Highlights

- Environment conditioned by the difficult situation of financial markets.

- Positive performance of lending.

- Excellent growth in deposits.

- Costs influenced by investments in technology.

Business activity

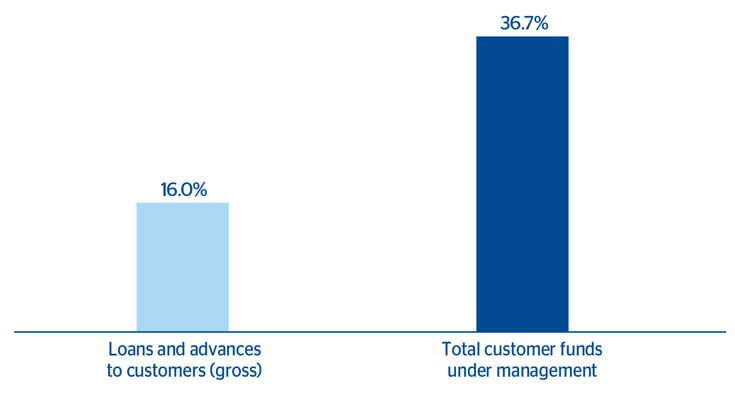

(Year-on-year change at constant exchange rates. Data as of 31-12-2015)

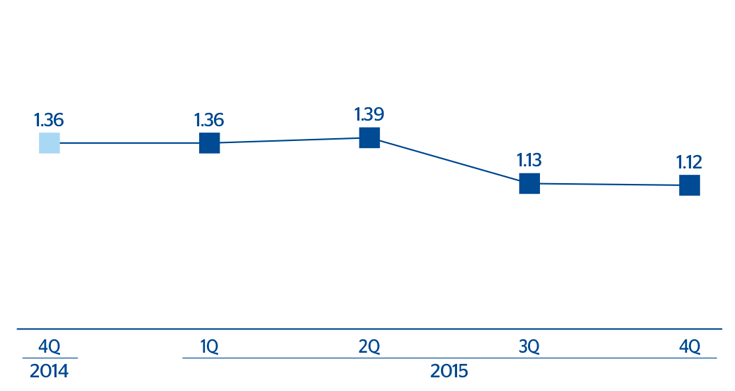

Gross income/ATA

(Percentage. Constant exchange rate)

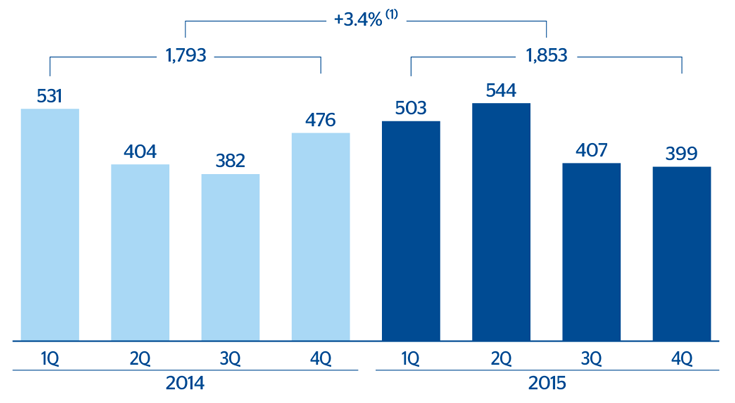

Operating income

(Million euros at constant exchange rate)

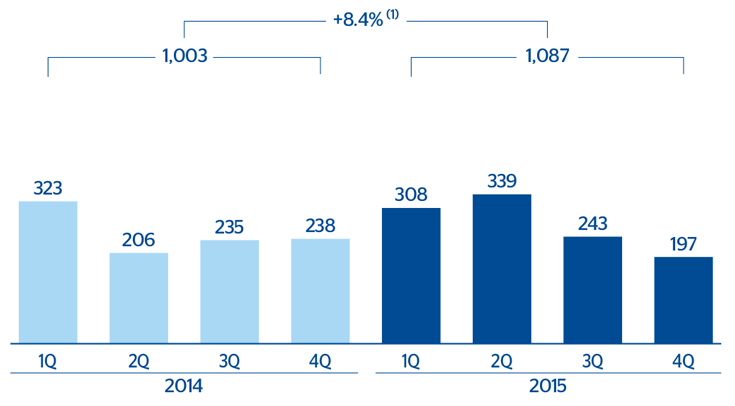

Net attributable profit

(Million euros at constant exchange rate)

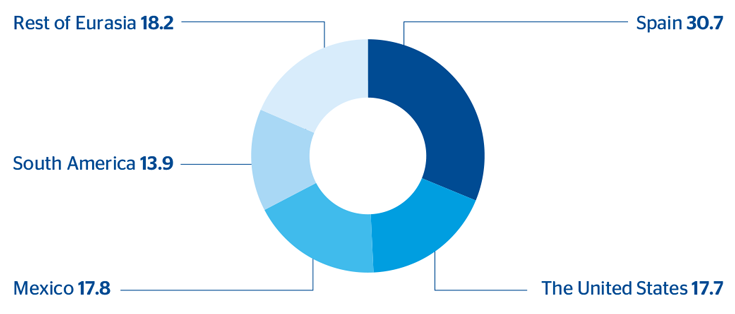

Breakdown of loans and advances to customers (gross) excluding repos

(Percentage as of 31-12-2015)

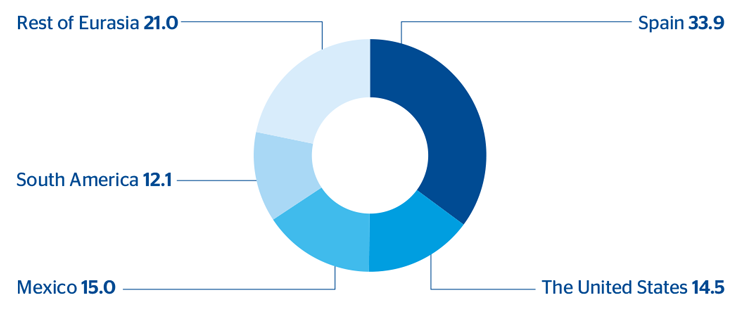

Breakdown of customer deposits under management

(Percentage as of 31-12-2015)

Financial statements and relevant business indicators

Download Excel

Download Excel

|

|

|

Million euros and percentage | ||

|---|---|---|---|---|

| Income statement | 2015 | Δ% | Δ% (1) | 2014 |

| Net interest income | 1,447 | (4.5) | 6.5 | 1,515 |

| Net fees and commissions | 665 | (8.6) | (9.5) | 727 |

| Net trading income | 635 | 18.9 | 22.8 | 535 |

| Other income/expenses | 96 | 78.4 | (4.9) | 54 |

| Gross income | 2,844 | 0.5 | 4.9 | 2,831 |

| Operating expenses | (991) | 7.8 | 7.8 | (919) |

| Personnel expenses | (518) | 4.7 | 2.6 | (494) |

| General and administrative expenses | (390) | 7.4 | 10.6 | (363) |

| Depreciation and amortization | (83) | 34.9 | 33.8 | (62) |

| Operating income | 1,853 | (3.1) | 3.4 | 1,912 |

| Impairment on financial assets (net) | (119) | (40.5) | (39.8) | (200) |

| Provisions (net) and other gains (losses) | (6) | (90.3) | (89.3) | (66) |

| Income before tax | 1,727 | 5.0 | 12.5 | 1,646 |

| Income tax | (500) | 10.2 | 13.0 | (453) |

| Net income | 1,228 | 3.0 | 12.3 | 1,192 |

| Non-controlling interests | (141) | 0.5 | 55.9 | (140) |

| Net attributable profit | 1,087 | 3.3 | 8.4 | 1,052 |

Download Excel

Download Excel

|

|

|

Million euros and percentage | ||

|---|---|---|---|---|

| Balance sheet | 31-12-15 | Δ% | Δ% (1) | 31-12-14 |

| Cash and balances with central banks | 4,063 | 23.2 | 69.2 | 3,297 |

| Financial assets | 90,369 | (3.5) | (2.4) | 93,648 |

| Loans and receivables | 83,790 | 10.1 | 10.7 | 76,096 |

| Loans and advances to customers | 57,189 | 10.3 | 11.2 | 51,841 |

| Loans and advances to credit institutions and other | 26,601 | 9.7 | 9.8 | 24,255 |

| Inter-area positions | - | - | - | 3,212 |

| Tangible assets | 45 | 92.0 | 87.3 | 23 |

| Other assets | 3,834 | 12.0 | 14.3 | 3,424 |

| Total assets/liabilities and equity | 182,101 | 1.3 | 4.6 | 179,701 |

| Deposits from central banks and credit institutions | 54,362 | (9.3) | (8.1) | 59,923 |

| Deposits from customers | 52,813 | 3.0 | 13.1 | 51,295 |

| Debt certificates | (36) | n.m. | 114.9 | (9) |

| Subordinated liabilities | 2,075 | 37.0 | 41.1 | 1,514 |

| Inter-area positions | 8,833 | n.s. | n.s. | - |

| Financial liabilities held for trading | 55,274 | (3.6) | (3.6) | 57,332 |

| Other liabilities | 4,222 | (24.2) | (22.4) | 5,570 |

| Economic capital allocated | 4,558 | 11.8 | 15.3 | 4,076 |

Download Excel

Download Excel

|

|

|

Million euros and percentage | ||

|---|---|---|---|---|

| Relevant business indicators | 31-12-15 | Δ% | Δ% (1) | 31-12-14 |

| Loans and advances to customers (gross) (2) | 53,499 | 15.0 | 16.0 | 46,523 |

| Customer deposits under management (2) | 43,441 | 21.1 | 38.7 | 35,875 |

| Off-balance sheet funds (3) | 1,084 | (22.6) | (13.5) | 1,400 |

| Efficiency ratio (%) | 34.8 |

|

|

32.5 |

| NPL ratio (%) | 1.4 |

|

|

0.9 |

| NPL coverage ratio (%) | 86 |

|

|

136 |

| Cost of risk (%) | 0.21 |

|

|

0.39 |

Macro and industry trends

The most relevant macroeconomic and industry aspect affecting the Group’s wholesale business in 2015, particularly in the fourth quarter, has been the difficult situation of the financial markets due to:

- Deterioration in the macroeconomic outlook in emerging markets.

- Volatility in the foreign-currency markets, which are entirely focused on the monetary measures to be announced by the central banks.

- In the United States, the Federal Reserve has increased interest rates, although it plans to keep them at low levels in the medium term.

- Low levels of activity in the markets and risk aversion.

- The prices of commodities remain at very low levels. • The different entities continue to announce new restructuring plans to deal with this difficult situation.

- The different entities continue to announce new restructuring plans to deal with this difficult situation.

Activity

All the comments below on rates of change will be expressed at constant exchange rates, unless expressly stated otherwise.

The main aspects of the Group’s wholesale business activity are:

- Positive performance of gross lending to customers, which as of 31-Dec-2015 is up 16.0% in year-on-year terms. Good performance across all the regions: Spain (up 18.2%), the United States (up 18.6%), Mexico (up 12.7%), South America (up 17.0%) and Rest of Eurasia (up 12.7%). In Spain, the Corporate Lending unit has led some of the most significant deals on the market, both in bilateral and syndicated loans and in finance for acquisitions (very much focused on SMEs). In the Rest of Europe it has taken part in significant deals, above all in the German and Italian markets. In Latin America, BBVA continues to maintain a leading position on the league tables of syndicated loans in 2015. It has also been very active in the arrangement and granting of structured finance across practically all the geographical areas where the unit operates.

- Excellent performance of customer deposits under management. Its balance as of 31-Dec-2015 registered a year-on-year rate of growth of 38.7%, thanks to the positive trend shown in Spain (up 28.9%), the United States (up 47.0%), Mexico (up 37.2%), South America (up 20.6%) and Rest of Eurasia (up 63.7%). The Global Transaction Banking unit (GTB) has continued to develop solutions to meet the transactional needs of the customers, incorporating new functionalities and improvements in online banking.

Earnings

In 2015, CIB generated a net attributable profit of €1,087m, 8.4% higher than the figure registered in 2014. The most relevant aspects of the income statement are summarized below:

- 4.9% growth in gross income. The positive aspects are the good performance of lending activity mentioned above (although at lower prices), fund gathering and advisory operations. The Mergers & Acquisitions Corporate Finance unit continues to be the Spanish leader in financial advice for M&A operations, according to Thomson Reuters, with a total of 96 deals advised since 2009. Also of note is the strong activity in the primary equity markets in Spain and Europe. One negative aspect is the uncertainty in the financial markets, especially in the last part of the year, which has resulted in lower growth of NTI (up 22.8% year-on-year) compared with that in the first nine months of 2015. Despite this situation, the revenue from customers generated by the Global Markets unit has been particularly resilient.

- Operating expenses have increased by 7.8% compared to those of 2014, affected by the investments in technology being undertaken, and also by the depreciation against the euro of Latin American currencies and the high inflation in some countries in the area.

- Lastly, reduction in impairment losses on financial assets (down 39.8%) and improvement in the cumulative cost of risk through December 2015 (0.21% compared to 0.39% in 2014).