The leverage ratio is a regulatory measure (not risk-based) complementing capital designed to guarantee the soundness and financial strength of institutions in terms of indebtedness.

In January 2014, the Basel Committee on Banking Supervision published the final version of the “Basel III leverage ratio framework and disclosure requirements”, which has been included through a delegated act that amends the definition of leverage ratio in the CRR regulation.

Pursuant to article 451, section 2 of the CRR, on June 15, 2015 the EBA published the final draft of the Implementing Technical Standard (ITS, leverage ratio disclosures) for breaking down the leverage ratio, which has been applied in this report.

The leverage ratio is defined as the quotient of eligible Tier 1 capital and exposure.

Described below are the elements making up the leverage ratio, in accordance with the “EBA FINAL draft Implementing Technical Standards on disclosure of the leverage ratio under Article 451(5) of Regulation (EU) No. 575/2013 (Capital Requirements Regulation – CRR) - Second submission following the EC’s Delegated Act specifying the LR5” published by the EBA on June 15, 2015:

Tier 1 capital (letter h in the following table): section 2.2. of this document presents details of the eligible capital, which has been calculated based on the criteria defined in the CRR.

Exposure: as set out in article 429 of the CRR, the exposure measurement generally follows the book value subject to the following considerations:

-On-balance-sheet exposures other than derivatives are included net of allowances and accounting valuation adjustments.

Measurement of the Group’s total exposure is composed of the total assets as per financial statements adjusted for reconciliation between the accounting perimeter and the prudential perimeter.

Total exposure for the purpose of calculating the Group’s leverage ratio is composed of the sum of the following items:

On-balance asset positions: book balance of assets corresponding to the financial statements, excluding the derivative headings.

Adjustments between the accounting perimeter and the solvency perimeter: the balance resulting from the difference between the accounting balance sheet and the regulatory balance sheet is included.

Exposure in derivatives: the exposure referred to the EAD used in the measurement of capital use for counterparty credit risk, which includes both the replacement cost (mark-to-market) and the future potential credit exposure (add-on). The cost of replacement is reported adjusted by the margin of variation in cash and by effective notional amounts.

Securities financing transactions (SFTs): in addition to the exposure value, an addition for counterparty credit risk determined as set out in article 429 of the CRR in included.

Off-balance-sheet items: these include to risks and contingent liabilities and commitments associated with collateral, which are mainly available. A minimum floor of 10% is applied to the conversion factors (CCF), in line with article 429, section 10 a) of the CRR.

The exposures of the Group’s financial institutions and insurance companies that are consolidated at accounting but not at regulatory level.

Tier 1 deductions: those amounts of assets that have been deducted in the determination of the eligible Tier 1 capital are deducted, in order not to duplicate exposures. The main deductions are intangible assets, loss carry forwards and other deductions defined in article 36 of the CRR and indicated in section 2.1 of this report.

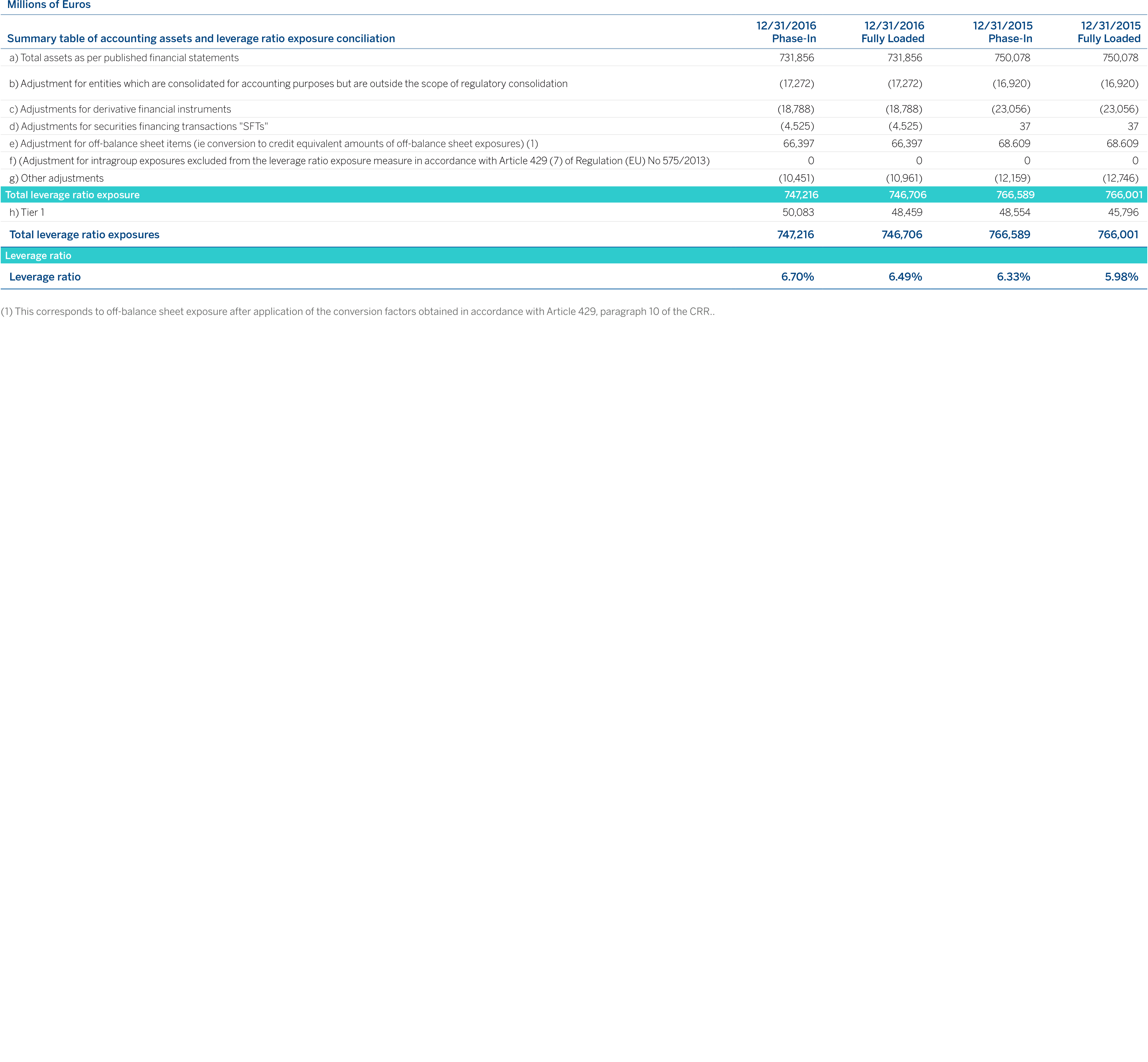

The table below shows a breakdown of the items making up the leverage ratio as of December 31, 2016 and December 31, 2015:

As it can be seen, the Group maintains a phased leverage ratio of 6.7% and a fully-loaded ratio of 6.5%, well above the minimum level required.

The leverage ratio, specifically the adjusted exposure, has been subject to variations caused by balance sheet movements in accordance with business activity. Stability can be seen as of December 2015 in the phase-in ratio levels with a slight upward trend in keeping with the behavior of the Tier 1 capital adequacy ratio and well above the required 3% minimum. The leverage level reflects the nature of the business model that is geared toward the retail sector.

The activities making up the Group’s regulatory reporting include the monthly measurement and control of the leverage ratio by assessing and monitoring this measurement in its more restrictive version (fully-loaded), to guarantee that leverage remains far from the minimum levels (which could be considered risk levels), without undermining the return on investment.

The estimates and the development of the leverage ratio are reported on a regular basis to different governing bodies and committees to guarantee an adequate control of the entity’s leverage levels and ongoing monitoring of the main capital indicators.

In line with the risk appetite framework and structural risk management, the Group operates by establishing limits and operational measures to achieve a sustainable development and growth of the balance sheet, maintaining at all times tolerable risk levels. This can be seen in the fact that the regulatory leverage level itself is well above the minimum required levels.