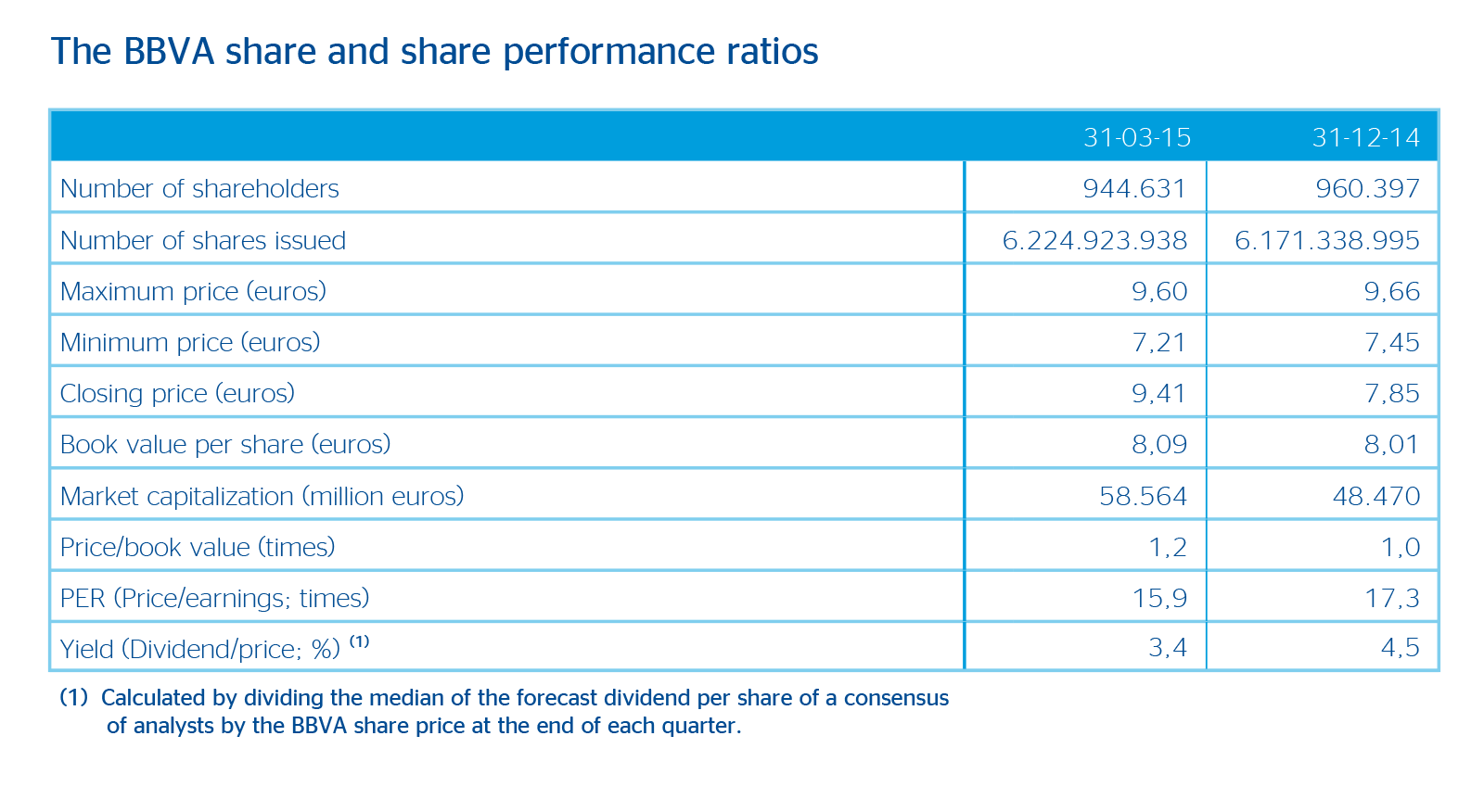

As of March 31, 2015, the BBVA share price stood at €9.41 per share, a gain of 19.8% over the quarter and 7.9% in the last 12 months

In the first quarter of 2015, the global economy continued to show differences between geographical areas, with better relative performance in developed economies compared with the gradual slowdown in China and moderate activity in other emerging regions. This is taking place in a scenario of some geopolitical tensions, an absence of inflationary pressures and diverging monetary policies.

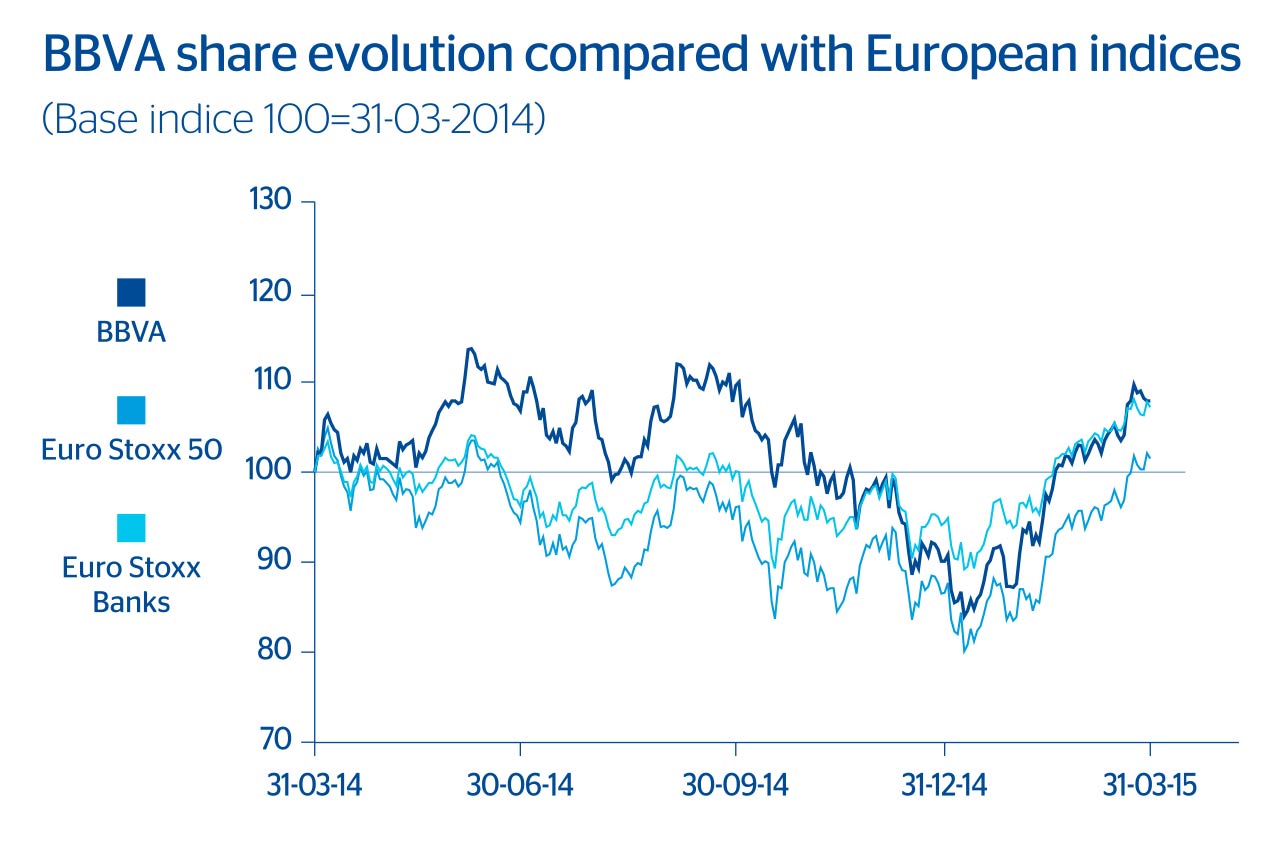

Against this backdrop, the main stock market indices closed the first quarter of 2015 with general rises, which were significantly higher in Europe than in the United States (the Euro Stoxx 50 up 17.5%, the Ibex 35 up 12.1% and the S&P 500 up 0.4%). At the industry level, the Eurozone banking index, Euro Stoxx Banks, gained 17.2% in the quarter, while the S&P Regional Banks in the United States lost 0.9% in the same period.

As of March 31, 2015, the BBVA share price stood at €9.41 per share, a gain of 19.8% over the quarter and 7.9% in the last 12 months. In quarter-on-quarter terms it outperformed the Ibex 35 and the European indices Euro Stoxx 50 and Euro Stoxx Banks. As of 31-Mar-2015, the share has a weighting of 10.51% on the Ibex 35 and of 2.49% on the Euro Stoxx 50. As of the same date, BBVA's market capitalization stood at €58,564m, 20.8% higher than on 31-Dec-2014.

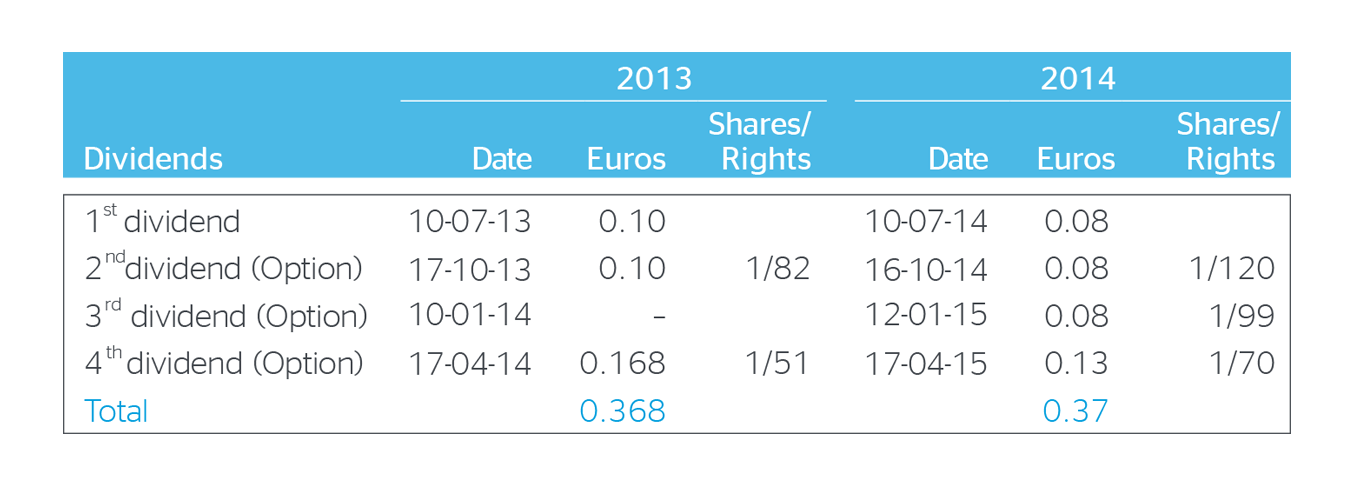

There was a new bonus share issue in April to implement the "dividend option". On this occasion, the holders of 90.3% of the free allocation rights chose to receive new shares, which once more demonstrates the success of this remuneration system.