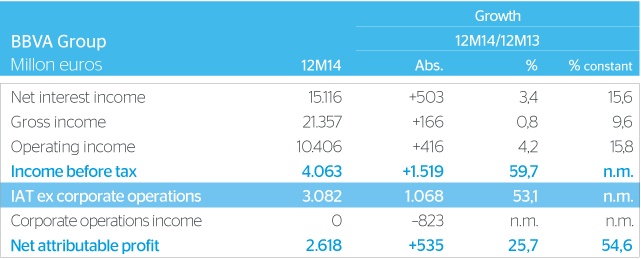

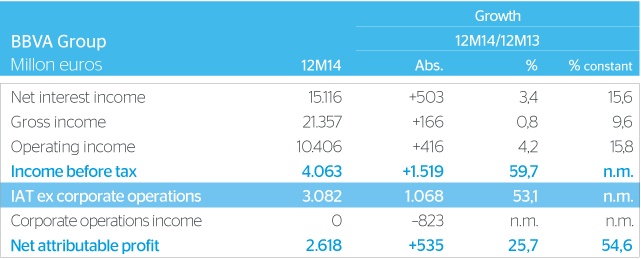

Net income from ongoing operations, which does not include the earnings from corporate operations, grew by 53.1% year-on-year to €3,082m.

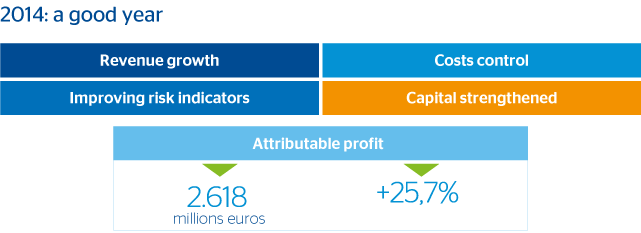

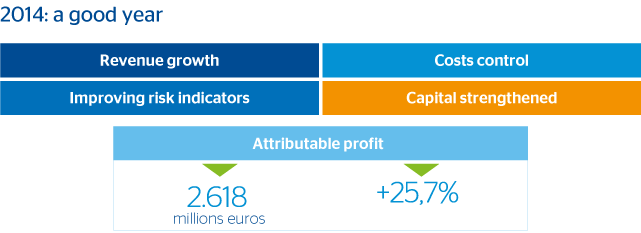

BBVA Group earned €2,618m in 2014, 25.7% up on the 2013 figure, according to the new accounting criteria (1), boosted by good net interest income, cost control and lower loan-loss provisions.

Revenue was particularly strong toward the end of the year.

Revenue was particularly strong toward the end of the year. Between October and December, all the income headings were at a record for the last 10 quarters. Net interest income totaled €4,248m, gross income €5,765m, while operating income was €2,860m.

Loan-loss and real-estate provisions for 2014 (€5,012m) were down by more than €1,600m on 2013 and practically half the figure two years earlier. Risk indicators have continued to improve. BBVA Group's NPA ratio stood at 5.8% in December (1 pp down on the same month in 2013).

(1) As a result of the adoption of the IFRIC 21 Interpretation on levies issued by the IFRS interpretation Committee, the accounting policy related to the contributions made to the Deposit Guarantee Fund was amended in 2014. In accordance with the International Accounting Standards, this change has been applied retroactively, and therefore certain amounts from previous years have been re-expressed for comparison purposes.

Geographical diversification

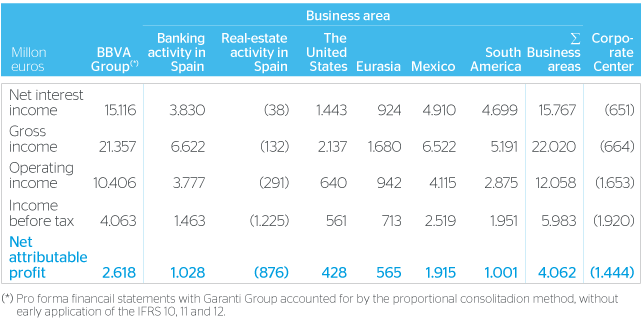

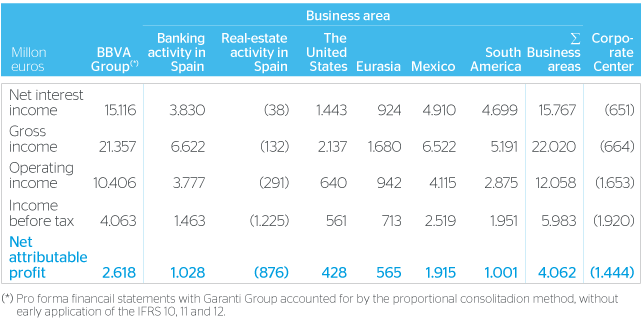

Banking Activity in Spain: recovery of activity and cost control have boosted the income headings in the income statement. In the cumulative figure, net interest income was practically the same as the previous year (down 0.2%) (1) , while gross income and operating income increased by 12.3% (1) and 31.0% (1) respectively. The NPA ratio improved to 6.0% (1) in December, with a coverage ratio of 45% (1) . The area had earnings of €1,028m in 2014, more than double the figure the previous year.

Real estate activity in Spain: sales in the area increased by 18% year-on-year to €1,932m. The trend in the market was positive, with an incipient recovery in prices and demand.

Main items on the income statement by business area (2014)

United States: all the income headings rose in the last three months on the same period in 2013. Risk indicators remained flat, with an NPA ratio of 0.9%(2) in December and a coverage ratio of 167%(2) . The United States had a net attributable profit of €428m in 2014 (up 8.9% year-on-year) (2).

Eurasia: Turkey has once more been key, with double-digit growth in revenue. The lower provisions and recovery of wholesale banking also led to the area generating a net attributable profit of €565m (up 36.3%(2) year-on-year).

Mexico: BBVA Bancomer maintained its leadership as the biggest bank in the country and a benchmark in terms of size, share of assets and liabilities, risk management, efficiency and profitability. The NPA ratio declined to 2.9%(2) in December, from 3.6%(2) in December 2013, with a coverage ratio of 114%(2). Mexico earned €1,915m in the year (up 10.7%(2) year-on-year).

South America: once more the most dynamic area in terms of activity, with growth of over 20%(2) year-on-year in both loans and customer funds. At the close of the year, the NPA ratio was again 2.1%(2) as in the two previous Decembers, with a coverage ratio of 138%(2). The area earned €1,001m last year (up 6.3%(2) with respect to 2013).

(1) Applying the accounting restatement

(2) At constant exchange rates

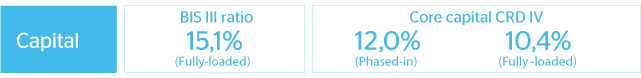

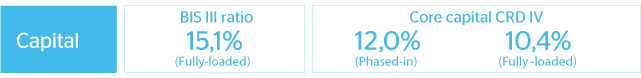

Solvency

BBVA increased its phased-in and fully-loaded capital ratios, thanks to the organic generation of earnings and capital increases completed during the period (one to implement the "dividend option" in October and the other through an accelerated bookbuilt offering of shares among qualified investors in November). As a result, BBVA maintained its capital levels well above the minimum regulatory requirements. The leverage ratio (fully-loaded) stood at 5.9%, a percentage that continues to compare very favorably with its peer group

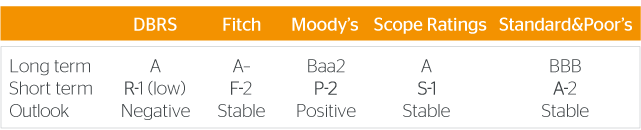

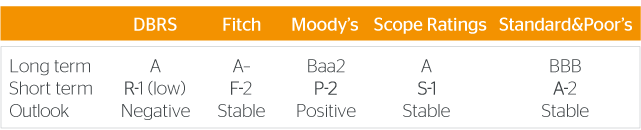

Credit rating agencies

Following the announcement of the acquisition of the additional 14.89% in Garanti Bank, in November 2014 the main agencies confirmed BBVA's rating. The upgrades in the Bank's ratings in the first half of 2014 were thus confirmed.

Risks

In the last quarter of 2014 the main variables related to the Group's credit risk management were positive, in line with the trend of previous quarters. The NPA ratio continued to decline, closing December at 5.8% (including real-estate activity), down from 6.1% in September 2014. This favorable performance cuts across all the geographical areas and is due to the declining trend in non-performing assets, combined with an increase in the balance of the loan book. In addition, the coverage ratio increased by 142 basis points over the quarter to 64%.

Key factors in the year