Highlights

Results and business activity

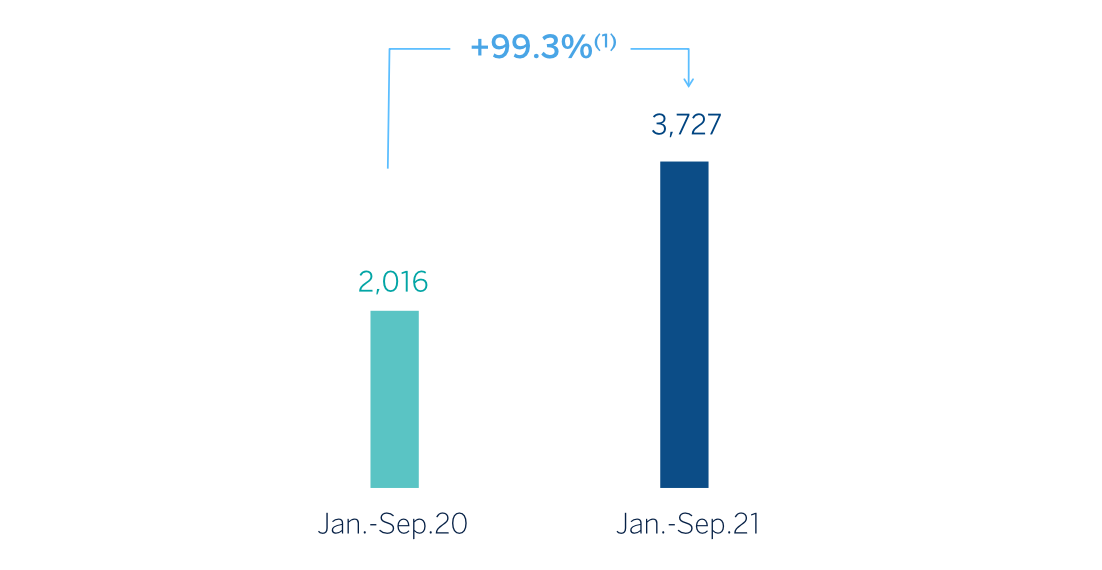

The BBVA Group generated a net attributable profit, excluding non-recurring impacts, of €3,727m between January and September 2021, representing a year-on-year increase of +84.9%.

Including the non-recurring impacts —namely the €+280m corresponding to the profit generated by BBVA USA and the rest of Group's companies included in the sale agreement to PNC until the closing date of the operation on June 1, 2021 and the €-696m of net costs related to the restructuring process— the Group's net attributable profit amounts to €3,311m, which compares very positively with the €-15m in the same period of the previous year, which was severely affected by the effects of the COVID-19 pandemic.

In year-on-year terms and at constant exchange rates, it is worth highlighting the good performance of the gross income and especially of the recurring income, i.e. the sum of net interest income and fees, which grew by 6.1%, and the positive evolution (+13.7%) of net trading income (hereinafter NTI) mainly due to the good performance of the Global Markets unit in Spain and the revaluations of the Group stakes in Funds & Investment Vehicles in tech companies and the industrial and financial portfolio.

Operating expenses increased (+6.5% year-on-year) in all areas except Spain and Rest of Business. This growth is framed within an environment of activity recovery and high inflation, particularly in Mexico and Turkey.

Lastly, the lower provisions for impairment on financial assets stand out (-46.2% in year-on-year terms and at constant exchange rates), mainly due to the strong impact of provisions for COVID-19 in 2020.

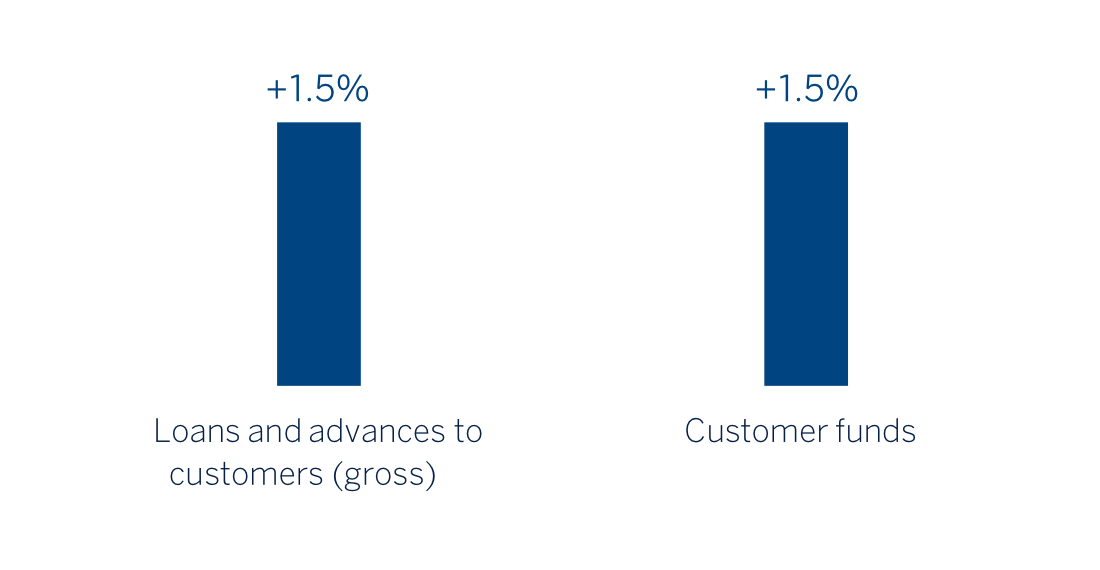

Loans and advances to customers (gross) recorded an increase of 1.5% compared to the end of December 2020, strongly supported by the performance of individuals (+2.5%), with growth in almost all geographical areas, except Rest of Business, highlighting the increase of consumer loans and credit cards in Turkey, Spain and Mexico. Loans to business also increased slightly (+0.6% in the year), thanks to the positive evolution in Mexico and Spain.

Customer funds showed an increase of 1.5% compared to the end of December 2020, due to the favorable performance of demand deposits and off-balance sheet funds in all geographical areas (highlighting mutual funds in Spain and Mexico), which manage to offset the decline in time deposits (-16.5%) thanks to the lower balances recorded in Spain and, to a lesser extent, in Rest of Business.

LOANS AND ADVANCES TO CUSTOMERS (GROSS) AND CUSTOMER FUNDS (YEAR-TO-DATE CHANGE)

Business areas

As for the business areas, in all of them, the provisions for impairment on financial assets decreased compared to 2020 due to the outbreak of the pandemic. In addition, in each of them it is worth mentioning:

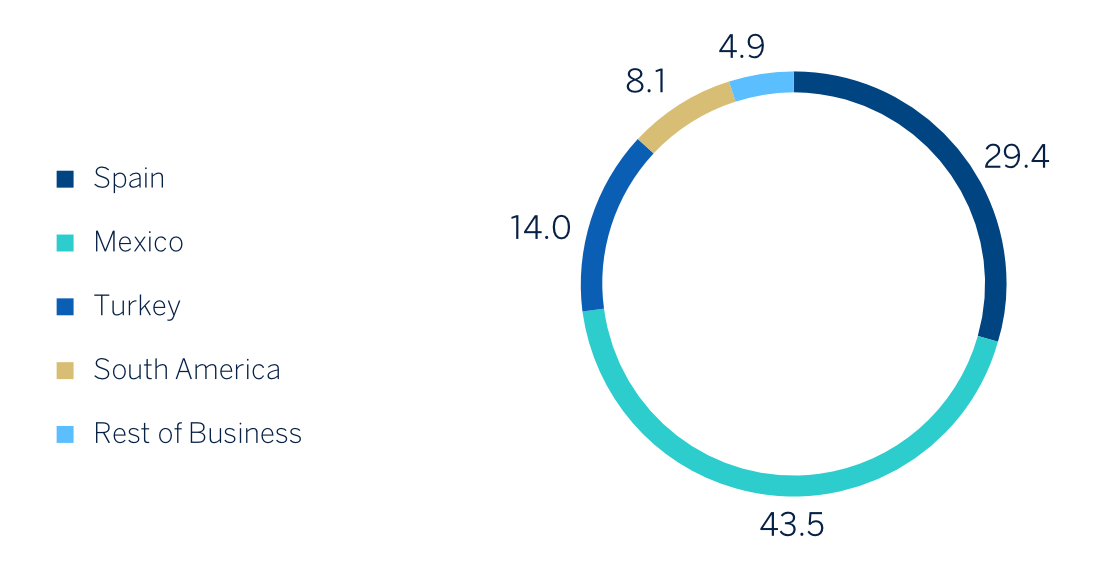

- Spain: BBVA in Spain achieved a net attributable profit of €1,223m between January and September 2021, +160.9% of the profit achieved in the same period of the previous year, mainly due to the increase in incurring income (thanks to the favorable evolution of fees) and in NTI and the reduction of operating expenses in 2021.

- Mexico: BBVA in Mexico generated a net attributable profit of €1,811m between January and September 2021, representing an increase of 47.4% compared to the same period of the previous year, at constant exchange rate. This evolution is driven by a 5.9% growth (at constant exchange rate) in recurring income and by the strength of the net margin (+1.4%).

- Turkey: The net attributable profit generated by Turkey between January and September 2021 stood at €583m, 48.4% (at constant exchange rate) above the figure achieved in the same period of the previous year, mainly due to the growth of net fees and commissions and NTI.

- South America: South America generated a cumulative net attributable profit of €339m between January and September 2021, which at constant exchange rates and excluding BBVA Paraguay in 2020, represents a year-on-year variation of +35.6%, mainly due to a better evolution of recurring income and NTI between January and September 2021 (+18.8%), partially offset by a higher inflation adjustment in Argentina in 2021.

- Rest of Businesses: At the end of September 2021, the net attributable profit for the area stood at €205m (+32.1% year-on-year, at constant exchange rates). It is worth mentioning that this area mainly incorporates the wholesale business developed in Europe (excluding Spain) and in the United States, as well as the banking business developed through the 5 BBVA branches in Asia.

Corporate Center: The net attributable loss of the Corporate Center, including the aforementioned non-recurring impacts, at the close of September 2021 was €-849m, well below (-68.2%) the net attributable loss for the same period of the previous year, €-2,675m. In 2021, this result includes several non-recurring impacts: 1) the net attributable profit amounting to €280m generated by the Group's businesses in the United States included in the sale agreement and 2) the net cost related to the restructuring process amounting to €-696m. Excluding these non-recurring impacts, the net attributable loss stood at €-433m (compared to the cumulative loss of €-644m at the end of September 2020).

Lastly and to allow a broader understanding of the Group's activity and results, supplementary information is provided in the following for the wholesale business carried out by BBVA, Corporate & Investment Banking (CIB), in the countries where it operates. The wholesale business area generated a net attributable profit of €955m between January and September 2021, which represents a 42.1% increase in year-on-year terms, thanks to the growth in the recurring income and the NTI and lower provisions for impairment on financial assets, which increased significantly in 2020 due to the outbreak of the COVID-19 pandemic.

NET ATTRIBUTABLE PROFIT (MILLIONS OF EUROS)

General note: (I) Excludes: BBVA USA and the rest of the Group's companies in the United States sold

to PNC on June 1, 2021, as of Jan.-Sep.20 and Jan.-Sep.21 and (II) the net cost related to the

restructuring process as of Jan.-Sep.21.

(1) At constant exchange rates.

NET ATTRIBUTABLE PROFIT BREAKDOWN (1)

(PERCENTAGE. JAN.-SEP. 2021)

(1) Excludes the Corporate Center.

Solvency

The CET1 Fully-loaded ratio stood at 14.48% as of September 30, 2021, which means a strong capital generation in the quarter (31 basis points) and a large capital buffer, widely covering the capital requirements of the BBVA Group even after the share buyback. For more information on the Group' share buyback program, please see "Other highlights" at the end of the current "Highlights" section.

Strategy developments

BBVA's strategy has been reinforced in 2021 as a result of the acceleration of some of the trends, such as digitization or the commitment to more sustainable and inclusive development. The anticipation of these trends in the Group strategy has allowed BBVA to progress in the execution of its six strategic priorities.

Between January and September 2021, BBVA has continued to help its clients improve their financial health by focusing on the development of new tools and functionalities.

In this regard, BBVA’s mobile banking app continues to lead the digital experience in Europe for the fifth consecutive year, according to the recent report “The Forrester Digital Experience ReviewTM : European Mobile Banking Apps, Q3 2021". BBVA has stood out especially for the experience it offers in financial health, which helps clients improve their financial well-being through tailored suggestions. This functionality also offers useful content that guides clients in managing their day-to-day finances with a clear and intuitive design.

Advice that is appreciated by BBVA clients, which is reflected in a better Net Promoter Score among users of the financial health tools in Spain in the last quarter, which is 39% higher than that of other customers. Likewise, these financial advisory tools have been a key element for the contracting of products. Thus, in Spain, in the first nine months of the year they have contributed 17% of all investment fund contracts, and 25% of mortgage contracts.

Furthermore, the Group has reaffirmed its commitment to sustainability in 2021 with a focus on combating climate change and inclusive growth. BBVA wants to help its clients in the transition towards a sustainable future not only with financing but also with advice and innovative sustainable solutions.

In terms of financing, BBVA has originated a total of €75,355m in sustainable financing between 2018 and September 2021. This type of financing has grown by 69% in the first nine months of 2021 compared to the same period of the previous year. A good example of the operations included in this type of financing is the €833m stake in a recent issuance of green debt from the Kingdom of Spain. The funds will be used to finance projects that promote ecological transition and adaptation to and mitigation of the impact of climate change.

BBVA aims to provide a comprehensive support service to its customers, individuals and companies, including also advisory so that they can take advantage of investment opportunities in sustainability and future technologies, and be more efficient and competitive. Thus, the Group continues being a pioneer in the development of innovative sustainable solutions. A good example is the recent launch in Spain of a tool for calculating the carbon footprint for retail customers, already developed for companies in 2020. This tools measures CO2 emissions into the atmosphere, based on data collected from invoices and card payments in selected shops, and offers a series of tailored tips on how to reduce them. The global nature of this new development allows it to be implemented in other geographical areas.

But beyond the origination of sustainable financing, in terms of managing the impact of the activity and integrating the risk of sustainability into the Bank’s processes, in the first nine months of 2021, BBVA has announced very relevant milestones such as the commitment to channel €200 billion to sustainable financing between 2018 and 2025, twice the amount established in the initial target; the decision to stop financing companies with coal-related activities; or the Net Zero 2050 commitment, which implies zero net CO2 emissions in that year, taking into account both the direct emissions of the Bank (where it has been neutral since 2020) and indirect emissions, i.e. those of the customers it finances. In this regard, BBVA is advancing in setting 2030 decarbonization goals in CO2 intensive selected industries, which will be announced in the context of the COP26.

In addition, a new global Sustainability area has been created, which aims to position BBVA as the benchmark bank for customers in sustainability solutions. The new global area will design the strategic sustainability agenda, define and promote the lines of work in this area of the different global and transformation units (Risk, Finance, Talent and Culture, Data, Engineering, among others) and develop new sustainable products. In addition, this area will be in charge of developing specialized knowledge for differential clients advice.

Regarding the focus on inclusive growth, BBVA and its foundations have recently announced their Community Commitment 2025, a plan through which they will allocate €550m to social initiatives, supporting inclusive growth in the countries where they operate. This commitment aims to address the most important social challenges in each region and complements the previously announced commitment to channel sustainable financing in the period 2018-2025 amounting to €200 billion.

This commitment has three lines of action: reducing inequality and promoting entrepreneurship, providing opportunities for all through education and supporting research and culture.

Through various initiatives, BBVA will support 5 million entrepreneurs, help more than 3 million people have a quality education and train 1 million people in financial education. In addition, the BBVA Microfinance Foundation will provide more than €7 billion in microcredits. In total, these programs will reach 100 million people during the mentioned period.

For all the reasons mentioned above, BBVA is the most sustainable European bank, according to the Dow Jones Sustainability Index, and the second in the world. An acknowledgement shared by Euromoney, which has named BBVA the best bank in corporate social responsibility in Western Europe in 2021, recognizing BBVA's commitment to improve social, economic and environmental conditions in the region.

On the other hand, BBVA seeks to accelerate its growth, positioning itself where its customers are, which requires a greater presence in digital channels, both own and third parties. BBVA considers that it is a great time to grow profitably and invest in value segments as well as other growth paths such as the entry into new markets, agreements with third parties or the digital acquisition of new customers. In this sense, the Group has recently announced the launch of a purely digital retail offer in Italy, with differential proposed value and customer experience. Besides, BBVA continues focusing on the acquisition of retail customers through its own digital channels, which, based on data as of the end of September 2021, has increased by 48% in the last twelve months, reaching 37% of new customers in the period. This has also been reflected in digital sales which, in cumulative terms and at the end of September, already represented 55% of the Group's total sales in PRV1.

BBVA continues to make progress towards operational excellence. The Group aims to offer an excellent customer experience at an efficient cost through a relationship model leveraging digitalization. In this sense, 68% of the bank's active customers already use digital channels and 64% use mobile channels. Thanks to this, BBVA stands out ¡n terms of efficiency with a ratio of 44.7% compared to the average of its European peers.

The Group places the best and most committed team at the center of its strategic priorities. For this reason, BBVA is one of the 30 companies worldwide awarded with the recognition “Exceptional Workplace 2021” by the American consulting firm Gallup. This award distinguishes organizations committed to developing the human potential of their staff.

Likewise, the Group's commitment to inclusion and diversity and the initiatives developed in this regard has led BBVA to be included for the fourth consecutive year in the Bloomberg Gender-Equality Index, a ranking that includes the 100 global companies with the best practices in gender diversity. BBVA is also a signee of the Charter of Diversity at the European level and the Women's Empowerment Principles of the United Nations.

For all this, the Group considers data and technology as the main catalysts for innovation. Data has become a key differential factor and data management creates strong competitive advantages. An example of BBVA's firm commitment to becoming a data-driven organization is the progress in the development of an integrated big data platform, in which more than 1,600 data scientists, developers and specialists are involved. BBVA is also committed to the increasing use of new technologies such as the cloud, blockchain or artificial intelligence.

Other highlights

- On January 29, 2021, BBVA announced its intention to return in 2021 to its shareholder remuneration policy consisting in the distribution of an annual payout of between 35% and 40% of the profits obtained in each financial year, fully paid in cash, in two different payments (expected to take place in October and April and subject to the applicable authorizations), provided that recommendation ECB/2020/62 is revoked and there are no further restrictions or limitations. On July 23, 2021, the European Central Bank made public the approval of recommendation ECB/2021/31 replacing recommendation ECB/2020/62 and to be in force as of September 30, 2021, removing the restrictions on dividends and buyback programs contained in that recommendation. Accordingly, on September 30, 2021 BBVA announced that BBVA’s Board of Directors approved the payment in cash of €0.08 per BBVA share, as gross interim dividen against 2021 results, which was paid on October 12, 2021.

-

On 26 October 2021, BBVA received the required authorization from the ECB for the buyback of up to 10% of its share capital for a maximum sum of €3,500m, in one or several tranches and over a maximum period of 12 months as from the communication by BBVA that the buyback of shares has effectively commenced (the “Authorization”).

Once the Authorization has been obtained the Board of Directors of BBVA, in its meeting held on 28 October 2021, agreed to carry out a program scheme for the buyback of own shares which will be executed in several tranches, for a maximum amount up to €3,500m, aimed at reducing BBVA’s share capital (the “Program Scheme”), notwithstanding the possibility to suspend or terminate the Program Scheme upon the occurrence of circumstances that makes it advisable.

Likewise, the Board of Directors agreed to carry out a first share buyback program which will have a maximum amount of €1,500m, a maximum number of shares to be acquired equal to 637,770,016 own shares, representing, approximately, 9.6% of the BBVA’s share capital, and a maximum term of 5 months as from its effective start, that will take place after 18 November 2021.

-

In June 2021, BBVA and the majority of the labor union representatives reached an agreement on the restructuring plan of BBVA S.A. in Spain, which includes redundancies of 2,935 employees in total (divided into 2,725 layoffs and 210 leaves of absence, about 10% of the Group's total workforce in Spain) and an outplacement program for all interested employees. The agreement also includes the closing of 480 branches. The process has been characterized by an attitude of dialogue between the parties and it has been carried out with a clear interest in voluntary acceptance. As of September 30, 2021, a total of 1,674 employees have already signed the exit of BBVA S.A. (some of them did not effectively leave the Bank until October 1, 2021) and 260 branches have been closed. Additional employee departures from the branches are expected to occur during October and November, the volume of which will depend on the branches closures during both months, although the departure of some workers could be extended until March 31, 2022 for organizational reasons.

For management information purposes, as it is considered a strategic decision, the impacts of the process have been assigned to the Corporate Center. This process will generate estimated savings of approximately €250m per year, before taxes, from 2022 onwards, of which approximately €220m would correspond to personnel expenses. In 2021 the estimated savings will be approximately €65m before taxes, most of which will materialize in the last quarter of 2021, with the departure of employees starting July 18, 2021.

1 Product Relative Value is a proxy used for the economic representation of the sale of units.