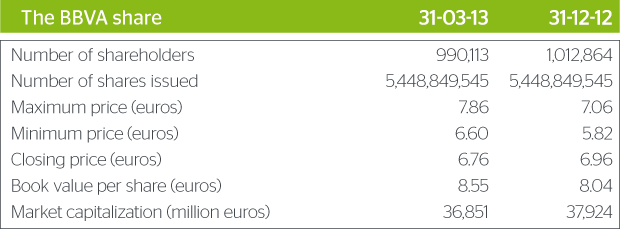

The BBVA share, after rising more than 12.0% in early 2013 compared to the end of 2012, closed the quarter at €6.76 per share. This represents a market capitalization of €36,851 million, a price/book value ratio of 0.8, a P/E (calculated on the average profit for 2013 estimated by the consensus of Bloomberg analysts) of 8.7 and a dividend yield (also calculated according to the average dividend per share forecast by analysts compared with the share price at March 28) of 6.2%.

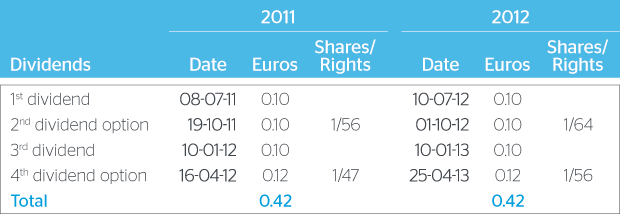

Shareholder remuneration for 2012 is maintained at €0.42 per share. The Annual General Meeting held on March 15, 2013 approved the implementation of the “dividend option” remuneration scheme through two share capital increases against voluntary reserves.

The first paid-up capital increase is taking place in April. Owners of 85.71% of the free allocation rights opted to receive new shares. According to schedule, the new shares will be allocated on April 30, 2013, subject to the obtainment of the required authorizations.