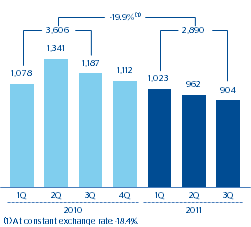

Impairment losses on financial assets continue to show a slight decrease on the previous quarter. Up until September 2011 they amounted to €2,890m, a year-on-year reduction of 19.9%. As a result, the Group’s risk premium has improved by 8 basis points over the quarter to 1.01%, and the coverage ratio now stands at 60%.

Impairment losses on financial assets

(Million euros)

Provisions amount to €328m, 19.7% down on last year. They basically include provisions for early retirements, other contributions to pension funds and contingent liabilities provisions.

Other gains (losses) stand at a negative €391m, compared with losses of €47m last year. These losses are mainly related to provisions on real estate and foreclosed assets with the aim of maintaining coverage at levels of over 30%.

Finally, there was also a low tax charge this quarter, mainly due to the lower NTI, revenues with low or zero tax rates (basically dividends and equity accounted earnings), and the higher proportion of results coming from The Americas and Garanti, which carry a low effective tax rate.