Shareholders, trading and share price

Europe is starting to come out of the recession and registers positive growth rates. Private demand is strong in the United States, despite long-term fiscal uncertainty. Emerging economies have been affected by the tightening of financial conditions at a global level. However, uncertainty has receded as real activity in China has proved to be stronger than expected, and following the Fed's announcement of an extension of its current monetary policy.

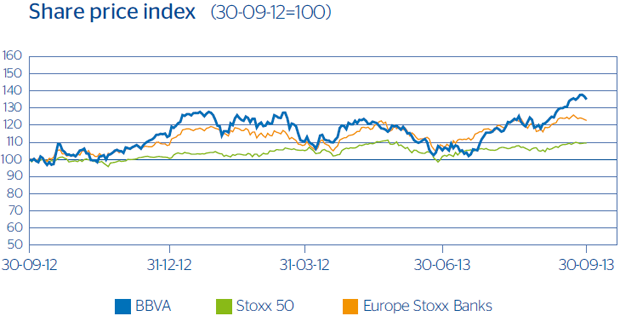

Performance in global financial markets has been more positive. At the close of September, the Stoxx 50 rose 6.6% in quarterly terms, while the Ibex 35 and the Euro Stoxx Banks were up 18.3% and 24.1%, respectively.

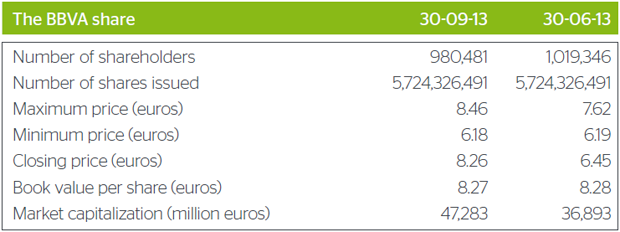

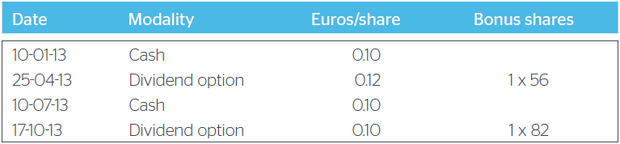

The BBVA share price appreciated by 28.2% in the quarter to €8.26 per share. This represents a price/book value of 1.0, a P/E of 13.7 (calculated on the average profit for 2013 estimated by the consensus of Bloomberg analysts) and a dividend yield of 5.1% (also calculated according to the average dividend per share estimated by analysts on the share price as of September 30).