Solvency

Capital base

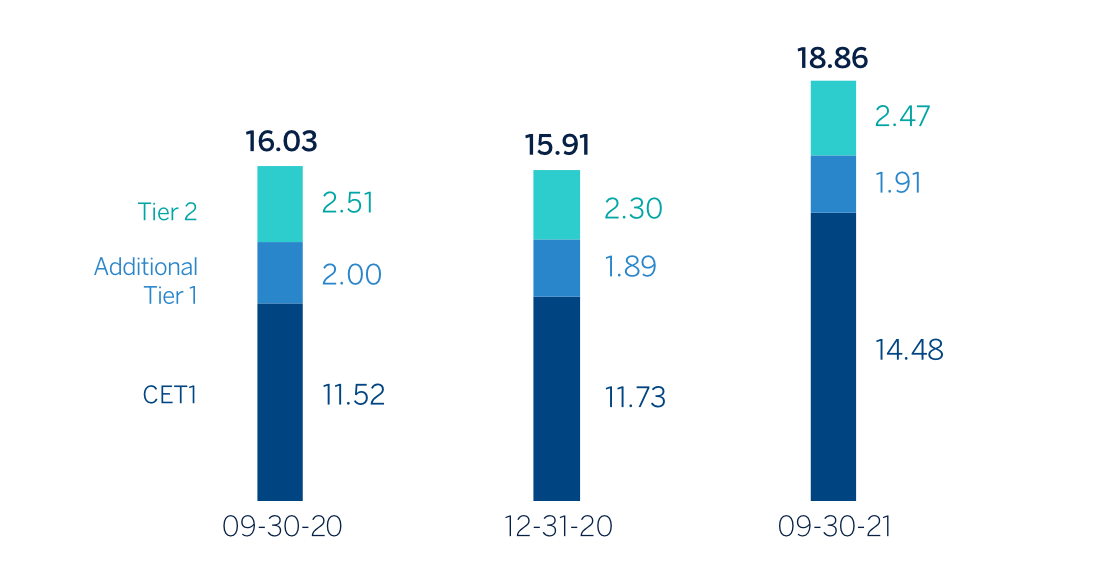

BBVA Group's fully-loaded CET1 ratio stood at 14.48% at September 30, 2021, which is an increase of +31 basis points above the previous quarter and amply covering the capital requirements of the BBVA Group (+588 basis points).

During the third quarter of 2021, the evolution of the consolidated fully-loaded CET1 ratio continued to be supported by recurrent organic capital generation, which, net of dividends and remunerations of AT1 instruments, contribute up to +24 basis points. Apart from these items, the capital consumption, due to organic activity evolution drained -3 basis points, while the evolution of the remaining components of the CET1 contributed +9 basis points. Among the latter, it is worth mentioning the positive contribution due to the parameters´update within the portfolios subject to the IRB credit risk method, which has been partially offset by, among others, a negative evolution of market variables, in particular, the exchange rate.

The consolidated fully-loaded additional Tier 1 capital (AT1) stood at 1.91% as of September 30, 2021, which results in an increase of +4 basis points compared to the previous quarter.

The consolidated fully-loaded Tier 2 ratio as of September 30, 2021 stood at 2.47%, an increase of +3 basis points in the quarter. The total fully-loaded capital adequacy ratio stands at 18.86%.

The phased-in CET1 ratio, on consolidated terms, stood at 14.71% as of September 30, 2021, considering the transitory effect of the IFRS 9 standard. AT1 reached 1.90% and Tier 2 reached 2.56%, resulting in a total capital adequacy ratio of 19.17%.

Regarding shareholder remuneration, after the lifting of the recommendations by the European Central Bank, on September 30, 2021, BBVA informed that the BBVA's Board of Directors approved the payment in cash of €0.08 per BBVA share, as gross interim dividend against 2021 results. The dividend was paid on October 12, 2021. This dividend is already considered within the capital ratios of the Group.

SHAREHOLDER STRUCTURE (31-06-2021)

| Shareholders | Shares | |||

|---|---|---|---|---|

| Number of shares | Number | % | Number | % |

| Up to 500 | 345,689 | 41.3 | 64,765,704 | 1.0 |

| 501 to 5,000 | 386,593 | 46.2 | 678,331,454 | 10.2 |

| 5,001 to 10,000 | 56,209 | 6.7 | 395,267,622 | 5.9 |

| 10,001 to 50,000 | 43,639 | 5.2 | 835,142,199 | 12.5 |

| 50,001 to 100,000 | 3,148 | 0.4 | 214,561,513 | 3.2 |

| 100,001 to 500,000 | 1,402 | 0.2 | 252,447,748 | 3.8 |

| More than 500,001 | 299 | 0.0 | 4,227,370,340 | 63.4 |

| Total | 836,979 | 100.0 | 6,667,886,580 | 100.0 |

FULLY-LOADED CAPITAL RATIOS (PERCENTAGE)

CAPITAL BASE (MILLIONS OF EUROS)

| CRD IV phased-in | CRD IV fully-loaded | |||||

|---|---|---|---|---|---|---|

| 30-09-21 (1) (2) | 31-12-20 | 30-09-20 | 30-09-21 (1) (2) | 31-12-20 | 30-09-20 | |

| Common Equity Tier 1 (CET 1) | 44,567 | 42,931 | 41,231 | 43,802 | 41,345 | 39.651 |

| Tier 1 | 50,338 | 49,597 | 48,248 | 49,573 | 48,012 | 46,550 |

| Tier 2 | 7,763 | 8,547 | 9.056 | 7,484 | 8,101 | 8,628 |

| Total Capital (Tier 1 + Tier 2) | 58,101 | 58,145 | 57,305 | 57,057 | 56,112 | 55,178 |

| Risk-weighted assets | 303,007 | 353,273 | 343,923 | 302,548 | 352,622 | 344,215 |

| CET1 (%) | 14.71 | 12.15 | 11.99 | 14.48 | 11.73 | 11.52 |

| Tier 1 (%) | 16.61 | 14.04 | 14.03 | 16.39 | 13.62 | 13.52 |

| Tier 2 (%) | 2.56 | 2.42 | 2.63 | 2.47 | 2.30 | 2.51 |

| Total capital ratio (%) | 19.17 | 16.46 | 16.66 | 18.86 | 15.91 | 16.03 |

- (1) As of September 30, 2021, the difference between the phased-in and fully-loaded ratios arises from the temporary treatment of certain capital items, mainly of the impact of IFRS 9, to which the BBVA Group has adhered voluntarily (in accordance with article 473bis of the CRR and the subsequent amendments introduced by the Regulation (EU) 2020/873).

- (2) Preliminary data.

With regard to MREL (Minimum Requirement for own funds and Eligible Liabilities) requirements, on May 31, 2021, BBVA made public that it had received a new communication from the Bank of Spain on its minimum requirement for own funds and admissible liabilities (MREL) established by the Single Resolution Board (hereinafter SRB), calculated taking into account the financial and supervisory information as of December 31, 2019.

This communication on MREL replaces the one previously received and according to it, BBVA must reach, by January 1, 2022, an amount of own funds and eligible liabilities equal to 24.78% 2 of the total Risk Weighted Assets (hereinafter, RWAs) of its resolution group, at a sub-consolidated3 level (hereinafter, the "MREL in RWAs"). Also, of this MREL in RWAs, 13.50% of the total RWAs must be met with subordinated instruments (the "subordination requirement in RWAs"). This MREL in RWAs is equivalent to 10.25% in terms of the total exposure considered for the purposes of calculating the leverage ratio (the “MREL in LR”), while the subordination requirement in RWAs is equivalent to 5.84% in terms of the total exposure considered for calculating the leverage ratio (the "subordination requirement in LR"). In the case of BBVA, the requirement that is currently the most restrictive is that expressed by the MREL in RWAs. Given the structure of own funds and admissible liabilities of the resolution group, as of September 30, 2021, the MREL ratio in RWAs stands at 29.92% 4 5 complying with the aforementioned MREL requirement.

With the aim of reinforcing compliance with these requirements, in March 2021, BBVA carried out an issue of senior preferred debt for an amount of €1,000m. Afterwards, in September 2021, BBVA carried out an issue of €1,000m under a floating rate senior preferred social bond, maturing in two years. Both issuances have mitigated the loss of eligibility of three issuances, two senior preferred issues and one senior non-preferred issue issued during 2017 and reaching their maturity in 2021.

Lastly, the Group's leverage ratio stood at 7.5% fully-loaded (7.6% phased-in) as of September 30, 2021. These figures include the effect of the temporary exclusion of certain positions with the central banks of the different geographical areas where the Group operates, foreseen in the “CRR-Quick fix”.

Ratings

During the first nine months of 2021, BBVA’s rating has continued to demonstrate stability and all the rating agencies have confirmed its rating, maintaining it in the A category. Last June, in a joint review of several European banks, S&P changed the outlook of BBVA’s rating to stable from negative (confirming its A- rating), acknowledging both the benefits of the Group’s geographical diversification and the substantial capital reinforcement experienced after the BBVA USA sale.

The following table shows the credit ratings and outlook given by the agencies:

Ratings

| Rating agency | Long term (1) | Short term | Outlook |

|---|---|---|---|

| DBRS | A (high) | R-1 (middle) | Stable |

| Fitch | A- | F-2 | Stable |

| Moody’s | A3 | P-2 | Stable |

| Standard & Poor’s | A- | A-2 | Stable |

(1) Ratings assigned to long term senior preferred debt. Additionally, Moody’s and Fitch assign A2 and A- rating respectively, to BBVA’s long term deposits.

2 Pursuant to the new applicable regulation, the MREL in RWAs and the subordination requirement in RWAs do not include the combined requirement of capital buffers. For these

purposes, the applicable combined capital buffer requirement would be 2.5%, without prejudice to any other buffer that may be applicable at any given time.

3 In accordance with the resolution strategy MPE (“Multiple Point of Entry”) of the BBVA Group, established by the SRB, the resolution group is made up of Banco Bilbao Vizcaya

Argentaria, S.A. and subsidiaries that belong to the same European resolution group. As of December 31, 2019, the total RWAs of the resolution group amounted to €204,218m

and the total exposure considered for the purpose of calculating the leverage ratio amounted to €422,376m.

4 Own resources and eligible liabilities to meet, both, MREL and the combined capital buffer requirement, which would be 2.5%, without prejudice to any other buffer that may be

applicable at any given time.

5 As of September 30, 2021, both the MREL ratio in RWAs and the next ratios shown hereafter are provisional: the MREL ratio in LR stands at 12.43% and the subordination ratios in terms of RWAs and in terms of exposure of the leverage ratio, stand at 26.60%

and 11.05%, respectively.