Highlights

COVID-19 pandemic

- The appearance of the COVID-19 virus in China and its global expansion to a large number of countries, caused the viral outbreak to be classified as a global pandemic by the World Health Organization since March 11, 2020. The pandemic has affected and continues to adversely the world economy and the activity and economic conditions, leading many countries into economic recession. The governments of the different countries in which the Group operates have adopted different measures that have conditioned the evolution of 2020, as explained below.

Results

The BBVA Group generated a net attributable profit of €1,305m during 2020, in a year marked by several factors that influenced the income statement:

- First, the outbreak of the COVID-19 pandemic, the main impacts of which were increased impairment on financial assets and higher provisions.

- Secondly, the goodwill impairment in the United States in the first quarter of 2020, amounting to €2,084m, also as a result of the pandemic. In relation to this business area, the sale agreement reached by the Group is detailed later in this section. It should be noted that the Group's results in this report are shown from a management’s business perspective, that is, with the United States business area in continuity. Financial information is being presented to the senior management of the Group with this management’s business perspective, and this report includes a conciliation between the management’s business perspective and the Consolidated Financial Statements of the Group.

- Lastly, and to a lesser extent, the execution in the fourth quarter of 2020 of the bancassurance agreement reached with Allianz in Spain, once all required authorizations were received, which has represented a net capital gain of €304m, registered in the line of corporate operations of the Group.

Despite the complexity of the environment, the operating income registered an 11.7% year-on-year increase at constant exchange rates at the end of 2020, driven by the net trading income (NTI) and the operating expenses reduction.

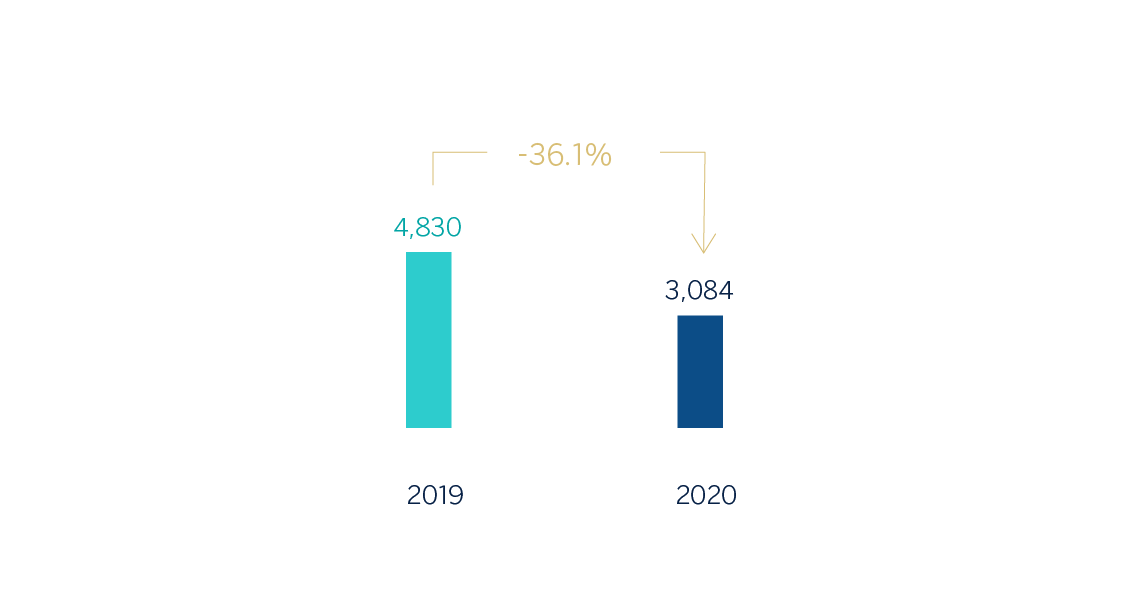

The Group’s adjusted net attributable profit, excluding the goodwill impairment in the United States and the results from corporate operations in 2020, stood at €3,084m, that is a 36.1% below the 2019 result, also excluding the goodwill impairment in the United States in the last quarter of 2019.

NET ATTRIBUTABLE PROFIT (1) (MILLIONS OF EUROS)

(1) Excluding the goodwill impairment in the United States, registered in 2019 and 2020 and the net capital gain from the bancassurance operation in 2020.

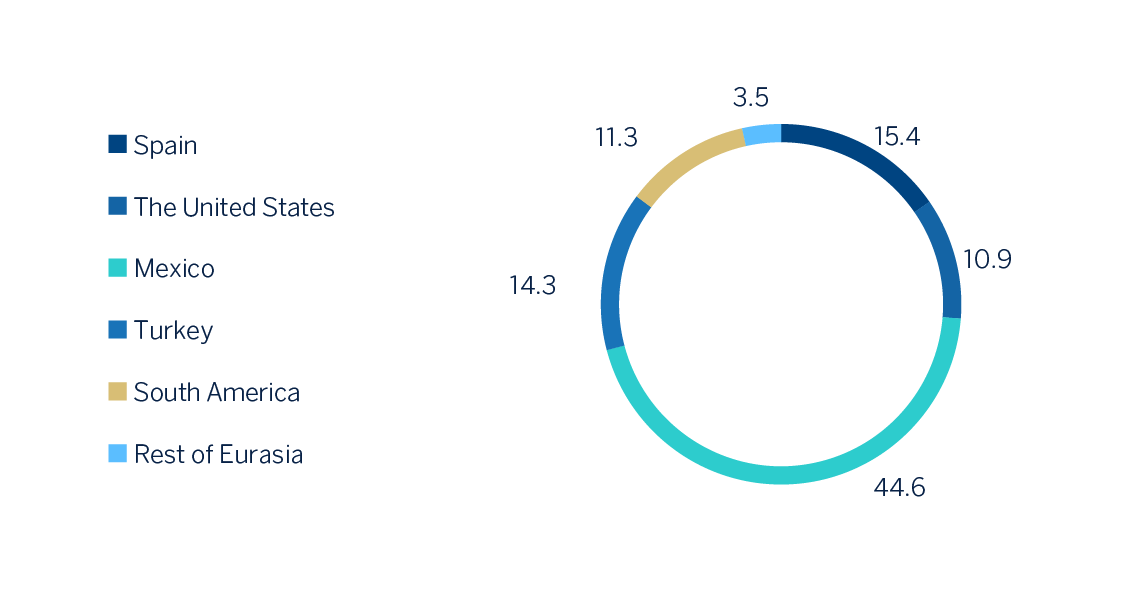

NET ATTRIBUTABLE PROFIT BREAKDOWN (1) (PERCENTAGE. 2020)

(1) Excludes the Corporate Center.

Balance sheet and business activity

- The figure for loans and advances to customers (gross) fell by 4.5% compared to the end of the previous year, with deleveraging in all portfolios in the last quarter of 2020, with the exception of consumer and credit cards.

- Customer funds grew by 3.8% during 2020, mainly as a result of customers placing larger liquidity in demand deposits.

Liquidity

- The availability of substantial liquidity buffers in each of the geographical areas in which the BBVA Group operates and their management, have allowed internal and regulatory ratios to be maintained well above the minimums required.

Solvency

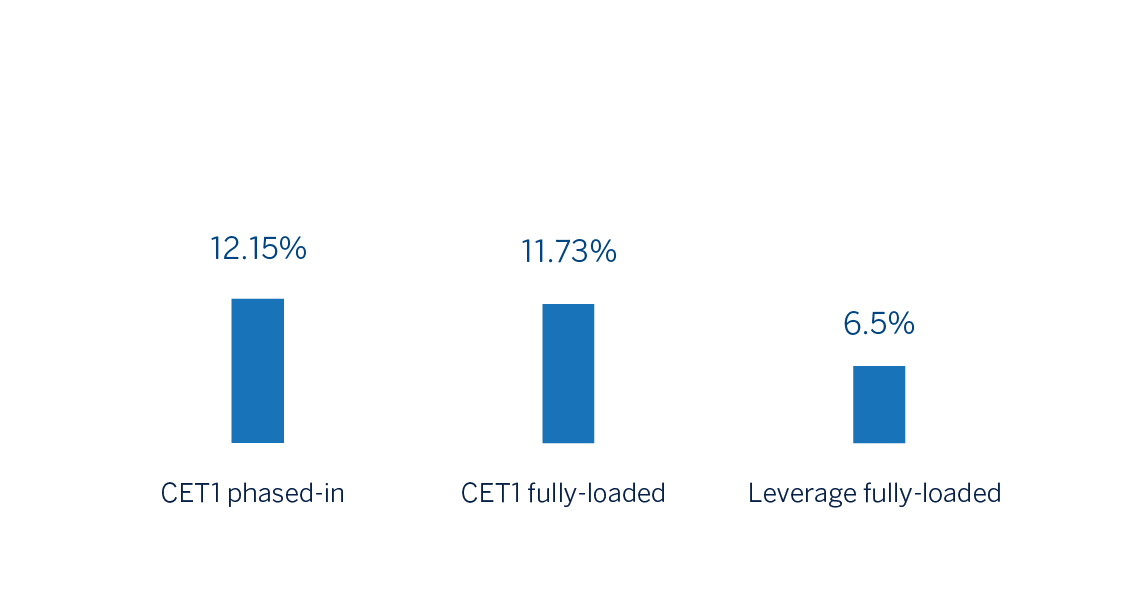

- From 2021 onwards the BBVA Group sets the target to keep the CET1 fully-loaded ratio between 11.5%- 12.0%, increasing the distance to the minimum requirement (currently at 8.59%) to 291-341 basis points. As of December 31, 2020, the CET1 fully-loaded ratio stood at 11.73%, already within the target range. This ratio does not include the positive impact of the sale of BBVA USA and other companies in the United States with activities related to its banking business, which according to the current estimate and taking by reference the capital base in 2020, would place the CET1 fully-loaded ratio at 14.58%. Additionally, it does not include the effect of the closing of the sale of BBVA Paraguay, which would have a positive impact of approximately +6 basis points, which will be registered in the first quarter of 2021.

CAPITAL AND LEVERAGE RATIOS (PERCENTAGE AS OF 31-12-20)

Shareholder remuneration

Regarding shareholder remuneration, the European Central Bank (hereinafter ECB) issued on December 15, 2020 a new recommendation on dividend distribution during the COVID-19 pandemic, that will be maintained until the end of September 2021 and repeals the previous recommendation. Following the recommendation from de ECB (for more information see later in this section the “Pronouncements of regulatory bodies and supervisors” paragraph), it is expected to be proposed for the consideration of the competent government bodies the intention to pay out €0.059 (gross) per share to its shareholders. The maximum amount distributed will be approximately €393m corresponding to the 15% consolidated profit for 2020 (excluding among others, the goodwill impairment in the United States, the capital gain from corporate operations and the remuneration of recommendation of the ECB.

Risk management

- The calculation of expected credit losses accumulated in 2020 incorporates:

- The update of the forward-looking information in the IFRS 9 models in order to reflect the circumstances created by the COVID-19 pandemic.

- The granting of relief measures in the form of temporary payment deferrals for customers affected by the pandemic, as well as the option to grant lending with a public guarantee facility. In relation to said payments deferrals and in order to mitigate as much as possible the impact of these measures for the Group, due to the high concentration in the time of their maturities, an anticipation plan has been worked out.

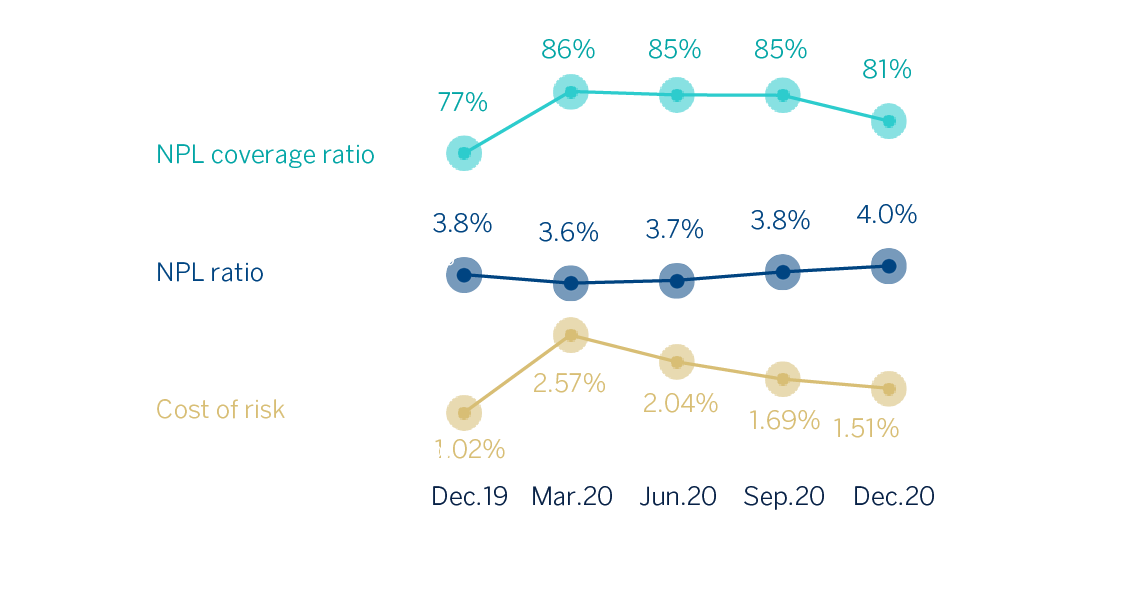

- The behaviour of the main credit risk indicators of the Group at the end of 2020 were:

- The NPL ratio stood at 4.0% at the end of December 2019, 17 basis points above the end of the previous year.

- The NPL coverage ratio closed at 81%, with a relevant improvement compared to the end of 2019.

- The cumulative cost of risk at the end of December stood at 1.51%, after the rebound experienced in the first quarter of 2020 and the subsequent correction throughout the year.

NPL AND NPL COVERAGE RATIOS AND COST OF RISK (PERCENTAGE)

Agreement for the sale of the United States

The BBVA Group announced, on November 16, 2020, that it has reached an agreement with The PNC Financial Services Group, Inc. (hereinafter PNC) for the sale of 100% of the shareholders' equity of its subsidiary BBVA USA Bancshares, Inc., which in turn owns, all of the shareholders' equity of the bank BBVA USA, as well as other companies of the BBVA Group in the United States with activities related to this banking business. The agreement reached does not include the sale of the institutional business of the BBVA Group developed through its broker dealer BBVA Securities Inc. or the participation in Propel Venture Partners US Fund I, L.P. Likewise, BBVA will continue to develop the wholesale business that it currently conducts through its New York branch. The price of the transaction amounts to aproximately USD 11,600m, which will be paid entirely in cash. It is estimated that the operation will generate a positive impact on the CET1 fully-loaded ratio of the BBVA Group of approximately 294 basis points and a net of taxes attributable profit of approximately €580m (calculated with a rate of 1.29 euros/U.S dollar) of which at the end of the financial year 2020, are already collected approximately €300m (corresponding to the results generated by the companies for sale from the signing of the transaction to the end of the year, and that there are recorded in the consolidated Financial Statements on 31 December, 2020) and approximately 9 basis points of positive impact in the CET1 fully-loaded ratio. As usual, the closing of the operation is subject to obtaining regulatory authorizations from the competent authorities and it is estimated that it will take place in mid-2021.

Sale of BBVA Paraguay

The BBVA Group announced on 22 January 2021 that, once the regulatory authorizations were obtained, it has completed the sale of its direct and indirect stake of 100% of the Shareholders' equity of the Banco Bilbao Vizcaya Argentaria Paraguay S.A. (hereinafter, BBVA Paraguay) to the Banco GNB Paraguay S.A. The total amount received after the closing of the operation amounts to approximately USD 250m and has generated a capital loss, net of taxes, of approximately €9m. Likewise, this transaction will have a positive impact on BBVA Group’s Common Equity Tier 1 (fully-loaded) of approximately +6 basis points. This impact will be reflected in the first quarter of 2021’s capital base of BBVA Group.

Security, business continuity and support measures taken by BBVA

From the outset, BBVA has adopted a series of measures to support its main stakeholders. The main business continuity measures taken are:

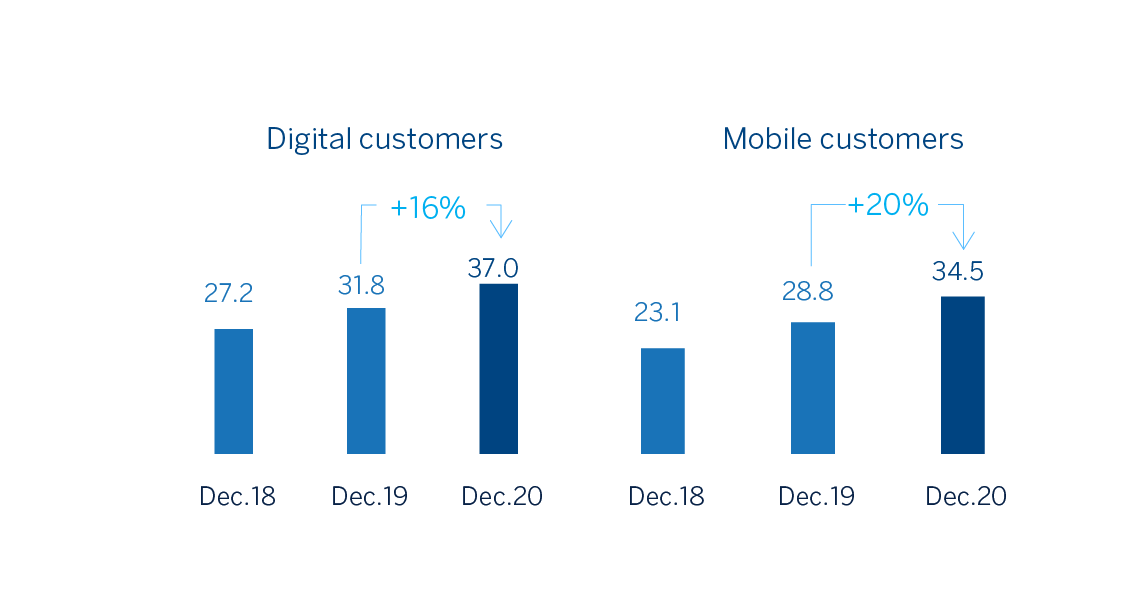

- In order to serve customers, and since financial services are legally considered an essential service in most of the countries in which the Group operates, the branch network remained operational, with dynamic management of the network considering the evolution of the pandemic and activity. In addition, the use of digital channels and remote managers was encouraged. The data indicates that the COVID-19 crisis is accelerating digitization: At Group level, and in cumulative terms, digital sales (measured in units) rebounded in March, and in April it reached 67.4%, with restrictions on the opening of branches in some of the countries where the Group operates, and in December 2020 they stood at 64.0%, which compares very positively with the 59.9% in February. Also at the end of the year, BBVA's digital customers accounted for 63% of the total and customers operating with the bank through their mobile phones accounted for 59% across the entire Group.

DIGITAL AND MOBILE CUSTOMERS (MILLIONS)

- With employees, recommendations from health authorities have been followed, including taking an early stance on promoting working from home. The priority in BBVA's return plan is to protect the health of the employees, customers and society in general. The return plan is being carried out following five principles: 1) cautiousness; 2) gradual return; 3) work shifts; 4) strict hygiene and safety measures; 5) creation of early identification protocols. The crisis is being handled dynamically; adapting the procedures in each geographical area which the Group is present to the current situation, based on the latest data available regarding the evolution of the pandemic, the business and the level of customer service, in addition to the guidelines set by local authorities.

- In terms of cybersecurity, the increase in remote work and digital transactions as a result of the coronavirus crisis has led to an increase in the risk of cyber attacks. To ensure data and corporate information protection, BBVA has established the appropriate measures and continues to strengthen its prevention and monitoring efforts, thus mitigating the possible associated risks.

The banks are a key part of the solution to the COVID-19 crisis. Among other support and responsibility measures, they include:

- BBVA has activated support initiatives with a focus on the most affected customers, regardless of whether they are companies, SMEs, self-employed workers or private individuals, and which includes, among others:

- In Spain, support for SMEs, self-employed workers and companies through credit lines and lines guaranteed by the Spanish Instituto de Crédito Oficial (ICO), grace periods on loans to affected individuals (up to 12 months in residential mortgages for primary residence and up to 6 months in consumer lending), and moratorium of 3 months for citizens in social rental housing under the Social Housing Fund;

- In the United States, flexibility in the repayment of loans for small business and for consumer finance has been extended, and certain fees and commissions for individual customers have been eliminated;

- In Mexico, BBVA granted various supports with personalized characteristics based on the needs of each of the customer segments, offers personalized solutions in a wide variety of products ranging from a lack of 6 months in capital and/or interest in various lending products until the suspension of Point of Sale (POS) fees to support retailers with lower turnover, as well as different support plans aimed at each situation for larger business customers;

- In Turkey, delay until June 2021 of loan repayments, interests and amortizations until December 31, 2020, without any penalty for private customers and extension of up to 6 months in the payment of principal on credits to companies;

- In South America, Argentina has provided micro-SMEs and SMEs with access to credit facilities to purchase teleworking equipment, funding facilities for payroll payments; Colombia has frozen the repayment of loans for individuals and companies for up to six months, and is offering a special working capital facility for companies; and in Peru, various measures were approved in order to support SMEs and customers with consumer loans or credit cards, including rescheduling of debts, extending the payment term.

- To support society in this fight against the COVID-19 pandemic, BBVA donated more than €35m to purchase medical supplies, support vulnerable groups and promote research. This donation was completed with more than €11m contributed by customers and employees.

Pronouncements of regulatory bodies and supervisors

- With the aim of mitigating the impact of COVID-19, various European and international bodies have made pronouncements aimed at allowing greater flexibility in the implementation of the accounting and prudential frameworks. The BBVA Group has taken these pronouncements into consideration when preparing this report.

- On December 2, 2020, the European Banking Authority (EBA) recognizing the exceptional circumstances of the second wave of COVID-19, it expanded the deadline to apply beneficial regulatory treatment to moratoriums, to March 31, 2021, updating the guidelines on legislative and non-legislative moratoriums on loan repayments, applied in light of the COVID-19 crisis and including additional safeguards against the risk of an excessive increase in unrecognized losses on banks' balance sheets.

- With regard to the payment of dividends, the ECB approved on December 15, 2020, given the persistent uncertainty about the economic impact of the COVID-19 pandemic, a new recommendation which will be maintained until the end of September 2021. The decision continues the line of recommending to the credit institutions exercise extreme prudence in the distribution of profits, either through the payment of dividends or through conducting share buy-backs, remaining this remuneration below 15% of the cumulative profit for 2019 and 2020 financial years, and in any case, not higher than 20 basis points of the Common Equity Tier 1 (CET1).

- In terms of solvency, the European Parliament and the European Council adopted Regulation 2020/873 (known as the "CRR Quick Fix"), which amends both Regulation (EU) 575/2013 (Capital Requirement Regulation (CRR)) and Regulation 2019/876 (Capital Requirement Regulation 2 (CRR2)), which will apply from June 27, 2020. Its main impacts on the BBVA Group as of December 31, 2020, involve the extension of the transitional treatment of IFRS 9 (only affects the phased-in ratios) the bringing forward of the application of the SME and infrastructure support factor, and the advance in the non-deductibility of the software.