The European financial sector made a notable recovery in the third quarter of 2012. This happened for a number of reasons. Among the most important are the announcements concerning the setting up of a single banking supervision mechanism in the euro zone, and the European Central Bank's new OMT purchasing program in secondary markets, subject to a prior bailout request.

The Stoxx Banks index rose 11.2% over the quarter, performing better than the Stoxx 50 general stock market index for the same period, which rose 5.8%.

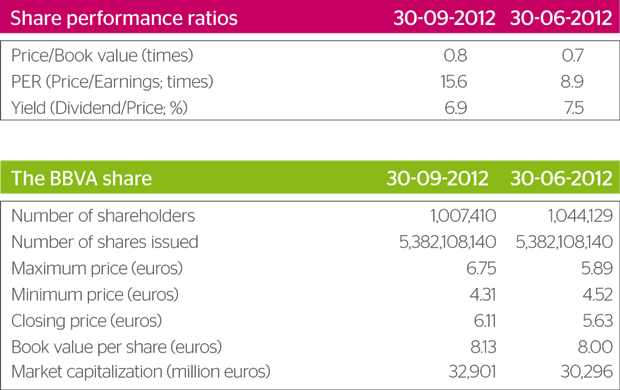

The BBVA share price rose 8.6% in the quarter to €6.11 per share, and the dividend yield (calculated using the average dividend per share estimated by Bloomberg analysts for 2012 as a proportion of the share price as of September 30, 2012) now stands at 6.9%.

The recurring earnings enable BBVA to continue with its dividend payment policy. On September 14, a payment of €0.10 per share was announced as part of the flexible remuneration system known as the "dividend option" and agreed at the General Meeting of Shareholders on March 16, 2012.

Around 80% of shareholders have chosen to receive new BBVA shares.