Shareholders

Global economic growth finally lost momentum in 2015, as mentioned in the first section of the Strategy chapter. In this global situation, the main stock-market indices, except for the European Stoxx 50, have closed 2015 at levels lower than those registered the previous year. The performance of the banking sector in 2015 has to a certain extent proved a burden on these general indices, as it has been affected by a number of factors, including market uncertainty about the potential impact of the regulatory changes currently being discussed and the downward revision of the expectations of earnings growth over the year.

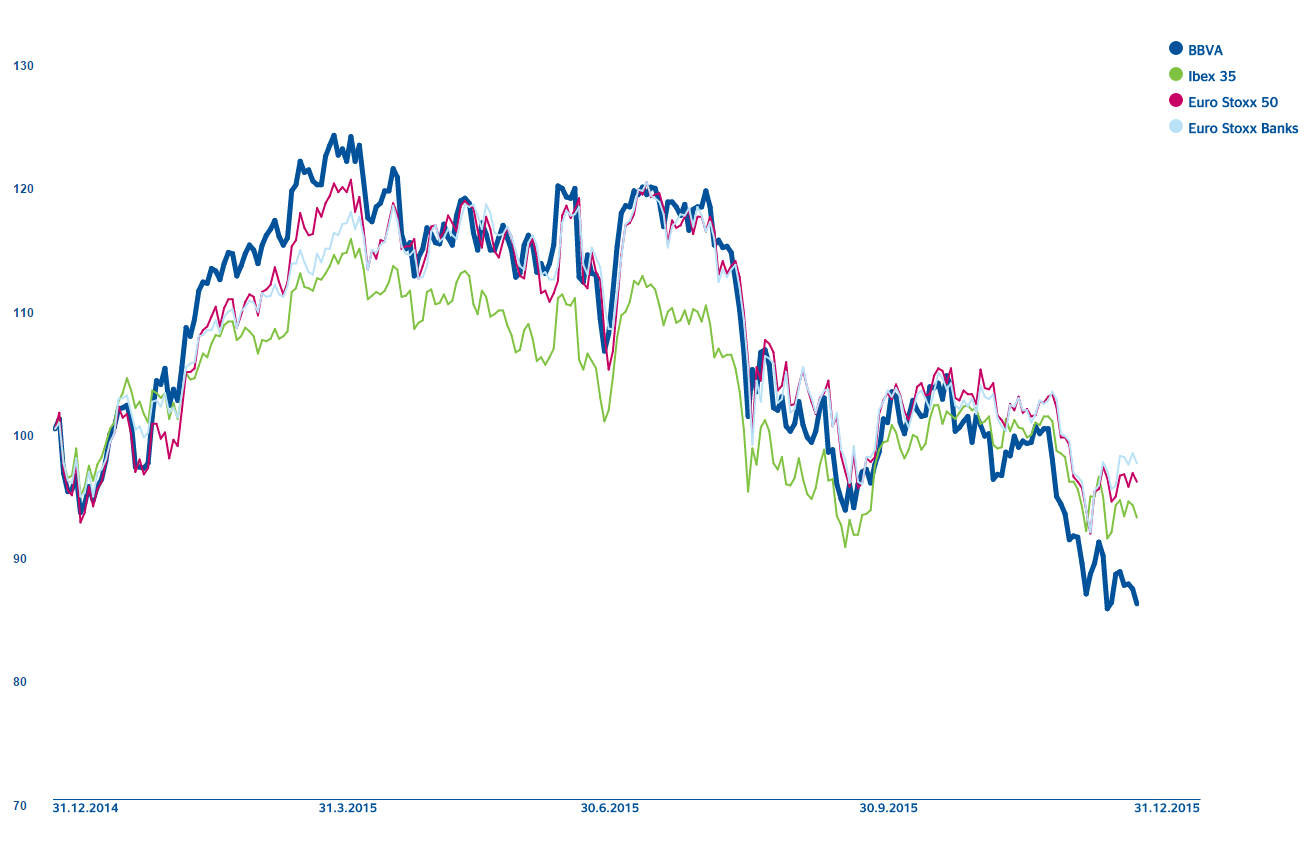

Year-on-year evolution of the main stock-market indices

(Percentage)

| Euro Stoxx Banks | Stoxx Banks | Euro Stoxx 50 | Ibex 35 | S&P Regional Banks | S&P 500 | S&P Financials Index | |

| -4.9% | -3.3% | 3.2% | -7.2% | -0.3% | -0.7% | -3.5% |

The price of the BBVA share increased by 19.8% in the first quarter of 2015 before starting a downward path that continued for the rest of the year. At the close of the year, the price posted a year-on-year decline of 14.2%, mainly in the second half of the year, with a price of €6.74 per share as of 31-Dec-2015. This amount represents a market capitalization of €42,905m, a price/book value ratio of 0.9 and a P/E of 13.2. At these levels, the value of the BBVA share compares favorably with the average for European banks.

The main stock-market indices in Europe have closed 2015 outperforming the S&P 500 in the United States

Share price index

(31-12-14 = 100)

BBVA's market capitalization

(Million euros)

The BBVA share and share performance ratios

| 31-12-15 | 31-12-14 | 31-12-13 | |

|---|---|---|---|

| Number of shareholders | 934,244 | 960,397 | 974,395 |

| Number of shares issued | 6,366,680,118 | 6,171,338,995 | 5,785,954,443 |

| Daily average number of shares traded | 46,641,017 | 48,760,861 | 55,515,852 |

| Daily average trading (million euros) | 393 | 437 | 411 |

| Maximum price (euros) | 9.77 | 9.99 | 9.40 |

| Minimum price (euros) | 6.70 | 7.45 | 6.18 |

| Closing price (euros) | 6.74 | 7.85 | 8.95 |

| Book value per share (euros) | 7.47 | 8.01 | 8.00 |

| Market capitalization (million euros) | 42,905 | 48,470 | 51,773 |

| Price/book value (times) | 0.9 | 1.0 | 1.1 |

| PER (Price/earnings; times) | 13.2 | 17.3 | 23.2 |

|

Yield (Dividend/price; %) |

5.5 | 4.2 | 4.1 |

As regards shareholder remuneration, two dividends were paid out in cash at €0.08 gross per share each, amounting to disbursements of €504.4m on July 16, 2015 and €509.3m on January 12, 2016, against 2015 earnings. Additionally, at its meetings held on March 25 and September 30, 2015, the Board of Directors of BBVA agreed to complete two capital increases against reserves, under the terms agreed by the Annual General Meeting of Shareholders held on March 13, 2015. These increases have served as instruments for developing the share remuneration scheme called “dividend-option”, which offers shareholders the chance to choose between receiving all or part of the corresponding amount in either new BBVA shares or in cash. Each shareholder is entitled to one free allocation right for each BBVA share held on a given date, usually the date of publication of the announcement of the capital increase in the Official Bulletin of the Companies Register (normally two days after the meeting of the Board of Directors at which the capital increase was agreed). In the case of the first increase, agreed in March, for every 70 rights each shareholder had the option to receive one new BBVA share. In the case of the second, agreed in September, each shareholder needed 92 rights to have the option to receive one new BBVA share.

The acceptance percentages of the "dividend-option" in 2015 are the highest obtained in the last two years

Alternatively, shareholders who wished to receive their remuneration in cash could sell their free allocation rights to BBVA during the first ten calendar days of their trading period, or on the market during the full trading period, at a gross fixed price of €0.13 per right in the case of the first “dividend-option” and of €0.8 per right in the case of the second. In this way, shareholders enjoy a greater degree of flexibility and efficiency, as they can adapt their remuneration to their preferences and personal circumstances. In the case of the implementation of the first "dividend-option", the holders of 90.31% of these rights chose to receive new shares. In the case of the second, the holders of 89.65% decided to receive new shares. The acceptance percentages are the highest obtained in the last two years, confirming the excellent level of support for this remuneration system among shareholders, as well as their confidence in the future performance of the share.

The number of BBVA shares as of 31-Dec-2015 stood at 6,367 million. Their increase on the figure at the end of 2014 is explained by the capital increases against reserves completed over the year to execute the aforementioned “dividend-option”.

The number of BBVA shareholders as of 31-Dec-2015 stood at 934,244, compared with 960,397 as of 31-Dec-2014, a year-on-year decline of 2.7%. The granularity of the shareholders remained at similar levels in 2015, with no significant holdings.

BBVA Group. Shareholder structure

(31-12-2015)

| Shareholders | Shares | |||

|---|---|---|---|---|

| Number of shares | Number | % | Number | % |

| Up to 150 | 217,876 | 23.3 | 15,490,716 | 0.2 |

| 151 to 450 | 196,590 | 21.0 | 53,455,140 | 0.8 |

| 451 to 1,800 | 282,378 | 30.2 | 265,401,936 | 4.2 |

| 1,801 to 4,500 | 124,071 | 13.3 | 353,693,692 | 5.6 |

| 4,501 to 9,000 | 57,993 | 6.2 | 364,537,906 | 5.7 |

| 9,001 to 45,000 | 48,866 | 5.2 | 851,284,685 | 13.4 |

| More than 45,001 | 6,470 | 0.7 | 4,462,816,043 | 70.1 |

| TOTAL | 934,244 | 100.0 | 6,366,680,118 | 100.0 |

In addition, 44.7% of the share capital belongs to investors resident in Spain, while the percentage owned by non-resident shareholders has continued to increase to 55.3% (compared with 53.9% in 2014). This demonstrates once more the brand recognition and improved confidence in BBVA among foreign investors.

BBVA Group. Shareholder structure

(Percentage 31-12-2015)

BBVA shares are traded on the Continuous Market of the Spanish Stock Exchanges and also on the stock markets in London and Mexico. BBVA American depositary shares (ADS) are traded in New York and also on the Lima Stock Exchange (Peru) under an exchange agreement between these two markets. The BBVA share was traded on each of the 256 days in the 2015 stock market year in Spain. During this period, a total of 11,940 million shares were traded on the continuous market, accounting for 187.54% of the share capital. Thus the daily average volume of traded shares was over 46 million, 0.7% of the total number of shares and a daily average of around €393m.

Lastly, BBVA shares are included in the key Ibex 35 and Euro Stoxx 50 indices, with an 8.82% weighting in the former and 2.02% in the latter, as well as in several banking industry indices, most notably Stoxx Banks, with a weighting of 4.31%, and the Euro Stoxx Banks, with a weighting of 8.96%.

Sustainability ratings

Sustainability ratings measure a company's ESG (environmental, social and corporate governance) performance and determine its presence in the sustainability indices. Continued presence and ranking in these sustainability indices thus depend on the demonstration of constant progress in a company's sustainability and have an influence on the eligibility of companies in the investment portfolios.

In 2015, BBVA maintained its place on the main sustainability indices at international level

Sustainability ratings on which BBVA is listed

(2015)

|

|

Listed on the DJSO World and DJSI Europe |

|---|---|

|

|

|

|

|

Listed on the FTSE4Good Global, FTSE4Good Europe and FTSE4Good IBEX indices |

|

|

Industry Leader according to the latest ESG 2015 rating |

|

|

Listed on the Euronext Vigeo Eurozone 120 and Euronext Vigeo Europe 120 indices |

|

|

Included on the Ethibel Excellence Investment Register |

|

|

Included on the STOXX Global and Europe ESG Leaders indices |

|

|

In 2015, BBVA received a score of 94 points for disclosure and a B and C rating for perfmance |

(1) The inclusion of BBVA in any MSCI index, and the use of MSCI logos, trademarks, service marks or index names herein, do not constitute a sponsorship, endorsement or promotion of BBVA by MSCI or any of its affiliates. The MSCI indices are the exclusive property of MSCI. MSCI and the MSCI index names and logos are trademarks or service marks of MSCI or its affiliates.

Moreover, since 2014, BBVA has been part of the investment universe of Triodos Investment Management, the Triodos Group subsidiary that manages socially responsible mutual funds. It is the only Spanish Bank on this list.

Synthetic responsible banking index

Given the many different sustainability indices currently available on the market, BBVA has developed the synthetic responsible banking index to provide aggregate information on the Group's position in relation to its competitors, in accordance with the analyses of the main international sustainability agencies. This index also allows us to identify best practices and to continue to make progress in our responsible business strategy.

According to the latest analysis conducted with 2014 figures, BBVA has improved its position and is in first place in the index, ahead of the other 18 banks in its peer group.

BBVA is the only Spanish bank included on the list of socially responsible mututal funds of Triodos Investment Management

Synthetic responsible banking index

(Peer Group at global scope)

| Peer 1 | Peer 2 | Peer 3 | Peer 4 | Peer 5 | Peer 6 | Peer 7 | Peer 8 | Peer 9 | Peer 10 | Peer 11 | Peer 12 | Peer 13 | Peer 14 | Peer 15 | Peer 16 | Peer 17 | Peer 18 | ||

| 2014 | 74.1 | 71.1 | 70.8 | 68.3 | 67.6 | 67.5 | 67.4 | 67.0 | 66.5 | 66.0 | 65.5 | 65.3 | 64.9 | 64.2 | 64.2 | 62.9 | 60.0 | 59.7 | 59.3 |

| 2012 | 72.8 | 72.9 | 69.6 | 63.8 | 72.7 | 67.5 | 69.7 | 66.5 | 61.7 | 66.9 | 65.9 | 70.8 | 66.0 | 71.6 | 70.0 | 58.0 | 65.8 | 63.0 | 61.7 |

Source: BBVA, own elaboration.

Dialog with analysts and investors

In recent years, market interest in the ESG performance of companies has increased. BBVA maintains ongoing dialog with specialized investors and analysts through conference calls, face-to-face meetings and constant exchange of information. In 2015 we also took part for the second year in a row in two roadshows specializing in socially responsible investment organized by Société Générale and Exane BNP Paribas in Paris. During these meetings, BBVA had the chance to present to investors, asset managers and specialist analysts, one by one or in reduced groups, its strategic responsible banking lines, which are included in this report.

BBVA maintains ongoing dialog with analysts and investors interested in its ESG strategy

(1)

(1)