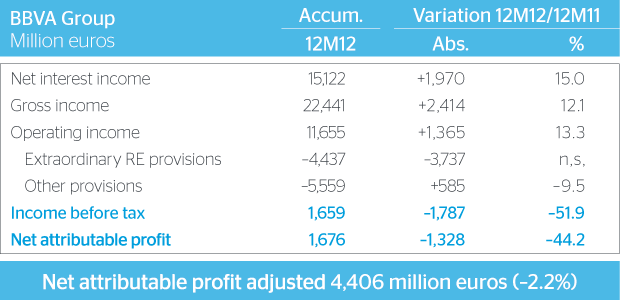

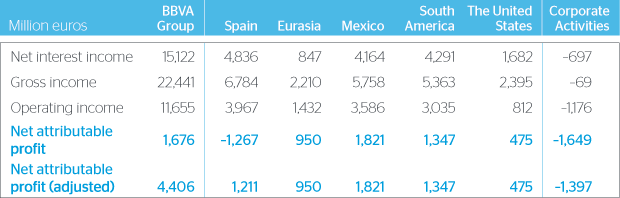

BBVA earned €1,676 million in 2012, 44.2% down on the previous year, once all real-estate provisioning has been completed in Spain. Excluding these charges and the positive one-off impact of the incorporation of Unnim, adjusted earnings for the year were €4,406 billion (down 2.2% year-on-year).

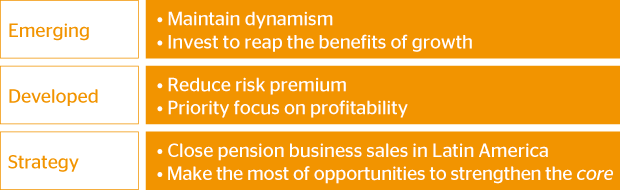

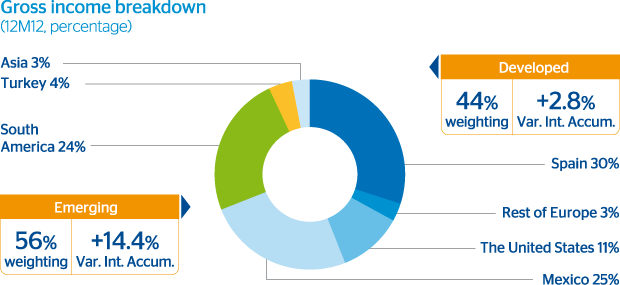

All of the Group's business areas contributed to increased revenues in 2012, which exceeded €22,000 million. The lion's share of gross income of the business areas (56%) was contributed by emerging economies, with their excellent potential for growth and increased banking penetration. Costs increased more slowly than revenues, and were heavily concentrated in strong investment in expansion plans in emerging economies. BBVA continues to top the efficiency ranking in the financial sector (48.1%).

Spain: Our performance is marked by the resilience of revenues in a scenario of very low activity and strong competition for attracting funds, gradually winning market share and improving our customer spread. The NPA ratio (6.9%) was better than the financial system average, with the coverage ratio increasing to 67%. Net attributable profit for the area was negative (-€1,267 million) after absorbing the loan-loss provisions related to impaired real-estate assets. Not including these loan-loss provisions, Spain registered positive earnings of €1,211 million.

Eurasia: This area is making an increasing contribution to the BBVA Group's gross income, thanks to the excellent performance of Garanti (Turkey) and a favorable contribution by CNCB (China). The area recorded positive earnings of €950 million.

Mexico: We are the leader in the country, with robust indicators for both activity and revenues. Our loan book increased by 6.7% at constant exchange rates, and customer funds were up 4.8%. Our risk ratios remained stable (NPA ratio of 3.8% and coverage ratio of 114%). Net attributable profit was €1,821 million, up 4% at constant exchange rates.

South America: BThe area's enormous dynamism was once again reflected in our earnings. The loan book grew by 17.7% at constant exchange rates, while on-balance-sheet funds increased by 23%. All margins increased by over 20% at constant exchange rates. These improvements were combined with improved efficiency and risk control. South America earned €1,347 million, up 23.6% at constant exchange rates.

United States: BBVA Compass showed a selective increase in its loan portfolio (+7.2%) and customer deposits (+12.9%). Excellent asset quality levels, with an NPA ratio of 2.4% and coverage ratio of 90%. The area focused on controlling costs, boosting its technological platform and maintaining a robust liquidity position. Net attributable profit was €475 million.

BBVA demonstrates its robust position and its ability to improve its capital ratios. Our core capital ratio under Basel II criteria increased from 10.3% in December 2011 to 10.8% (+45 basis points). Furthermore, the Group has complied with all recommendations from supervisors without selling any of its strategic assets and while maintaining its dividend policy.

BBVA has managed its balance sheet excellently, improving its liquidity gap by €23,000 million euros since December 2011. Debt issues amounted to around €14,000 million, and the bank has returned to the capital markets in 2013.

In a particularly difficult year, BBVA has set aside provisions of €4.4 billion for loan-loss provisioning and foreclosed and acquired assets within the scope of Royal Decree-Laws 2/12 and 18/12, complying with these legislative requirements.

The BBVA Group's NPA ratio was 5.1%, below the 6% average of our competitors, with the coverage ratio up eleven percentage points to 72%.