Corporate & Investment Banking

A detailed explanation of the aforementioned business area can be found in the Management Report.

Definition

Corporate & Investment Banking (CIB or BBVA CIB) includes the Group's wholesale businesses, i.e. investment banking, global markets, global loans and transactional services for international corporate customers and institutional investors across its global footprint.

BBVA CIB is a provider of high added-value services that, thanks to its successful business model, offers a complete catalog of products for its customers, ranging from the simplest to the most complex solutions.

BBVA's significant presence and experience on the Latin American markets has allowed BBVA CIB to position itself as a benchmark for customers around the world with interests in this region.

CIB: a global business unit with a diversified business

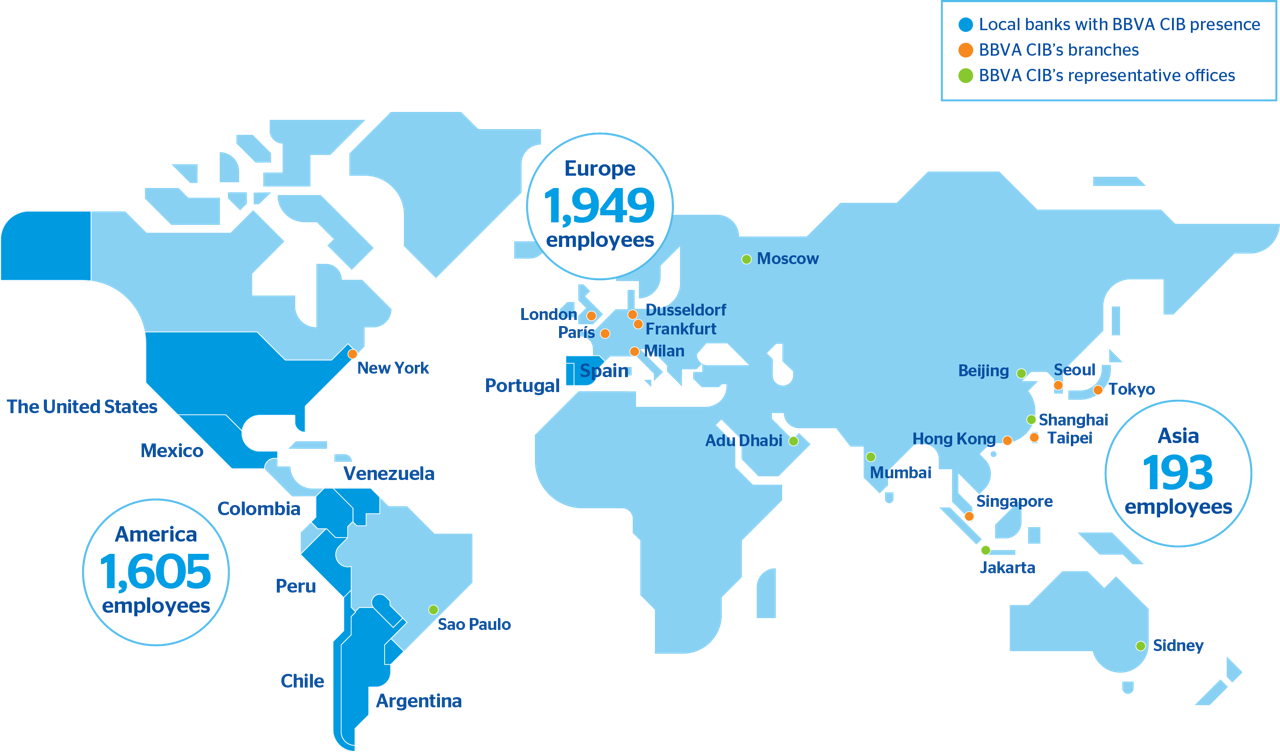

3,747 employees with a presence in 27 countries

Source: Talent & Culture. Figures as of December 2015.

Management priorities

In 2015, BBVA CIB has strengthened its customer-centric strategy of previous years, with the customer as one of the main pillars, in line with the Group's strategic priorities. This has meant working to develop a less capital-intensive and more efficient in terms of costs model, and to continue making progress in the digital transformation.

Looking forward, BBVA CIB aims to continue to offer differential growth and profitability that is higher than the industry as a whole, based on a recurring and stable business model, aligned with the Group's main strategic and financial priorities:

1. Strategic priority 1: To provide a new standard in customer experience; and 2: To drive digital sales

Customer Experience & Digital Sales are the foundations for business transformation, with the development of new digital channels that can achieve greater customer integration, providing a wider range of products and improving processes through a high level of automation, transparency and speed of execution. All the aforementioned with the aim of a better customer experience.

2. Strategic priority 4: To optimize capital allocation

Optimization of the capital model through the development of new processes and tools that help us to adapt to the new regulatory capital requirements.

3. Strategic priority 5: To adapt the model, the processes and structures to achieve an unrivaled efficiency

Cost efficiency, through the promotion of a cost policy within corporate guidelines, with greater emphasis on the management of discretionary expenses.

4. Strategic priority 6: To develop, retain and motivate a first class workforce

Lastly, BBVA CIB is developing initiatives to boost the talent of its team and promote the culture change that is being developed and implemented across the Group by Talent & Culture.

The customer as main pillar, in line with the Group's strategic priorities