Shareholders, trading and share price

The advanced economies recovered in the first half of 2014, improving their contribution to global growth. The financial markets remained relatively calm, with episodes of volatility more linked to geopolitical risk events than to monetary policy decisions. Capital flows returned to bonds and shares of emerging economies and to financial assets of the peripheral Eurozone countries.

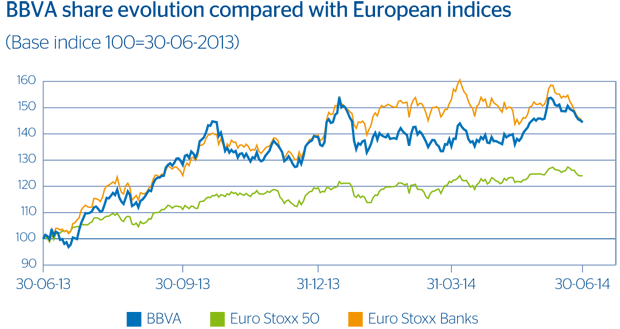

In the financial markets, the Stoxx 50 general European index closed the month of March with a quarterly revaluation of 2.1%. The Ibex 35 closed with a 5.6% revaluation. The banking index for the Eurozone (Euro Stoxx Banks) declined 5.6% influenced by the possible impact of significant fines that could be imposed on some of the main European investment banks.

BBVA's earnings in the first quarter of 2014 stand out thanks to the favorable performance of recurring revenues, the cost-reduction efforts made and the fall in the risk premium.

The BBVA share price increased by 6.8% in the quarter and 44.4% over the last 12 months, with a market capitalization of €54,804 million euros, which puts the price/book value ratio at 1.2, the P/E ratio at 17.2 and the dividend yield at 3.8%.