The BBVA Group’s earnings grew sharply in the first quarter

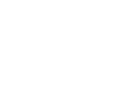

The net attributable profit for the quarter stands at €1,536m, well above the €624m reported for the same period the previous year. Net income from ongoing operations grew year-on-year by 42.0%.

Earnings from corporate operations includes the capital gains (€583m after tax) from the various sale operations equivalent to the 5.6% of BBVA Group's stake in CNCB.

Recurring revenue increased year-on-year by 8.3%, thanks to the growth of net interest income in practically all geographical areas and to the positive trend in fees and commissions, despite the regulatory limitations that took effect in several countries in recent quarters.

Thus, the Group's gross income has risen by 11.5% over the last twelve months to €5,632m in the quarter.

There has been a moderate increase in operating expenses, largely because they have been kept firmly in check in Spain, the United States and the Corporate Center. This has offset the effect of the high inflation in some countries and the digital transformation plans that the Group is continuing to implement. The year-on-year increase in expenses is below that of gross income. As a result, operating income grew to €2,857m, 17.2% up on the same period in 2014.

Impairment losses on financial assets are very similar to the quarterly average in the 2014.

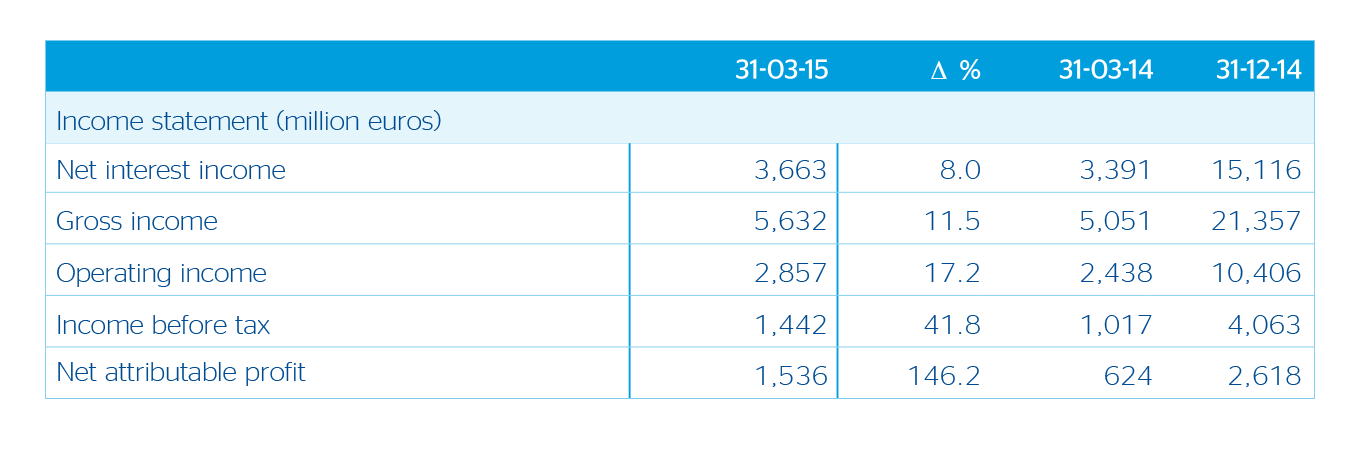

Banking activity in Spain: The recovery in credit is consolidating its trend, although there is still no clear growth in credit stock. Year-on-year growth in net interest income (up 3.9%) is basically due to the reduced cost of both retail and wholesale finance. Impairment losses on financial assets continue to fall, with an improvement in the NPA and coverage ratios. Net attributable profit in the area is €347m, a year-on-year fall of 9.6%.

Impairment losses on financial assets continue to fall, with an improvement in the NPA and coverage ratios. Net attributable profit in the area is €347m, a year-on-year fall of 9.6%.

Real-estate activity in Spain: The negative result of €154m compares very favorably with the same period the previous year, mainly due to the lower provisioning requirements for loans and real-estate assets.

United States: Gross income figures were positive, and combined with operating expenses being kept in check, resulted in a year-on-year rise in operating income of 10.1% and a significant improvement in the efficiency ratio. The NPA ratio is 0.9% and the coverage ratio 164%. The area has generated a net attributable profit of €136m.

Turkey: Gross customer lending closed the quarter with year-on-year growth of over 18% (up 25% at constant prices), boosted by the strength of consumer loans, mortgage loans and corporate finance. The integration into BBVA Group earnings of the 25.01% stake in Garanti has resulted in additional earnings of €86m.

Mexico: In Mexico, BBVA has reported a sound income statement, despite the country's moderate economic growth. The area's net attributable profit stands at €524m, up 7.1% over the last 12 months.

South America: The area has posted double-digit year-on-year growth in both lending and customer funds, while restricting both the NPA ratio and coverage ratio. The area's earnings in the first quarter of 2015 were €227m.

Rest of Eurasia: Net attributable profit similar to the first three months of 2014.

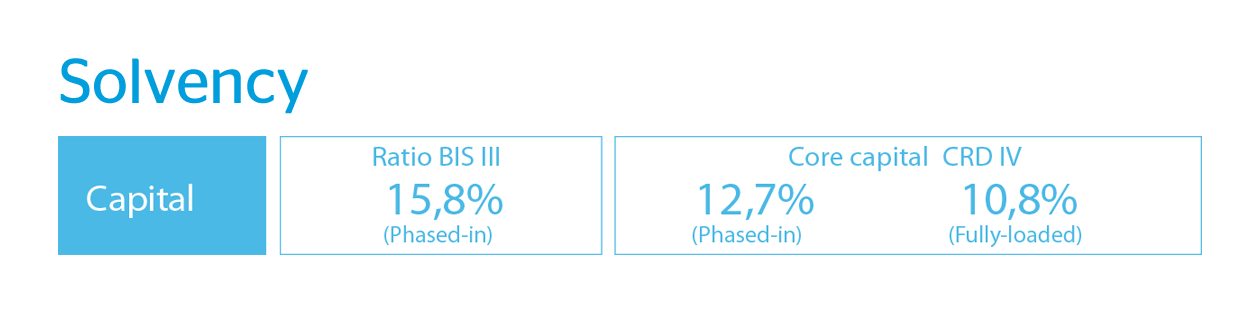

BBVA's capital levels remain well above the minimum required levels, thanks basically to three factors: organic generation of earnings, closure of the CNCB sale operations mentioned earlier, and the issue of instruments that are eligible as additional Tier I, while preserving a leverage ratio (fully-loaded) of 6.2%, which still compares very favorably with the rest of its peer group.

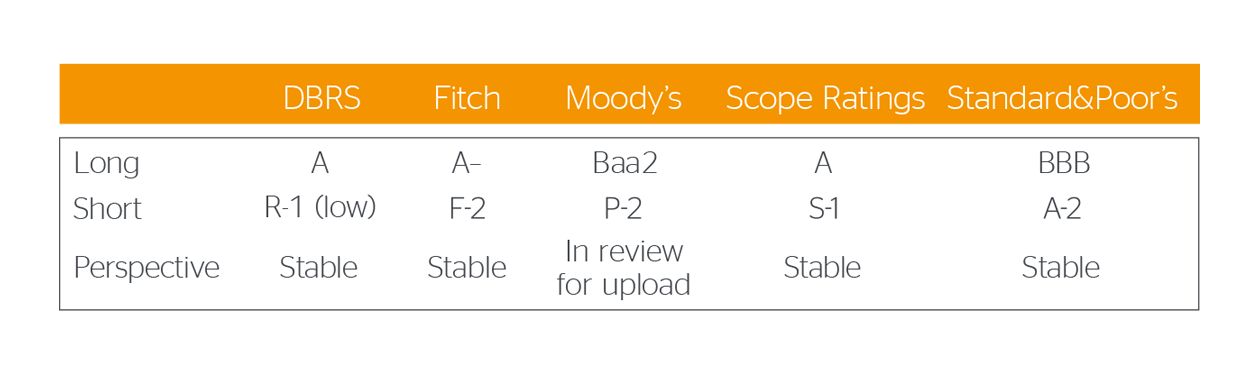

Moody’s has placed the long-term rating of BBVA's senior debt and deposits under review for upgrade.

In the first quarter of 2015 the main variables related to the Group's credit risk management have been positive, in line with the trend in previous quarters:

As of March 2015, BBVA has 9.5 million digital customers who interact with the Bank via the Internet or their cell phones, up 20% as an average annual growth rate (AAGR) since December 2011. Of this total, 4.7 million are mobile banking customers (up 125% AAGR since December 2011).

The Annual General Meeting of Shareholders was held on March 13, with a percentage participation rate of over 62%, in line with previous meetings. There was overwhelming support from both institutional and individual shareholders for the management in 2014. BBVA is the first company in Spain to submit the remuneration policy of its directors to a binding vote of the shareholders, and the policy received 95% votes in favor.