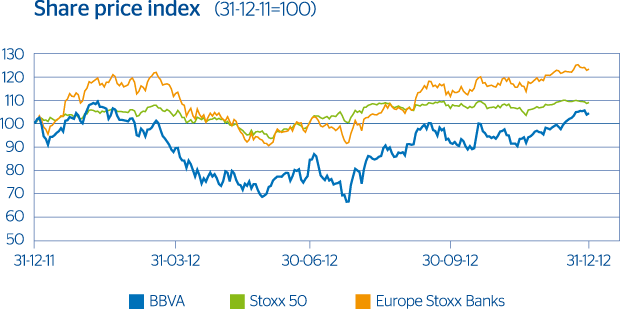

The final quarter of 2012 saw a continuation of the easing of perceptions of sovereign risk that began with the ECB announcement of the launch of a sovereign debt repurchasing program, subject to conditionality and express requests from countries. This contributed to market sentiment remaining positive (the Stoxx 50 was up 2.4% in the quarter). Securities in peripheral countries benefited to a greater extent (the Ibex 35 gained 6.0% in the quarter).

There were no negative surprises in the financial sector, although the trends seen in previous quarters continued (pressure on margins and impaired asset quality, particularly in peripheral countries). As a result, the performance of the financial industry improved, with the Stoxx Banks and Euro Stoxx Banks indices performing very similarly, rising 10.5% and 10.6%, respectively, in the quarter.

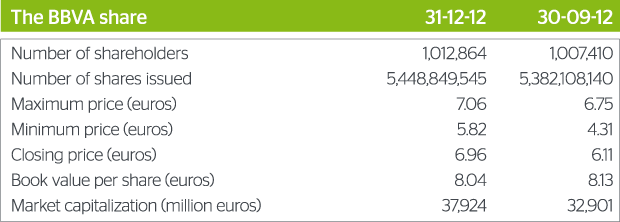

The BBVA share gained 13.9% over the quarter to €6.96 per share, with market capitalization of €37,924 million. This equates to a price/ book value ratio of 0.9, with a PER of 21.5 times and a dividend yield of 6.0% (calculated on average dividends per share estimated by analysts for 2012 compared to the share price on 31 December).

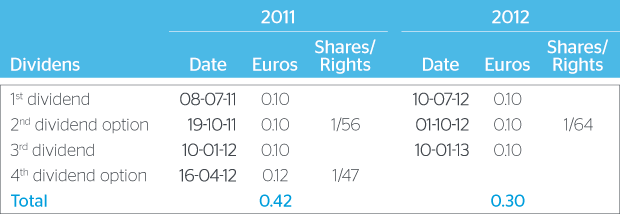

Recurring earnings enable BBVA to continue its dividend payment policy. With respect to shareholder remuneration, payment of an interim dividend of €0.10 per share against 2012 earnings was announced on December 19, and paid out on January 10, 2013.