Fees and commissions amount to €3,424m year to date, practically the same (up 0.7%) as for the same period in 2010. There was a positive contribution from the Turkish bank Garanti, and good figures from the banking business fees, which were up 1.4% year-on-year. However, fees from the fund management business were down 1.1% due to the adverse market conditions.

The negative performance of NTI over the quarter can be explained by various factors: a fall in asset values, reduced customer activity and the lack of earnings from portfolio sales. As a result, this item amounted to an accumulated figure of €1,063m to September (€1,642m a year ago).

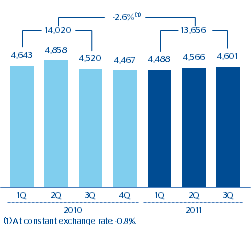

Gross income net of NTI and dividends

(Million euros)

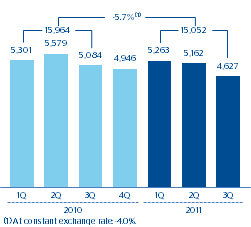

Gross income

(Million euros)

Dividend income, which basically includes income from BBVA’s holding in Telefónica, amounted to €332m, 10.2% up on the same period in 2010. However, it is important to note that the Telefónica remuneration is paid in the second and fourth quarters of 2011.

Income by the equity method continues with its positive trend, with year-on-year growth of 86.6% to €394m, thanks basically to the significant contribution from CNCB.

Finally, the item of other operating income and expenses amounted to €163m, down 27.5% compared with the same period last year. This fall is the result of both, the hyperinflation in Venezuela and the increased allocation to the deposit guarantee fund (up 21.8% year-on-year), which have not been offset by the positive performance of income from the insurance business (up 13.9%).

To sum up, the strong resilience of the Group’s recurring earnings, together with the negative figures from NTI, combine to explain why the gross income year to date is 5.7% down on the figure 12 months previously, at €15,052m. However, it is important to point out BBVA’s high capacity to generate recurring revenues quarter after quarter. The quarterly gross income net of NTI and dividends amounted to €4,602m, a year-on-year increase of 1.8% and a quarterly increase of 0.8%. In the year to date figures, the recurring gross income excluding NTI and dividends amounted to €13,656m, 2.6% down on the same period in 2010. This is due to a customer-centric retail model that uses technology as leverage and is highly diversified geographically, with the emerging countries gaining increasing weight.