BBVA earns €1.85 billion

The share

Global growth has shown resilience and has generally been higher than expected by analysts, despite the moderating trend in recent quarters.

Economic activity has benefited from the surprisingly rapid decline in energy prices following the sharp increase observed after the outbreak of the war in Ukraine, as well as from the process of normalization of global supply chains and the dynamism of labor markets, which have contributed to the relative strength of private consumption and the service sector. In addition, the easing of anti-COVID-19 policies in China has contributed to a more gradual than expected slowdown in growth, despite its initial negative impact on activity.

Lower energy prices and improvements in bottlenecks in production processes have contributed to a reduction in headline inflation, which, in annual terms, reached 5.0% in the United States and 6.9% in the Eurozone in March. However, despite the recent slowdown in headline inflation, measures of underlying inflation continue to show no significant improvement.

Against this backdrop of still elevated inflationary pressures, central banks have continued to tighten monetary conditions, causing tensions in the banking sector and increasing financial volatility, which eased more recently, following decisive actions taken by authorities in Europe and the United States and in line with the perception that the problems in the banking sector are not systemic.

Despite the recent turmoil in the banking sector, which has contributed to a further tightening of financial conditions, reducing to some extent the pressure for additional monetary tightening, central banks have remained focused on reducing inflation. The U.S. Federal Reserve and the European Central Bank (ECB) have raised their benchmark interest rates (refinancing rates in the case of the ECB) to, respectively, 5.00% and 3.50% in March.

Although uncertainty is high, policy rates are likely to continue rising in the short term, to around 5.25% in the United States and 4.00% in the Eurozone, and to remain at these levels at least until the end of the year. In addition, central banks in both regions are expected to continue to reduce their balance sheets and address stress in the banking sector through macroprudential measures.

BBVA Research expects global growth to be 2.8% in 2023 (0.5 percentage points higher than the previous forecast), after reaching 3.2% in 2022 and 6.1% in 2021. Recent activity data and fading supply shocks favor an upward revision of GDP forecasts for 2023 to 0.8% in the United States and 0.6% in the Eurozone (respectively 0.3 and 0.7 percentage points higher than previously forecast), while in China growth this year is most likely to be 5.2%, 0.2 percentage points above the previous forecast mainly due to the positive impact of the easing of anti-COVID-19 policies. Also, despite the upward revisions, the outlook for a slowdown in global growth remains, in a context where financial volatility is expected to remain relatively high and interest rates and inflation are expected to remain at higher than expected levels for a longer period.

Uncertainty remains high and a number of factors could determine the materialization of more negative scenarios than the one forecast by BBVA Research. In particular, persistently high inflation and interest rates could generate a deep and widespread recession, as well as new episodes of financial volatility.

The main indexes have shown a positive performance during the first quarter of 2023. In Europe, the Stoxx Europe 600 index rose by 7.8% compared to the end of December 2022, and in Spain the Ibex 35 increased by 12.2% in the same period, showing a better relative performance. In the United States, the S&P 500 index also increased by 7.0%.

With regard to the banking sector indexes, the performance in the first quarter was slightly lower than the general indexes in Europe. The Stoxx Europe 600 Banks index, which includes the banks in the United Kingdom, and the Euro Stoxx Banks, an index of Eurozone banks, increased 3.9% and 6.4% respectively, while in the United States, the S&P Regional Banks sector index fell by -25.3% in the period.

The BBVA share price increased by 16.6% during the quarter, closing the month of March 2023 at €6.57.

BBVA share evolution

Compared with European indexes (Base indice 100=31-12-22)

BBVA

Eurostoxx-50

Eurostoxx Banks

The BBVA share and share performance ratios

| 31/03/2023 | 31/12/2022 | |

|---|---|---|

| Number of shareholders | 786,031 | 801,216 |

| Number of shares issued (millions) | 6,030 | 6,030 |

| Closing price (euros) | 6.57 | 5.63 |

| Book value per share (euros) (1) | 8.02 | 7.78 |

| Tangible book value per share (euros) (1) | 7.65 | 7.43 |

| Market capitalization (millions of euros) | 39,624 | 33,974 |

| Yield (dividend/price; %) (1)(2) | 5.3 | 6.2 |

(1) For more information, see Alternative Performance Measures at the end of the quarterly report.

(2) Calculated by dividing shareholder remuneration over the last twelve months by the closing price of the period.

Regarding shareholder remuneration, as approved by resolution of the General Shareholders’ Meeting, on April 5, 2023 a cash payment of €0.31 (gross) per share was made as an additional remuneration for the 2022 fiscal year. Thus, the total cash distribution for the year 2022, taking into account the €0.12 (gross) per share that was paid in October 2022, amounted to €0.43 (gross) per share.

Total shareholder remuneration includes, in addition to the cash payments mentioned above, the extraordinary remuneration resulting from the execution of BBVA's share buyback program announced on February 1, 2023 for a maximum amount of €422m. On April 21, 2023, BBVA announced the completion of this share buyback program, having acquired 64,643,559 BBVA shares between March 20 and April 20, 2023, representing approximately 1.1% of BBVA's share capital as of said date.

On March 31, 2023 the number of BBVA shares outstanding was 6,030 million. The number of shareholders reached 786,031 and, by type of investor, 59.73% of the capital belonged to institutional investors and the remaining 40.27% was in the hands of retail shareholders.

BBVA shares are included on the main stock market indexes. At the closing of March 2023, the weighting of BBVA shares in the Ibex 35, Euro Stoxx 50 and the Stoxx Europe 600 index, were 8.1%, 1.3% and 0.4%, respectively. They are also included on several sector indexes, including Stoxx Europe 600 Banks, which includes the United Kingdom, with a weighting of 5.1% and the Euro Stoxx Banks index for the eurozone with a weighting of 8.6%. Moreover BBVA maintains a significant presence on a number of international sustainability indexes, such as, Dow Jones Sustainability Index (DJSI), FTSE4Good or MSCI ESG Indexes.

Group's information

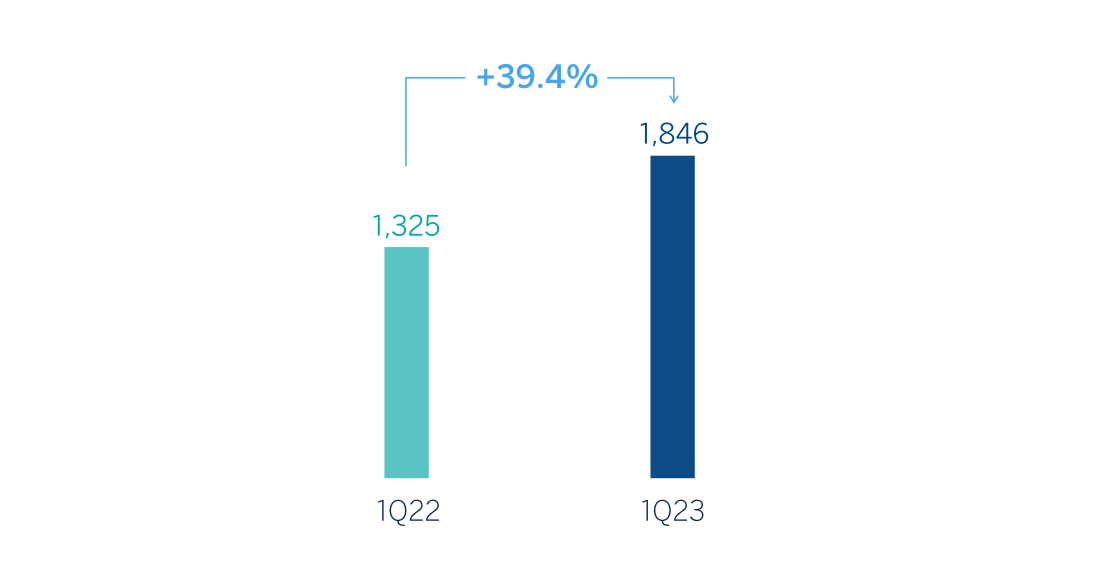

The BBVA Group generated a net attributable profit of €1,846m in the first quarter of 2023, which represents an increase of 39.4% compared to the first quarter of the previous year, driven by the performance of recurring income from the banking business, mainly net interest income.

These results include the recording, for the financial year 2023, of the temporary tax on credit institutions and financial credit institutions for €225m, included in the other operating income and expenses line of the income statement.

Operating expenses increased by 25.4% at Group level, largely impacted by the inflation rates observed in the countries in which the Group operates. Notwithstanding the above, thanks to the remarkable growth in gross income, higher that the growth in expenses, the efficiency ratio stood at 43.3% as of March 31, 2023, with an improvement of 241 basis points, in constant terms, compared to the ratio recorded 12 months earlier, placing BBVA, once again, in a leading position among its European peer group1.

The provisions for impairment on financial assets increased (+28.9% in year-on-year terms and at constant exchange rates), with higher provisions mainly in South America and Mexico.

NET ATTRIBUTABLE PROFIT (LOSS)

(MILLIONS OF EUROS)

1 European peer group: Barclays, BNP Paribas, Crédit Agricole, Caixabank, Deutsche Bank, HSBC, ING, Intesa Sanpaolo, Lloyds Banking Group, Nordea, Banco Santander, Société Générale, UBS and Unicredit, comparable peer data as of the end of December 2022.

Loans and advances to customers grew by 1.4% compared to the end of December 2022, strongly favored by the evolution of retail loans (+2.9% at Group level).

Customer funds increased by 2.3% compared to the end of December 2022, thanks to the good performance of off-balance sheet funds (+7.2%), also linked to increased customer preference for them.

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-2022)

The availability of substantial liquidity buffers in each of the geographical areas in which the BBVA Group operates and their management, have allowed internal and regulatory ratios to be maintained well above the minimums required.

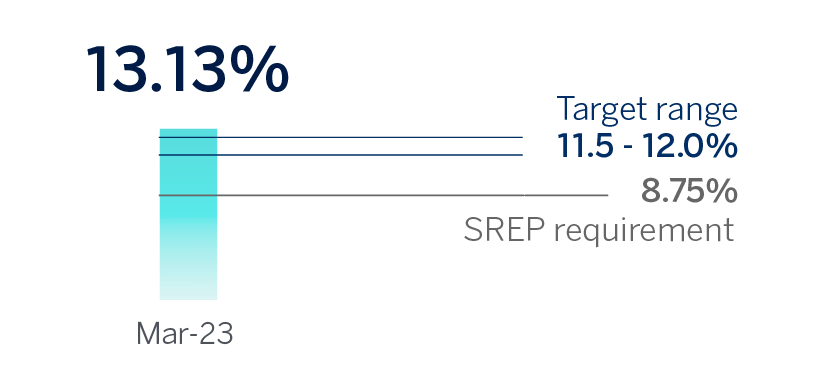

The Group's CET1 fully-loaded ratio stood at 13.13% as of March 31, 2023, maintaining a large management buffer over the Group's CET1 requirement (8.75%), and also above the Group's established target management range of 11.5-12.0% of CET1.

CET1 fully-loaded

Regarding shareholder remuneration, as approved by the General Shareholders' Meeting on March 17, 2023, in its first item on the agenda, on April 5, 2023, a cash payment of €0.31 gross per each outstanding BBVA share entitled to receive such amount was made against the 2022 results, as an additional shareholder remuneration for the financial year 2022. Thus, the total amount of cash distributions for 2022, taking into account the €0.12 gross per share that was distributed in October 2022, amounted to €0.43 gross per share.

Total shareholder remuneration includes, in addition to the cash payments mentioned above, the extraordinary remuneration resulting from the execution of BBVA's buyback program for the repurchase of own shares announced on February 1, 2023 for a maximum amount of €422m. On April 21, 2023, BBVA announced the completion of this share buyback program, having acquired 64,643,559 BBVA shares between March 20 and April 20, 2023, representing approximately 1.1% of BBVA's share capital as of said date.

Channeling sustainable business

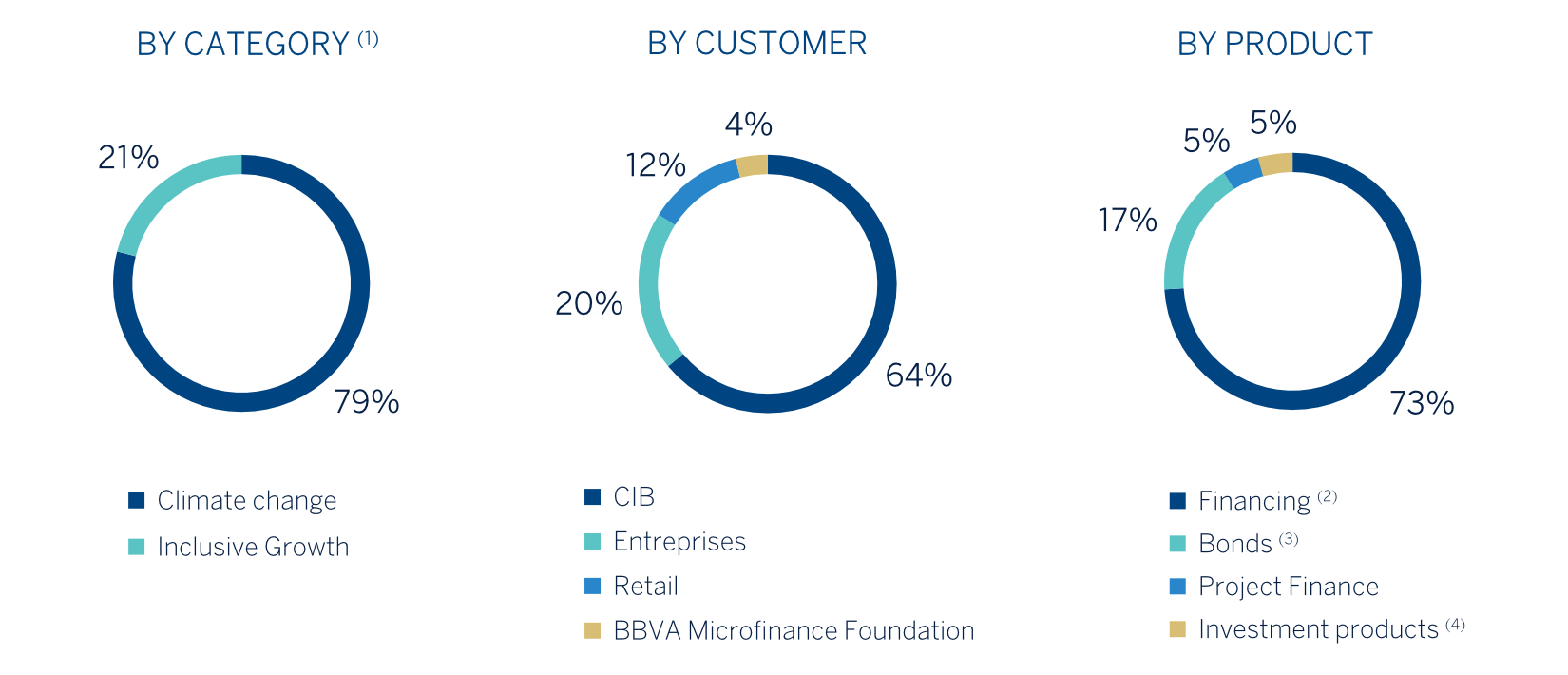

SUSTAINABLE BUSINESS BREAKDOWN (PERCENTAGE. TOTAL AMOUNT CHANNELED 2018-MARCH 2023)

(1) In those cases where it is not feasible or there is not enough information available to allow an exact distribution between the categories of climate change and inclusive growth, internal estimates are made based on the information available.

(2) Non-Project Finance and transactional banking activity.

(3) Bonds in which BBVA acts as bookrunner.

(4) Investment products art. 8 or 9 under Sustainable Finance Disclosure Regulation (SFDR) or similar criteria outside the European Union, managed, intermediated or marketed by BBVA. Includes, in Retail: structured deposits, insurance policies for electric vehicles and self-renting of electric vehicles, mainly; and in CIB and Enterprise: structured deposits, mainly.

BBVA has mobilized a total of approximately €150bn in sustainable business between 2018 and March 2022. Close to €14 billion have been mobilized this quarter, which represents an increase of nearly 20% compared to the same period in 2022.

Within the channeling of sustainable business2 accumulated between 2018 and March 2023 which aims to promote the fight against climate change, what stands out is the contribution of the financing of sustainable projects, distinct from project finance and transactional banking activity, which represents 78% of the total channeled at the end of March 2023. It should be considered that these products have had a normal rate of amortization since the beginning of their channeling. The intermediation of third-party bonds in which BBVA acts as bookrunner, a business activity that is recorded off-balance sheet, represents 18% of the channeled business linked to the fight against climate change. Lastly, investment funds and other off-balance sheet products such as insurance and pension plans represent 4%.

For its part, within the channeling of sustainable business accumulated between 2018 and March 2023 which aims to promote inclusive growth, the financing of sustainable projects, financing other than project finance and transactional banking activity, represent 58% of the total amount channeled at the end of March 2023, showing a normal rate of amortization since the beginning of its channeling. The intermediation of third-party bonds in which BBVA acts as bookrunner represents 14%, while investment funds and other off-balance sheet products such as insurance and pension plans represent 8%. Finally, the activity of the BBVA Microfinance Foundation (FMBBVA), not recorded on the BBVA Group's balance sheet, whose objective is to support entrepreneurs with microcredits, represents 20% in terms of the purpose of promoting inclusive growth.

During the first quarter of 2023, the good performance of the retail business has continued, highlighting the mobilization related to sustainable mobility, such as the acquisition of hybrid or electric vehicles, which has grown by 27% compared to the same quarter of the previous year, activity in which geographical areas such as Turkey, Mexico and Peru multiply by more than two times the mobilization compared to the same period of 2022. In financing for inclusive growth, one of the activities that stands out the most is the mobilization for entrepreneurship, which has grown by 15% compared to the same quarter of the previous year and where Turkey more than doubles the mobilization of the same quarter of the previous year.

In commercial business (enterprises), financing related to energy efficient buildings stands out, such as the developer loan or energy efficiency measures for buildings, where channeling grew by 50% in relation to the same quarter of the previous year and where Spain has been fundamental by increasing its channeling in this line by 57%.

Lastly, in corporate business, the dynamism of the brokered bond market in which BBVA acts as bookrunner stands out. During this quarter, the mobilization related to intermediation of these bonds has experienced an increase of 102% compared to the same quarter last year, mainly driven by the greater volume of green bonds, an activity that stands out with an increase of 103% compared to the same quarter of the previous year. However, this first quarter has also been marked by signs of a slowdown in the sustainable corporate financing market, both in the long and short term.

Relevant advances in sustainability matters

- TCFD

BBVA has published its fourth TCFD (Task Force on climate-related financial disclosure) report this quarter. As this is its fourth report, BBVA has been one of the first banks to incorporate several of the recommendations of the Glasgow Financial Alliance for Net Zero Emissions (GFANZ) to draw up a plan of transition, a crucial element to facilitate a better understanding of how the Group approaches the transition towards a low carbon economy. New features include the creation of the BBVA Sustainability Alignment Steering Group, which will monitor the objectives and transition plans of its clients.

- Publication of the progress in the decarbonization of the BBVA portfolios

BBVA is committed to aligning its activity with a scenario of zero net emissions in 2050. To this end, it supports its customers with financing, advice and innovative solutions, and it is monitoring its customers' decarbonization strategies and incorporating them into its tools of evaluating risks. BBVA follows operational indicators that are relevant in the transformation to obtain a prospective and individualized vision of each client.

During this quarter, BBVA has published for the first time in its TCFD report the progress made in its commitment to decarbonize its credit portfolio, publishing details of the sector plans in which alignment objectives have been set: oil and gas, electricity generation, autos, steel and cement; or phase-out targets, as in the case of the coal sector. In the oil and gas sector, according to the Net Zero Banking Alliance (NZBA) recommendations, progress must be reported 12 months after the date the target is set. BBVA set them in October 2022. For this reason, in this sector it has not published this follow-up at the moment. In all sectors in which progress has been published, there have been cumulative reductions in all decarbonization indicators, although progress is not expected to be linear in the short term.

2030 ALIGNMENT TARGETS AND EMISSIONS ALLOCATED (banking activity)

| Sector and metric | 2020(1) | 2022 |

2020(1)- 2030 target |

% progress 2022 |

Emissions allocated associated with the value chain (M t CO2e)(2) |

|---|---|---|---|---|---|

Oil & Gas |

14 | - | (30)% | n/a | n/a |

Power

|

221 | 212 | (52)% | (4.0)% | 3,5 |

Autos |

205 | 195 | (46)% | (4.8)% | 0.77 |

Steel |

1,270 | 1,140 | (23)% | (10.2)% | 0.82 |

Cement |

700 | 690 | (17)% | (1.4)% | 0.31 |

Coal(3) |

1,701 | 0.31 |

n/a: not applicable

(1) Oil & Gas baseline year 2021.

(2) The calculation of the attributed emissions associated with the value chain has been carried out by adding all the emissions from the different NACE sectors of the sectors under analysis. These NACE sectors comprise more sectors than those included in the PACTA calculation since PACTA is only calculated on the point in the value chain where most of the emissions are generated. This calculation is carried out in this way because, based on the PACTA methodology, it is assumed that by aligning the part of the value chain responsible for emissions, the sector as a whole is aligned. The calculation has been carried out using the PCAF methodology and includes the emissions of BBVA.S.A. except Portugal branches.

(3) Phase-out 2030 in developed countries and 2040 globally.

- Progress in energy efficiency products in Spain

BBVA has launched a personalized digital solution for clients in collaboration with a large energy company, for the installation of solar panels in residential homes together with a media campaign. The solution allows private customers to simulate the installation of solar panels at home, both in single-family homes and in communities of owners, with information on potential savings in electricity, the subsidies that could be applied for and financing with advantageous conditions.

During this quarter, BBVA has financed a total of approximately 4,000 panel installations with a growth of more than 67% compared to the first quarter of 2022.

- Sustainability training for suppliers

BBVA has promoted sustainability training among 252 of its SME suppliers. With this, BBVA extends to suppliers cross-sectoral sustainability training that its employees have already received since 2020. This initiative is part of the United Nations Compact Sustainable Suppliers training program.

- BBVA Asset Management recognized with the Best Sustainability Team Award

BBVA Asset Management has received the award for the Best Sustainability Team of a Spanish Manager at the Funds People Awards 2023. This represents the recognition of the implementation of its Global Sustainability Plan started in 2021, its adherence to UNPRI and the Net Zero Asset Managers in 2021, and the announcement in 2022 of its initial objectives of decarbonization of its portfolios.

2 Channeling sustainable business is considered to be any mobilization of financial flows, cumulatively, towards activities or clients considered sustainable in accordance with existing regulations, both internal and market standards and best practices. The foregoing is understood without prejudice to the fact that said mobilization, both initially and at a later time, may not be recorded on the balance sheet. To determine the amounts of channeled sustainable business, internal criteria based on both internal and external information are used.

Business areas

Spain

€1,726 Mill.*

+4.3%

Highlights

- Seasonal drop in lending

- Significant improvement in net interest income

- Recording of the temporary tax on credit institutions for the financial year 2023

- Cost of risk remains at low levels, in line with the end of 2022

Results

(Millions of euros)

Net interest income

1,183Gross income

1,726Operating income

974Net attributable profit

541Activity (1)

Variation compared to 31-12-22.

Balances as of 31-03-23.

Performing loans and advances to customers under mangement

-1.2%

Customers funds under management

-1.0%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes.

Mexico

€3,306 Mill.*

+29.2%

Highlights

- Favorable performance of the portfolio, with greater dynamism of the retail segment

- Increase in net interest income as a result of effective spread management

- Outstanding evolution of the efficiency ratio

- Significant growth in net attributable profit

Results

(Millions of euros)

Net interest income

2,589Gross income

3,306Operating income

2,318Net attributable profit

1,285Activity (1)

Variation compared to 31-12-22 at constant exchange

rate.

Balances as of 31-03-23.

Performing loans and advances to customers under mangement

+2.3%

Customers funds under management

+1.3%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange rate.

Turkey

802 Mill.*

n.s.

Highlights

- Significant de-dollarization of the balance sheet

- Improved risk indicators compared to year-end 2022

- Net attributable profit positively affected by lower income tax

Results

(Millions of euros)

Net interest income

626Gross income

802Operating income

403Net attributable profit

277Activity (1)

Variation compared to 31-12-22 at constant exchange

rate.

Balances as of 31-03-23.

Performing loans and advances to customers under mangement

+9.5%

Customers funds under management

+14.0%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange rate.

South America

€1,175 Mill.*

+66.1%

Highlights

- Growth in lending activity and customer funds

- Favorable performance of recurring income

- Higher adjustment for hyperinflation in Argentina

- Improvement of the efficiency ratio

Results

(Millions of euros)

Net interest income

1,190Gross income

1,175Operating income

642Net attributable profit

184Activity (1)

Variation compared to 31-12-22 at constant exchange

rates.

Balances as of 31-03-23.

Performing loans and advances to customers under mangement

+2.9%

Customers funds under management

+4.6%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange

rates.

Rest of business

€260 Mill.*

+27.3%

Highlights

- Growth in lending activity in the New York branch and in customer funds

- Recurring income dynamism

- NPL ratio and cost of risk remain at low levels

- Improved efficiency

Results

(Millions of euros)

Net interest income

113Gross income

260Operating income

122Net attributable profit

92Activity (1)

Variation compared to 31-12-22 at constant exchange

rates.

Balances as of 31-03-23.

Performing loans and advances to customers under mangement

-3.4%

Customers funds under management

+2.9%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange

rates.

* Gross income

(1) At constant exchange rate.

(2) At constant exchange rates.

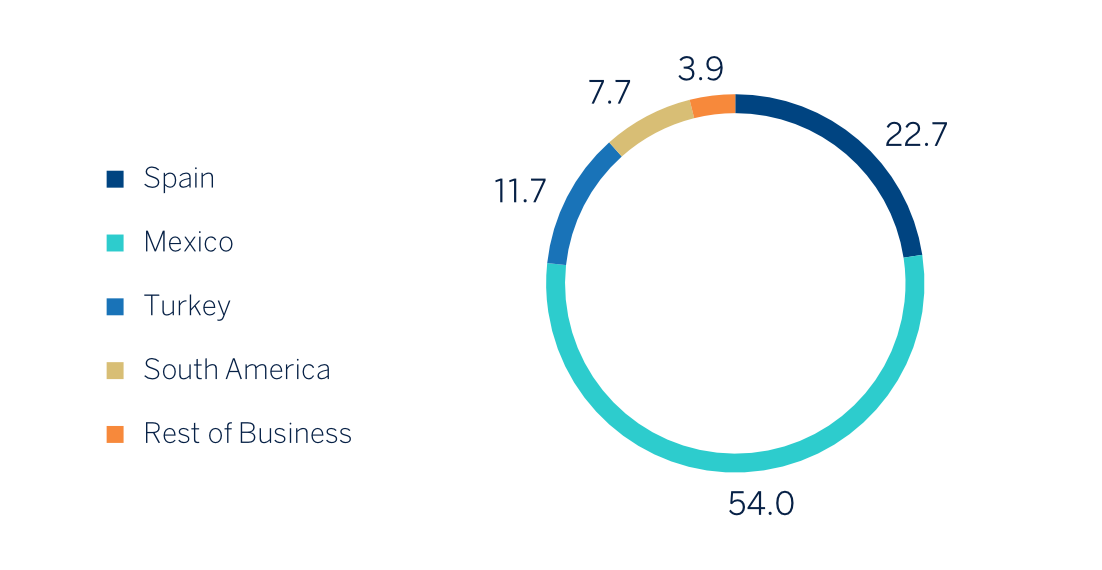

As for the business areas, excluding the effect of currency fluctuation in those areas where it has an impact, in each of them it is worth mentioning:

- Spain generated a net attributable profit of €541m in the first quarter of the year 2023, 9.5% lower than in the same period of the previous year, due to the recording, on January 1, 2023, of the temporary tax on credit institutions and financial credit institutions for €225m.

- In Mexico, BBVA achieved a net attributable profit of €1,285m by the end of the first quarter of 2023, representing an increase of 44.2% compared to the same period in 2022, mainly as a result of the boost in lending activity and improvement in the customer spread, which translated into significant growth in net interest income and, to a lesser extent, fee and commission income.

- Turkey generated a net attributable profit of €277m in the first quarter of 2023, which compares very positively with the negative result of €76m in the same quarter of 2022, both periods reflecting the impact of the application of hyperinflation accounting. The accumulated result at the end of March 2023 reflects, in addition to the good business dynamics, the positive impact of the revaluation for tax purposes of the real estate and other depreciable assets of Garanti BBVA AS which has generated a credit in corporate income tax expense, due to the higher tax base of the assets, amounting to approximately €260m.

- South America generated a cumulative net attributable profit of €184m at the end of the first quarter of the year 2023, which represents a year-on-year variation of +57.2%, mainly due to the outstanding performance of recurring income (+70.3%) and NTI, which comfortably offset the growth of expenses, in a highly inflationary environment throughout the region, and the higher provisioning requirements for impairment on financial assets.

-

Rest of Business achieved a net attributable profit of €92m accumulated at the end of the first quarter of 2023, 11.6% higher than in the same period of the previous year, thanks to a favorable performance of recurring income and NTI, which offset the increase in expenses in a context of higher inflation and a normalization of loan-loss provisions.

The Corporate Center recorded a net attributable profit of €-531m in the first quarter of the year 2023, compared with €-215m recorded in the same period of the previous year, mainly due to a negative contribution in the NTI line from exchange rate hedges as a result of better than expected currency performance, in particular the Mexican peso.

Lastly, and for a broader understanding of the Group's activity and results, supplementary information is provided below for the wholesale business carried out by BBVA, Corporate & Investment Banking (CIB), in the countries where it operates. CIB generated a net attributable profit of €550m in the first quarter of 2023. These results, which do not include the application of hyperinflation accounting, represent an increase of 28.1% on a year-on-year basis, due to the growth in recurring income and NTI, which comfortably offset the higher expenses and provisions for impairment on financial assets, highlighting the contribution of Global Transactional Banking.

NET ATTRIBUTABLE PROFIT BREAKDOWN (1)

(PERCENTAGE. 1Q23)

(1) Excludes the Corporate Center.

News

Contact

Shareholder attention line

Shareholder attention line912 24 98 21

Subscription service

Subscription service  Shareholder Office

Shareholder Office Contact email

Contact email