The share

The economic slowdown has continued in recent months, with differences emerging among the main geographic areas. Growth was stronger than expected in the United States, relatively weak in the Eurozone and surprisingly weak in China. High inflation, tightening monetary conditions and the gradual fading of the positive effects of the reopening after the COVID-19 pandemic all contributed to the slowing of global growth. However, economic activity continues to benefit from the dynamism of the labor markets and the relative easing of the supply shocks triggered by the pandemic and the war in Ukraine.

Falling commodity prices compared to the levels seen in 2022 -despite the recent upward trend in oil prices- and improvements in production process bottlenecks supported a softening of headline inflation, which, in annual terms, reached 3.7% in the United States and 4.3% in the Eurozone in September. Core inflation measures, however, still show no significant improvement. In this context, although the possibility of further adjustments in the coming months cannot be ruled out, the trend of interest rate hikes seems to have come to an end. BBVA Research believes that an eventual reduction in inflation in the coming months will most likely prevent further interest rate hikes. Rates are expected to remain at restrictive levels for a longer period than expected, at around 5.50% until mid-2024 in the United States and 4.50% until the end of 2024 in the Eurozone. Moreover, measures to reduce liquidity by the U.S. Federal Reserve ("Fed") and the European Central Bank ("ECB") are expected to continue to contribute to the monetary tightening.

BBVA Research forecasts that global growth will gradually taper off, reaching 2.9% in 2023 (unchanged from the forecast of three months ago) and 3.0% in 2024 (10 basis points higher than the previous forecast). In the United States, strong domestic demand supports an upward revision of growth forecasts to 2.3% in 2023 and 1.5% in 2024 (respectively, 120 and 90 basis points higher than the previous forecast) and makes a recession unlikely. In China, recent stimulus measures are expected to help avoid a sharp slowdown in activity. However, growth forecasts have been revised downward to 4.8% in 2023 and 4.4% in 2024 (respectively, 90 and 40 points lower than the previous forecast). In the Eurozone, economic expansion is likely to be more modest than expected, at around 0.4% in 2023 and 1.0% in 2024 (respectively, 40 and 30 basis points less than the previous forecast). In addition, the slowing of global growth is expected to encourage a gradual reduction in inflation, which, however, will remain above inflation targets in the United States and the Eurozone until at least the end of 2024.

Uncertainty remains high, and a number of factors could lead to more adverse scenarios unfolding. Persistently high inflation and interest rates could trigger a deep and widespread recession, as well as new bouts of financial volatility. Moreover, the slowdown in China could proceed more sharply and more severely than anticipated. Finally, another key risk is that the current geopolitical turbulence will eventually feed through to higher energy prices.

The main indexes have shown a slightly negative performance during the third quarter of 2023. In Europe, the Stoxx Europe 600 index fell by -2.5% compared to the end of June, and in Spain the Ibex 35 decreased by -1.7% in the same period, showing a better relative performance. In the United States, the S&P 500 index also decreased by -3.6%.

With regard to the banking sector indexes, the performance in the third quarter of 2023 was better than the general indexes in Europe. The Stoxx Europe 600 Banks index, which includes the banks in the United Kingdom, and the Euro Stoxx Banks, an index of Eurozone banks, increased 3.8% and 4.2% respectively, while in the United States, the S&P Regional Banks sector index rose by 2.3% in the period.

The BBVA share price increased by 9.6% during the quarter, outperforming its sector index, closing the month of September 2023 at €7.71.

BBVA share evolution

Compared with European indexes (Base indice 100=31-12-22)

BBVA

Eurostoxx-50

Eurostoxx Banks

The BBVA share and share performance ratios

| 30/09/2023 | 30/06/2023 | |

|---|---|---|

| Number of shareholders | 764,567 | 778,810 |

| Number of shares issued (millions) | 5,965 | 5,965 |

| Closing price (euros) | 7.71 | 7.03 |

| Book value per share (euros) (1) | 8.53 | 8.23 |

| Tangible book value per share (euros) (1) | 8.13 | 7.84 |

| Market capitalization (millions of euros) | 45,994 | 41,949 |

| Yield (dividend/price; %) (1)(2) | 5.6 | 6.1 |

(1) For more information, see Alternative Performance Measures at the end of the quarterly report.

(2) Calculated by dividing shareholder remuneration over the last twelve months by the closing price of the period.

Regarding shareholder remuneration, the Board of Directors of BBVA, at its meeting held on September 27, 2023, agreed to distribute a cash interim dividend of €0.16 gross per share on account of the 2023 dividend, which was paid on October 11, 2023. This dividend is already considered in the Group's capital adequacy ratios and represents an increase of 33.3% compared to the gross amount paid in October 2022 (€0.12 per share).

On October 2, 2023, and having received the required authorization from the European Central Bank, the Group started the execution of a new share buyback program for a total amount of €1,000m. This share buyback program is considered to be an extraordinary shareholder distribution and is therefore not included in the scope of the shareholder ordinary distribution policy. For more information on this, see "Solvency" chapter within this report.

On September 30, 2023 the number of BBVA shares outstanding was 5,965 million. The number of shareholders reached 764,567, and by type of investor, 60.7% of the capital was held by institutional investors and the remaining 39.3% was in the hands of retail shareholders.

BBVA shares are included on the main stock market indexes. At the closing of September 2023, the weighting of BBVA shares in the Ibex 35, Euro Stoxx 50 and the Stoxx Europe 600 index, were 9.4%, 1.6% and 0.5%, respectively. They are also included on several sector indexes, including Stoxx Europe 600 Banks, which includes the United Kingdom, with a weighting of 5.4% and the Euro Stoxx Banks index for the eurozone with a weighting of 9.3%. Moreover, BBVA maintains a significant presence on a number of international sustainability indexes, such as Dow Jones Sustainability Index (DJSI), FTSE4Good or MSCI ESG Indexes.

Group's information

The BBVA Group generated a net attributable profit of €5,961m between January and September of 2023, which represents an increase of 24.3% compared to the same period of the previous year, driven by the performance of recurring income from the banking business, mainly the net interest income, which grew at a rate of 29.4%.

These results include the recording for the total annual amount paid for the temporary tax on credit institutions and financial credit institutions for €215m, included in the other operating income and expenses line of the income statement.

Operating expenses increased by 18.1% at Group level, largely impacted by the inflation rates observed in the countries in which the Group operates. Notwithstanding the above, thanks to the remarkable growth in gross income, higher than the growth in expenses, the efficiency ratio stood at 41.8% as of September 30, 2023, with an improvement of 328 basis points, in constant terms, compared to the ratio recorded 12 months earlier.

The provisions for impairment on financial assets increased (+35.5% in year-on-year terms and at constant exchange rates), with lower requirements in Turkey, which were offset by higher provisioning needs, mainly in South America and Mexico, in a context of rising interest rates and growth in the most profitable segments, in line with the Group's strategy.

NET ATTRIBUTABLE PROFIT (LOSS)

(MILLIONS OF EUROS)

Loans and advances to customers recorded an increase of 5.3% compared to the end of December 2022, strongly favored by the evolution of retail loans (+6.9% at Group level).

Customer funds increased by 3.6% compared to the end of December 2022 thanks both to the growth in deposits from customers which increased by 2.4% and to the increase in off-balance sheet funds, which grew by +6.9%.

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-2022)

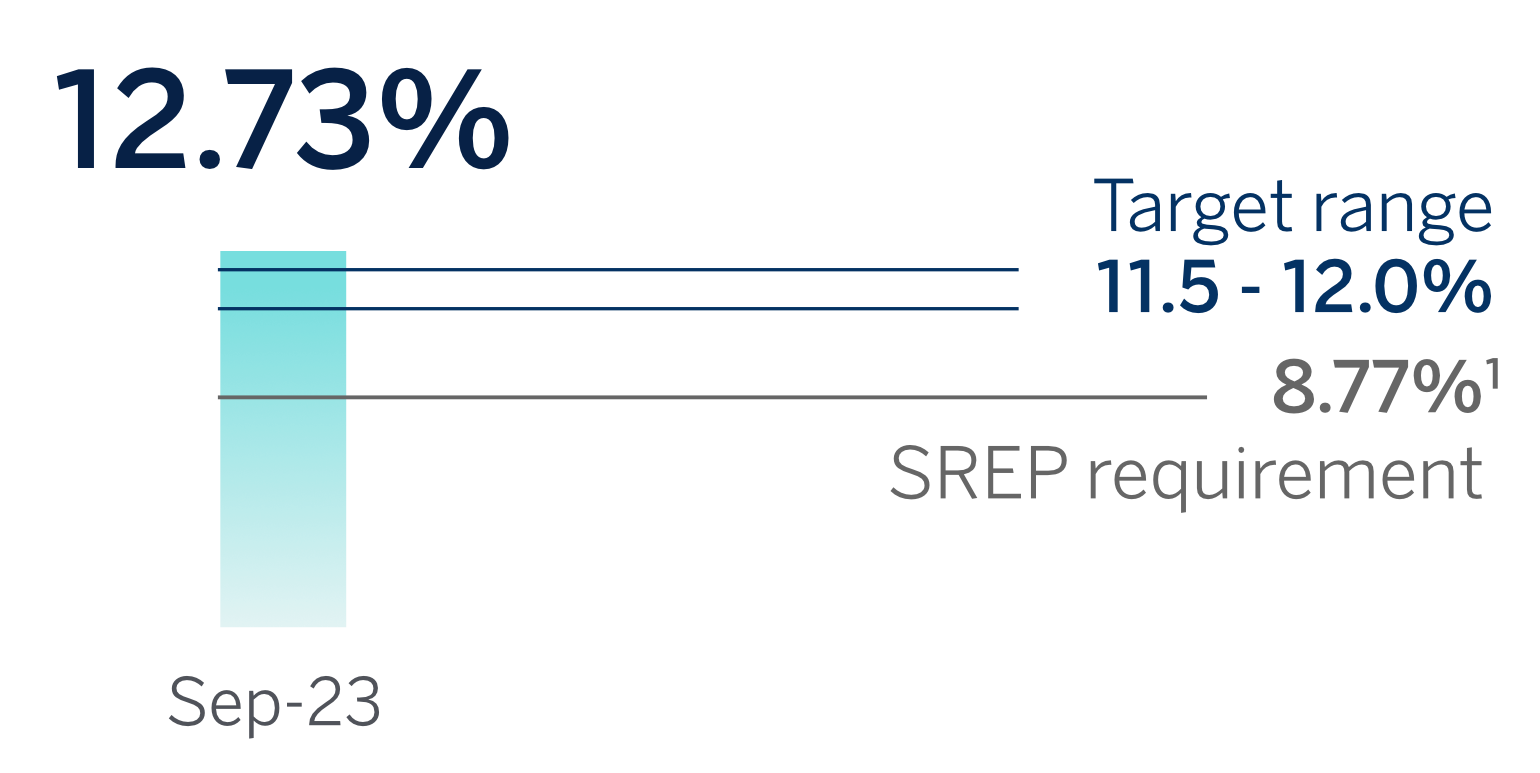

The Group's CET1 fully-loaded ratio stood at 12.73% as of September 30, 2023, including the effect of the share buyback program launched on October 2, 2023 for a total amount of €1,000m (-32 basis points), which allows to keep maintaining a large management buffer over the Group's CET1 requirement (8.77%)1 and above the Group's established target management range of 11.5-12.0% of CET1.

CET1 fully-loaded

(1) This includes the update of the countercyclical capital buffer calculated on the basis of exposure at end June 2023.

1 This includes the update of the countercyclical capital buffer calculated on the basis of exposure at end June 2023.

Regarding shareholder remuneration, as approved by the General Shareholders' Meeting on March 17, 2023, at the top of the agenda, on April 5, 2023, a cash payment of €0.31 gross per each outstanding BBVA share entitled to receive such amount was made and charged to the 2022 results, as final dividend for the financial year 2022. Thus, the total amount of cash distributions for 2022, taking into account the €0.12 gross per share that was distributed in October 2022, amounted to €0.43 gross per share. The Board of Directors of BBVA resolved on its meeting hold on September 27, 2023, the payment of a cash interim dividend of €0.16 gross per share on account of the 2023 dividend, which was paid on October 11, 2023. This dividend is already considered in the Group's capital adequacy ratios.

Total shareholder remuneration includes, in addition to the cash payments mentioned above, the remuneration resulting from the execution of the share buyback programs that the Group may execute. Regarding BBVA's buyback program announced past February 1, 2023 for an amount of €422m, on April 21, 2023, BBVA announced the completion of this share buyback program, having acquired 64,643,559 own shares between March 20 and April 20, 2023, representing approximately 1.07% of BBVA's share capital as of said date.

Likewise, on October 2, 2023, after receiving the required authorization from the ECB, BBVA announced that it would implement a buyback program for the repurchase of own shares in accordance with the Regulations, aimed at reducing BBVA’s share capital by a maximum monetary amount of €1,000 million, having acquired 60,000,000 shares between October 2 and October 27, 2023. The execution is being carried out internally by the Company, executing the trades through BBVA. This share buyback program would be considered to be an extraordinary shareholder distribution and is therefore not included in the scope of the ordinary distribution policy.

As of September 30, 2023, BBVA's share capital stood at €2,923,081,772.45 divided into 5,965,473,005 shares, at €0.49 par value each, once the Group has carried out the partial execution, announced on June 2, 2023, of the share capital reduction resolution adopted by the Ordinary General Shareholders' Meeting of BBVA held on March 17, 2023, under item 3 of the agenda through the reduction of BBVA’s share capital in a nominal amount of €31,675,343.91 and the consequent redemption, charged to unrestricted reserves, of 64,643,559 own shares of €0.49 par value each acquired derivatively by BBVA in execution of the share buyback program scheme and which were held in treasury shares.

Channeling sustainable business 2

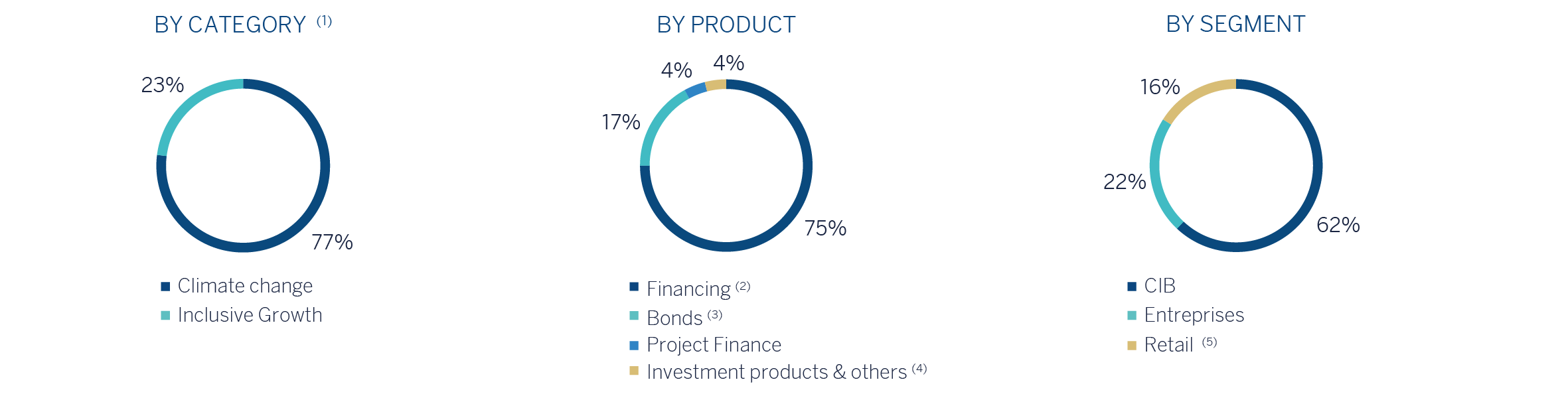

SUSTAINABLE BUSINESS BREAKDOWN (PERCENTAGE. TOTAL AMOUNT CHANNELED 2018-SEPTEMBER 2023)

(1) In those cases where it is not feasible or there is not enough information available to allow an exact distribution between the categories of climate change and inclusive growth, internal estimates are made based on the information available.

(2) Non-Project Finance and transactional banking activity.

(3) Bonds in which BBVA acts as bookrunner.

(4) Investment products art. 8 or 9 under Sustainable Finance Disclosure Regulation (SFDR) or similar criteria outside the European Union, managed, intermediated or marketed by BBVA. Others includes, in Retail: structured deposits, insurance policies for electric vehicles and self-renting of electric vehicles, mainly; and in CIB and Enterprise: structured deposits, mainly.

(5) Includes the activity of the BBVA Microfinance Foundation (FMBBVA), which is not part of the consolidated Group and has channeled during the third quarter around €400m to support vulnerable entrepreneurs through microloans. This represents a 7% decrease compared to the same quarter of the previous year, while it remains stable for the first nine months of 2023 compared to the previous year.

Regarding the objective of channeling €300 billion between 2018 and 2025 as part of the sustainability strategy, the BBVA Group has mobilized an approximate total of €185 billion in sustainable business between 2018 and September 2023, of which approximately 77% is allocated toward the fight against climate change, while the remaining 23% is dedicated to promoting inclusive growth. The channeled amount includes financing, intermediation, investment, off-balance sheet, or insurance operations. These operations have contractual maturity or amortization dates, so the above mentioned accumulated figure does not represent the amount reflected on the balance sheet.

During the first nine months of 2023, around €49 billion was mobilized (+25% compared to the same period of the previous year), of which around €16 billion corresponds to the third quarter of 2023. This channeling during the third quarter of 2023, represents an increase of about 13% compared to the same quarter of 2022 and is the second best quarter in sustainable business channeling for the Group, following the quarterly record achieved in the second quarter of this year.

In this third quarter, the retail business has mobilized around €1.700m, to reach a cumulative amount of around €7,300m since January 2023 (+69% compared to the same period last year). The good behavior of the channeling related to the acquisition of hybrid or electric vehicles stands out with €87m representing a growth of 78% compared to the same period of the previous year (+35% compared to the accumulated amount of the first 9 months of 2023 on a year-on-year basis). The contribution from Spain, which has channeled over half of this amount, is the most relevant.

Between July and September 2023, the commercial business (enterprises) has mobilized around €5.400m. In cumulative terms, mobilization in the first 9 months of the 2023 financial year has reached nearly €15,600m (+95% year-on-year). As in the previous quarter, the funding allocated to promote or improve the energy efficiency of buildings stands out with €1.088m, representing a 21% year-on-year increase (+55% when comparing the accumulated amount for the first 9 months of 2023 with the same period last year). In this area, Mexico's contribution is fundamental, with a 37% increase.

CIB has channeled approximately €8,100m during this quarter, and during the first 9 months of this year, around €26,200m (-3% year-on-year). During this quarter, the positive development of short-term financing or sustainable transactional banking activity stands out, which contributed approximately €4,400m, more than half the amount channeled by the corporate segment, representing a 34% year-on-year growth (and 10% if considering the accumulated amount from January 2023 compared to the same period last year). Since the beginning of 2023, signs of slowdown have been noted in the field of sustainable corporate financing, especially in long-term financing, as well as a revitalization of the sustainable bond market in which BBVA acts as bookrunner.

2 Channeling sustainable business is considered to be any mobilization of financial flows, cumulatively, towards activities or clients considered sustainable in accordance with existing regulations, both internal and market standards and best practices. The foregoing is understood without prejudice to the fact that such mobilization, both initially and at a later time, may not be recorded on the balance sheet. To determine the amounts of channeled sustainable business, internal criteria based on both internal and external information are used.

Business areas

Spain

€5,833 Mill.*

+26.3%

Highlights

- Growth in consumer loans, SMEs and public sector during the year

- Net interest income dynamism continues

- Very significant improvement of the efficiency ratio

- Cost of risk remains at low levels

Results

(Millions of euros)

Net interest income

4,053Gross income

5,833Operating income

3,532Net attributable profit

2,110Activity (1)

Variation compared to 31-12-22.

Balances as of 30-09-23.

Performing loans and advances to customers under management

-0.5%

Customer funds under management

-0.7%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes.

Mexico

€10,475 Mill.*

+22.3%

Highlights

- Lending activity acceleration in the quarter, with greater dynamism of the retail segment

- Net interest income continues to grow at double digits

- Favorable evolution of the efficiency ratio

- Quarterly net attributable profit continues at high levels

Results

(Millions of euros)

Net interest income

8,164Gross income

10,475Operating income

7,300Net attributable profit

3,987Activity (1)

Variation compared to 31-12-22 at constant exchange

rate.

Balances as of 30-09-23.

Performing loans and advances to customers under mangement

+8.0%

Customer funds under management

+6.1%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange rate.

Turkey

2,210 Mill.*

+184.0%

Highlights

- The dedollarization of the balance sheet continues in the quarter

- Improvement of the NPL ratio and NPL coverage ratio

- The cost of risk remains at low levels

- Net attributable profit of the third quarter negatively impacted by the hyperinflation adjustment and the increase in the tax rate

Results

(Millions of euros)

Net interest income

1,581Gross income

2,310Operating income

1,264Net attributable profit

367Activity (1)

Variation compared to 31-12-22 at constant exchange

rate.

Balances as of 30-09-23.

Performing loans and advances to customers under mangement

+46.7%

Customer funds under management

+59.8%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange rate.

South America

€3,577 Mill.*

+52.9%

Highlights

- Growth in lending activity

- Excellent evolution of the net interest income

- Favorable NTI evolution

- Higher adjustment for hyperinflation in Argentina

Results

(Millions of euros)

Net interest income

3,892Gross income

3,577Operating income

1,900Net attributable profit

496Activity (1)

Variation compared to 31-12-22 at constant exchange

rates.

Balances as of 30-09-23.

Performing loans and advances to customers under mangement

+6.9%

Customer funds under management

-9.9%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange

rates.

Rest of business

€852 Mill.*

+48.6%

Highlights

- Recovery in lending activity during the quarter

- Dynamism in recurring income and NTI in the year

- NPL ratio and cost of risk remain at low levels

- Efficiency improvement continues in year-on-year terms

Results

(Millions of euros)

Net interest income

405Gross income

852Operating income

424Net attributable profit

322Activity (1)

Variation compared to 31-12-22 at constant exchange

rates.

Balances as of 30-09-23.

Performing loans and advances to customers under mangement

+0.8%

Customer funds under management

+2.9%

Risks

NPL coverage ratio

NPL ratio

Cost of risk

(1) Excluding repos.

(2) Year-on-year changes at constant exchange

rates.

* Gross income

(1) At constant exchange rate.

(2) At constant exchange rates.

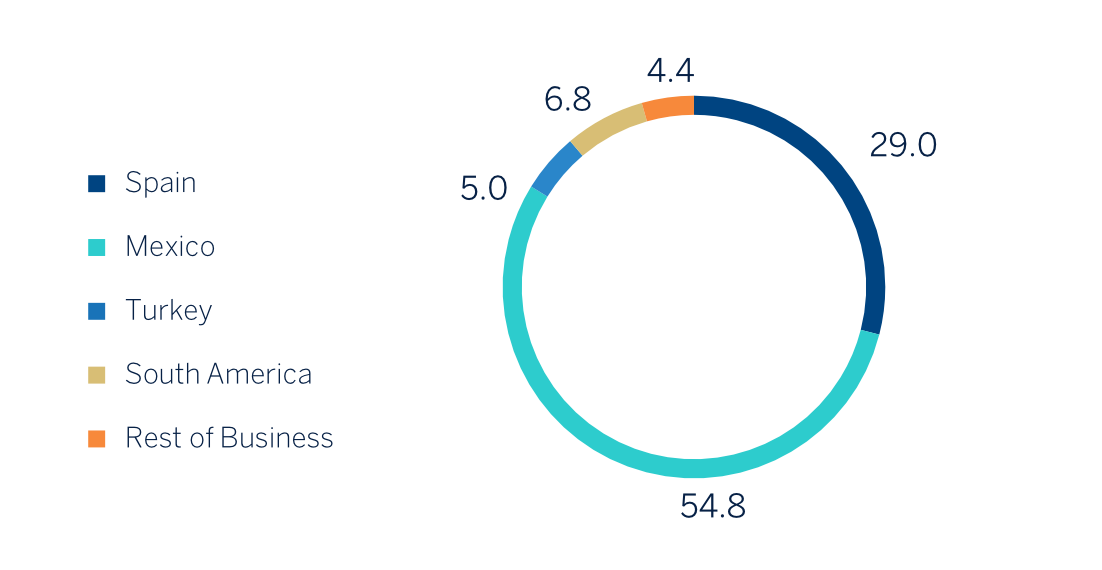

As for the business areas evolution, excluding the effect of currency fluctuation in those areas where it has an impact, in each of them it is worth mentioning:

- Spain generated a net attributable profit of €2,110m in the first nine months of 2023, 61.9% higher than in the same period of the previous year, thanks again to the strength of the net interest income, which boosted gross income growth.

- In Mexico, BBVA achieved a cumulative net attributable profit of €3,987m by the end of September 2023, representing an increase of 22.3% compared to the same period in 2022, mainly as a result of the significant growth in net interest income, thanks to the strong boost of the activity and the improvement in the customer spread.

- Turkey generated a net attributable profit of €367m during the first nine months of 2023, which compares positively with the accumulated result reached at the end of September 2022, both periods reflecting the impact of the application of hyperinflation accounting.

- South America generated a cumulative net attributable profit of €496m at the end of the first nine months of the year 2023, which represents a year-on-year increase of +20.5%, driven again by the good performance of recurring income (+59.1%) and the area's NTI, which offset the increase in expenses and higher provisioning needs for impairment on financial assets.

-

Rest of Business achieved an accumulated net attributable profit of €322m at the end of the first nine months of 2023, 80.8% higher than in the same period of the previous year, thanks to a favorable performance of recurring income, especially the net interest income, and the NTI.

The Corporate Center recorded, between January and September of 2023 a net attributable profit of €-1,321m, compared with €-566m recorded in the same period of the previous year, mainly due to a negative contribution in the NTI line from exchange rate hedges as a result of a better than expected currency performance, in particular the Mexican peso.

Lastly, and for a broader understanding of the Group's activity and results, supplementary information is provided below for the wholesale business carried out by BBVA, Corporate & Investment Banking (CIB), in the countries where it operates. CIB generated a net attributable profit of €1,763m between January and September of 2023. These results, which do not include the application of hyperinflation accounting, represent an increase of 43.8% on a year-on-year basis and reflect the contribution of the diversification of products and geographical areas, as well as the progress of the Group's wholesale businesses in its strategy, leveraged on globality and sustainability, with the purpose of being relevant to its clients.

NET ATTRIBUTABLE PROFIT BREAKDOWN (1)

(PERCENTAGE. JAN.-SEP. 2023)

(1) Excludes the Corporate Center.

News

Contact

Shareholder attention line

Shareholder attention line912 24 98 21

Subscription service

Subscription service  Shareholder Office

Shareholder Office Contact email

Contact email