The share

In the third quarter of 2021, the global economy has continued to recover from the crisis caused by the COVID-19 pandemic, mainly thanks to progress in vaccine rollout against COVID-19 and the significant economic stimuli adopted by public authorities. Activity indicators show, however, that the economic recovery process has lost momentum in recent months, especially in countries such as the United States and China.

Furthermore, upward pressure on prices has recently increased more than expected. Consumer inflation remains at unusually high levels, well above average levels in 2010 and 2019. In September, annual inflation stood at 5.4% in the United States and 3.4% in the Eurozone.

Both the recent slowdown in growth and inflation rise in recent months are partly due to a series of problems in global supply chains, caused, among other factors, by the relative strength of demand versus supply, after the rapid reopening of the economy which was possible thanks to the drop of COVID-19 infections. Meanwhile, commodity prices have risen sharply in recent months, especially energy prices, reinforcing upward pressures on prices and downward pressures on economic activity.

In this context, the United States Federal Reserve is preparing to start the process of withdrawing monetary stimuli. Specifically, the rollback in its bond-buying program is probably to begin in the last quarter of 2021 and, in terms of monetary policy, it is likely that interest rates will be gradually adjusted upward starting the end of 2022. In any case, the approach of economic policy in the major regions is expected to settle in the coming quarters.

According to BBVA Research estimates, the recovery process of the global economy is expected to continue in the coming months, although at a slightly slower pace than expected three months ago and global GDP will expand around 6.1% in 2021. Also according to BBVA Research forecasts, growth will reach 5.9% in 2021 in the United States, 8% in China and 5.2% in the Eurozone. Furthermore, inflationary pressures are expected to remain relatively high, though they will most likely moderate next year as problems in global supply chains remedied.

The main stock market indexes remained practically stable during the third quarter of the year. In Europe, the Stoxx Europe 600 index increased by +0.4% compared to the end of June, and in Spain the Ibex 35 decreased slightly by -0.3% during the quarter. In The United States, the S&P 500 index also remained practically flat, +0.2% in the period.

With regard to the banking sector indexes, their performance in the third quarter of 2021 was better than the general indexes in Europe. The Stoxx Europe 600 Banks index, which includes the banks in the United Kingdom, and the Euro Stoxx Banks, an index of Eurozone banks, increased by +5.1% and +7.1% respectively, meanwhile in The United States, the S&P Regional Banks sectoral index increased by +3.4% in the period.

For its part, the BBVA share performed better than its sectoral index, with an increase of +9.4% during the quarter and closed the month of September at €5.72.

BBVA share evolution

Compared with European indexes (Base indice 100=31-12-20)

BBVA

Eurostoxx-50

Eurostoxx Banks

The BBVA share and share performance ratios

| 30-09-21 | 31-06-21 | |

|---|---|---|

| Number of shareholders | 836,979 | 849,605 |

| Number of shares issued (millions) | 6,668 | 6,668 |

| Closing price (euros) | 5.72 | 5.23 |

| Book value per share (euros) | 6.76 | 6.69 |

| Tangible book value per share (euros) | 6.41 | 6.34 |

| Market capitalization (millions of euros) | 38,120 | 34,860 |

| Yield (dividend/price; %) (1) | 1.0 | 1.1 |

(1) Calculated by dividing shareholder remuneration over the last twelve months by the closing price of the period.

Regarding shareholder remuneration, following the lifting of restrictions by the European Central Bank, BBVA has resumed, on September 30, 2021, to its shareholder remuneration policy of distributing between 35% and 40% of the profits obtained in each year entirely in cash through two payments (tentatively in October and April, subject to the relevant approvals). Thus, on September 30th, the Board of Directors of BBVA approved a cash interim dividend payment of €0.08 (gross) per share for the 2021 fiscal year. The dividend was paid on October 12, 2021.

As of September 30, 2021, the number of BBVA shares was 6,668 billion, and the number of shareholders reached 836,979. By type of investor, 62.24% of the capital is held by institutional investors and the remaining 37.76% by retail shareholders.

BBVA shares are included on the main stock market indexes, among them the Euro Stoxx 50, of which BBVA returned to on September 20th, only one year after its exit, due to the good performance of the share. This milestone -exit and re-enter the following year- has not been achieved by any company at least in the last decade.

At the closing of September 2021, the weighting of BBVA shares in the Ibex 35, Euro Stoxx 50 and the Stoxx Europe 600 index, were 7.90%, 1.26% and 0.38%, respectively. They are also included on several sector indexes, including Stoxx Europe 600 Banks, which includes the United Kingdom, with a weighting of 5.02% and the Euro Stoxx Banks index for the eurozone with a weighting of 8.19%.

Group's information

The BBVA Group generated a net attributable profit, excluding non-recurring impacts, of €3,727m between January and September 2021, representing a year-on-year increase of +84.9%.

Including the non-recurring impacts —namely the €+280m corresponding to the profit generated by BBVA USA and the rest of Group's companies included in the sale agreement to PNC until the closing date of the operation on June 1, 2021 and the €-696m of net costs related to the restructuring process— the Group's net attributable profit amounts to €3,311m, which compares very positively with the €-15m in the same period of the previous year, which was severely affected by the effects of the COVID-19 pandemic.

In year-on-year terms and at constant exchange rates, it is worth highlighting the good performance of the gross income and especially of the recurring income, i.e. the sum of net interest income and fees, which grew by 6.1%, and the positive evolution (+13.7%) of net trading income (hereinafter NTI) mainly due to the good performance of the Global Markets unit in Spain and the revaluations of the Group stakes in Funds & Investment Vehicles in tech companies and the industrial and financial portfolio.

Operating expenses increased (+6.5% year-on-year) in all areas except Spain and Rest of Business. This growth is framed within an environment of activity recovery and high inflation, particularly in Mexico and Turkey.

Lastly, the lower provisions for impairment on financial assets stand out (-46.2% in year-on-year terms and at constant exchange rates), mainly due to the strong impact of provisions for COVID-19 in 2020.

Net attributable profit (1)(MILLIONS OF EUROS)

General note: (I) Excludes: BBVA USA and the rest of the Group's companies in the United States sold to PNC on June 1, 2021, as of Jan.-Sep.20 and Jan.-Sep.21 and (II) the net cost related to the restructuring process as of Jan.-Sep.21

(1) At constant exchange rates.

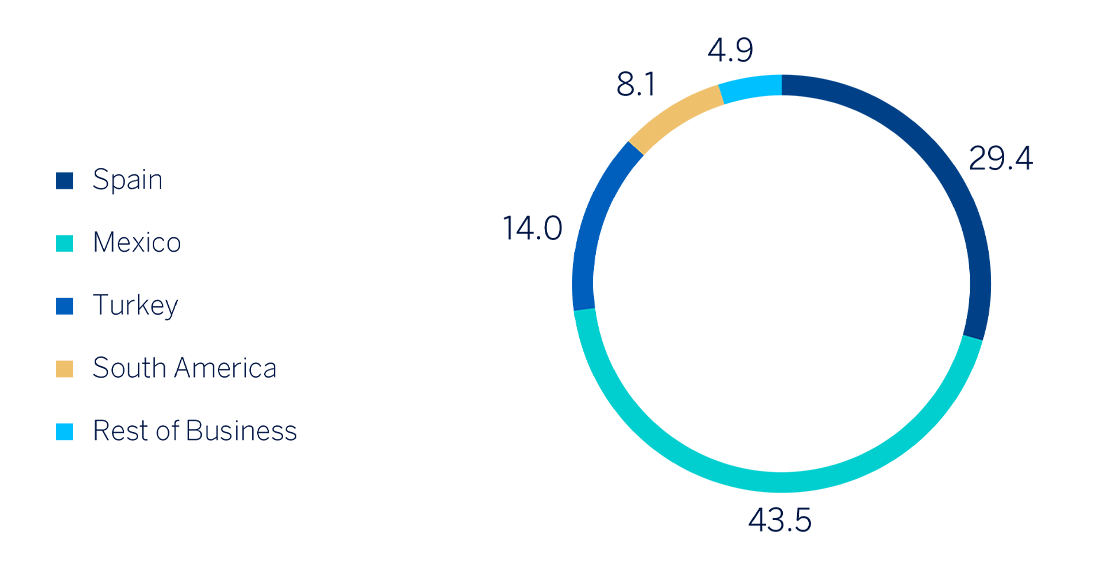

Net attributable profit breakdown (1) (PERCENTAGE. JAN.-SEP.2021)

(1) Excludes the Corporate Center.

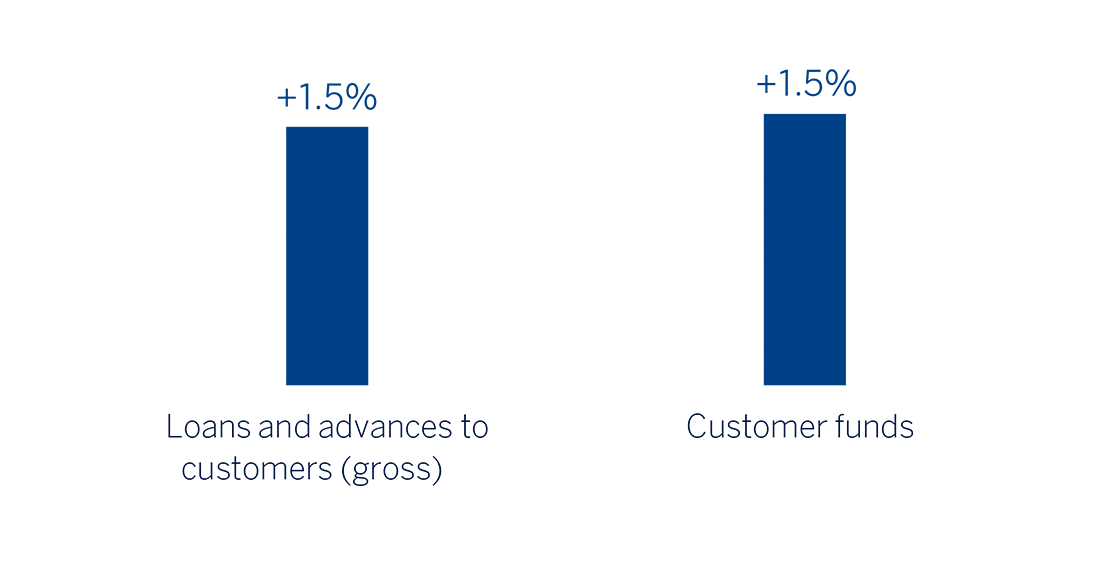

- Loans and advances to customers (gross) recorded an increase of 1.5% compared to the end of December 2020, strongly supported by the performance of individuals (+2.5%), with growth in almost all geographical areas, except Rest of Business, highlighting the increase of consumer loans and credit cards in Turkey, Spain and Mexico. Loans to business also increased slightly (+0.6% in the year), thanks to the positive evolution in Mexico and Spain.

- Customer funds showed an increase of 1.5% compared to the end of December 2020, due to the favorable performance of demand deposits and off-balance sheet funds in all geographical areas (highlighting mutual funds in Spain and Mexico), which manage to offset the decline in time deposits (-16.5%) thanks to the lower balances recorded in Spain and, to a lesser extent, in Rest of Business.

LOANS AND ADVANCES TO CUSTOMERS (GROSS) AND CUSTOMER FUNDS (YEAR-TO-DATE CHANGE)

BBVA's strategy has been reinforced in 2021 as a result of the acceleration of some of the trends, such as digitization or the commitment to more sustainable and inclusive development. The anticipation of these trends in the Group strategy has allowed BBVA to progress in the execution of its six strategic priorities

Between January and September 2021, BBVA has continued to help its clients improve their financial health by focusing on the development of new tools and functionalities.

In this regard, BBVA’s mobile banking app continues to lead the digital experience in Europe for the fifth consecutive year, according to the recent report “The Forrester Digital Experience ReviewTM: European Mobile Banking Apps, Q3 2021". BBVA has stood out especially for the experience it offers in financial health, which helps clients improve their financial well-being through tailored suggestions. This functionality also offers useful content that guides clients in managing their day-to-day finances with a clear and intuitive design.

Advice that is appreciated by BBVA clients, which is reflected in a better Net Promoter Score among users of the financial health tools in Spain in the last quarter, which is 39% higher than that of other customers. Likewise, these financial advisory tools have been a key element for the contracting of products. Thus, in Spain, in the first nine months of the year they have contributed 17% of all investment fund contracts, and 25% of mortgage contracts.

Furthermore, the Group has reaffirmed its commitment to sustainability in 2021 with a focus on combating climate change and inclusive growth. BBVA wants to help its clients in the transition towards a sustainable future not only with financing but also with advice and innovative sustainable solutions.

In terms of financing, BBVA has originated a total of €75,355m in sustainable financing between 2018 and September 2021. This type of financing has grown by 69% in the first nine months of 2021 compared to the same period of the previous year. A good example of the operations included in this type of financing is the €833m stake in a recent issuance of green debt from the Kingdom of Spain. The funds will be used to finance projects that promote ecological transition and adaptation to and mitigation of the impact of climate change.

BBVA aims to provide a comprehensive support service to its customers, individuals and companies, including also advisory so that they can take advantage of investment opportunities in sustainability and future technologies, and be more efficient and competitive. Thus, the Group continues being a pioneer in the development of innovative sustainable solutions. A good example is the recent launch in Spain of a tool for calculating the carbon footprint for retail customers, already developed for companies in 2020. This tools measures CO2 emissions into the atmosphere, based on data collected from invoices and card payments in selected shops, and offers a series of tailored tips on how to reduce them. The global nature of this new development allows it to be implemented in other geographical areas.

But beyond the origination of sustainable financing, in terms of managing the impact of the activity and integrating the risk of sustainability into the Bank’s processes, in the first nine months of 2021, BBVA has announced very relevant milestones such as the commitment to channel €200 billion to sustainable financing between 2018 and 2025, twice the amount established in the initial target; the decision to stop financing companies with coal-related activities; or the Net Zero 2050 commitment, which implies zero net CO2 emissions in that year, taking into account both the direct emissions of the Bank (where it has been neutral since 2020) and indirect emissions, i.e. those of the customers it finances. In this regard, BBVA is advancing in setting 2030 decarbonization goals in CO2 intensive selected industries, which will be announced in the context of the COP26.

In addition, a new global Sustainability area has been created, which aims to position BBVA as the benchmark bank for customers in sustainability solutions. The new global area will design the strategic sustainability agenda, define and promote the lines of work in this area of the different global and transformation units (Risk, Finance, Talent and Culture, Data, Engineering, among others) and develop new sustainable products. In addition, this area will be in charge of developing specialized knowledge for differential clients advice.

Regarding the focus on inclusive growth, BBVA and its foundations have recently announced their Community Commitment 2025, a plan through which they will allocate €550m to social initiatives, supporting inclusive growth in the countries where they operate. This commitment aims to address the most important social challenges in each region and complements the previously announced commitment to channel sustainable financing in the period 2018-2025 amounting to €200 billion.

This commitment has three lines of action: reducing inequality and promoting entrepreneurship, providing opportunities for all through education and supporting research and culture.

Through various initiatives, BBVA will support 5 million entrepreneurs, help more than 3 million people have a quality education and train 1 million people in financial education. In addition, the BBVA Microfinance Foundation will provide more than €7 billion in microcredits. In total, these programs will reach 100 million people during the mentioned period.

For all the reasons mentioned above, BBVA is the most sustainable European bank, according to the Dow Jones Sustainability Index, and the second in the world. An acknowledgement shared by Euromoney, which has named BBVA the best bank in corporate social responsibility in Western Europe in 2021, recognizing BBVA's commitment to improve social, economic and environmental conditions in the region.

On the other hand, BBVA seeks to accelerate its growth, positioning itself where its customers are, which requires a greater presence in digital channels, both own and third parties. BBVA considers that it is a great time to grow profitably and invest in value segments as well as other growth paths such as the entry into new markets, agreements with third parties or the digital acquisition of new customers. In this sense, the Group has recently announced the launch of a purely digital retail offer in Italy, with differential proposed value and customer experience. Besides, BBVA continues focusing on the acquisition of retail customers through its own digital channels, which, based on data as of the end of September 2021, has increased by 48% in the last twelve months, reaching 37% of new customers in the period. This has also been reflected in digital sales which, in cumulative terms and at the end of September, already represented 55% of the Group's total sales in PRV1.

BBVA continues to make progress towards operational excellence. The Group aims to offer an excellent customer experience at an efficient cost through a relationship model leveraging digitalization. In this sense, 68% of the bank's active customers already use digital channels and 64% use mobile channels. Thanks to this, BBVA stands out ¡n terms of efficiency with a ratio of 44.7% compared to the average of its European peers.

The Group places the best and most committed team at the center of its strategic priorities. For this reason, BBVA is one of the 30 companies worldwide awarded with the recognition “Exceptional Workplace 2021” by the American consulting firm Gallup. This award distinguishes organizations committed to developing the human potential of their staff.

Likewise, the Group's commitment to inclusion and diversity and the initiatives developed in this regard has led BBVA to be included for the fourth consecutive year in the Bloomberg Gender-Equality Index, a ranking that includes the 100 global companies with the best practices in gender diversity. BBVA is also a signee of the Charter of Diversity at the European level and the Women's Empowerment Principles of the United Nations.

For all this, the Group considers data and technology as the main catalysts for innovation. Data has become a key differential factor and data management creates strong competitive advantages. An example of BBVA's firm commitment to becoming a data-driven organization is the progress in the development of an integrated big data platform, in which more than 1,600 data scientists, developers and specialists are involved. BBVA is also committed to the increasing use of new technologies such as the cloud, blockchain or artificial intelligence.

1 Product Relative Value is a proxy used for the economic representation of the sale of units.

- On June 1, BBVA made public that, once the mandatory authorizations were obtained, the sale of 100% of the capital stock of BBVA USA Bancshares, Inc, the company that in turn owns all of the capital stock of the bank BBVA USA, has been completed in favor of PNC (The PNC Financial Services Group, Inc). The accounting of the results generated by BBVA USA since the announcement of the operation in November 2020, as well as the closing of the sale on June 1, 2021, generated a result net of taxes of €582m, which is entirely included in the line "Profit/(loss) after tax from discontinued operations" of the consolidated income statement and of the Corporate Center income statement. These impacts were included in the Group’s cumulative results at the end of June 2021.

- In June 2021, BBVA and the majority of the labor union representatives reached an agreement on the restructuring plan of BBVA S.A. in Spain, which includes redundancies of 2,935 employees in total (divided into 2,725 layoffs and 210 leaves of absence, about 10% of the Group's total workforce in Spain) and an outplacement program for all interested employees. The agreement also includes the closing of 480 branches. The process has been characterized by an attitude of dialogue between the parties and it has been carried out with a clear interest in voluntary acceptance. As of September 30, 2021, a total of 1,674 employees have already signed the exit of BBVA S.A. (some of them did not effectively leave the Bank until October 1, 2021) and 260 branches have been closed. Additional employee departures from the branches are expected to occur during October and November, the volume of which will depend on the branches closures during both months, although the departure of some workers could be extended until March 31, 2022 for organizational reasons.

On 26 October 2021, BBVA received the required authorization from the ECB for the buyback of up to 10% of its share capital for a maximum sum of €3,500m, in one or several tranches and over a maximum period of 12 months as from the communication by BBVA that the buyback of shares has effectively commenced (the “Authorization”).

Once the Authorization has been obtained the Board of Directors of BBVA, in its meeting held on 28 October 2021, agreed to carry out a program scheme for the buyback of own shares which will be executed in several tranches, for a maximum amount up to €3,500m, aimed at reducing BBVA’s share capital (the “Program Scheme”), notwithstanding the possibility to suspend or terminate the Program Scheme upon the occurrence of circumstances that makes it advisable.

Likewise, the Board of Directors agreed to carry out a first share buyback program which will have a maximum amount of €1,500m, a maximum number of shares to be acquired equal to 637,770,016 own shares, representing, approximately, 9.6% of the BBVA’s share capital, and a maximum term of 5 months as from its effective start, that will take place after 18 November 2021.

- The CET1 Fully-loaded ratio stood at 14.48% as of September 30, 2021, which means a strong capital generation in the quarter (31 basis points) and a large capital buffer, widely covering the capital requirements of the BBVA Group even after the share buyback. For more information on the Group' share buyback program, please see "Share buyback".

- On January 29, 2021, BBVA announced its intention to return in 2021 to its shareholder remuneration policy consisting in the distribution of an annual payout of between 35% and 40% of the profits obtained in each financial year, fully paid in cash, in two different payments (expected to take place in October and April and subject to the applicable authorizations), provided that recommendation ECB/2020/62 is revoked and there are no further restrictions or limitations. On July 23, 2021, the European Central Bank made public the approval of recommendation ECB/2021/31 replacing recommendation ECB/2020/62 and to be in force as of September 30, 2021, removing the restrictions on dividends and buyback programs contained in that recommendation. Accordingly, on September 30, 2021 BBVA announced that BBVA’s Board of Directors approved the payment in cash of €0.08 per BBVA share, as a gross interim dividend against 2021 results, which was paid on October 12, 2021.

Business areas

Spain

€4,550 Mill.*

+3.6%

Highlights

- Slight growth in lending activity throughout the year

- Improvement in the efficiency ratio

- Favorable year-on-year growth of recurring revenue due to the evolution of fees

- Decrease in impairment on financial assets, compared to a 2020 that was strongly affected by the pandemic, resulting in an improvement in the cost of risk

Results

Net interest income

2,635Gross income

4,550Operating income

2,305Net attributable profit

1,223Activity (1)

Variation compared to 31-12-20

Balances as of 30-09-21

Performing loans and advances to customers under mangement

+0.2%

Customers funds under management

-0.7%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes.

Mexico

€5,558 Mill.*

-+4.1%

Highlights

- Growth in lending activity in the first nine months of the year driven by the acceleration in the retail portfolio

- Good performance of customer funds continues, as a result of growing demand deposits, which allows for an improvement in the funding mix of BBVA Mexico

- Increase in recurring income and strength of operating income

- Decrease in impairment on financial assets, compared to the first nine months of 2020, which were strongly affected by the pandemic

Results

Net interest income

4,280Gross income

5,558Operating income

3,609Net attributable profit

1,811Activity (2)

Variation compared to 31-12-20 at constant exchange rate

Balances as of 30-09-21

Performing loans and advances to customers under mangement

+3.1%

Customers funds under management

+5.6%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Year on year changes at constant Exchange rate.

(2) Excluding repos.

Turkey

2,414 Mill.*

+7.6%

Highlights

- Activity growth driven by Turkish lira loans and deposits

- Outstanding performance of NTI and net fees

- Downward trend in the cost of risk continues

- Net attributable profit growth driven by lower impairment losses on financial assets, compared to 2020 which was strongly affected by the effects of the pandemic

Results

Net interest income

1,651Gross income

2,414Operating income

1,680Net attributable profit

583Activity (1)

Variation compared to 31-12-20 at constant exchange rate

Balances as of 30-09-21

Performing loans and advances to customers under mangement

+17.7%

Customers funds under management

+21.1%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes at constant Exchange rate.

South America

€2,294 Mill.*

+8.8%

Highlights

- Growth in lending activity between January and September, with greater dynamism from April onwards

- Reduction in higher-cost customer funds

- Year-on-year increase in recurring income and NTI, and higher adjustment for inflation in Argentina

- Year-on-year comparison influenced at the net attributable profit level as a result of the increase in the impairment on financial assets line in 2020 due to the outbreak of the pandemic

Results

Net interest income

2,061Gross income

2,294Operating income

1,220Net attributable profit

339Activity (1)

Variation compared to 31-12-20 at constant exchange rates. It excludes the balances of BBVA Paraguay as of 31-12-20

Balances as of 30-09-21

Performing loans and advances to customers under mangement

+5.8%

Customers funds under management

+5.0%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos and BBVA Paraguay figures as of 31-12-20.

(2) Year on year changes at constant exchange rates

(3) At constant exchange rates excluding BBVA Paraguay.

Rest of business

€568 Mill.*

-5.1%

Highlights

- Increase in lending due to quarterly performance and the decrease in customer funds between January and September, with growth in the third quarter

- Favorable performance of risk indicators in the quarter

- Continued good performance of net interest income from the branches in Asia and the NTI from the area as a whole

- Reversal in the impairment on financial assets line, which compares to a 2020 strongly affected by the outbreak of the pandemic

Results

Net interest income

209Gross income

568Operating income

243Net attributable profit

205Activity (1)

Variation compared to 31-12-20 at constant exchange rates

Balances as of 30-09-21

Performing loans and advances to customers under mangement

+2.6%

Customers funds under management

-22.4%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year on year changes at constant exchange rates.

* Gross income

(1) At constant exchange rate.

(2) At constant exchange rates.

(3) At constant exchange rates excluding BBVA Paraguay.

As for the business areas, in all of them, the provisions for impairment on financial assets decreased compared to 2020 due to the outbreak of the pandemic. In addition, in each of them it is worth mentioning:

- Spain: BBVA in Spain achieved a net attributable profit of €1,223m between January and September 2021, +160.9% of the profit achieved in the same period of the previous year, mainly due to the increase in incurring income (thanks to the favorable evolution of fees) and in NTI and the reduction of operating expenses in 2021.

- Mexico: BBVA in Mexico generated a net attributable profit of €1,811m between January and September 2021, representing an increase of 47.4% compared to the same period of the previous year, at constant exchange rate. This evolution is driven by a 5.9% growth (at constant exchange rate) in recurring income and by the strength of the net margin (+1.4%).

- Turkey: The net attributable profit generated by Turkey between January and September 2021 stood at €583m, 48.4% (at constant exchange rate) above the figure achieved in the same period of the previous year, mainly due to the growth of net fees and commissions and NTI.

- South America: South America generated a cumulative net attributable profit of €339m between January and September 2021, which at constant exchange rates and excluding BBVA Paraguay in 2020, represents a year-on-year variation of +35.6%, mainly due to a better evolution of recurring income and NTI between January and September 2021 (+18.8%), partially offset by a higher inflation adjustment in Argentina in 2021.

-

Rest of Business: At the end of September 2021, the net attributable profit for the area stood at €205m (+32.1% year-on-year, at constant exchange rates). It is worth mentioning that this area mainly incorporates the wholesale business developed in Europe (excluding Spain) and in the United States, as well as the banking business developed through the 5 BBVA branches in Asia.

News

Contact

Shareholder attention line

Shareholder attention line912 24 98 21

Subscription service

Subscription service  Shareholder Office

Shareholder Office Contact email

Contact email