The share

Economic global growth has slowed down through 2023 and, particularly, during the last months, due to the high inflation, the tightening of monetary conditions and the gradual fading of the positive effects linked to the reopening after the COVID-19 pandemic. The slowdown has been, in general, less harsh than expected, and economic activity remains relatively dynamic, particularly in the Unites States, thanks to the dynamism of the labor markets, expansionary fiscal policies and the gradual fading of supply shocks triggered by the pandemic and the war in Ukraine.

Falling commodity prices compared to the levels seen in 2022 and the improvements in production process bottlenecks have contributed to a significant moderation of inflation. which, in annual terms, reached 3.4% in the United States and 2.9% in the Eurozone in December 2023, far below the levels registered at the end of 2022 (6.5% in the United States and 9.2% in the Eurozone).

In this context, the process of interest rate hikes launched approximately two years ago seems to have reached an end. According to BBVA Research, it is most likely that inflation will keep evolving favorably in the next months, enabling the start of a gradual process of relaxation of monetary conditions around mid-2024, which would take monetary policy interest rates to around 4.50% in the United States and 3.75% (in the case of refinancing operation rates) in the Eurozone by the end of 2024. However, it cannot be ruled out that monetary policy benchmark rates might be reduced more quickly in the future, mainly if inflation evolves surprisingly on the downside. In any case, it is expected that both the U.S. Federal Reserve ("Fed") and the European Central Bank ("ECB") will continue taking liquidity reduction measures over 2024.

BBVA Research forecasts that global growth will be approximately 3.0% in 2024 (unchanged from the previous forecast and similar to the forecasted for the GDP growth in 2023) In the United States, strong domestic demand supports a slightly upward revision of growth forecasts for 2023, from 2.3% to 2.4%, but the restrictive monetary conditions are likely to contribute to a growth deceleration in 2024, to 1.5%, without changes from the previous forecast. In China, structural challenges to avoid a fast economic deceleration remain, but a series of stimulus measures have enabled a greater than expected dynamism of activity in the past few months, which supports an upward revision of the growth in 2023 from 4.8% to 5.2%. The GDP growth forecast for 2024 remains unchanged at 4.4%. In the Eurozone, economic activity came to a standstill in the last months, reinforcing the low growth prospects; the forecast of the GDP expansion of the region remains at 0.4% for 2023 and it has been cut from 1.0% to 0.7% for 2024.

In this context of below potential growth and still high interest rates, aggregate demand moderation will probably favor an additional inflation reduction, which, however, would remain somewhat over the inflation targets in the United States and the Eurozone until the end of 2024.

In any case, uncertainty remains high, and a number of factors could lead to more adverse scenarios unfolding. Persistently high inflation and high interest rates, due to eventual supply shocks generated by the current geopolitical turbulence, and particularly by the recent maritime trade disruptions in the Red Sea, or other factors, could trigger a deep and widespread recession, as well as new bouts of financial volatility. Moreover, the slowdown in China could end up being more severe than expected. Finally, current geopolitical turbulence might contribute to higher energy prices and new disruptions in global supply chains.

The main indexes have shown a positive performance in 2023. In Europe, the Stoxx Europe 600 index increased by 12.7% compared to the end of 2022, and in Spain the Ibex 35 rose by 22.8% in the same period, showing a better relative performance. In the United States, the S&P 500 index also increased by 24.2%.

With regard to the banking sector indexes, the performance during 2023 was better than the general indexes in Europe. The Stoxx Europe 600 Banks index, which includes the banks in the United Kingdom, and the Euro Stoxx Banks, an index of Eurozone banks, increased by 20.3% and 23.5% respectively, while in the United States, the S&P Regional Banks sector index fell by -10.8% in the period.

As for BBVA’s share price, it increased by 46.0% during the year, outperforming its sector index, closing 2023 at €8.23.

BBVA share evolution

Compared with European indexes (Base indice 100=31-12-22)

BBVA

Eurostoxx-50

Eurostoxx Banks

The BBVA share and share performance ratios

| 31/12/2023 | 30/09/2023 | |

|---|---|---|

| Number of shareholders | 742,194 | 764,567 |

| Number of shares issued (millions) | 5,838 | 5,965 |

| Closing price (euros) | 8.23 | 7.71 |

| Book value per share (euros) (1)(2) | 8.86 | 8.53 |

| Tangible book value per share (euros) (1)(2) | 8.46 | 8.13 |

| Market capitalization (millions of euros) | 48,023 | 45,994 |

| Yield (dividend/price; %) (2)(3) | 5.7 | 5.6 |

(1) Balances restated according to IFRS 17 -Insurance contracts.

(2) For more information, see Alternative Performance Measures at the end of the quarterly report.

(3) Calculated by dividing the dividends paid in the last twelve months by the closing price of the period.

Regarding shareholder remuneration, which includes cash payments and the remuneration resulting from the execution of the share buyback programs that the Group may execute, a cash gross distribution in the amount of €0.39 per share on April as final dividend of 2023 and the execution of a new Share Buyback Program of BBVA for an amount of €781m, subject to the corresponding regulatory authorizations and the communication with the program specific terms and conditions before its effective start, are expected to be submitted to the relevant governing bodies for consideration. Thus, the total distribution for the year 2023 will reach €4,010m, a 50% of the net attributable profit, which represents €0.68 per share, taking into account the payment in cash of €0.16 gross per share paid in October 2023 as interim dividend of the year.

During the year 2023, BBVA has executed two share buyback programs. The first program was announced on February 1, 2023 for a maximum amount of €422m and was part of the ordinary application of the shareholder remuneration policy of the year 2022. On April 21, 2023, BBVA announced the completion of this, having acquired 64,643,559 own shares between March 20 and April 20, 2023, representing approximately 1.07% of BBVA's share capital as of said date. The shares acquired in the execution of this first share buyback program were redeemed on June 2, 2023. The second program, which is considered extraordinary shareholder remuneration and thus is not included in the ordinary remuneration policy, was announced on July 28, 2023, for a maximum amount of €1,000m. On November 29, 2023, BBVA announced the completion of this, having acquired 127,532,625 own shares between October 2 and November 29, 2023, representing approximately 2.14% of BBVA's share capital as of said date. The shares acquired in the execution of this second share buyback program were redeemed on December 19, 2023. Thus, the total amount disbursed in both share buyback programs stands at €1,422m.

On December 31, 2023 the number of BBVA shares outstanding was 5,838 million. The number of shareholders reached 742,194, and by type of investor, 61.7% of the capital was held by institutional investors and the remaining 38.3% was in the hands of retail shareholders.

BBVA shares are included on the main stock market indexes. At the end of September 2023, the weighting of BBVA shares in the Ibex 35, Euro Stoxx 50 and the Stoxx Europe 600 index, were 9.2%, 1.6% and 0.5%, respectively. They are also included on several sector indexes, including Stoxx Europe 600 Banks, which includes the United Kingdom, with a weighting of 5.7% and the Euro Stoxx Banks index for the eurozone with a weighting of 9.5%. Moreover BBVA maintains a significant presence on a number of international sustainability indexes, such as, Dow Jones Sustainability Index (DJSI), FTSE4Good or MSCI ESG Indexes.

Group's information

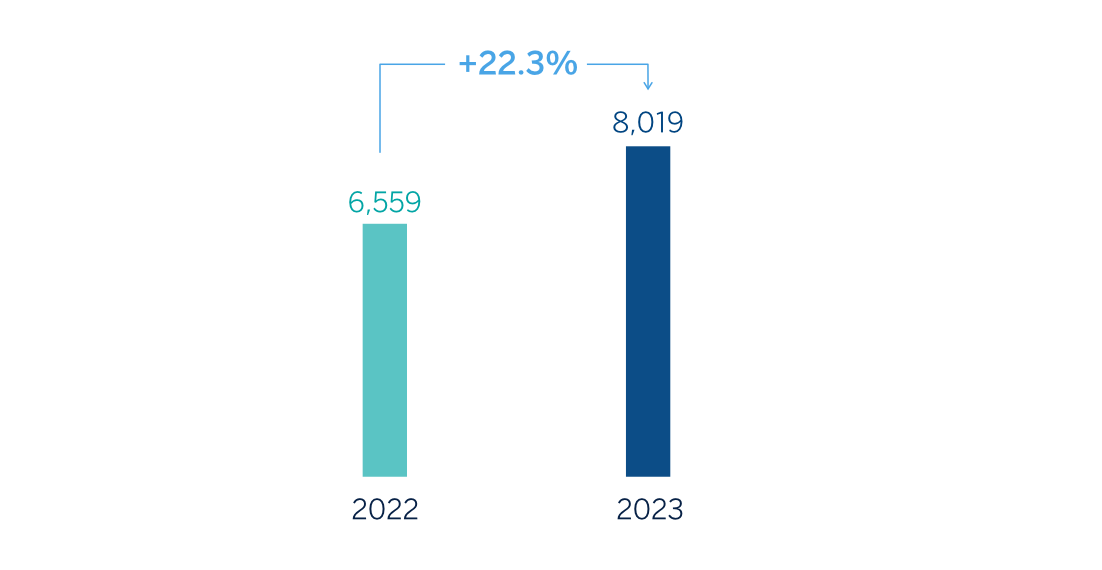

The BBVA Group generated a net attributable profit of €8,019m between January and December of 2023, boosted by the performance of recurring income of the banking business, mainly the net interest income. This result means an increase of 22.3% compared to the previous year, excluding the net impact arisen from the purchase of offices in Spain in 2022 from the comparison.

These results include the recording for the total annual amount paid for the temporary tax on credit institutions and financial credit institutions for €215m, included in the other operating income and expenses line of the income statement.

Operating expenses increased by 19.7% at Group level at constant exchange rates, largely impacted by the inflation rates observed in the countries in which the Group operates. Thanks to the remarkable growth in gross income (+30.3%), higher than the growth in expenses, the efficiency ratio stood at 41.7% as of December 31, 2023, with an improvement of 370 basis points, in constant terms, compared to the ratio recorded 12 months earlier.

The provisions for impairment on financial assets increased (+33.8% in year-on-year terms and at constant exchange rates), with lower requirements in Turkey, which were offset by higher provisioning needs, mainly in Mexico and South America, in a context of rising interest rates and growth in the most profitable segments, in line with the Group's strategy.

NET ATTRIBUTABLE PROFIT (LOSS)

(MILLIONS OF EUROS)

General note: 2022 excludes net impact arisen from the purchase of offices in Spain.

Loans and advances to customers recorded an increase of 5.7% compared to the end of December 2022, strongly favored by the evolution of retail loans (+7.2% at Group level).

Customer funds increased by 6.1% compared to the end of the previous year, thanks to both the growth in deposits from customers, which increased by 4.8% and to the increase in off-balance sheet funds, which grew by 9.5%.

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-2022)

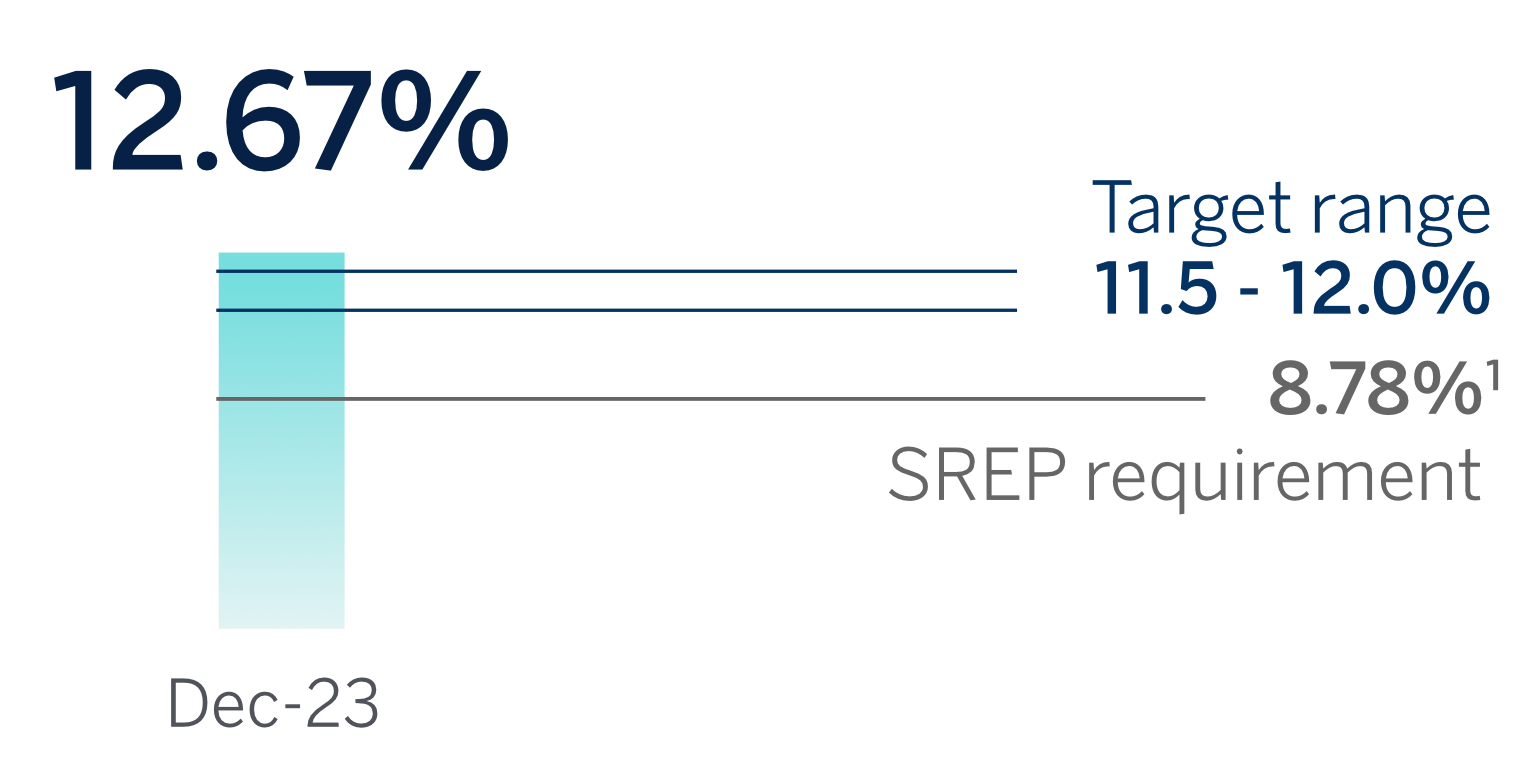

The Group's CET1 fully-loaded ratio stood at 12.67% as of December 31, 2023, which allows to keep maintaining a large management buffer over the Group's CET1 requirement (8.78%)1 and above the Group's established target management range of 11.5-12.0% of CET1.

CET1 fully-loaded

(1) This includes the update of the countercyclical capital buffer calculated on the basis of exposure at end September 2023.

1 This includes the update of the countercyclical capital buffer calculated on the basis of exposure at end September 2023.

Regarding shareholder remuneration, which includes cash payments and the remuneration resulting from the execution of the share buyback programs that the Group may execute, a cash gross distribution in the amount of €0.39 per share on April as final dividend of 2023 and the execution of a new Share Buyback Program of BBVA for an amount of €781m, subject to the corresponding regulatory authorizations and the communication with the program specific terms and conditions before its effective start, are expected to be submitted to the relevant governing bodies for consideration. Thus, the total distribution for the year 2023 will reach €4,010m, a 50% of the net attributable profit, which represents €0.68 per share, taking into account the payment in cash of €0.16 gross per share paid in October 2023 as interim dividend of the year.

During the year 2023, BBVA has executed two share buyback programs. The first program was announced on February 1, 2023 for a maximum amount of €422m and was part of the ordinary application of the shareholder remuneration policy of the year 2022. On April 21, 2023, BBVA announced the completion of this, having acquired 64,643,559 own shares between March 20 and April 20, 2023, representing approximately 1.07% of BBVA's share capital as of said date. The shares acquired in the execution of this first share buyback program were redeemed on June 2, 2023. The second program, which is considered extraordinary shareholder remuneration and thus is not included in the ordinary remuneration policy, was announced on July 28, 2023, for a maximum amount of €1,000m. On November 29, 2023, BBVA announced the completion of this, having acquired 127,532,625 own shares between October 2 and November 29, 2023, representing approximately 2.14% of BBVA's share capital as of said date. The shares acquired in the execution of this second share buyback program were redeemed on December 19, 2023. Thus, the total amount disbursed in both share buyback programs stands at €1,422m.

Business areas

Spain

€7,888 Mill.*

+29.1%

Highlights

- Growth in consumer loans, SMEs and public sector during the year

- Favorable evolution of core revenues

- Very relevant improvement of the efficiency ratio during the year

- Cost of risk remains at low levels

Results

(Millions of euros)

Net interest income

5,620Gross income

7,888Operating income

4,743Net attributable profit

2,755Activity (1)

Variation compared to 31-12-22.

Balances as of 31-12-23.

Performing loans and advances to customers under management

-0.9%Customer funds under management

+1.7%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes.

Mexico

€14,267 Mill.*

+20.4%

Highlights

- Growth of all the segments in the loan portfolio, with greater dynamism of the retail segment

- Double digit year-on-year growth in all the income statement margins

- Favorable evolution of the efficiency ratio

- Quarterly net attributable profit continues at high levels

Results

(Millions of euros)

Net interest income

11,054Gross income

14,267Operating income

9,883Net attributable profit

5,340Activity (1)

Variation compared to 31-12-22 at constant exchange

rate.

Balances as of 31-12-23.

Performing loans and advances to customers under mangement

+10.9%Customer funds under management

+12.2%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange rate.

Turkey

2,981 Mill.*

+140.3%

Highlights

- The dedollarization of the balance sheet continues in the quarter

- Progressive improvement of the NPL ratio in the year

- The cost of risk remains at low levels during 2023

- Net attributable profit growth in the quarter

Results

(Millions of euros)

Net interest income

1,869Gross income

2,981Operating income

1,581Net attributable profit

528Activity (1)

Variation compared to 31-12-22 at constant exchange

rate.

Balances as of 31-12-23.

Performing loans and advances to customers under mangement

+64.2%Customer funds under management

+77.8%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange rate.

South America

€4,331 Mill.*

+43.9%

Highlights

- Growth in lending activity focused on the retail segments

- Excellent evolution of the net interest income and of the NTI

- Improvement in the efficiency of the area

- Higher adjustment for hyperinflation in Argentina and the Argentine peso devaluation in the fourth quarter

Results

(Millions of euros)

Net interest income

4,394Gross income

4,331Operating income

2,397Net attributable profit

613Activity (1)

Variation compared to 31-12-22 at constant exchange

rates.

Balances as of 31-12-23.

Performing loans and advances to customers under mangement

+8.1%Customer funds under management

-9.3%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange

rates.

Rest of business

€1,103 Mill.*

+40.7%

Highlights

- Growth in lending activity during the year, favored by the recovery during the quarter

- Dynamism in net interest income and NTI in the year

- The cost of risk remains at low levels

- Significant improvement of the efficiency ratio

Results

(Millions of euros)

Net interest income

539Gross income

1,103Operating income

507Net attributable profit

389Activity (1)

Variation compared to 31-12-22 at constant exchange

rates.

Balances as of 31-12-23.

Performing loans and advances to customers under mangement

+5.7%Customer funds under management

+32.5%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange

rates.

* Gross income

(1) At constant exchange rate.

(2) At constant exchange rates.

As for the business areas evolution, excluding the effect of currency fluctuation in those areas where it has an impact, in each of them it is worth mentioning:

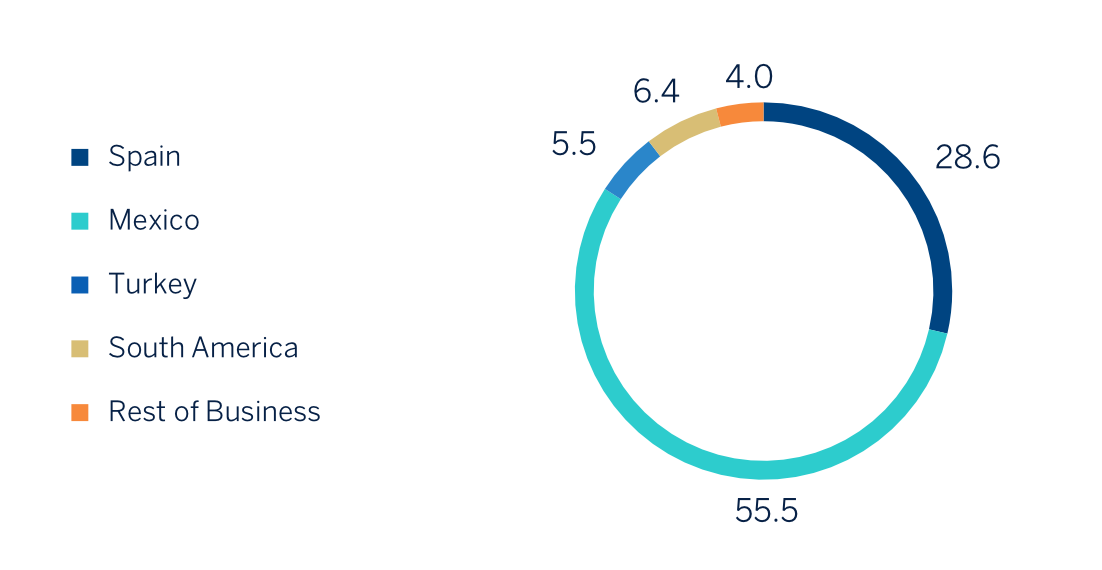

- Spain generated a net attributable profit of €2,755m in 2023, 65.3% higher than in the previous year, which included the net impact arisen from the purchase of offices to Merlin (-201 millions of euros). In 2023, the favorable evolution of the net interest income stands out, which continued to boost the gross income growth despite including the total annual amount paid for the temporary tax on credit institutions and financial credit institutions.

- In Mexico, BBVA achieved a cumulative net attributable profit of €5,340m by the end of December 2023, representing an increase of 17.1% compared to the 2022, mainly as a result of the significant growth in net interest income, thanks to the strong boost of the activity and the improvement in the customer spread.

- Turkey generated a net attributable profit of €528m during 2023, which compares positively with the accumulated result reached at the end of December 2022, both periods reflecting the impact of the application of hyperinflation accounting.

- South America generated a cumulative net attributable profit of €613m at the end of the year 2023, which represents a year-on-year increase of +43.2%, driven by the good performance of recurring income (41.4%) and the area's NTI (net trading income).

- Rest of Business achieved an accumulated net attributable profit of €389m during 2023, 63.7% higher than in the previous year, thanks to a favorable performance of the net interest income, and the NTI.

The Corporate Center recorded 2023 a net attributable profit of €-1,607m between January and December of 2023, compared with €-922m recorded on the same period of the previous year, mainly due to a negative contribution in the NTI line from exchange rate hedges as a result of a better than expected currency performance, in particular, the Mexican peso during the first half of the year.

Lastly, and for a broader understanding of the Group's activity and results, supplementary information is provided below for the wholesale business carried out by BBVA, Corporate & Investment Banking (CIB), in the countries where it operates. CIB generated a net attributable profit of €2,253m between January and December of 2023. These results, which do not include the application of hyperinflation accounting, represent an increase of 44.5% on a year-on-year basis and reflect the contribution of the diversification of products and geographical areas, as well as the progress of the Group's wholesale businesses in its strategy, leveraged on globality and sustainability, with the purpose of being relevant to its clients.

NET ATTRIBUTABLE PROFIT BREAKDOWN (1)

(PERCENTAGE. 2023)

(1) Excludes the Corporate Center.

News

Contact

Shareholder attention line

Shareholder attention line912 24 98 21

Subscription service

Subscription service  Shareholder Office

Shareholder Office Contact email

Contact email