Results

Quarterly evolution of results

The net attributable profit achieved by the BBVA Group in the last quarter of 2022 stood at €1,578m, 14.3% below the previous quarter.

- Net interest income continued to grow, favored by higher volumes of activity and the repricing of the loan portfolio, in a quarter in which the vast majority of central banks continued the cycle of interest rate hikes.

- Less positive NTI due to the negative impact of the hedging of exchange rate registered in the Corporate Center, negatively affected by the depreciation of the U.S. dollar during the quarter.

- Contained operating expenses in a highly inflationary environment. The quarter includes the variable remuneration improvement to employees.

CONSOLIDATED INCOME STATEMENT: QUARTERLY EVOLUTION (MILLIONS OF EUROS)

| 2022 | 2021 | |||||||

|---|---|---|---|---|---|---|---|---|

| 4Q | 3Q | 2Q | 1Q | 4Q | 3Q | 2Q | 1Q | |

| Net interest income | 5,342 | 5,261 | 4,602 | 3,949 | 3,978 | 3,753 | 3,504 | 3,451 |

| Net fees and commissions | 1,323 | 1,380 | 1,409 | 1,242 | 1,247 | 1,203 | 1,182 | 1,133 |

| Net trading income | 269 | 573 | 516 | 580 | 438 | 387 | 503 | 581 |

| Other operating income and expenses | (410) | (358) | (432) | (355) | (187) | (13) | (85) | (11) |

| Gross income | 6,524 | 6,857 | 6,094 | 5,416 | 5,477 | 5,330 | 5,104 | 5,155 |

| Operating expenses | (2,889) | (2,818) | (2,630) | (2,424) | (2,554) | (2,378) | (2,294) | (2,304) |

| Personnel expenses | (1,550) | (1,475) | (1,346) | (1,241) | (1,399) | (1,276) | (1,187) | (1,184) |

| Other administrative expenses | (1,001) | (1,005) | (944) | (870) | (850) | (788) | (800) | (812) |

| Depreciation | (338) | (338) | (340) | (313) | (305) | (314) | (307) | (309) |

| Operating income | 3,636 | 4,038 | 3,464 | 2,992 | 2,923 | 2,953 | 2,810 | 2,850 |

| Impairment on financial assets not measured at fair value through profit or loss | (998) | (940) | (704) | (737) | (832) | (622) | (656) | (923) |

| Provisions or reversal of provisions | (50) | (129) | (64) | (48) | (40) | (50) | (23) | (151) |

| Other gains (losses) | (6) | 19 | (3) | 20 | 7 | 19 | (7) | (17) |

| Profit (loss) before tax | 2,581 | 2,988 | 2,694 | 2,227 | 2,058 | 2,299 | 2,124 | 1,759 |

| Income tax | (856) | (1,004) | (697) | (904) | (487) | (640) | (591) | (489) |

| Profit (loss) for the period | 1,724 | 1,984 | 1,997 | 1,324 | 1,571 | 1,659 | 1,533 | 1,270 |

| Non-controlling interests | (147) | (143) | (120) | 3 | (230) | (259) | (239) | (237) |

| Net attributable profit (loss) excluding non-recurring impacts | 1,578 | 1,841 | 1,877 | 1,326 | 1,341 | 1,400 | 1,294 | 1,033 |

| Discontinued operations and Other (1) | - | - | (201) | - | - | - | (593) | 177 |

| Net attributable profit (loss) | 1,578 | 1,841 | 1,675 | 1,326 | 1,341 | 1,400 | 701 | 1,210 |

| Adjusted earning per share (euros) (2) | 0.25 | 0.29 | 0.30 | 0.21 | 0.19 | 0.20 | 0.18 | 0.14 |

| Earning per share (euros) (2) | 0.24 | 0.28 | 0.25 | 0.19 | 0.20 | 0.20 | 0.09 | 0.17 |

- (1) Include: (I) the net impact arisen from the purchase of offices in Spain in 2022 for €-201m; (II) the net costs related to the restructuring process in 2021 for €-696m; and (III) the profit (loss) generated by BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021 for €+280m.

- (2) Adjusted by additional Tier 1 instrument remuneration. For more information, see Alternative Performance Measures at the end of this report.

Year-on-year performance of results

The BBVA Group generated a net attributable profit excluding non-recurring impacts of €6,621m in the year 2022, which represents an increase of 30.6% compared to the previous year, and the highest result ever. Including the non-recurring impacts, i.e. the net impact for an amount of €-201m from the purchase of offices in Spain from Merlin in June 2022 and €-416m from the results of discontinued operations corresponding to BBVA USA and the rest of the companies sold to PNC on June 1, 2021, together with the net cost related to the restructuring process of the same year, the net attributable profit increased by 38.0% in year-on-year terms to €6,420m.

CONSOLIDATED INCOME STATEMENT (MILLIONS OF EUROS)

| 2022 |

∆% |

∆% at constant exchange rates |

2021 |

|

|---|---|---|---|---|

| Net interest income | 19,153 | 30.4 | 35.8 | 14,686 |

| Net fees and commissions | 5,353 | 12.3 | 15.3 | 4,765 |

| Net trading income | 1,938 | 1.5 | 9.4 | 1,910 |

| Other operating income and expenses | (1,555) | n.s. | n.s. | (295) |

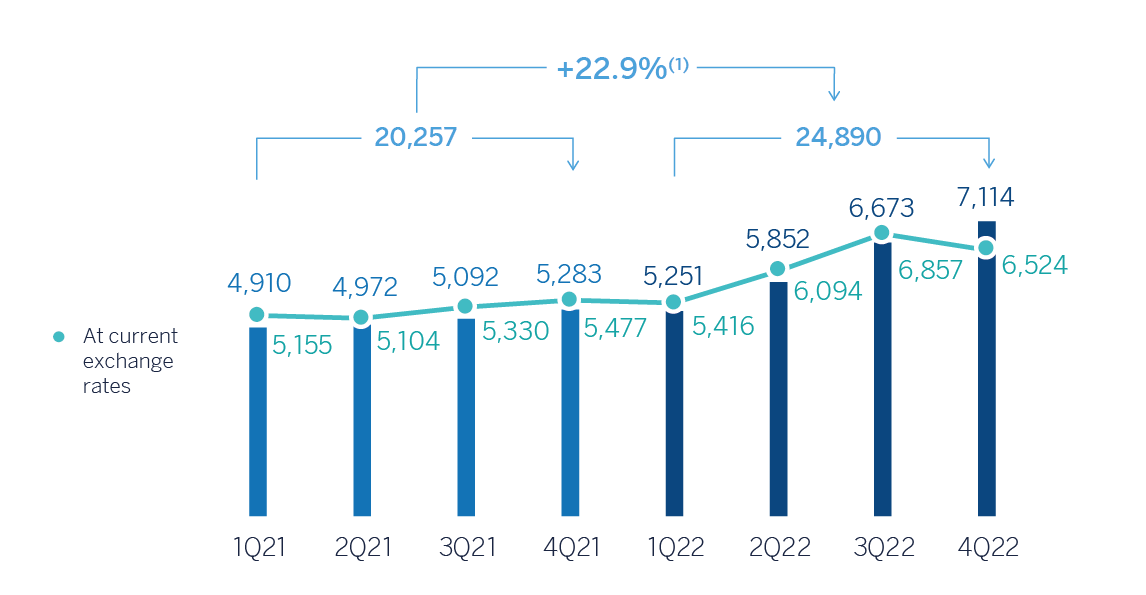

| Gross income | 24,890 | 18.2 | 22.9 | 21,066 |

| Operating expenses | (10,760) | 12.9 | 15.5 | (9,530) |

| Personnel expenses | (5,612) | 11.2 | 14.8 | (5,046) |

| Other administrative expenses | (3,820) | 17.6 | 19.1 | (3,249) |

| Depreciation | (1,328) | 7.6 | 8.4 | (1,234) |

| Operating income | 14,130 | 22.5 | 29.2 | 11,536 |

| Impairment on financial assets not measured at fair value through profit or loss | (3,379) | 11.4 | 12.9 | (3,034) |

| Provisions or reversal of provisions | (291) | 10.2 | 7.5 | (264) |

| Other gains (losses) | 30 | n.s. | n.s. | 2 |

| Profit (loss) before tax | 10,490 | 27.3 | 36.7 | 8,240 |

| Income tax | (3,462) | 56.9 | 66.0 | (2,207) |

| Profit (loss) for the period | 7,028 | 16.5 | 25.7 | 6,034 |

| Non-controlling interests | (407) | (57.8) | (30.3) | (965) |

| Net attributable profit (loss) excluding non-recurring impacts | 6,621 | 30.6 | 32.3 | 5,069 |

| Discontinued operations and Other (1) | (201) | (51.6) | (47.7) | (416) |

| Net attributable profit (loss) | 6,420 | 38.0 | 39.0 | 4,653 |

| Adjusted earning per share (euros)(2) | 1.05 | 0.71 | ||

| Earning (loss) per share (euros) (2) | 0.99 | 0.67 |

- (1) Include: (I) the net impact arisen from the purchase of offices in Spain in 2022 for €-201m; (II) the net costs related to the restructuring process in 2021 for €-696m; and (III) the profit (loss) generated by BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021 for €+280m.

- (2) Adjusted by additional Tier 1 instrument remuneration. For more information, see Alternative Performance Measures at the end of this report.

The result attributed to the Group in the year 2022 includes the application to the Group's entities in Turkey of IAS 29, "Financial Reporting in Hyperinflationary Economies"3.

Unless expressly indicated otherwise, to better understand the changes under the main headings of the Group's income statement, the year-on-year rates of change provided below refer to constant exchange rates. When comparing two dates or periods in this report, the impact of changes in the exchange rates against the euro of the currencies of the countries in which BBVA operates is sometimes excluded, assuming that exchange rates remain constant. For this purpose, the average exchange rate of the currency of each geographical area of the most recent period is used for both periods, except for those countries whose economies have been considered hyperinflationary, for which the closing exchange rate of the most recent period is used.

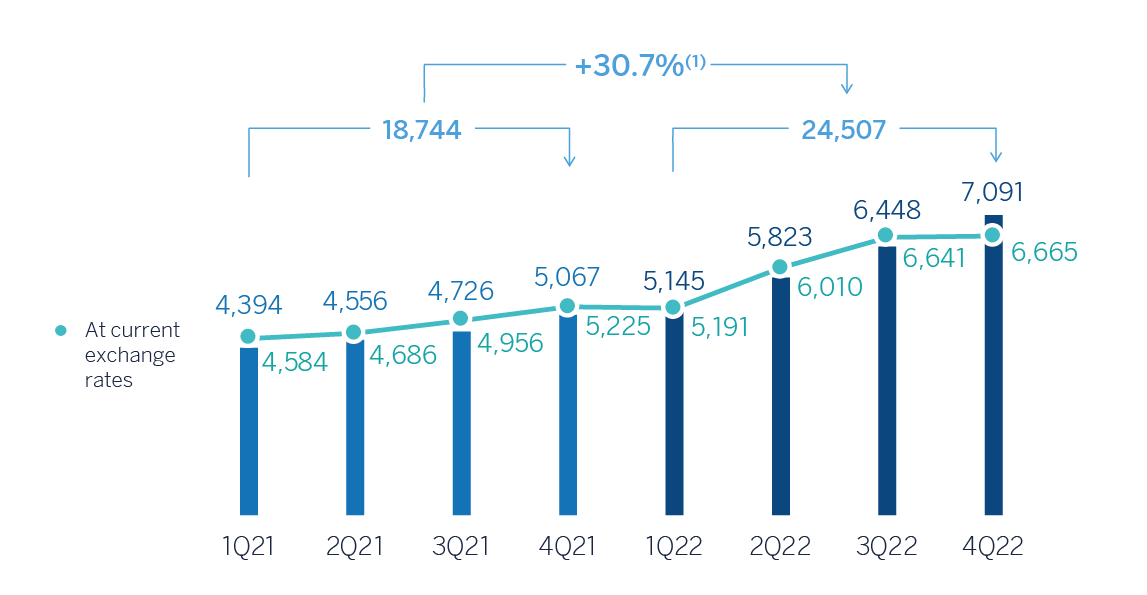

The accumulated net interest income as of December 31, 2022 was higher than the previous year (+35.8%), with increase in all business areas due to the improvement in customer spread and higher managed loan portfolio volumes. Particularly noteworthy was the good evolution in Mexico -especially- and, to a lesser extent, in South America and Turkey.

Positive evolution in the net fees and commissions line, which increased by 15.3% in the year due to favorable performance in payment systems and demand deposits.

NET INTEREST INCOME/AVERAGE TOTAL ASSETS

(PERCENTAGE)

NET INTEREST INCOME PLUS NET FEES AND COMMISSIONS

(MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES)

(1) At current exchange rates: +20.8%.

NTI recorded a year-on-year variation of +9.4% at the end of December 2022, with a positive trend in Turkey, South America, Spain and Mexico, which offset the lower results recorded in the Corporate Center due to the negative contribution of the foreign exchange hedging.

The other operating income and expenses line accumulated a result of €-1,555m as of December 31, 2022, compared to €-295m in the previous year, mainly due to the more negative adjustment for inflation in Argentina, the recording of this adjustment in the Group's entities in Turkey in 2022 and BBVA's higher contribution to the public deposit guarantee schemes, mainly in Spain.

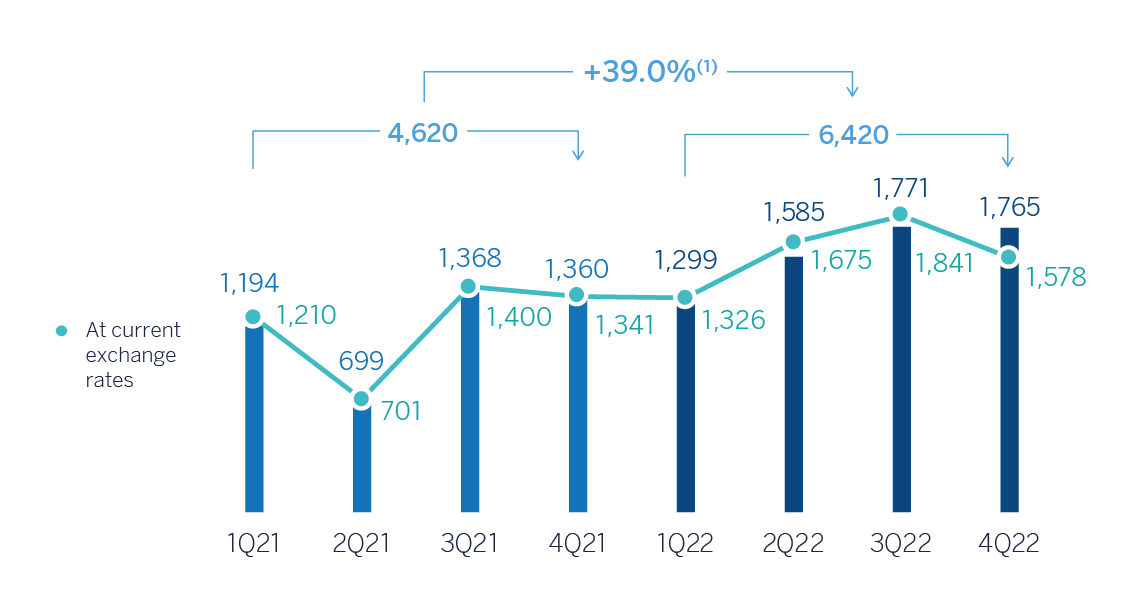

GROSS INCOME (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES)

(1) At current exchange rates: +18.2%.

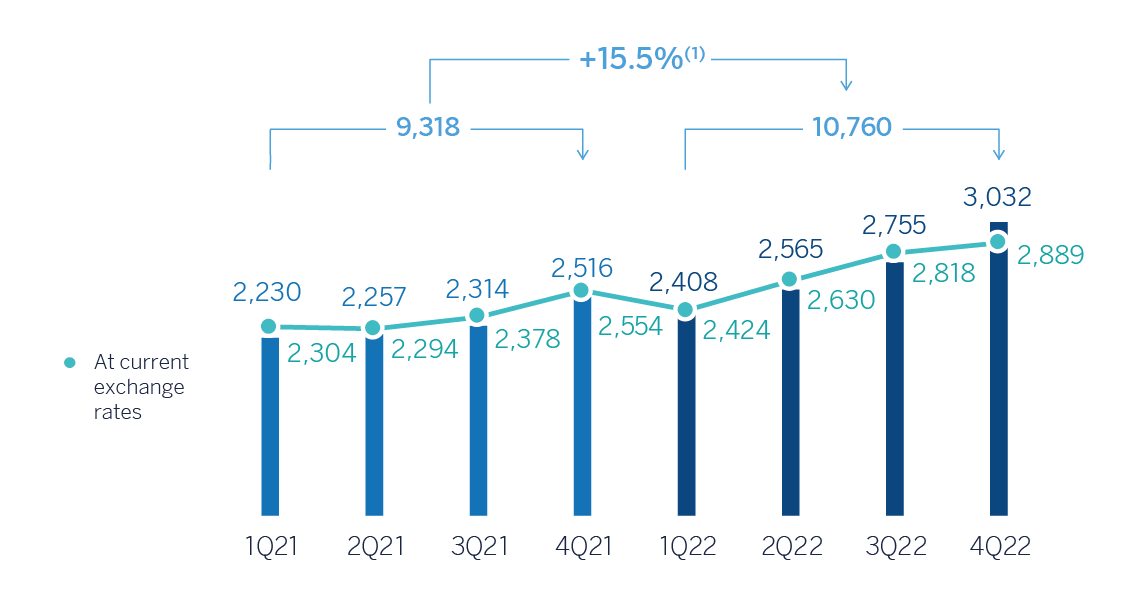

Year-on-year terms operating expenses increased at a pace of 15.5% at the Group level, below the average inflation rate in all countries in which BBVA operates. By areas, only Spain registered a year-on-year decrease as a result of the restructuring process in 2021.

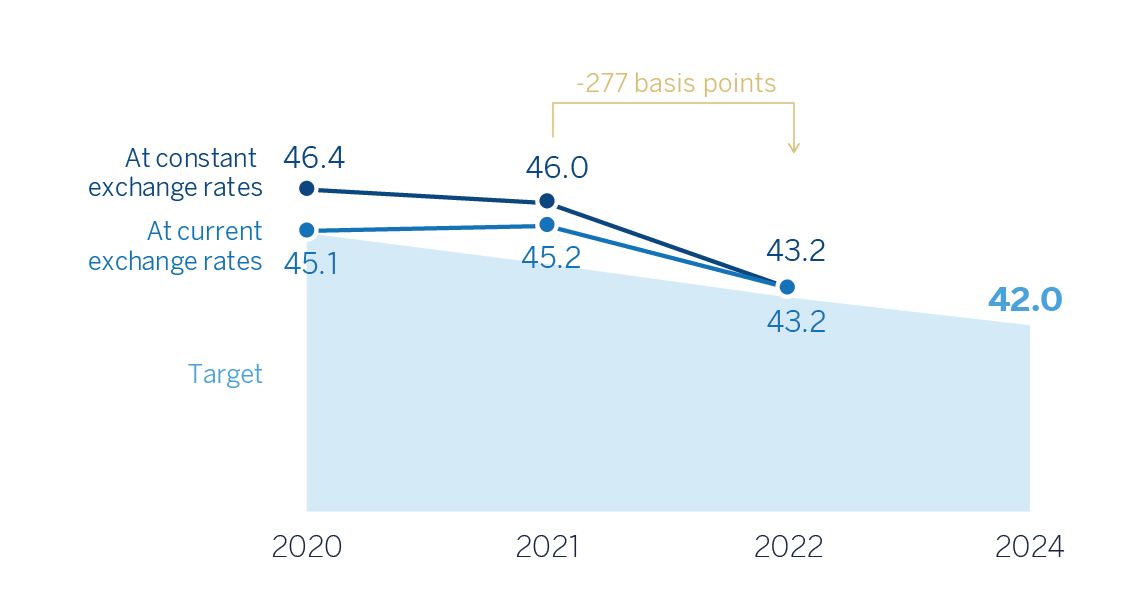

Notwithstanding the above, thanks to the remarkable growth in gross income (+22.9%), the efficiency ratio stood at 43.2% as of December 31, 2022, with an improvement of 277 basis points compared to the ratio recorded 12 months earlier. By areas, Spain, Mexico and, to a lesser extent, South America recorded a favorable performance in terms of efficiency.

OPERATING EXPENSES (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES)

(1) At current exchange rates: +12.9%.

EFFICIENCY RATIO (PERCENTAGE)

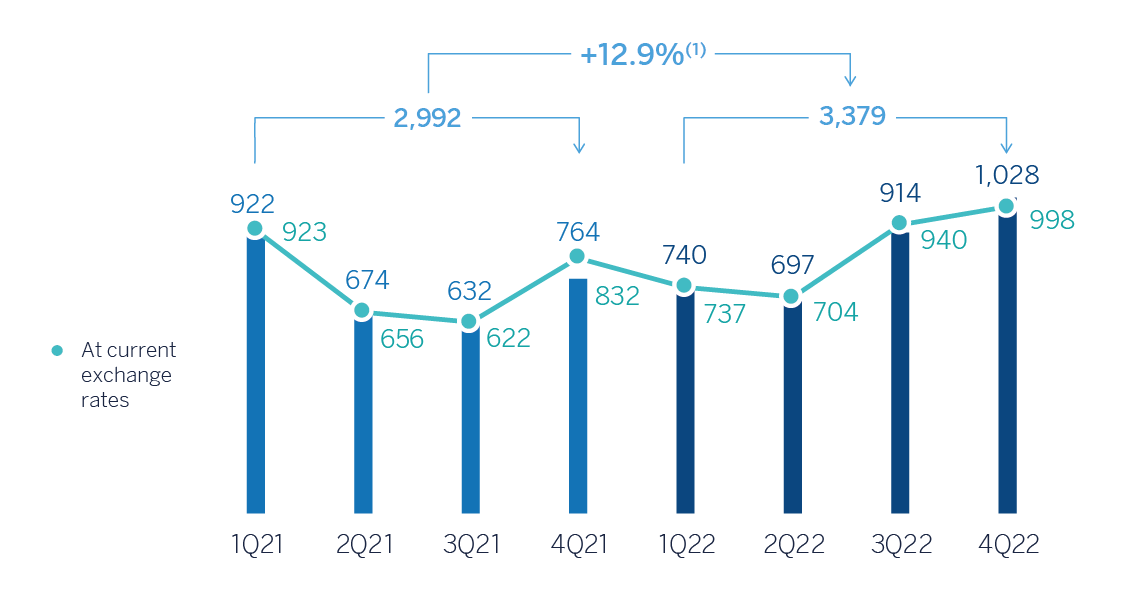

Impairment on financial assets not measured at fair value through profit or loss (impairment on financial assets) was 12.9% higher at the end of December 2022 than in the previous year, with higher credit impairments especially in South America and Turkey.

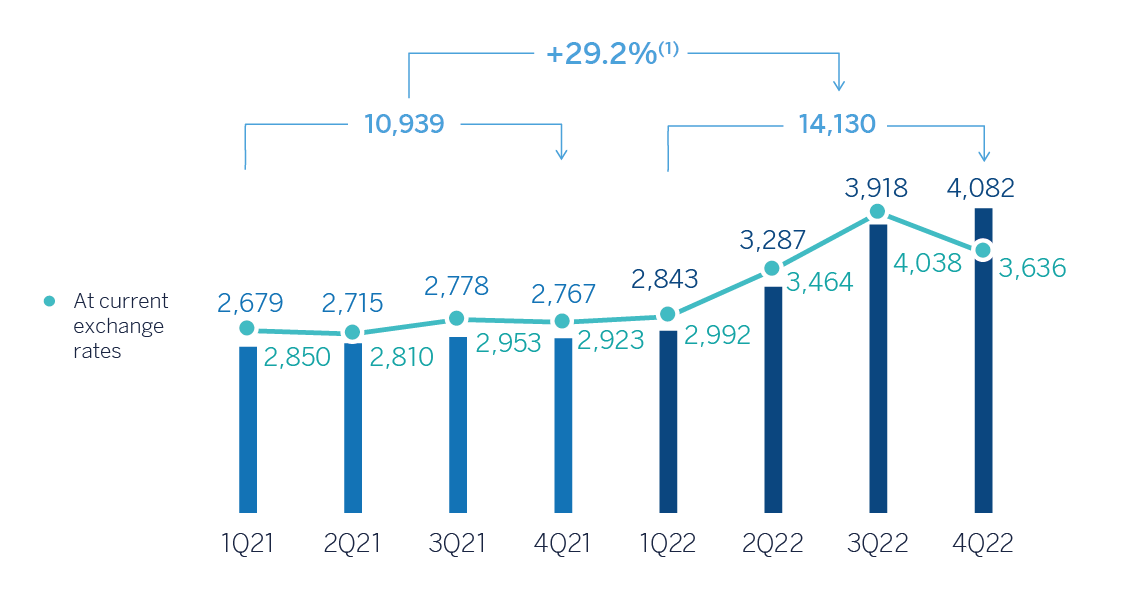

OPERATING INCOME (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES)

(1) At current exchange rates: +22.5%.

IMPAIRMENT ON FINANCIAL ASSESTS (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES)

(1) At current exchange rates: +11.4%.

The provisions or reversal of provisions line (hereinafter, provisions) accumulated a negative balance of €291m as of December 31, 2022, 7.5% above the accumulated figure in the previous year mainly due to provisions for risks and contingent commitments in Turkey.

For its part, the other gains (losses) line closed December 2022 with a balance of €30m, which compares positively to the figure reached the previous year (€2m), mainly in Spain and Turkey.

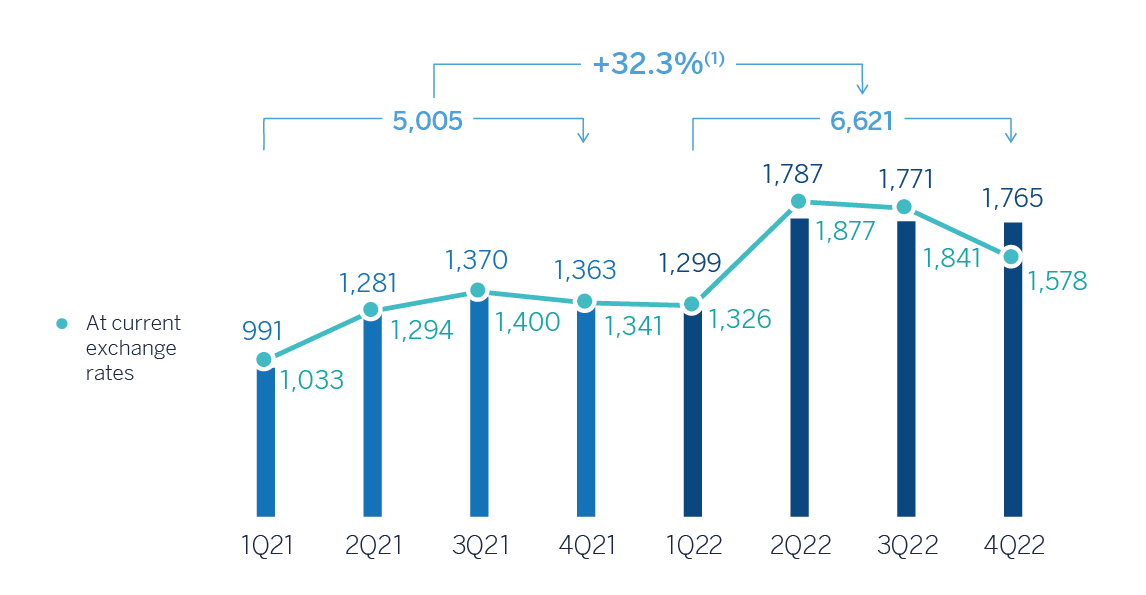

As a result of the above, the BBVA Group generated a net attributable profit, excluding non-recurring impacts, of €6,621m in the year 2022, representing a year-on-year increase of +32.3%. Taking into account the non-recurring impacts, registered within the line "Discontinued operations and Other," that is: (I) €-201m recorded in the second quarter of 2022 for the purchase of offices in Spain; (II) €+280m for the results generated by BBVA USA and the rest of the companies sold to PNC on June 1, 2021; and (III) €-696m of the net costs associated with the restructuring process recorded in the second quarter of 2021, the cumulative net attributable profit of the Group at the end of December 2022 stood at €6,420m, 39.0% higher than that achieved in the year 2021.

The cumulative net attributable profits, in millions of euros, at the end of December 2022 for the business areas that compose the Group were as follows: €1,678m in Spain, €4,182m in Mexico, €509m in Turkey, €734m in South America and €240m in Rest of Business.

NET ATTRIBUTABLE PROFIT (LOSS) (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES)

(1) At current exchange rates: +38.0%.

NET ATTRIBUTABLE PROFIT (LOSS) EXCLUDING NON-RECURRING IMPACTS (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES)

General note: non-recurring impacts include the net impact arisen from the purchase of offices in Spain in 2Q22, BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021 for the periods 1Q21 and 2Q21 and the net cost related to the restructuring process in 2Q21.

(1) At current exchange rates: +30.6%.

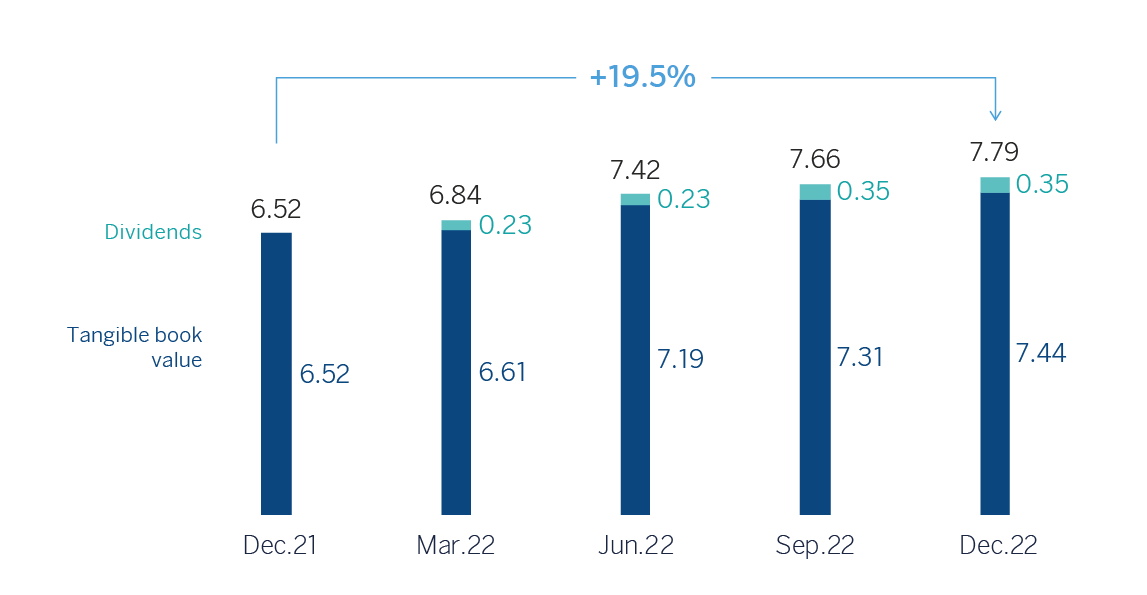

The Group's excellent performance in 2022 has also allowed it to accelerate value creation, as reflected in the growth of the tangible book value and dividends, which at year-end 2022 was 19.5% above the previous year.

TANGIBLE BOOK VALUE PER SHARE(1) AND DIVIDENDS (EUROS)

General note: replenishing dividends paid in the period.

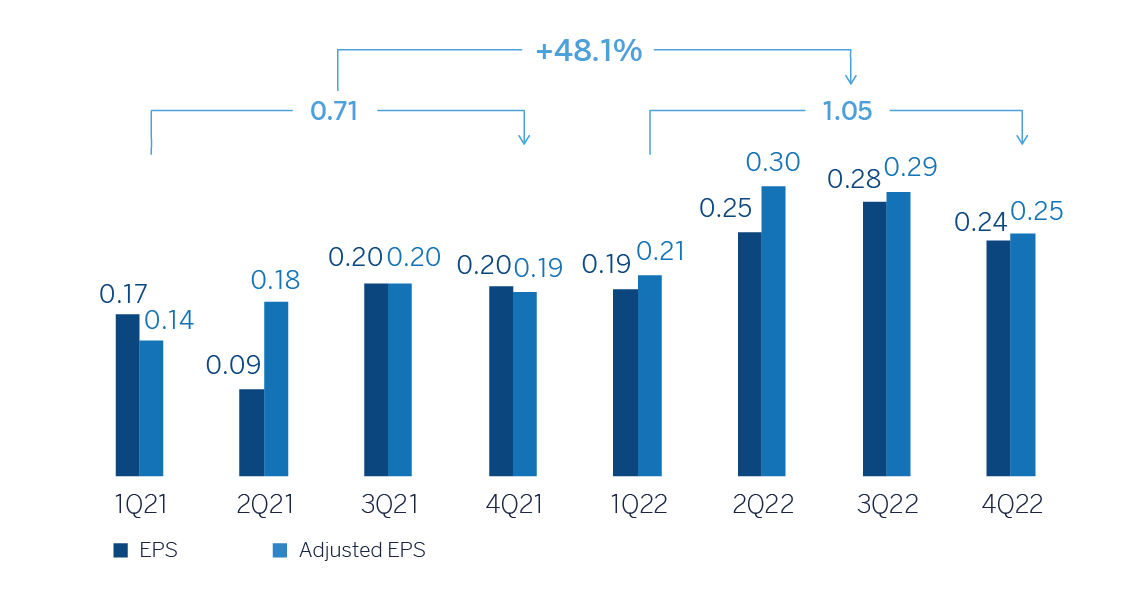

ADJUSTED EARNING PER SHARE (2) AND EARNING PER SHARE (2) (EUROS)

General note: adjusted earning per share excludes: (I) the net

impact arisen from the purchase of offices in Spain in 2Q22;

(II) the net cost related to the restructuring process for the

period 2Q21; and (III) the profit (loss) after tax from

discontinued operations derived from the sale of BBVA USA and

the rest of the companies in the United States to PNC on June 1,

2021 for the periods 1Q21 and 2Q21.

(1) For more information, see Alternative Performance Measures at the end of this report.

(2) Adjusted by additional Tier 1 instrument remuneration. For more information, see Alternative Performance Measures at the end of this report.

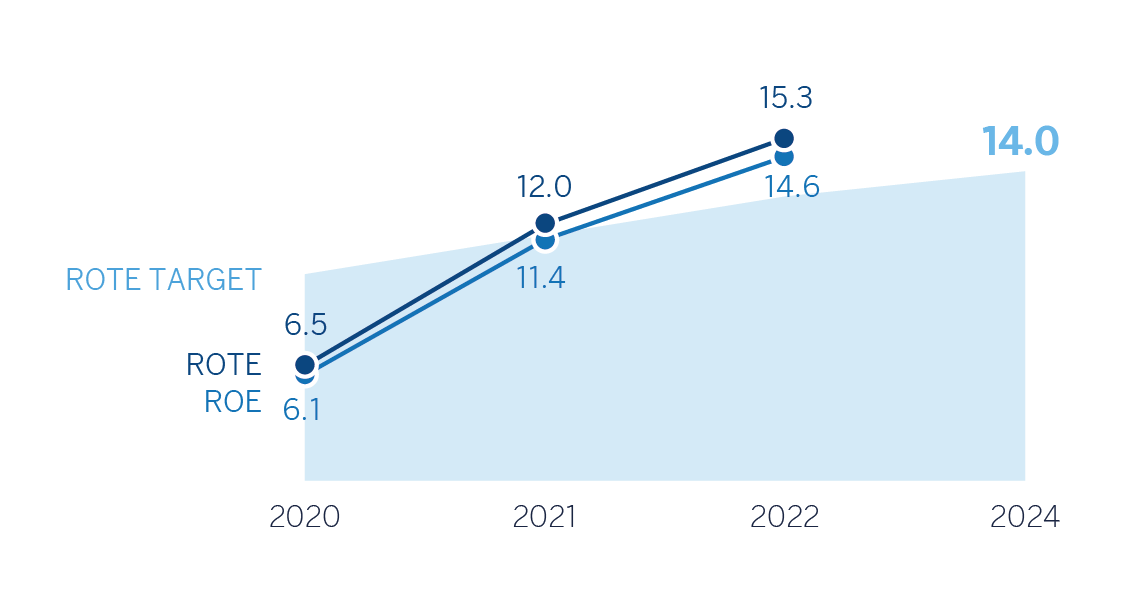

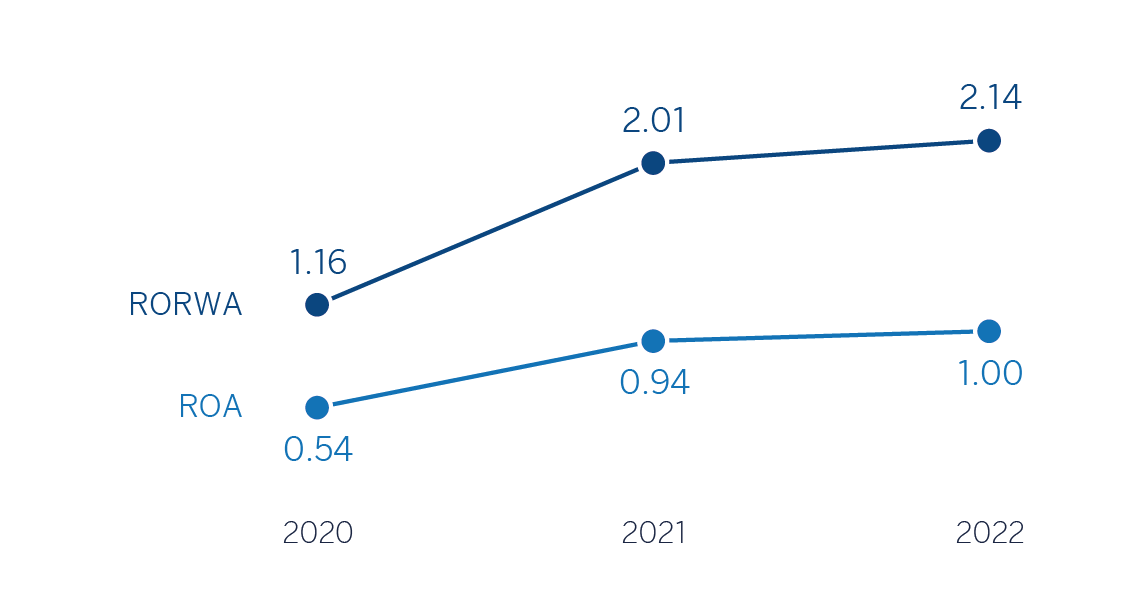

The Group’s profitability indicators improved in year-on-year terms, supported by the favorable performance of results.

ROE AND ROTE (1) (PERCENTAGE)

ROA AND RORWA (1) (PERCENTAGE)

(1) Excludes the net impact arisen from the purchase of offices in Spain in 2022, the net cost related to the restructuring process in 2021, the net capital gains from the bancassurance transaction with Allianz in 2020, and the resuls generated by BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021 for the periods 2021 and 2020.

3 IAS 29 has not been applied to operations outside Turkey, in particular to the financial statements of Garanti Bank in Romania and Garanti Bank International N.V. in the Netherlands.