Highlights

Invasion of Ukraine

Russia's invasion of Ukraine, the largest military attack on a European state since World War II, has had an immediate impact on global geopolitics and economy. There has also been an increase in the level of uncertainty, which remains high at the date of elaboration of this report. The European Union, the United States, the United Kingdom and other governments have imposed harsh sanctions against Russia and Russian interests. The impact of these measures, as well as the potential response by Russia, are currently uncertain and could negatively affect the Entity's business, financial position and results, although the Group's direct exposure to Ukraine and Russia is limited.

The Group observes the events with particular concern and unease because of the human tragedy that they entail. In this regard, the Entity has contributed to respond to the humanitarian emergency in Ukraine with a donation of €1m, a campaign among customers and employees, that has raised, until April 19, 2022, €2.1m, in addition to the possibility of free transfers from individuals to Ukraine. Finally, BBVA joined a declaration signed by more than 50 companies from around the world to provide support to people fleeing Ukraine and to attend their immediate needs. Thus, the Group has offered the Ministry of Inclusion, Social Security and Migration of the Government of Spain 200 homes for the reception of refugees and, in order to facilitate the financial inclusion of the refugees, the Basic Payment Account has been made available to them, so that they can have a free account and a card, which allows them to access basic banking services.

Results and business activity

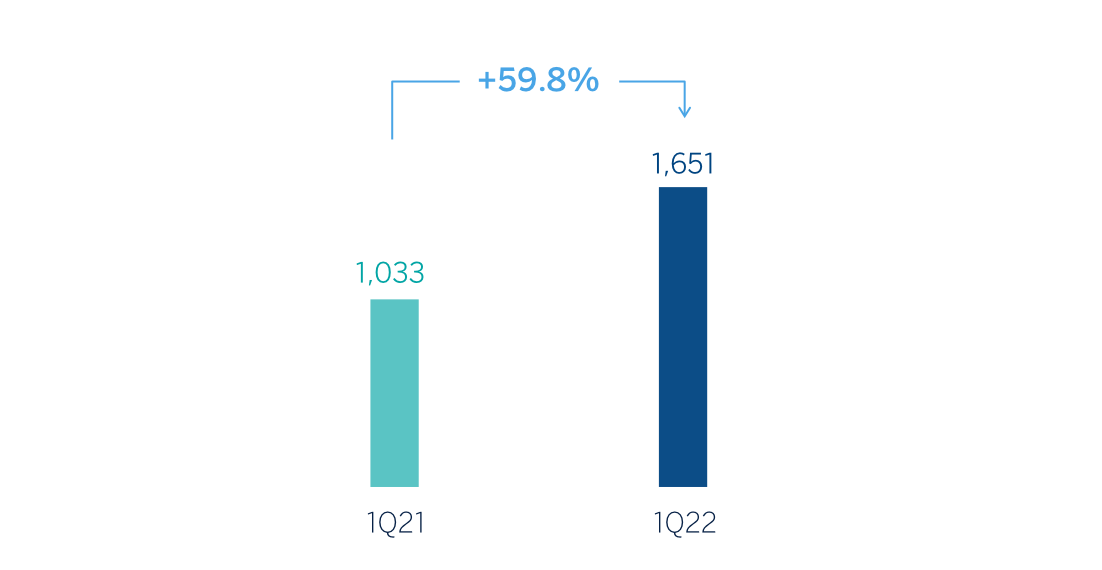

The BBVA Group generated a net attributable profit of €1,651m in the first quarter of 2022, representing a year-on-year variation of +36.4%. Excluding non-recurring impacts in the first quarter of 2021, namely €177m from the results of discontinued operations and corresponding to BBVA USA and the rest of the companies sold to PNC on June 1, 2021, the Group's net attributable profit registered a year-on-year increase of 59.8%.

In a complex environment marked by a high level of uncertainty, the results generated by the Group in the first quarter of 2022 were characterized by the good performance in recurring income from the banking business, which continued to grow for the fifth consecutive quarter. This favorable trend in net interest income and net fees and commissions, together with lower provisions for impairment on financial assets and provisions, largely explain the positive year-on-year performance of the Group's income statement.

Operating expenses increased at Group level (+8.5% in year-on-year terms and excluding the exchange rate effect), in an inflationary environment in all countries in which BBVA operates.

Notwithstanding the above, thanks to the remarkable growth in gross income, the efficiency ratio stood at 40.7% as of March 31, 2022, with an improvement of 528 basis points in constant terms, compared to the ratio at the end of December 2021, placing BBVA, once again, in a leading position among its European peer group1. Thus, BBVA seeks to offer an excellent customer experience at an efficient cost through a relational model leveraged on digitization.

The provisions for impairment on financial assets decreased (-17.9% in year-on-year terms and at constant exchange rates), mainly due to the good performance of the underlying asset, highlighting the decrease in Spain, Mexico and South America.

In the first quarter of 2022, provisions were lower (-70.0% at constant exchange rates) than the previous year.

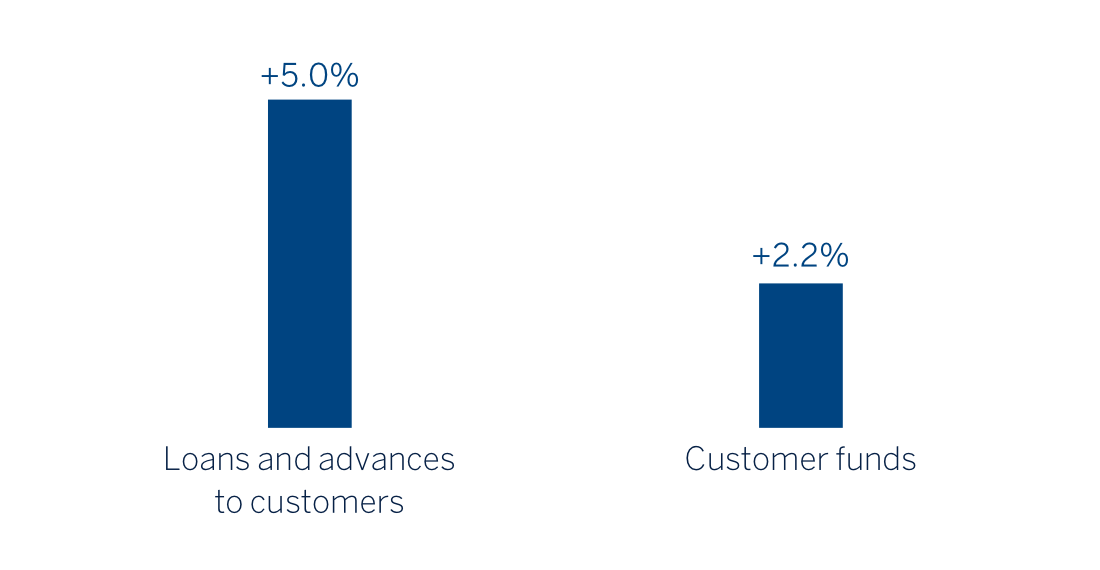

Loans and advances to customers recorded a growth of 5.0% compared to the end of December 2021, strongly favored by the evolution of business loans (+7.7%) in all business areas and, to a lesser extent, by the dynamism of retail loans.

Customer funds showed an increase of 2.2% compared to the end of December 2021, thanks to the contribution of demand deposits (+2.8%) and, to a lesser extent, of time deposits (+5.7%).

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-2021)

Business areas

As for the business areas, excluding the effect of currency fluctuation in those areas where it has an impact, in each of them it is worth mentioning:

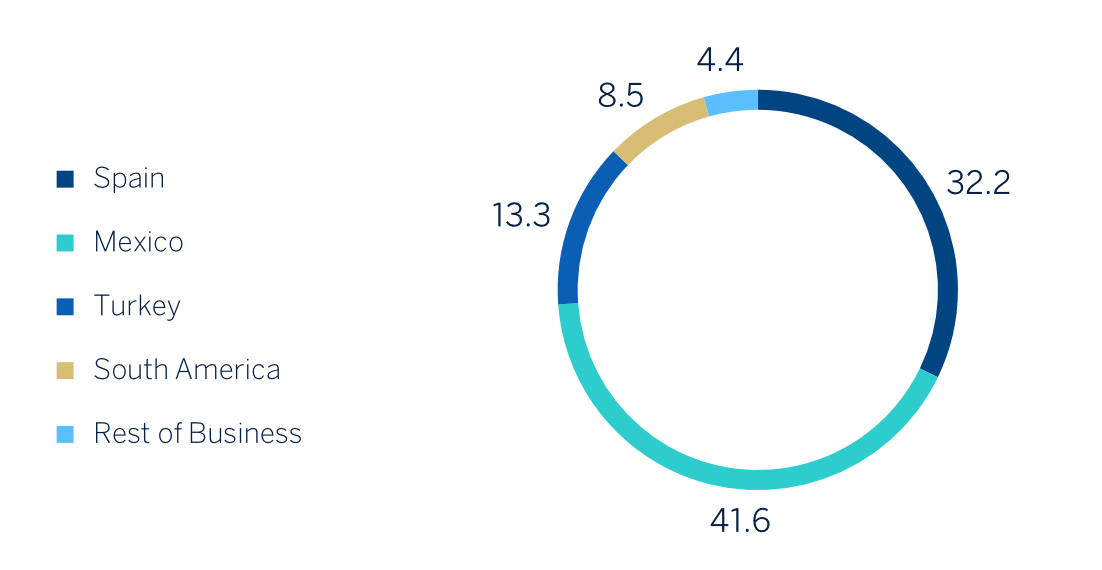

- Spain generated a net attributable profit of €601m during the first quarter of 2022, up 62.3% from the result achieved between January and March of the previous year, due to the good performance of gross income, driven by commissions, the significant reduction in personnel expenses, as well as lower write-offs and provisions.

- In Mexico, BBVA achieved a net attributable profit of €777m between January and March 2022, representing an increase of 49.0% compared to the first quarter of 2021, mainly as a result of the good performance of recurring revenues, favored especially by the dynamism of the net interest income and lower loan-loss provisions, which compensated the increase in operating expenses.

-

Turkey generated a net attributable profit of €249m in the first quarter of 2022, 129.6% higher than the same period of the previous year, supported by strong growth in recurring income, especially on the net interest income side, and higher contribution from NTI. Taking into account the effect of the depreciation of the Turkish lira over the period, the results generated by Turkey increased by 30.6%.

With regard to this business area and the voluntary takeover bid, submitted by the BBVA Group for the entire share capital of Garanti BBVA not already owned, BBVA announced on March 31, 2022 that the securities market supervisor of Turkey had approved the information memorandum for the bid. The period of acceptance of the offer began on April 4, 2022 and on April 25, 2022, BBVA has reported the increase in the offered price per share, from the initially announced (12.20 Turkish liras) to 15.00 Turkish liras. As a consequence of this price increase, the last day of the offer acceptance period has been extended until May 18, 2022. - South America generated €158m in the first quarter of 2022, representing a year-on-year variation of +68.2%, mainly due to the improved performance of recurring income (+30.6%) and NTI (+28.2%), which more than offset the higher impact of inflation in Argentina and the growth of expenses.

- Rest of Business achieved a net attributable profit of €81m accumulated at the end of the first quarter of 2022, 5.4% less than in the first quarter of the previous year, mainly due to the lower performance of the Group's broker dealer in the United States.

The Corporate Center recorded a net attributable loss of €-215m in the first quarter of 2022, This result compares to €-24m recorded in the same period of the previous year, although it must be taken into account that this figure included the results generated by the businesses that the Group had in the United States until its sale to PNC on June 1, 2021.

Lastly and for a broader understanding of the Group's activity and results, supplementary information is provided below for the wholesale business carried out by BBVA, Corporate & Investment Banking (CIB), in the countries where it operates. CIB generated a net attributable profit of €444m in the first quarter of 2022, which represents an increase of 45.6% on a year-on-year basis, thanks to the growth in recurring income, NTI and lower provisions, which offset the growth in operating expenses. It should also be noted that all business lines of the CIB area recorded growth compared to the first quarter of 2021, both in income and at the level of net attributable profit.

NET ATTRIBUTABLE PROFIT (LOSS) (MILLIONS OF EUROS)

General note: 1Q21 excludes BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021.

NET ATTRIBUTABLE PROFIT BREAKDOWN (1)

(PERCENTAGE. 1Q22)

(1) Excludes the Corporate Center.

Solvency

The Group's CET1 Fully-loaded ratio stood at 12.70% as of March 31, 2022, which allows to maintain a large management buffer over the Group's CET1 requirement (8.60%), also standing above the Group's target management range established at 11.5-12% of CET1. This CET1 level includes the deduction of the total amount of the share buyback program authorized by the supervisor, amounting to maximum €3.500m that were already registered at the end of December 2021.

Shareholder remuneration

- On April 8, 2022, a cash payment of €0.23 gross against voluntary reserves was made for each outstanding share of BBVA entitled to receive this amount as additional shareholder remuneration for the year 2021, approved by the Annual General Meeting held on March 18, 2022. Thus, the total amount of cash distributions for the year 2021 was €0.31 gross per share, the largest distribution in 10 years.

- The total shareholder remuneration includes, in addition to the aforementioned cash payments, the extraordinary remuneration resulting from the execution of the program scheme announced on October 29, 2021 for the buyback of own shares up to a maximum amount of €3,500m. Regarding the first tranche of the share buyback program, BBVA announced on March 3, 2022 the completion of the program, having reached the maximum monetary amount of €1,500m disclosed in the inside information of November 19, 2021. The total number of own shares acquired was 281,218,710 shares. Additionally, the Bank announced on March 16, 2022 the execution of the first segment of the second tranche up to a maximum amount of €1,000m or a maximum number of shares of 356,551,306. This first segment is being externally executed by Goldman Sachs International thorough Kepler Cheuvreux, S.A. as broker. Upon full execution of the first segment, a second segment will be executed up to the remaining amount or remaining number of shares for the complete execution of the program scheme. From March 16 to March 31, 2022 and from April 1 to April 21, 2022, Goldman Sachs International, acting as lead manager for the first segment through the broker Kepler Cheuvreux, S.A., has acquired 8,540,302 and 60,285,015 BBVA shares respectively.

Other highlights

- In February 2022, BBVA announced the investment of approximately $300m in Neon Payments Limited for the acquisition of 21.7% of its share capital. This investment adds up to others performed by BBVA in the digital Atom Bank in the United Kingdom or Solarisbank in Germany, and offers the Group enormous strategic options in a highly attractive market with great potential. For its part, on April 19, 2022, BBVA announced an investment of $20m in Lowercarbon Capital, one of the few venture capital funds specializing in companies that develop technologies in the climate change and decarbonization fields. In addition, on 20 April 2022, BBVA announced an investment of €15m in the Leadwind venture capital fund to support companies with a high technological component in accelerated growth. BBVA continues its strong commitment to the entrepreneurial ecosystem through selective investments in digital banks, investments through venture capital vehicles or the launch of a purely digital bank in Italy, among others.

- On April 1, 2022, BBVA informed Merlin Properties, SOCIMI, S.A., among other aspects, that it had accepted the proposal to purchase 100% of the shares of Tree Inversiones Inmobiliarias Socimi, S.A. for a total amount of €1,987m. This company also owns 662 offices sold by BBVA between 2009 and 2010. This deal gives BBVA greater flexibility in the management of its network of offices in Spain and it is expected to generate economic savings once the transaction, subject to the prior approval by the National Commission on Markets and Competition in Spain, will be closed.

1 European peer group: Barclays, BNP Paribas, Crédit Agricole, Commerzbank, Credit Suisse, Deutsche Bank, HSBC, Intesa Sanpaolo, Lloyds Banking Group, Natwest, Banco Santander, Société Générale, UBS and Unicredit, data at the end of December 2021.