The European financial sector made a notable recovery in the third quarter of 2012.

The BBVA share price rose 8.6% in the quarter to €6.11 per share and the dividend yield now stands at 6.9%.

| Share performance ratios | |

|---|---|

| P/E (Price/earnings ratio; times) | 8,9 |

| Dividend yield (Dividend/price; %) | 7,5 |

| The BBVA share | |

|---|---|

| Number of shareholders: | 1.007.410 |

| Market capitalization (million euros): | 32.901 |

BBVA paid a dividend of €0.10 per share using the "dividend option" formula in October.

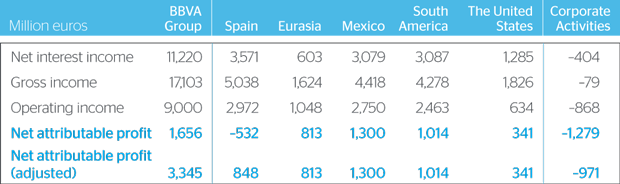

During the first nine months of the year, BBVA's earnings amounted to €1,656 million. Operating income, which is critical to covering loan-loss provisions, came to €9,000m, 16.1% higher than in the same period of 2011.

|

Capital:

|

||

EBA ratio >9% |

BIS II 10,8% |

BIS III (e) 2013 10,8% |

Liquidity: |

Issues: 6.7 billion euros |

Risks: |

|

NPL ratio 4,8% |

Coverage ratio 69% |

Efficiency: |

Efficiency ratio 47,4% |

Income statement by business area.

BBVA wins the Stevie award for Best Investor Relations Site at the International Business Awards.

BBVA wins the Stevie award for Best Investor Relations Site at the International Business Awards.

BBVA Bancomer is joining the Momentum Project, a global initiative of the BBVA Group, which helps entrepreneurs develop business initiatives.

BBVA Sustainability Indices.