As set out in article 85 of Act 10/2014, dated June 26, on the regulation, supervision and solvency of credit institutions, and in article 93 of Royal Decree 84/2015, dated February 13, which implements Act 10/2014, the entities will make available to the public and update on a regular basis (at least once a year) information including that on their remuneration policy and practices set out in part 8 of Regulation 575/2013/EU in relation to those categories of staff whose professional activities may have a significant impact on the Group’s risk profile (hereinafter the “Identified Staff”).

As set out in BBVA’s Bylaws, the Board of Directors Regulations stipulate that one of the powers of the Board is to approve the remuneration for directors for submission to the General Meeting, for senior executives and for employees whose professional activities may have a material impact on the Entity’s risk profile and to determine directors’ remuneration, and, in the case of executive directors, the remuneration for their executive functions and other terms and conditions set out in their contracts.

The Regulations of the Board of Directors of BBVA set out the internal rules for the operation of the Board and its Committees, which provide assistance on matters within their competence. The Remuneration Committee assists the Board with matters related to remuneration as set out in the Board Regulations, ensuring compliance with the remuneration policy established.

As set out in Article 36 of the Regulations of the Bank’s Board of Directors, the Remuneration Committee performs the following functions:

Propose to the Board of Directors, for submission to the General Meeting, the remuneration policy for directors, in terms of items and amounts, the parameters for its determination and the payment system. It will also submit its corresponding report as set out in applicable law.

Determine the extent and amount of the individual remuneration, entitlements and other economic rewards, as well as the contractual terms and conditions, for the executive directors, submitting the relevant proposals to the Board of Directors.

Propose on an annual basis to the Board of Directors the annual report on the remuneration of the Bank’s directors, which will be submitted to the Annual General Meeting as set out in applicable legislation.

Propose to the Board of Directors the remuneration policy for senior executives and those employees whose professional activities may have a material impact on the Company’s risk profile.

Propose to the Board the basic terms and conditions of the contracts of senior executives and directly supervise the remuneration of senior officers responsible for risk management and compliance functions in the Company.

Oversee enforcement of the remuneration policy established by the Company and periodically review the remuneration policy applied to directors, senior officers and employees whose professional activities may have a material impact on the Company’s risk profile.

Verify the information on the remuneration of directors and senior management contained in the different corporate documents, including the annual report on director remuneration.

Any others that may have been assigned under these Regulations or conferred by a decision of the Board of Directors or by applicable legislation.

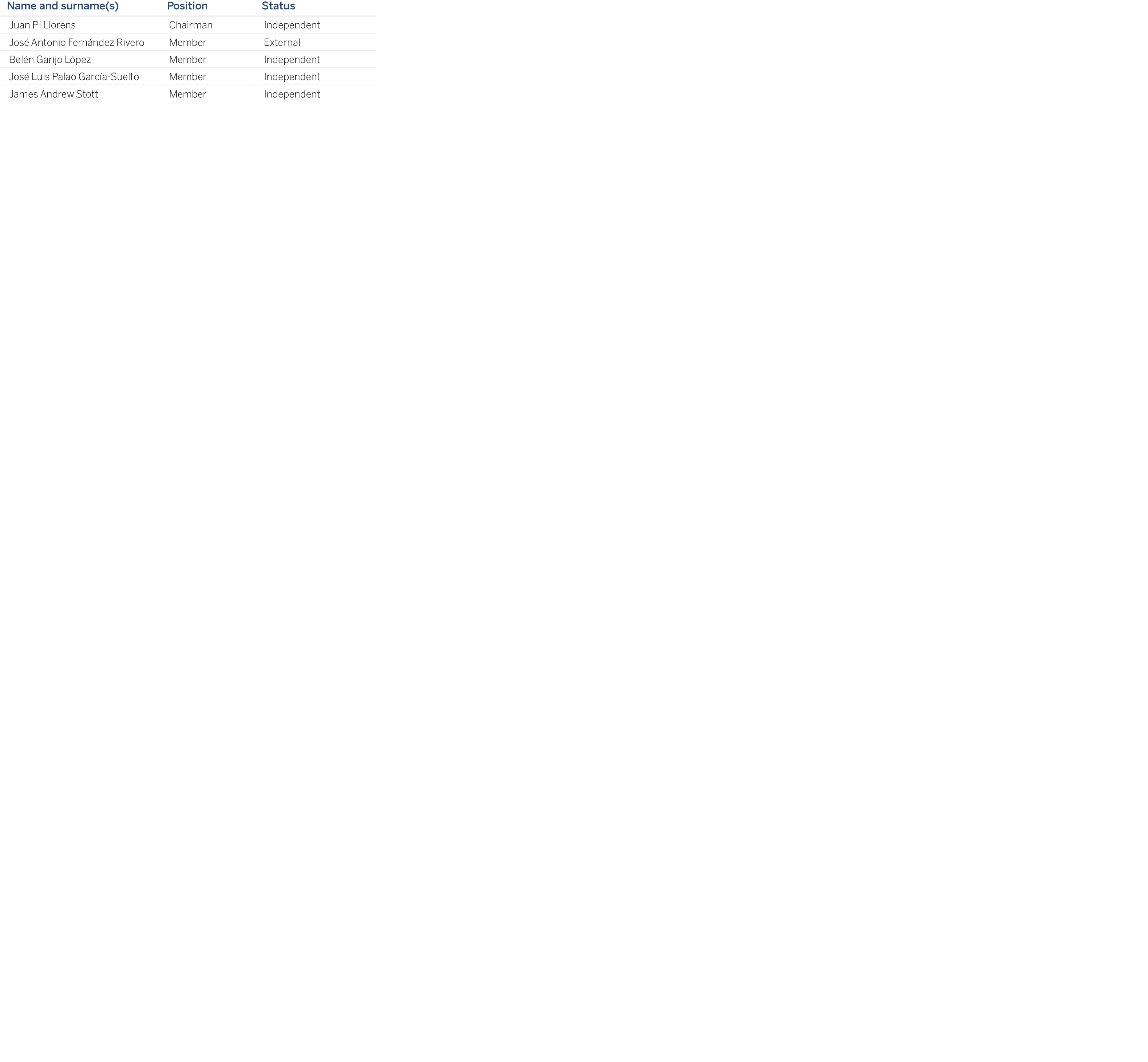

As of the date of this report, the Remuneration Committee is composed of five members, all of them non-executive directors; the majority independent, including its chairman. Their names, positions and status are given in the following table:

In compliance with its functions, the BBVA Remuneration Committee met six times in 2016 to deal with matters that fall under its responsibility.

Among the main duties of the Remuneration Committee is to determine the annual variable remuneration, including the amounts deferred from previous years, together with the fixed remuneration, of executive directors for 2016; and in the case of non-executive directors, to determine and submit to the Board of Directors the remuneration corresponding to members of the new Technology and Cybersecurity Committee, created by the Board of Directors in 2016.

In addition, in 2016 the Committee has determined matters such as the basic contractual conditions of the Bank’s Senior Management, as a result of the changes in its composition over the year, and has reviewed the application of the remuneration policy for Identified Staff, including executive directors of BBVA and members of BBVA’s Senior Management, as set out in article 33.2 of the aforementioned Act 10/2014.

The Board of Directors of BBVA has also approved, in response to the proposal submitted by the Remuneration Committee, the 2016 Annual Report on Remuneration of BBVA Directors, in accordance with the model established by the Spanish Securities and Investment Board (CNMV) through Circular 4/2013, dated June 12 (modified by Circular 7/2015). This Report will be put to the vote at the Annual General Meeting, as set out in article 541 of Royal Legislative Decree 1/2010, dated July 2, which approves the amended text of the Corporations Act (hereinafter the “Corporations Act”), and is available on the Company’s website (www.bbva.com) from the date of calling the Annual General Meeting.

The Annual Report on the Remuneration of BBVA Directors includes a description of the basic principles of the Bank’s remuneration policy with respect to the members of the Board of Directors, whether executive or non-executive, as well as a detailed presentation of the different elements and amounts making up their remuneration, based on the current Remuneration Policy for BBVA directors and BBVA’s Bylaws and the Board of Directors Regulations. The Report also includes the principles and basic elements of the Bank’s general remuneration policy.

Among the matters reviewed by the Remuneration Committee in 2016 was an analysis of the new regulations approved during the year with respect to remuneration. The review was carried out in collaboration with world-class independent consultants in the area of remuneration.

The Board of Directors, in the performance of its duties as included under Article 17 of the Board of Directors Regulations and at the request of the Remuneration Committee, has, given the progress made in market practice, approved a new remuneration policy applicable to BBVA directors for the years 2017, 2018 and 2019. It will be submitted to a vote at the next Annual General Meeting, as a separate agenda item, in accordance with article 529 novodecies of the Corporations Act.

Among the new elements of this policy applicable to the remuneration of executive directors are:

A clear allocation between the fixed and variable components of total remuneration, and criteria to establish these components;

A change to the fixed-variable balance of remuneration to bring it more into line with the regulations applicable, providing more flexibility for variable remuneration with respect to fixed remuneration. Under no circumstances does this change entail an increase in the total remuneration of the beneficiaries;

An increase in the percentage of variable remuneration whose payment is deferred (60% in the case of executive directors, Senior Management and members of Identified Staff with particularly high variable remuneration), and an increase in the deferral period (5 years in the case of executive directors and Senior Management);

An increase in the share-based component of variable remuneration;

A review of the reduction and recovery (malus and clawback) clauses for variable remuneration to bring them more into line with the scenarios established in the new regulations;

The elimination of the system of defined-benefit welfare schemes for the CEO;

Consideration of a portion of the contributions to pension systems as “discretionary pension benefits”, as required by new regulations;

Modification of contractual conditions applicable to payments due to termination of the contractual relationship of the CEO and executive director Head of GERPA; and

The inclusion of a commitment by the executive directors not to transfer a number of shares equivalent to twice the annual fixed remuneration for a period of, at least, three years from the time of their vesting, on top of the general one-year retention period applicable to all the shares; the above shall not apply to those shares the transfer of which is derived from tax obligations originated from their delivery.

The text of the Remuneration Policy for BBVA Directors proposed for the years 2017, 2018 and 2019 is available on the Bank’s website (www.bbva.com) from the date of calling the Annual General Meeting.

In addition, following a proposal by the Remuneration Committee, the Board of Directors has approved a new remuneration policy to be applied to Identified Staff for the years 2017, 2018 and 2019. In line with the Remuneration Policy for BBVA Directors, it also has the aim of bringing BBVA’s remuneration practices into line with the regulations applicable, the recommendations of good governance and best market practices, thereby enabling BBVA to continue to act as a benchmark for remuneration within the sector.

As already indicated, BBVA has a decision-making system for remuneration matters in which the Remuneration Committee plays a key role. It is responsible for determining the amount of fixed and variable remuneration for the executive directors and the remuneration policy applicable to the Identified Staff, including the directors and members of the Group’s Senior Management, and then submits the corresponding proposals to the Board.

To help perform their functions correctly, in 2016 the Remuneration Committee and the Board of Directors have been supported by the Bank’s internal services and the information and advice provided by two of the leading global consultants on remuneration for board members and Senior Management, Towers Watson and McLagan.

The Remuneration Committee is also assisted by the Board’s Risk Committee, which in accordance with article 39 of the Board of Directors Regulations has participated in the establishment of the remuneration policy, checking that it is compatible with adequate and effective risk management and does not offer incentives for assuming risks that exceed the Company’s acceptable level.

Lastly, the decisions related to the remuneration of executive directors, when required by law, are submitted to the Bank’s Annual General Meeting for approval.

This system ensures an adequate decision-making process on questions of remuneration.

For more information on the activity of the Remuneration Committee, the Activity Report of the Remuneration Committee is published on the Bank’s website (www.bbva.com) as part of the document: “Corporate Governance and Remuneration in BBVA”.

The members of the Remuneration Committee with this status in 2016 received an aggregate total of €282 thousand for their work on it. In addition, the Annual Report on the Remuneration of BBVA Directors includes a breakdown of the remuneration by item for each director.

As set out in article 32.2 of Act 10/2014, BBVA has determined the professionals affected by this regulation (Identified Staff) following the criteria established by European Regulation 604/2014, dated March 4, of the Commission, which are grouped into two main blocks: qualitative criteria (defined around the position’s responsibility and the employee’s capacity to assume risks) and quantitative criteria (namely, having received total annual remuneration of 500,000 euros or more; being within the 0.3% with the highest total remuneration in the Group; or having received total remuneration higher than the lowest total remuneration set out in the qualitative criteria).

Also, in compliance with the requirement included in Rule 38 of Bank of Spain Circular 2/2016 of February 2, BBVA has included its own criteria for identifying Identified Staff, in addition to those established in the Delegated Regulation No. 604/2014, by including employees and managers of business and risks units who while not complying with the quantitative or qualitative criteria of the European Delegated Regulation 604/2014 BBVA considers must have this status. For these purposes, for 2016 the Identified Staff includes:

Members of the Board of Directors

Members of senior management

Professionals responsible for control functions and risk takers by function: This group is set up by functions that correspond to the qualitative criteria established in article 3 of Regulation EU 604/2014 of the European Commission, points 4 to 15 inclusive.

Risk takers by remuneration: Made up of employees who meet the quantitative criteria of article 4 of Regulation EU 604/2014.

Notwithstanding the foregoing, BBVA will adapt the definition of Identified Staff, including categories of professionals as necessary, based on the requirements set out by applicable regulations.

The remuneration system applicable to the BBVA Identified Staff in 2016 contains a number of special points with respect to that applicable to the rest of the staff, as a special settlement and payment scheme for variable incentives has been established for the Identified Staff, in line with legal requirements, recommendations and the best market practices, as set out in the Remuneration Policy applicable to the Identified Staff approved by the board of Directors, at the proposal of the Remuneration Committee in 2015 for the years 2015, 2016 and 2017.

According to BBVA’s remuneration policy applicable in 2016, the remuneration system is made up of:

5.3.1. Fixed remuneration

Fixed remuneration in BBVA is established by taking into consideration the employee’s level of responsibility and professional career history in the Group. A benchmark salary is fixed for each function that reflects its value for the Organization. This benchmark salary is defined by analyzing what is fair internally and comparing it with the market through the advice of leading firms specializing in remuneration.

The fixed component in the employee’s total remuneration represents a sufficiently high proportion to allow maximum flexibility with respect to the variable components.

5.3.2. Variable remuneration

BBVA’s variable remuneration represents a key element in the Bank’s remuneration policy, as it rewards the creation of value in the Group through each of the areas and units that make up BBVA. In short, it rewards individuals and teams and their combined contributions to the Group’s recurrent earnings.

The annual variable remuneration in BBVA for 2016 was made up of a single incentive that is granted annually (hereinafter “Annual Variable Remuneration”). It has been designed so that it is aligned with prudent risk management and generation of long-term value.

The essential aspects of Annual Variable Remuneration corresponding to 2016 are detailed below:

5.3.2.a) Annual variable remuneration in cash

BBVA’s Annual Variable Remuneration corresponding to 2016 is based on the achievement of previously established indicators. These indicators are defined at the level of Group and Area to which the employee belongs, and are associated with the financial and non-financial strategic objectives. Individual targets are also established for each employee. These must be aligned with the strategic priorities of the Area and Group.

BBVA considers that prudent risk management is a key element within its variable remuneration policy. Among the financial indicators defined at Group level for this purpose is RAROEC (Risk Adjusted Return on Economic Capital), which is applied in general for all employees. Additionally, in the business areas, this indicator is also defined at the area level, so it is also an element that influences the determination of variable remuneration of employees in the said area. The RAROEC is an indicator that takes into account present and future risks in relation to the return obtained in relation to the economic capital needed to obtain this return.

It has also been decided that in the units that carry out control functions, the indicators inherent to their activity should have a greater weight, with the aim of strengthening the independence of the staff carrying out control functions with respect to the areas they supervise.

Thus BBVA’s annual variable remuneration has been organized in 2016 by combining employees’ results (financial and non-financial) with those of their Unit, those of the Area to which they belong and those of the Group as a whole.

5.3.2.b) Settlement and payment system for annual variable remuneration

According to the specific settlement and payment system for annual variable remuneration in 2016 that applies to the Identified Staff:

The Annual Variable Remuneration for 2016 will be paid in equal parts of cash and BBVA shares.

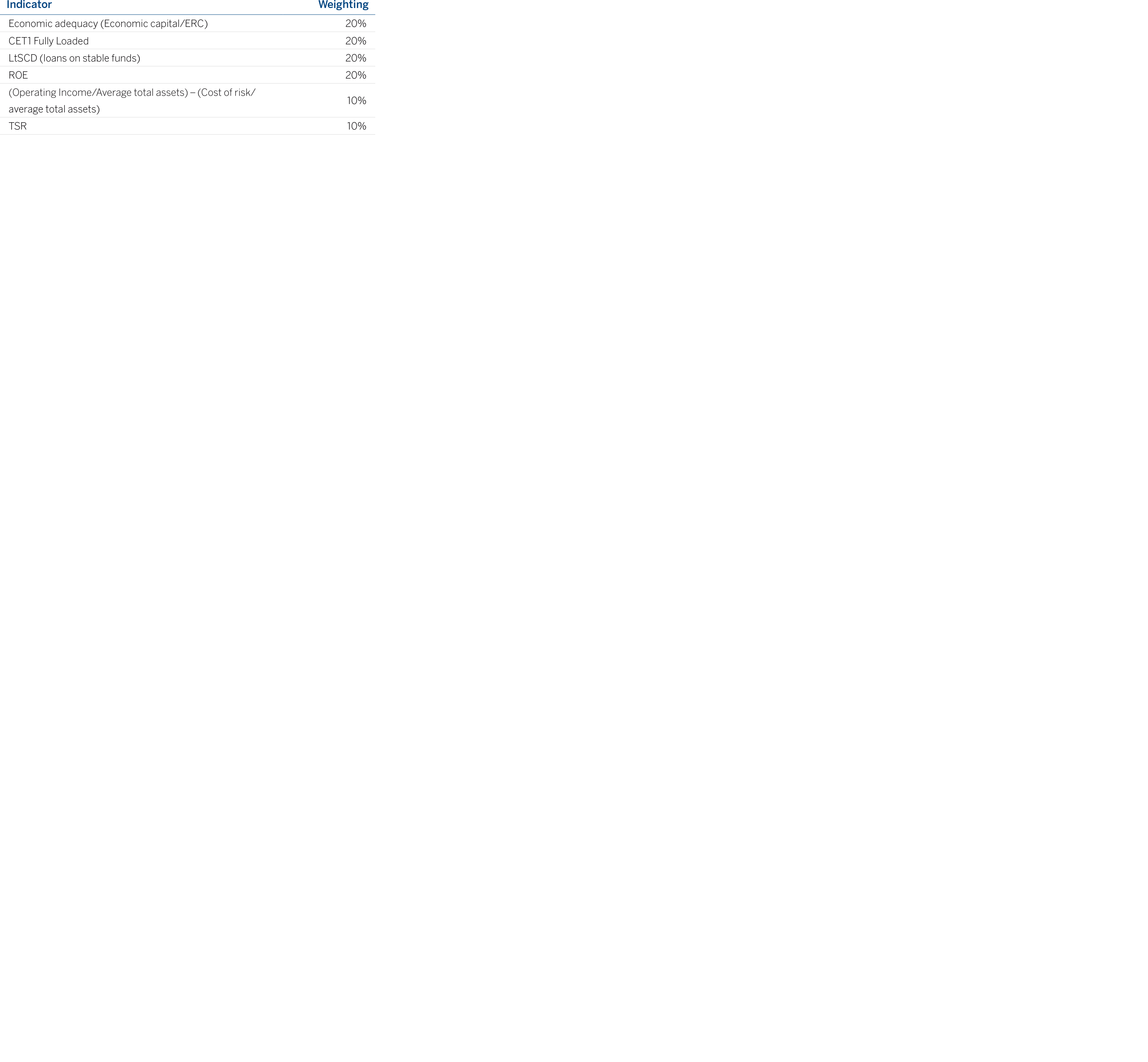

Payment of 40% of the Annual Variable Remuneration for 2016 –50% in the case of executive directors and members of senior management – both in cash and in shares, will be deferred. The deferred amount will be paid at the end of the 3-year period and subject to fulfillment of the following multi-year evaluation indicators approved by the Board of Directors for the 3-year deferment period:

All the shares that are delivered according to the aforementioned rules may not be used for a period of one year starting from the date of their provision. This retention is applied on the net amount of the shares, after discounting the part necessary to make the tax payment for the shares received.

The deferred parts of the Annual Variable Remuneration in 2016 will be updated as established by the Board of Directors.

Using the shares delivered which are unavailable and the shares pending delivery for hedging purposes is also prohibited.

Lastly, the variable component of the remuneration for a year for the Identified Staff will be limited to a maximum amount of 100% of the fixed component of total remuneration, except for those positions approved by the General Meeting, which may reach up to 200%.

In addition, the parts of the annual variable remuneration that are deferred and pending payment in accordance with the above rules will not be paid to the members of the Identified Staff if one of the malus clauses established in the remuneration policy for Identified Staff is applicable.

Notwithstanding this, to achieve better alignment with new regulatory requirements, best market practices and the organization and internal strategy of BBVA, the Bank’s Board of Directors, at the proposal of the Remuneration Committee, as indicated previously, has approved a new remuneration policy applicable to the Identified Staff for the years 2017, 2018 and 2019 (hereinafter “the Remuneration Policy for the Identified Staff”), in line with the modifications to the Remuneration Policy for BBVA directors, whose fundamental characteristics can be summed up as follows:

An appropriate balance between fixed and variable elements of the remuneration of the Identified Staff; The proportion between both components shall be established on whether employees carry out business functions, support or control functions, and shall take account of the kind of work carried out by each person and also of the impact on the Bank’s risk profile, adapted in each case to the reality of different countries or specific functions.

Variable remuneration will continue to consist of an incentive, based on the establishment of value-creation indicators, which combine the employees’ results (financial and non-financial) with those of their unit, those of the area to which they belong and those of the Group as a whole. It shall be calculated on the basis of a number of annual indicators, according to the corresponding performance scales and the weighting allocated to each indicator.

A significant percentage of variable remuneration (which increases to 60% for executive directors, Senior Management and members of Identified Staff with particularly high variable remuneration, and remains at 40% for other Identified Staff) will all be deferred for a period of 3 years, rising to 5 years in the case of executive directors and Senior Management.

A substantial portion, and at least 50% of annual variable remuneration, of both the initial portion and the deferred portion, shall be established in BBVA shares, and a larger proportion in shares shall be deferred in the case of executive directors and Senior Management (60%).

The variable remuneration will be subject to ex ante adjustments, so that it will only be paid if BBVA complies with the capital requirements set by the regulator and with the minimum threshold of net attributable profit. In addition, among the indicators for determining this variable remuneration, indicators are incorporated that take into account current and future risks and the cost of capital.

The deferred portion of annual variable remuneration (in shares and in cash) may be reduced in accordance with ex post adjustments, which shall be determined considering the results of multi-year evaluation indicators relating to variations in the share price and the Group’s basic management metrics in respect of profitability, liquidity and long-term capital adequacy, calculated over the 3-year deferral period. Such indicators are associated a number of scales of achievement whereby, should the targets set for each indicator during the 3-year period not be achieved, the deferred amount of variable remuneration may be reduced, and even be completely lost (yet never be increased).

During the entire deferral period (5 or 3 years in each case), variable remuneration shall be subject to malus and clawback arrangements which are both related to poor performances by the Group, unit or individual, in certain scenarios, in the terms set out below.

All shares shall be unavailable to the beneficiaries for one year from the date of delivery, except for those shares that must be disposed of to pay the corresponding taxes.

There is a ban on personal hedge or insurance strategies in connection with remuneration or responsibility to the detriment of the effects of alignment with proper management of risks.

Any amounts in cash deferred that are subject to multi-annual assessment indicators for Annual Variable Remuneration and are finally paid shall be updated, in the terms established by the Board of Directors of the Bank, and shares shall not be updated.

Finally, the variable component of the remuneration of members of Identified Staff shall be limited to a maximum amount of 100% of the fixed component of total remuneration, with the exception of employees for whom the General Meeting agrees to raise this percentage to 200%.

For this purpose, in accordance with the new Remuneration Policy for the Identified Staff and subject to approval by the AGM of the Policy applicable to BBVA directors, all the Annual Variable Remuneration for 2016 of each member of the Identified Staff shall be subject to mauls and clawback arrangements in the following terms:

Up to 100% of the Annual Variable Remuneration of each member of Identified Staff for each financial year shall be subject to reduction clauses (malus) and recovery of remuneration already paid (clawback), both of which relate to an insufficient financial performance by the Bank overall or by a specific division or area or exposures generated by a member of Identified Staff, when poor financial performance has arisen from one of the following circumstances:

Here the Bank shall compare the assessment of the member of identified staff’s performance to the subsequent behavior of some of the variables which helped achieve the targets. Malus and clawback arrangements shall apply to Annual Variable Remuneration for the year in which the event giving rise to application of the clause occurred, and shall be in force during the deferral and restriction period applicable to the Annual Variable Remuneration.

Notwithstanding the foregoing, in the event that these scenarios give rise to a dismissal or termination of the Identified Staff member due to serious and guilty breach of duties, malus arrangements may apply to the deferred Annual Variable Remuneration pending payment at the date of the dismissal or cease of functions, in light of the extent of the damage caused.

In any case, the Annual Variable Remuneration is paid or vested only if it is sustainable according to the Group’s situation as a whole, and justified on the basis of the performance of the Bank, the business unit and of the Identified Staff member concerned.

Clauses for reduction and recovery of variable remuneration shall be applicable to the Annual Variable Remuneration generated as of 2016, inclusive.

As indicated earlier, the remuneration system described applies to the Identified Staff, which includes the Bank’s executive directors.

Notwithstanding the foregoing, the Remuneration Policy for BBVA Directors also makes a distinction between the remuneration system applicable to executive directors and the system applicable to non-executive directors, as set out in the Bank’s Bylaws.

A detailed description of the remuneration system applicable to BBVA’s non-executive directors in 2016 is included in the current Remuneration Policy for BBVA directors, which was approved by the Annual General Meeting in 2016, and in the Annual Report on the Remuneration of Directors. As set out in those documents, non-executive directors do not receive variable remuneration; they receive a fixed annual amount in cash for holding the position of director and another for the members of the various Committees, with a greater weight being given to the exercise of the function of chairman of each Committee, and the amount depending on the nature of the functions attributed to each Committee.

In addition, the Bank has a remuneration system for its non-executive directors with deferred delivery of shares, approved by the Annual General Meeting, that also constitutes fixed remuneration. It consists of the annual allocation to those directors, as part of their remuneration, of a number of “theoretical shares” of the Bank that will be effectively delivered, where applicable, on the date of their termination as directors for any cause other than serious breach of their obligations. The annual number of “theoretical shares” to be allocated to each non-executive director will be equivalent to 20% of the total remuneration in cash received by each in the previous year. This is based on the average closing prices of the BBVA share during the 60 trading sessions prior to the dates of the ordinary General Meetings approving the financial statements for each year.

The Remuneration Policy for BBVA Directors for the years 2017, 2018 and 2019, which will be submitted to the Annual General Meeting, does not include changes to the remuneration system applicable to non-executive BBVA directors, and will remain in the same terms indicated.

As specified above, in 2016 the amount of variable remuneration received by BBVA’s Identified Staff has been determined by the following factors:

Strategic objectives (both financial and non-financial) established at the Group and Area level.

Targets for the individual in question, which must be aligned with the strategic objectives of the Area and the Group.

The annual variable incentives in 2016 for executive directors have been determined by the Group’s results, through the following indicators: net attributable profit not including ongoing operations, economic profit, risk adjusted results over economic capital (RAROEC), return on regulatory capital (RORC), the Efficiency Ratio, Operating Income, customer satisfaction (IReNe), and the assessment of the achievement of the strategic indicators in the case of the CEO and the executive director and Head of Global Economics, Regulations & Public Affairs (GERPA), approved at the start of the year.

The amount of annual variable remuneration has been obtained from the level of fulfillment of the indicators shown, based on the achievement scales approved by the Board of Directors for each indicator. These scales take into account both budgetary fulfillment and the year-on-year variation of the results of each indicator with respect to the results obtained the previous year.

In 2016, Net Attributable Profit not including corporate transactions was 7.4% down on 2015, affected by the impact of floor clauses and exchange rates. Excluding the impact of floor clauses, the year-on-year variation would have been a 3% increase.

The negative effect of these two elements on earnings have also had a negative effect on the RORC and RAROEC capital ratios. This is despite the good performance of capital levels in 2016. Thus both risk-weighted assets (RWAs) and use of economic capital have been reduced.

The efficiency ratio has been improved in 2016, supported by the effort to control costs and the restructuring processes, while operating income has been affected by the negative impact of exchange rates and lower income from fees and commissions associated with market activity.

Similarly, the annual variable incentives of Senior Management are linked to both the Group’s results and those of their management area.

For the rest of the members of the Identified Staff, the amount of variable remuneration depends on individual performance, results in the Area in which they provide their service, and the Group’s results overall.

However, any variable remuneration that is pending payment will always be paid, provided that such payment is sustainable in terms of the situation of the BBVA Group as a whole.

As explained above, the remuneration policy for the Identified Staff is aligned with shareholders’ interests and with prudent risk management, and in 2016 includes the following elements:

Use of indicators for evaluating the results, which incorporate adjustments for current and future risks;

Consideration when measuring the performance of financial and non-financial indicators that encompass both individual management aspects as well as goals of the Unit and Group;

Greater weighting of objectives related to their specific functions on financial and Group objectives in measuring the performance of the control units, favoring their independence compared with the business areas supervising them.

Payment in shares of 50% of the annual variable remuneration.

Deferral clauses, designed so that a substantial part of the variable remuneration -50% in the case of executive directors and senior management and 40% for the remaining cases- is deferred over a three-year period, thus considering the economic cycle and business risks.

Inclusion of multi-year evaluation indicators for the 3-year deferment period, with achievement scales which, in the event of failing to reach the goals set for each one, may reduce the deferred amount of annual variable remuneration, never increase it, and may even result in the loss of the beneficiary’s entire deferred amount;

Obligatory withholding periods of any shares delivered as variable remuneration, so that beneficiaries may not freely dispose of them until six months after their delivery date.

Hedging prohibition.

Clauses that prevent or limit the payment of variable remuneration (both deferred remuneration and remuneration corresponding to a year), as a result of both actions involving the individual recipient and the results of the Group as a whole (malus clauses).

Limitation of the amount of variable remuneration to a percentage of the fixed remuneration.

The main parameters and reasons for the components of the variable remuneration plans for the Identified Staff have been set out in other sections of this Report.

As already mentioned, in the case of employees who are responsible for control functions, variable remuneration will depend more firmly on the targets related to their functions, thus making them more independent of the business areas they supervise.

Thus the weight of the financial indicators both for the Group and Area is limited to a maximum of 20% of all the indicators for generating annual variable remuneration for people who form part of what are considered control areas.

One of the general principles of BBVA’s remuneration policy is that fixed remuneration should constitute a relevant amount of total remuneration.

For this purpose, in accordance with the indications of current regulations, the Board of Directors has established target ratios between fixed and variable remuneration for executive directors as part of the Remuneration Policy of BBVA Directors applicable to the years 2017, 2018 and 2019. These ratios are aligned with the ratios generally established for the Identified Staff. These ratios represent a change with respect to the proportion between the fixed and variable remuneration, allowing the fixed component to be sufficiently high to allow a fully flexible policy to be applied with respect to the variable components, to the extent that in some cases it is possible not to pay them.

In accordance with the Remuneration Policy of BBVA and in accordance with Article 34 of Act 10/2014, the variable component of the remuneration for members of the Identified Staff shall be restricted to a maximum amount of 100% of the fixed component of the total remuneration, except for those functions for which the Annual General Meeting agrees to increase the percentage to 200%.

The Annual General Meeting approved that the variable component of the annual remuneration for executive directors, senior executives and certain employees who carry out professional activities that may have a material impact on the Bank’s risk profile, or who are responsible for the control functions, may reach up to 200% of the fixed component of total remuneration, in accordance with the Recommendations Report issued by the Board of Directors of BBVA on January 30, 2014. This resolution was approved by the General Meeting with 97.81% of the votes.

Moreover, and as a result of BBVA’s application of the new criteria set out in the European regulation for the identification of the members of the Identified Staff (Regulation 604/2014), which has led to an increase in the number of identified employees in the Group, a new agreement was approved by the 2015 General Meeting for increasing the group of employees who carry out professional activities that may have a material impact on the Group’s risk profile, or who are responsible for the control functions and to whom the highest level of remuneration applies, so that the maximum variable component of the remuneration for a year may reach up to 200% of the fixed component of the total remuneration of those professionals, in accordance with the Recommendations Report issued for this purpose by the Board of Directors on February 3, 2015 and made available to the shareholders from the date of calling the General Meeting. This agreement was approved by the General Meeting with 97.94% of the votes.

However, the Board of Directors has agreed to submit a proposal to the next Annual General Meeting to increase the maximum level of variable remuneration to 200% of the fixed component for a number of risk takers (replacing the previous ones) numbering a maximum of 200 people, in the terms indicated in the Report of Recommendations issued for this purpose by the Board of Directors dated February 9, 2017, and made available to the shareholders when the Annual General Meeting is called.

The annual variable remuneration of the members of the Identified Staff for 2016 was determined at the close of that year.

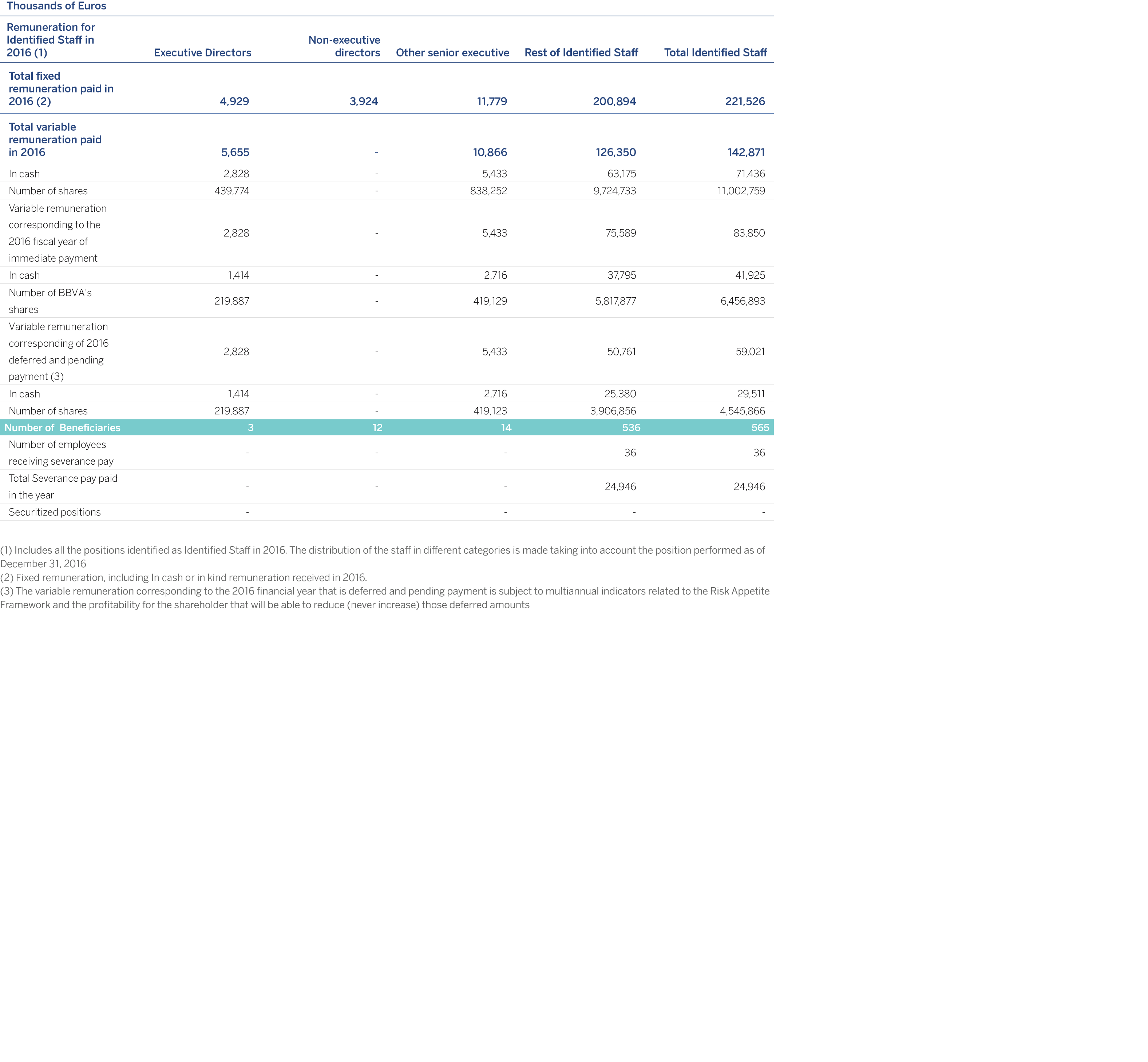

In accordance with the settlement and payment system established for the Identified Staff’s Annual Variable Remuneration in 2016, a percentage of the annual variable remuneration for 2016 will be paid in 2017 (50% in the case of executive directors and members of the Management Committee and 60% in all other cases), with the rest being deferred to be paid in 2020, subject to the multi-year indicators described in the above sections. This gives rise to amounts that are detailed in the following table, broken down by types of employees and Senior Management:

Of the total compensation paid, the highest paid to a single member amounts to €2,765 thousand.

In addition, in accordance with the provisions of Rule 40.1 of Bank of Spain Circular 2/2016 of February 2 to credit institutions, on supervision and solvency, it should be indicated here that of the 36 cases of payments for early contract termination there are 12 cases in which the amount paid has exceeded two yearly payments of the fixed remuneration.

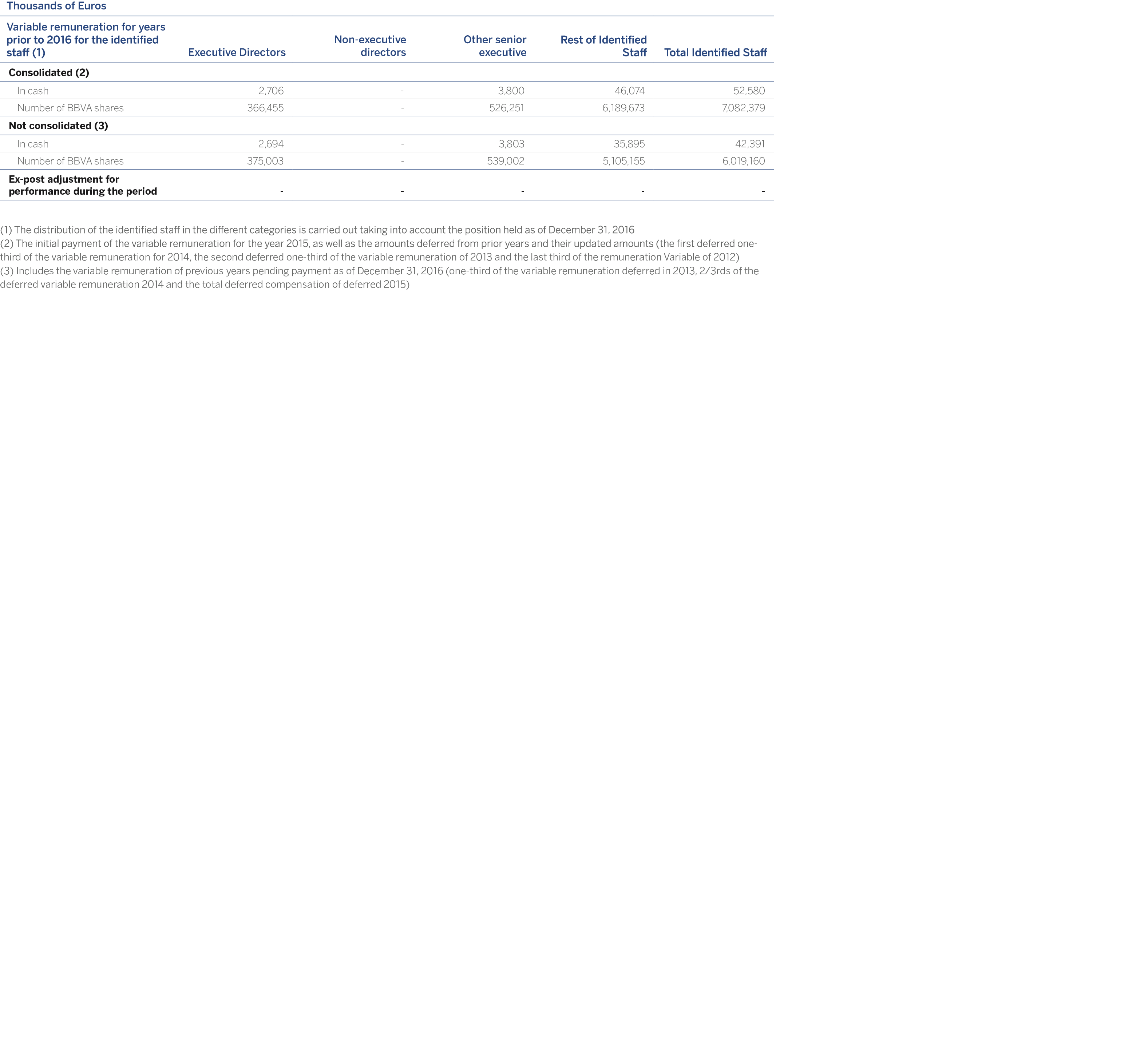

Payment has also been made of the amounts deferred from years before 2016. The following table shows the amounts paid in both cash and shares, as well as the amounts that continue to be deferred from years before December 31, 2016:

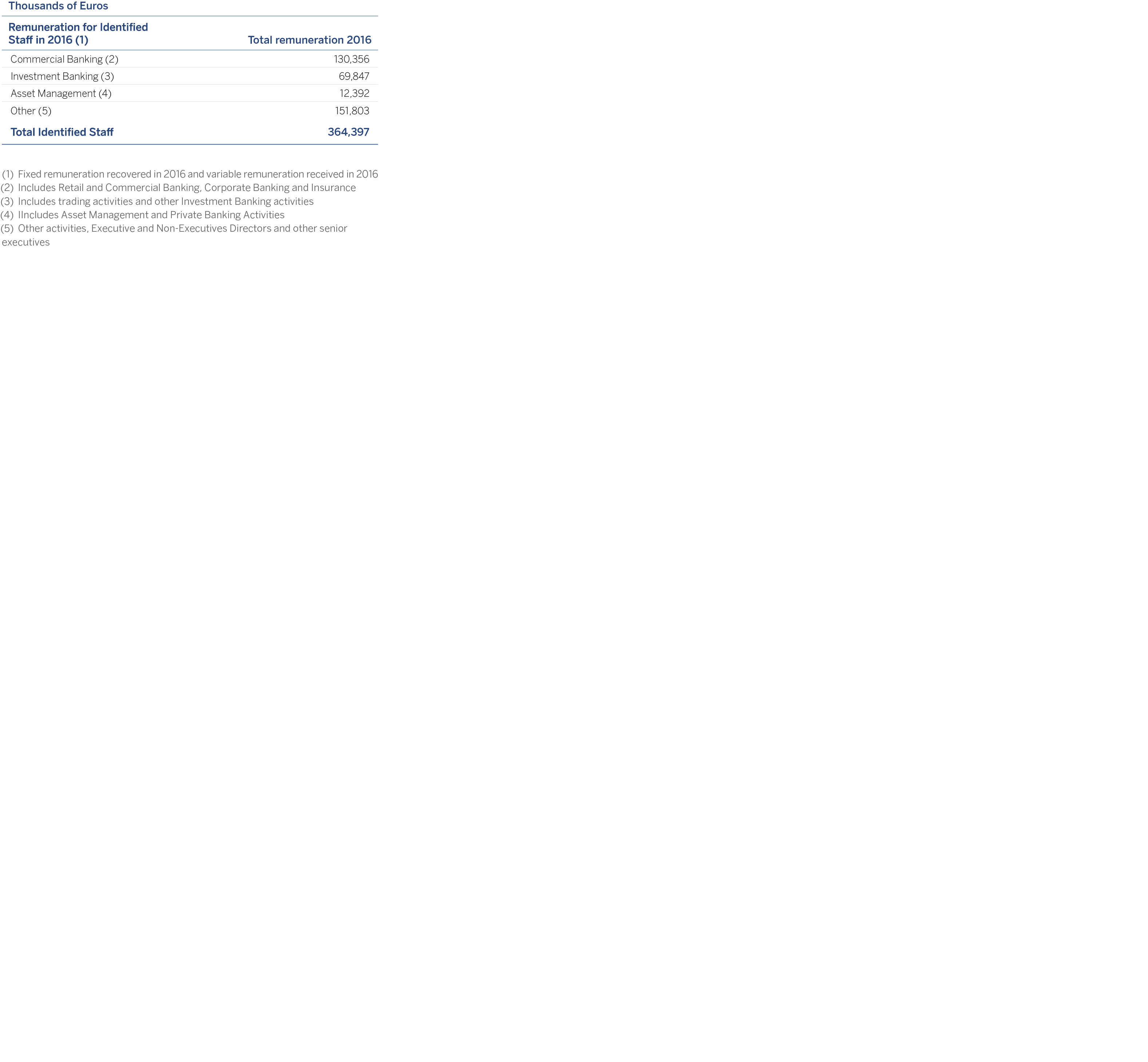

The table below gives the total remuneration of the Identified Staff for the year 2016, broken down by area of activity:

The number of employees receiving remuneration of 1 million euros or more is as follows: