Relevant events

Results

- In the January–September period of 2019, the overall growth in recurring revenue items is maintained, with a positive evolution in terms of net interest income in most business areas.

- The trend of containing operating expenses continued, improving the efficiency ratio compared to the same period of the previous year.

- As a result of the above, operating income increased 4.8% year-on-year.

- Impairment on financial assets increased by 12.7% year-on-year, mainly as a result of the higher loan-loss provisions in the United States.

- Finally, net attributable profit stood at €3,667m, a 15.2% lower than in the January–September period of 2018. Excluding the corporate operations from the 2018 comparison, the net attributable profit closed in line with the same period of the previous year.

Net attributable profit

(Millions of euros)

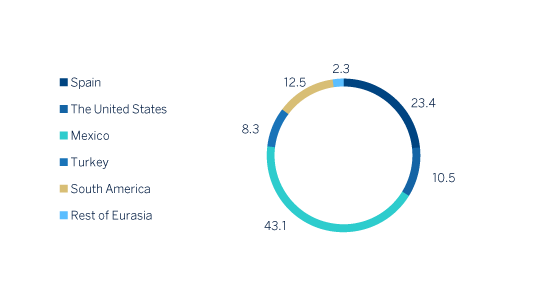

Net attributable profit breakdown (1)

(Percentage. Jan.-Sep. 2019)

(1) Excludes the Corporate Center.

Balance sheet and business activity

- As of September 30, 2019, loans and advances to customers (gross) grew by 1.3% compared to December 31, 2018, with improved levels in the business areas of Mexico and, to a lesser extent, South America and Rest of Eurasia.

- Strong performance of customer funds (up 2.3% compared to December 31, 2018) thanks to the positive evolution in demand deposits, mutual funds and pension funds.

Solvency

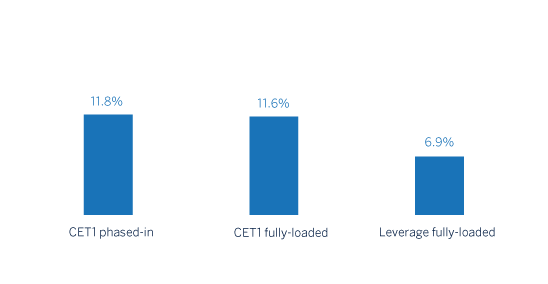

- The fully loaded CET1 ratio stood at 11.6% as of September 30, 2019, up 22 basis points in the first nine months of the year, due to recurring organic capital generation. Thus, this ratio is positioned within the range of this capital target defined for the Group.

Capital and leverage ratios

(Percentage as of 30-09-19)

Risk management

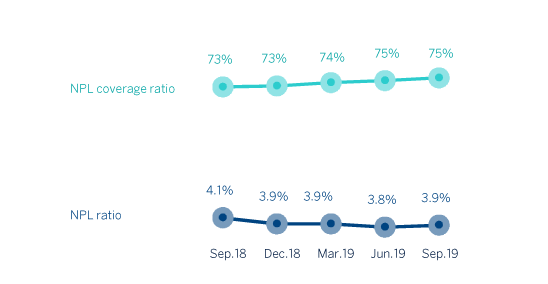

- Positive performance of the risk metrics. Non-performing loans remained flat from January to September 2019. The NPL ratio stood at 3.9%, the NPL coverage ratio was 75% and the cost of risk 1.01%, all figures as of September 30, 2019.

NPL and NPL coverage ratios (Percentage)

Transformation

- The unification of the BBVA brand in all the countries in which BBVA operates, announced in June 2019, is now a visible reality in most of the Group's digital and physical environments.

- The Group's digital and mobile customer base continues to grow, as well as its digital sales.

Digital and mobile customers (Millions)

Dividends

- On October 15, there was a gross cash payment of €0.10 per share, corresponding to the dividend for 2019 that was approved at the Board of Directors Meeting held on October 2.

Other matters of interest

- On August 7, 2019, BBVA reached an agreement with Banco GNB Paraguay S.A., for the sale of its shareholding, direct and indirect, in Banco Bilbao Vizcaya Argentaria Paraguay, S.A. (BBVA Paraguay), which amounts to 100% of its share capital. As a result of the above, all items in BBVA Paraguay's balance sheet have been reclassified into the category of 'Non-current assets (liabilities) and disposal groups held for sale' (hereinafter NCA&L).

- On January 1, 2019, IFRS 16 'Leases' entered into force, which requires the lessee to recognize the assets and liabilities arising from the rights and obligations of lease agreements. The main impacts are the recognition of an asset through the right of use and a liability based on future payment obligations. The impact of the first implementation was €3,419m and €3,472m, respectively, resulting in a decrease of 11 basis points of the CET1 capital ratio.

- In order to ensure that the information for 2019 is comparable to that of 2018, the balance sheets, income statements and ratios of the first three quarters of 2018 financial year for the Group and the South America business area have been restated to reflect the impact of the hyperinflation in Argentina as a result of the application of IAS 29 “Financial Reporting in Hyperinflationary Economies”. This impact was first registered in the third quarter of 2018, but with accounting effects as of January 1, 2018.