BBVA increases its profit from continuing operations by 11.7%.

BBVA earned €1,328 million between January and June, 53.9% less than in the same period last year, due to the absence of corporate operations. Not including these operations in the comparison, net income from continuing operations is up 11.7% to €1,544 million.

The soundness of recurring revenues, cost control and the decline in loan-loss provisions have driven operating profit. Gross income stands at €10,368 million, up 6.0% on the first half of 2013 at constant exchange rates. Cost control efforts have paid off, as seen in the trend in operating expenses, which are down 5.3% in the first half of the year at constant exchange rates (up 3.6% at constant exchange rates).

Revenues grew faster than expenses, generating operating income of €5,093 million between January and June, up 8.7% on the same period in 2013, excluding the exchange-rate effect.

The income statement also benefited from a gradual decline in the volume of loan-loss and real-estate provisioning. The quarterly average of provisions has been nearly halved since 2012 from €2,357 to €1,221 million in the last quarter.

Geographical diversification

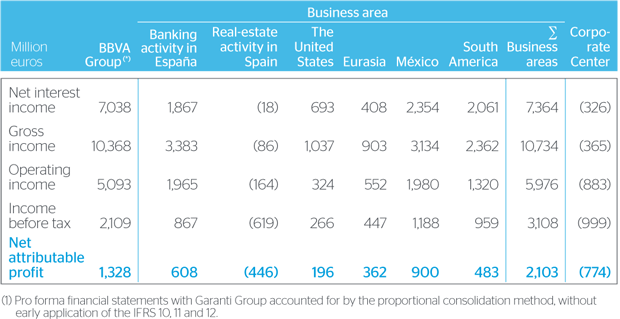

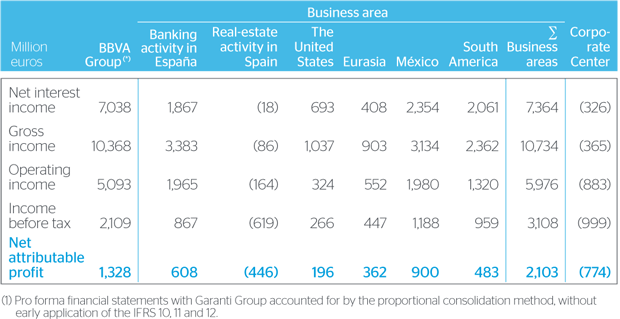

Banking activity in Spain: Worth mentioning are the improvement in customer spreads, the significant reduction in NPA and stronger, although incipient, demand for loans, more noticeable in consumer loans. BBVA granted over €43,000 million in funding to companies and SMEs and attracted 27,000 new companies. Operating expenses remain in check and are down 7.4% over the last 12 months. Risk indicators have improved: the NPA ratio stood at 6.3% and the coverage ratio at 44%. Net attributable profit from banking activity was €608 million.

Real-estate activity in Spain: Reduction in net exposure to the sector (down 12% since the end of 2012) and gradual recovery of demand. The area cut losses by 29.0% year-on-year, with net attributable profit of –€446 million.

Main items on the income statement by business area (1H14)

United States: Strong activity thanks to the commercial effort and the new digital offering being developed. Good risk indicators (the NPA ratio stands at 0.92% and the coverage ratio is 168%). The area earned €196 million (up 0.6% (1)). BBVA Compass ranked number one in American Banker's Annual Reputation Survey among customers.

Eurasia: Turkey has better prospects in terms of lending activity, revenues, loan-loss provisions, risk indicators and exchange rate. Accounting of the CNCB dividend. The area earned €362 million (up 15.2% (1)).

Mexico: The area maintained strong business activity, in both lending (up 10.2% (1)) and customer deposits (12.1% (1)). Sound income statement based on recurring revenues. Risk indicators remain stable with a 3.4% NPA ratio and a 113% coverage ratio. The area generated net attributable profit of €900 million (up 12.5% (1)).

South America: Strong rate of growth in both lending (up 24.6% (1)) and customer deposits (23.9% (1)). The NPA ratio fell to 2.1% while the coverage ratio stands at 138%. Net attributable profit was €483 million (up 177% (1)).

(1) Constant exchange rates.

Solvency and liquidity

BBVA's capital percentages remain well above the minimum required levels. If closed the first half of 2014 with core capital and Tier I capital of 11.6%, Tier II capital of 3.1% and a BIS III ratio of 14.7% (all phased-in). With a leverage ratio (fully-loaded) of 5.8%, BBVA holds a standout position in its peer group. This will enable it to confidently undergo the Comprehensive Assessment, whose results are expected to be released in October.

The BBVA Group's NPA ratio fell for the second quarter in a row to 6.4%, while the coverage ratio stands at 62%. Excluding real-estate activity, the BBVA Group's NPA ratio was 4.5%, with a coverage ratio of 63%, while net additions to NPA in the second quarter declined by 75.5% year-on-year.

(1) Real-estate activity in Spain excluded.

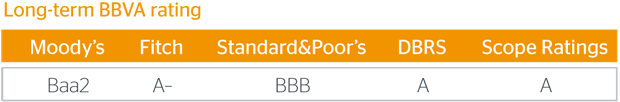

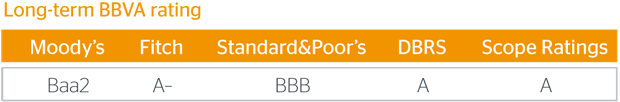

Credit rating agencies

In the first half of 2014, Moody’s, Fitch and S&P upgraded BBVA's rating, for the first time since the start of the crisis. The main credit rating agencies have confirmed BBVA's ratings following the announcement of the acquisition of Catalunya Banc by the Group.

Highlights of the quarter