The BBVA Group’s earnings grew sharply in the first quarter

BBVA Group has generated a half-yearly net attributed profit of €2,759m, a figure that is over twice that for the same period the previous year. These earnings include those generated by Catalunya Banc, whose effect is practically neutral at the level of net attributable profit.

Banking activity in Spain: The purchase of Catalunya Banc was completed on April 24. As of June 30, this bank contributed €23,459m to the loan book and €29,555m in customer funds. Excluding the effect of this change in scope, the rate of fall in gross customer lending continues to slow (-0.6% since December 2014), thanks to the good performance of new loans granted. Net attributable profit in the area is €809m, a year-on-year rise of 33.1%.

Real-estate activity in Spain: The loss of €300m compares very favorably with the same period last year, basically due to the lower loan-loss and real estate provisioning requirements, as well as better revenue from sales.

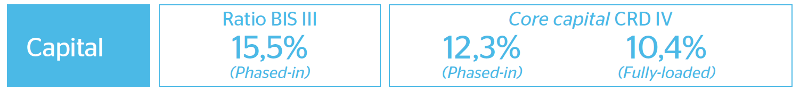

BBVA ended the first half of 2015 with comfortable capital levels clearly above the minimum regulatory requirements, and a leverage ratio (fully-loaded) that continues to compare very favorably with the rest of its peer group.

In the first half of 2015 the main variables related to the Group's credit risk management have been positive. The increase in credit risk and non-performing loans, as well as the performance of the main risk indicators, have been affected by the incorporation of Catalunya Banc. On a comparable basis, the general tone remains positive.

BBVA Group had 13.5 million digital customers as of June 2015, a year-on-year increase of 21%. This growth is even bigger (59%) if we focus on the customers who connect with the Bank via their cell phones. Of the new consumer loans granted by BBVA in Spain, 17.9% were arranged through digital channels.

The Board of Directors has appointed Carlos Torres Vila as President and COO. It has also approved an organizational structure whose top priority is to boost the business and continue to grow profitably, increasing the number of customers with the focus on their satisfaction. In order to gain market share, customers and business, BBVA is committed to investing in new capabilities associated with customer experience, big data, technology and engineering, marketing and digital sales, and talent and new digital businesses. BBVA has drawn up a new Code of Conduct to adapt to social, technological and regulatory changes. It strengthens the Bank's commitment to its customers, employees and society as a whole.