Macroeconomic environment

Economic global growth has slowed down through 2023 and, particularly, during the last months, due to the high inflation, the tightening of monetary conditions and the gradual fading of the positive effects linked to the reopening after the COVID-19 pandemic. The slowdown has been, in general, less harsh than expected, and economic activity remains relatively dynamic, particularly in the Unites States, thanks to the dynamism of the labor markets, expansionary fiscal policies and the gradual fading of supply shocks triggered by the pandemic and the war in Ukraine.

Falling commodity prices compared to the levels seen in 2022 and the improvements in production process bottlenecks have contributed to a significant moderation of inflation. which, in annual terms, reached 3.4% in the United States and 2.9% in the Eurozone in December 2023, far below the levels registered at the end of 2022 (6.5% in the United States and 9.2% in the Eurozone).

In this context, the process of interest rate hikes launched approximately two years ago seems to have reached an end. According to BBVA Research, it is most likely that inflation will keep evolving favorably in the next months, enabling the start of a gradual process of relaxation of monetary conditions around mid-2024, which would take monetary policy interest rates to around 4.50% in the United States and 3.75% (in the case of refinancing operation rates) in the Eurozone by the end of 2024. However, it cannot be ruled out that monetary policy benchmark rates might be reduced more quickly in the future, mainly if inflation evolves surprisingly on the downside. In any case, it is expected that both the U.S. Federal Reserve ("Fed") and the European Central Bank ("ECB") will continue taking liquidity reduction measures over 2024.

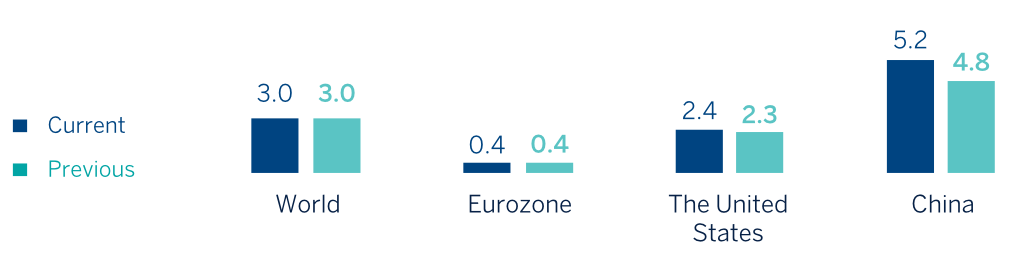

BBVA Research forecasts that global growth will be approximately 3.0% in 2024 (unchanged from the previous forecast and similar to the forecasted for the GDP growth in 2023) In the United States, strong domestic demand supports a slightly upward revision of growth forecasts for 2023, from 2.3% to 2.4%, but the restrictive monetary conditions are likely to contribute to a growth deceleration in 2024, to 1.5%, without changes from the previous forecast. In China, structural challenges to avoid a fast economic deceleration remain, but a series of stimulus measures have enabled a greater than expected dynamism of activity in the past few months, which supports an upward revision of the growth in 2023 from 4.8% to 5.2%. The GDP growth forecast for 2024 remains unchanged at 4.4%. In the Eurozone, economic activity came to a standstill in the last months, reinforcing the low growth prospects; the forecast of the GDP expansion of the region remains at 0.4% for 2023 and it has been cut from 1.0% to 0.7% for 2024.

In this context of below potential growth and still high interest rates, aggregate demand moderation will probably favor an additional inflation reduction, which, however, would remain somewhat over the inflation targets in the United States and the Eurozone until the end of 2024.

In any case, uncertainty remains high, and a number of factors could lead to more adverse scenarios unfolding. Persistently high inflation and high interest rates, due to eventual supply shocks generated by the current geopolitical turbulence, and particularly by the recent maritime trade disruptions in the Red Sea, or other factors, could trigger a deep and widespread recession, as well as new bouts of financial volatility. Moreover, the slowdown in China could end up being more severe than expected. Finally, current geopolitical turbulence might contribute to higher energy prices and new disruptions in global supply chains.

GDP GROWTH ESTIMATES IN 2023 (PERCENTAGE. YEAR-ON-YEAR VARIATION)

Source: BBVA Research estimates.