The market remained upbeat in the final quarter of 2012, with the Ibex 35 gaining 6.0% over the quarter.

The BBVA share price appreciated by 13.9% in the quarter to €6.96 per share. Adjusted earnings per share stood at 0.63 euros per share.

In the financial sector, the Stoxx Banks and Euro Stoxx Bank indexes have posted quarterly rises of 10.5% and 10.6%, respectively.

| Share performance ratios | |

|---|---|

| P/E (Price/earnings ratio; times) | 21,5 |

| Dividend yield (Dividend/price; %) | 6,0 |

| The BBVA share | |

|---|---|

| Number of shareholders: | 1.012.864 |

| Market capitalization (million euros): | 37.924 |

BBVA earned €1,676 million in 2012, 44.2% down on the previous year, once real-estate provisioning in Spain was completed.

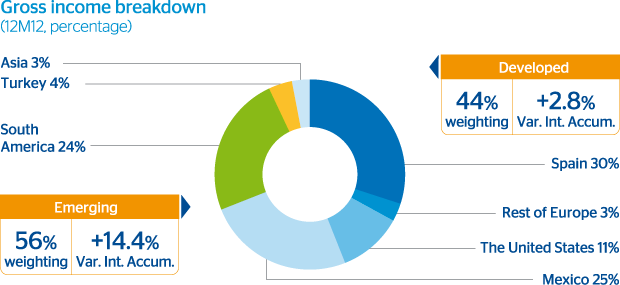

Gross income increased in all of the Group's business areas

Capital: |

BIS II ratio

10,8% |

EBA ratio

>9% |

Liquidity: |

Total emissions in 2012: 14 billion euros |

Risks: |

|

NPL ratio 5,1% |

Coverage ratio 72% |

Efficiency: |

Efficiency ratio 48,1% |

Income statement by business area.

Emerging markets: |

Invest to reap the benefits of growth

|

Developed markets: |

Priority focus on profitability |

Group strategy: |

Make the most of opportunities to strengthen the core business

|

The BBVA ‘Tu solidaridad vale el doble’ (Your solidarity is worth twice as much) campaign ends with nearly €5 million raised.

BBVA Sustainability Indices.