Banco Bilbao Vizcaya Argentaria, S.A. (hereinafter “the Bank” or “BBVA”) is a private-law entity subject to the laws and regulations governing banking entities operating in Spain. It carries out its activity through branches and agencies across the country and abroad.

The Bylaws and other public information are available for consultation at its registered address (Plaza San Nicolás, 4 Bilbao) and on its corporate website (www.bbva.com).

The Solvency Regulations are applicable at the consolidated level for the whole Group.

BBVA Group’s Consolidated Financial Statements are presented in accordance with the International Financial Reporting Standards as adopted by the European Union (“EU-IFRS”) in effect as of December 31 2016, taking into consideration Bank of Spain Circular 4/2004, dated December 22, and its successive amendments, and other provisions of the regulatory financial reporting framework applicable to the Group in Spain.

The BBVA Group Annual Consolidated Financial Statements for 2016 are posted according to the models included in Circular 5/2015 of the Spanish Securities and Investment Board, with the aim of adapting the content of public financial information of credit institutions to the terminology and formats of financial statements established as mandatory by the European Union for credit institutions.

On the basis of accounting criteria, companies are considered to form part of a consolidated group when the controlling institution holds or can hold, directly or indirectly, control of them. An institution is understood to control another entity when it is exposed, or is entitled to variable returns as a result of its involvement in the investee and has the capacity to influence those returns through the power it exercises on the investee. For such control to exist, the following aspects must be fulfilled:

a) Power: An investor has power over an investee when it has current rights that provide it with the capacity to direct its relevant activities, i.e. those that significantly affect the returns of the investee.

b) Returns: An investor is exposed, or is entitled to variable returns as a result of its involvement in the investee when the returns obtained by the investor for such involvement may vary based on the economic performance of the investee. Investor returns may be positive only, negative only or both positive and negative.

c) Relationship between power and returns: Relationship between power and returns: An investor has control over an investee if the investor not only has power over the investee and is exposed, or is entitled to variable returns for its involvement in the investee, but also has the capacity to use its power to influence the returns it obtains due to its involvement in the investee.

Therefore, in drawing up the Group’s consolidated Financial Statements, all dependent companies and consolidated structured entities have been consolidated by applying the full consolidation method.

Associates as well as joint ventures (those over which joint control arrangements are in place), are valued using the equity method.

The list of all the companies of BBVA Group is included in the appendices to the Group’s Annual Consolidated Financial Statements.

For purposes of the solvency regulation, the consolidated group comprises the following subsidiaries:

Likewise, the special-purpose entities whose main activity implies an extension of the business of any of the institutions included in the consolidation, or includes the rendering of back-office services to these, will also form part of the consolidated group.

However, according to the solvency regulation, insurance entities and some service firms do not form part of consolidated groups of credit institutions.

Therefore, for the purposes of solvency requirements, and hence the drawing up of this Information of Prudential Relevance, the scope of consolidated entities is different from the scope defined for the purposes of drawing up the Group’s Consolidated Financial Statements.

The effect of the difference between the two regulations is basically due to:

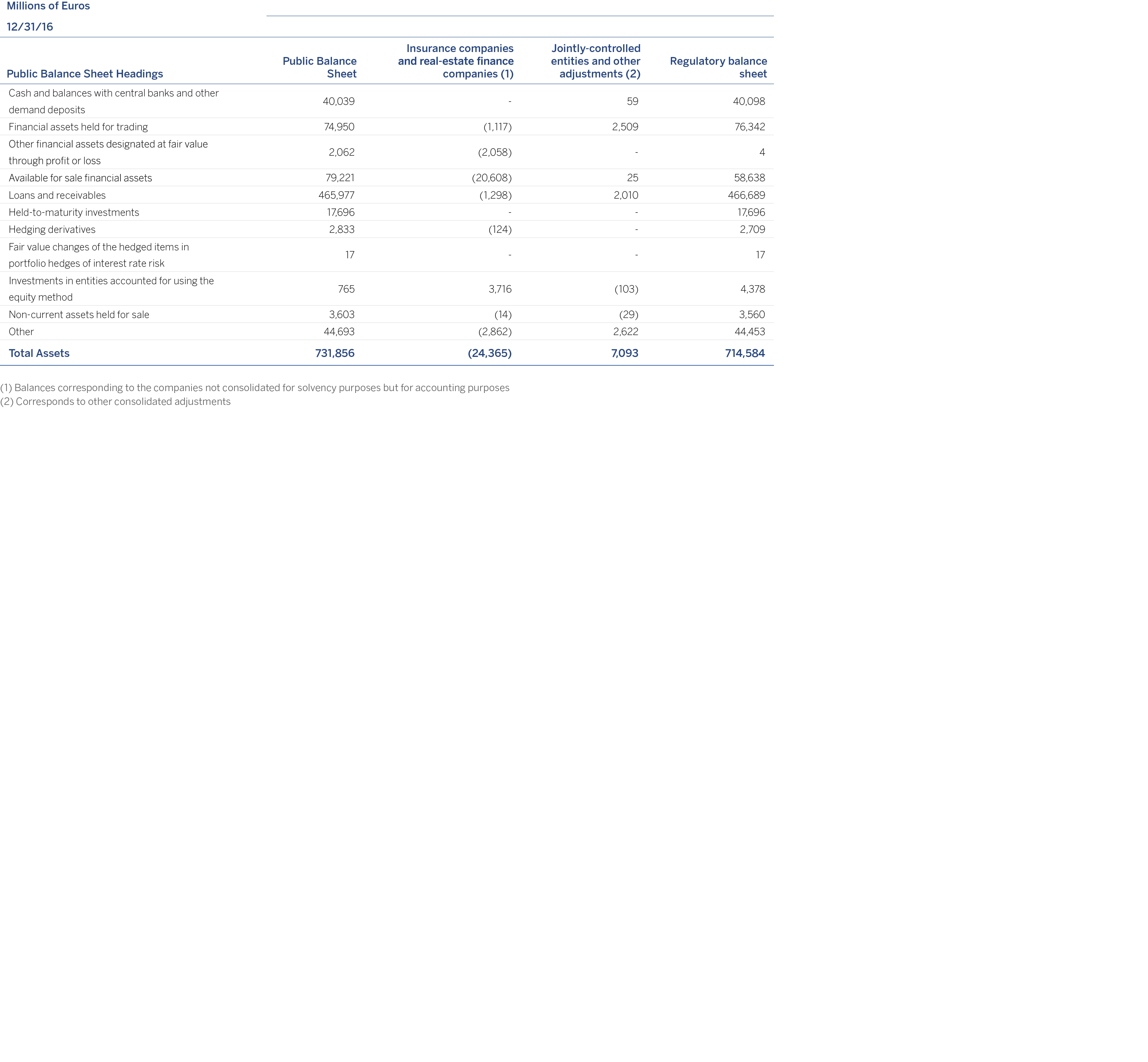

The difference between the balance contributed by entities (largely insurance, real-estate and financial companies) that are consolidated in the Group’s Annual Consolidated Financial Statements by the full consolidation method and consolidated for the purposes of solvency by applying the equity method. The details of these companies are available in Annexes I and II to this Document; the balance is mainly composed of the companies BBVA Seguros and Pensiones Bancomer.

The entry of the balance from institutions (mainly financial) that are not consolidated at the accounting level but for purposes of solvency (by the proportional integration method). Details of these companies can be found in Annex IV to this Document.

As explained in Note 32 of the Group’s Annual Consolidated Financial Statements, this section includes an exercise in transparency aimed at offering a clear view of the process of reconciliation between the account balances reported in the Public Balance Sheet (attached to the Group’s Annual Consolidated Financial Statements) and the account balances as per this report (regulatory scope), revealing the main differences between both scopes.

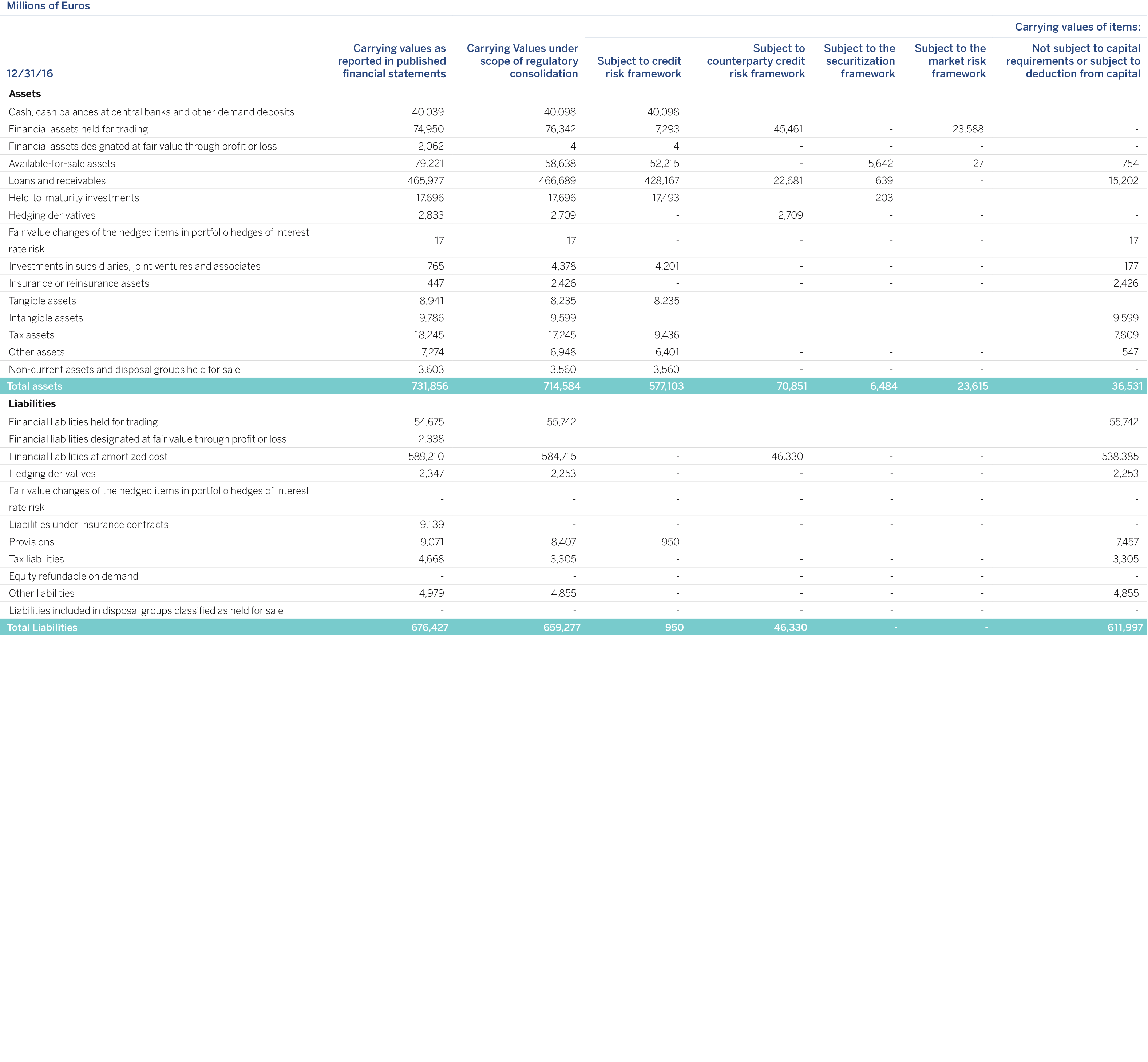

Furthermore, and in line with the RPDR, the following table shows the risks to which each one of the items in the regulatory balance sheet is exposed:

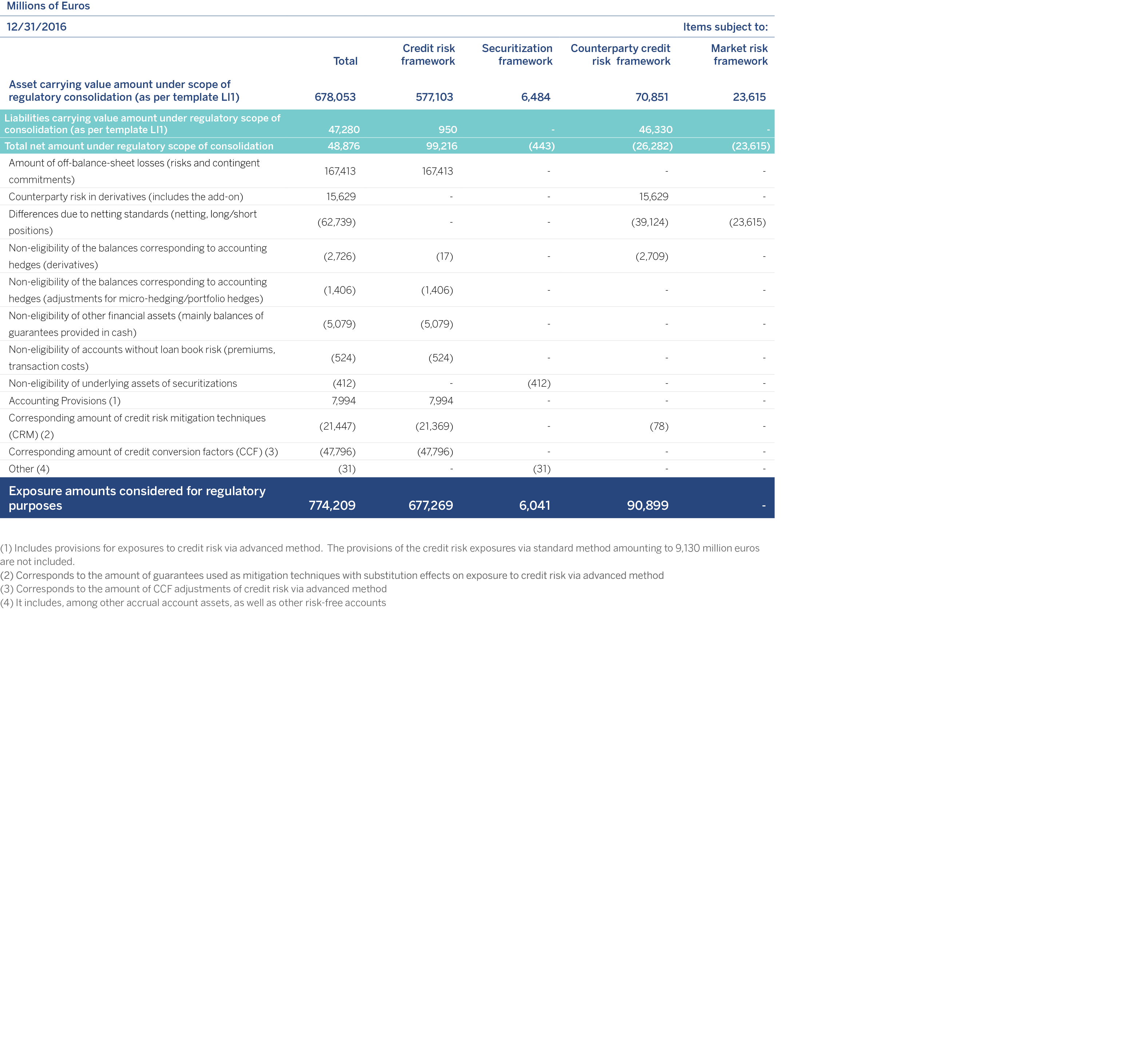

The table below summarizes the main sources of the differences between the amount of exposure in regulatory terms and the carrying values according to the Financial Statements. Following the instructions for template LI2 of the RPDR document, the amount of credit risk exposure by the standardized approach is presented net of provisions and value adjustments, while the credit risk exposures by the advanced approach are presented net of CCF and CRM:

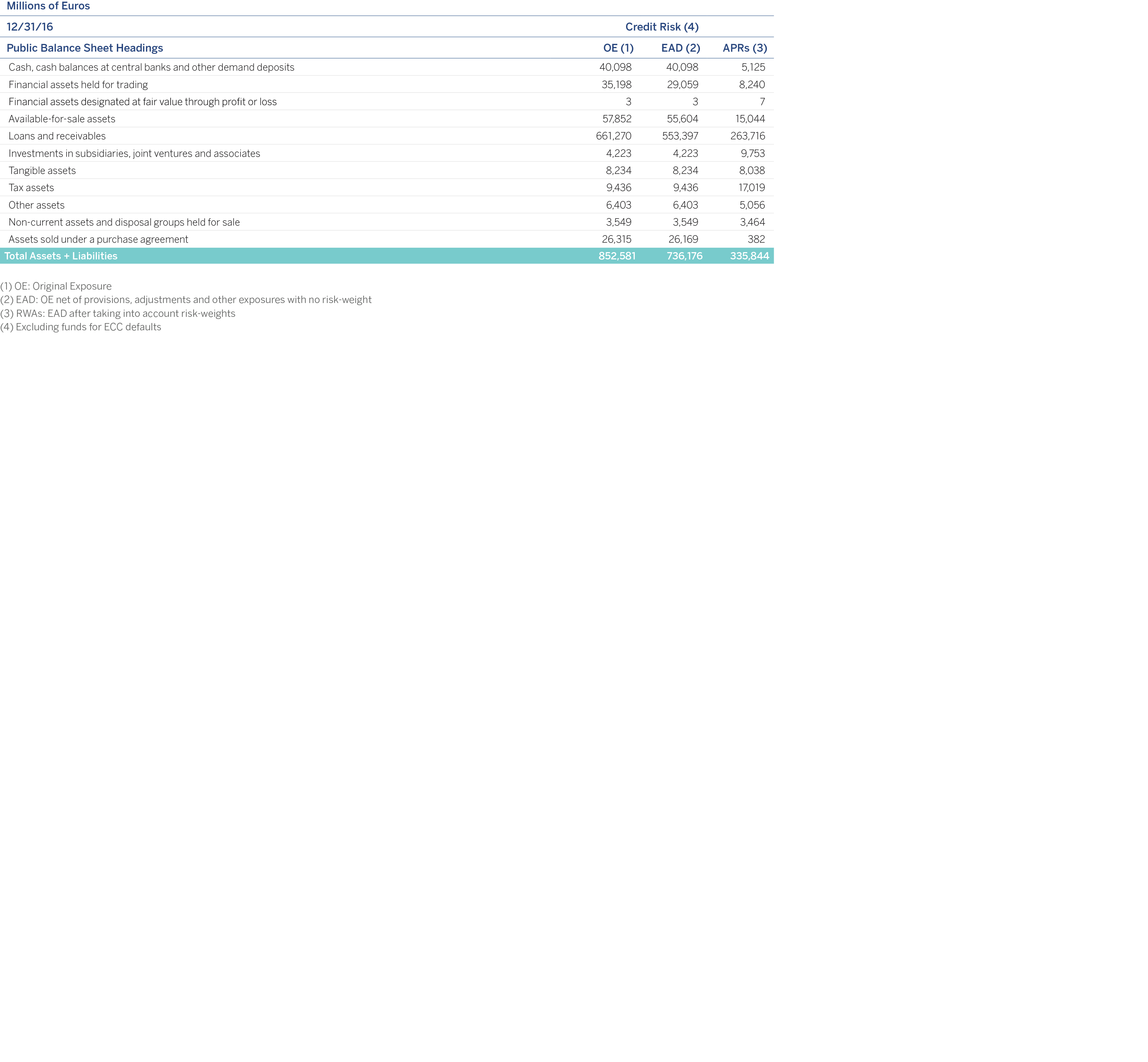

The following table breaks down the credit risk and counterparty credit risk amounts by items as per the Public Balance Sheet by EO, EAD and RWAs, which are the risk concepts on which this Document is based.

As detailed in Note 3 of the BBVA Group’s Annual Consolidated Financial Statements, at the Bank’s Board of Directors meeting held on March 31 2016, the Group agreed to begin the process of integrating the companies BBVA, S.A., Catalunya Banc, S.A., Banco Depositario BBVA, S.A. and Unoe Bank, S.A., the first of which is the absorbing company.

This operation is part of a corporate reorganization process involving its banking subsidiaries in Spain and was completed in 2016. In the consolidated financial statements, the aforementioned merger operations have no impact on either accounting or solvency levels.

There is no institution in the Group not included in the consolidated Group for the purpose of the solvency regulations whose capital is below the regulatory minimum requirement.

The Group operates in Spain, Mexico, the United States and 30 other countries, largely in Europe and Latin America. The Group’s banking subsidiaries around the world are subject to supervision and regulation (with respect to issues such as compliance with a minimum level of regulatory capital) by a number of regulatory bodies.

The obligation to comply with these capital requirements may affect the capacity of these banking subsidiaries to transfer funds to the parent company via dividends or other means.

In some jurisdictions in which the Group operates, the regulations lay down that dividends may only be paid with the funds available by regulation for this purpose.

In accordance with the exemption from capital requirements compliance for Spanish credit institutions belonging to a consolidated group (at individual or subconsolidated level) established in the CRR, the Group obtained exemption from the supervisor on December 30, 2009 for the following companies (this exemption was ratified through ECB decision 1024/2013):

On February 10, 2017 the European Central Bank accepted the withdrawal of the authorization as a credit institution submitted by Banco de Promoción de Negocios, S.A. which thus was no longer a credit institution regulated by the solvency regulations.