Introduction

Regulatory framework and regulatory developments in 2019

As a Spanish credit institution, BBVA is subject to Directive 2013/36/EU of the European Parliament and of the Council dated June 26, 2013, on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms (the "CRD IV Directive”) amending Directive 2002/87/EC and repealing Directives 2006/48/EC and 2006/49/EC, through which the EU began implementing the capital reforms agreed under Basel III, with effect from January 1, 2014, thus establishing a period of gradual implementation of certain requirements until January 1, 2019.

The major regulation governing the solvency of credit institutions is (EU) Regulation No. 575/2013 of the European Parliament and of the Council of June 26, 2013, on the prudential requirements for credit institutions and investment firms amending (EU) Regulation No 648/2012 ("CRR" and in conjunction with Directive CRD IV and any implementing measures of CRD IV, "CRD IV"), which is complemented by several binding Regulatory Technical Standards that are directly applicable to all EU member states, without the need to implement national measures.

The CRD IV Directive was transposed to Spanish national law by means of the Royal Decree-Law 14/2013, of November 29 ("RD-L 14/2013"), Law 10/2014, Royal Decree 84/2015, of February 13 ("RD 84/2015"), Bank of Spain Circular 2/2014 of January 31 and Circular 2/2016 of February 2 ("Bank of Spain Circular 2/2016").

In the Macroprudential field, Royal Decree 102/2019 was published in March 2019, establishing the Macroprudential Authority of the Financial Stability Board, establishing its legal regime. The aforementioned Royal Decree also develops certain aspects related to the macroprudential tools contained in Royal Decree-Law 22/2018.

Regulatory developments in 2019

BIS III reform: The Basel Committee has carried out a reform of the Basel III framework to achieve a balance between risk sensitivity, simplicity and comparability (hereinafter, BIS III). The main modifications focus on internal models, the standard credit risk method, the market risk framework, operational risk and the advanced model capital floors based on the standardized approach. This reform was approved by the Basel Committee on December 8, 2017, and is expected to be implemented on January 1, 2022. Capital floors will be introduced gradually over a period of 5 years, from a floor of 50% on January 1, 2022 to 72.5% on January 1, 2027. The Committee also introduced an additional leverage coefficient for global systemically important entities ("G-SIB").

With regard to the implementation of BIS III Reform in Europe, although there is still no legislative proposal, the following steps have been taken:

- The European Banking Authority (EBA), at the request of the European Commission, has published its opinion on the various regulatory options contained in the BIS III Reform in the area of Credit Risk, Operational Risk, Market Risk, capital floors and Credit Valuation Adjustment (CVA). The EBA advocates a faithful implementation of Basel by maintaining the date of entry into force as January 1, 2022.

- The European Commission published a public consultation on the implementation of BIS III Reform in the European Union in October 2019.

- In December 2019, the European Commission adopted the delegated act which includes specific topics for calculating the CRR2 standard alternative market risk method (Commission delegated regulation with regard to the alternative standardized approach for market risk), which is pending publication in the Official Journal of the European Union (hereinafter referred to as the OJUE). It is part of the European implementation of the new market framework (Fundamental Review of the Trading Book, FRTB), which will be carried out through this delegated act (for the alternative standardized approach) and through EBA technical standards (for the alternative internal method).

Reform of the securitization framework: On December 28, 2017, the reform of the securitization framework was published in the OJUE, and its implementation date is January 1, 2019 for securitization issued from that date. For securitization made before January 1, 2019, entities should have kept on applying the old regime, according to the regulation, until December 31, 2019. The reform is made of two regulations:

- 1. Regulation (EU) 2017/2401 of the European Parliament and Council of December 12, 2017 amending the CRR regarding the capital requirements of securitization positions. It grants preferential treatment to securitization considered to be simple, transparent and standardized (STS).

- 2. Regulation (EU) No. 2017/2402 of the European Parliament and Council of December 12, 2017 which establishes a general framework for securitizations, creating a specific framework for STS securitizations, detailing the characteristics that a securitization must meet to be considered STS.

Management and framework of NPLs: In July 2017, the European Council published a package of measures to address non-performing loan assets (NPL) in Europe. For this purpose, the European Central Bank (ECB) has established supervisory expectations for Pillar 2 on prudential provisions for non-performing loan exposure classified as such as of April 1, 2018. Its application date is from the SREP exercise (Supervisory Review and Examination Process) of 2021. The supervisory expectations on prudential provisions applicable to stock (non-performing loan exposures classified as such before April 1, 2018) will be treated by the ECB within the individual dialog with each entity.

For its part, Regulation 2019/630 of April 17, 2019 was published in the OJUE on April 25, 2019, modifying the CRR with regard to the minimum coverage of losses arising from non-performing loan exposure, applies from April 26, 2019 to exposure originating from that date which become non-performing. Regarding transparency, the EBA has published guidelines on the management of NPLs that apply from June 30, 2019 and publication (disclosure) guidelines for information from NPLs that apply as of December 31, 2019.

Declaration of Equivalence of Third Countries: On April 1, 2019, the EC updated the list of third countries and territories whose monitoring and regulatory requirements are considered equivalent to European requirements (Implementing Decision 2019/536 of the Council Dated March 29, 2019), including Argentina for the first time. Subsequently, in December 2019 (effective January 7, 2020) the EC has included Serbia and South Korea (Commission Implementing Decision 2019/2166 of December 16, 2019). Therefore, the complete list as of December 31, 2019 is as follows:

Argentina, Australia, Brazil, Canada, China, Faeroe Islands, Greenland, Guernsey, Hong Kong, India, Isle of Man, Japan, Jersey, Mexico, Monaco, New Zealand, Saudi Arabia, Serbia, Singapore, South Africa, South Korea, Switzerland, Turkey and the United States.

Request for authorization to compute issuances: On April 30, 2019, the second transitional provision and the second paragraph of the single derogatory provision of Royal Decree 309/2019 entered into force, repealing the first additional provision of RDL 84/2015 which obliged Spanish entities to request authorization to the ECB to include issuances in the capital ratios. This part of RDL 309/2019 applies to new issuances as well as authorization requests in course.

CE reforms and provisions: On November 23, 2016, the European Commission published a new reform package amending both the prudential banking regime (CRR) and the resolution regime (Bank Recovery and Resolution Directive, BRRD). This revision included the implementation of international standards into European legislation (regulation later than 2010 adopted by the Basel Committee – except for standards approved in December, 2017 and market risk requirements – and the total loss absorbing capacity (TLAC), the final design of the minimum requirement for own funds and eligible liabilities (MREL) along with a package of technical improvements. At the same time, a proposal has also been put forward for a directive to harmonize the hierarchy of senior debt creditors within the European Union. This directive was adopted in December 2017.

The CRR and BRRD reform package was published in the OJUE on June 7, 2019 and came into force on June 27, 2019. The regulations and directives that make up this reform are as follows:

- 1. Regulation (EU) 2019/876 (CRR2) of the European Parliament and of the Council of May 20, 2019 amending Regulation (EU) 575/2013 (CRR).

Its general implementation date is June 28, 2021, although some articles apply from its entry into force and others on different dates. - 2. Regulation (EU) 2019/877 of the European Parliament and of the Council of May 20, 2019, amending Regulation (EU) No 806/2014 regarding loss absorption and recapitalization capacity for credit institutions and investment firms.

The implementation date is December 28, 2020. - 3. Directive (EU) 2019/878 (CRD V) of the European Parliament and of the Council of May 20, 2019 amending Directive 2013/36/EU (CRD IV).

Its adoption date is December 28, 2020 as Member States have until that date to publish the provisions necessary to comply with this Directive. - 4. Directive (UE) 2019/879 (BRRD2) of the European Parliament and of the Council of May 20, 2019 amending Directive 2014/59/EU(BRRD).

Its adoption date is December 28, 2020 as Member States have until that date to publish the provisions necessary to comply with this Directive.

Regarding the supervisory reporting, during the last quarter of 2019, the EBA has published several documents that are currently in consultation:

- 1. ITS on supervisory reporting requirements for institutions: Establishes new templates that meet CRR2 reporting requirements, as well as reporting requirements for NPLs. The proposed implementation date is June 28, 2021.

- 2. ITS on specific supervisory reporting requirements for market risk: In reference to the new reporting requirements of the new market risk framework, the EBA will gradually publish the documents that contain the new templates, this being the first publication. The proposed implementation date is March 1, 2021.

- 3. ITS amending Commission Implementing Regulation (EU) 2016/2070 with regard to benchmarking of internal models: Introduces changes to the benchmarking exercise of internal 2021 models, where the inclusion of templates referring to IFRS 9 are the most relevant.

- 4. ITS on disclosure and reporting of MREL and TLAC: Establishes new Pillar 3 and reporting supervisor templates associated with TLAC and MREL requirements of CRR2 and BRRD2. The proposed implementation date is June 28, 2021.

In addition to the above, the EBA has proceeded to update the guidelines on definitions to be applied and templates to be submitted for Funding Plans (EBA/GL/2019/05).

Moreover, on December 18, 2019, the new framework for guaranteed bonds was published in the OJUE. The reform consists of a regulation and a directive as follows:

- 1. Regulation 2019/2160 of the European Parliament and of the Council of November 27, 2019 amending Regulation (EU) 575/2013 as regards exposures in the form of guaranteed bonds.

The implementation date is July 8, 2022. - 2. Directive 2019/2162 of the European Parliament and of the Council of November 27, 2019 on the issue and public supervision of guaranteed bonds and which amends Directives 2009/65/EC and 2014/59/EU.

Member States have until July 8, 2021 to transpose the directive into national legislation. The implementation date will be at maximum July 8, 2022.

Developments Pillar 3 framework: On June 27, 2019, BCBS integrated the three phases of review of Pillar 3 into the Basel Consolidated Framework, which collects in a single document all the requirements of the Basel Committee. This Pillar 3 framework applies at the consolidated level to all internationally active banks and covers both disclosure of information on regulatory capital requirements, as well as other relevant regulatory metrics such as liquidity (LCR, NSFR), leverage, TLAC and remuneration information.

The BCBS will continue to update this document as new requirements are incorporated or existing requirements are modified, allowing better access to applicable regulations and facilitating credit institutions to comply with market discipline.

As a result of BCBS's review of the market risk framework (FRTB) in January 2019, BCBS published a document in November 2019 for consultation on Pillar 3 requirements related to the new framework (“Revisions to market risk disclosure requirements”). The consultation ended in February 2020 and the proposed implementation date is January 1, 2022.

In addition, in November 2019, a consultation was launched on the breakdown of sovereign exposures (“Voluntary disclosure of sovereign exposures”). The consultation specifies that such breakdowns will only be mandatory upon request of the supervisor. The proposed implementation date is January 1, 2022.

For its part, in Europe, the EBA published on December 17, 2018 its Guidelines on disclosure of non-performing and forborne exposures (EBA/GL/2018/10), which were adopted by the Bank of Spain on July 2, 2019.

These guidelines are intended to specify the common content and uniform disclosure formats for the information related on non-performing exposures, forborne exposures and foreclosed assets. It consists of 10 templates that apply to entities that are subject to all or part of the disclosure requirements specified in the Eighth Part of the CRR. However, it includes the principle of proportionality based on the significance of the credit institutions and their level of gross non-performing loan ratio. In this way, significant entities according to the criteria set out in the aforementioned guidelines that have a non-performing loan ratio of more than 5% will be subject to the publication of all templates, while the other significant entities will be subject to 4 templates (NPL1 - Credit quality of forborne exposures, NPL3 – Credit quality of performing and non-performing exposures by past due days, NPL4 – performing and non-performing exposures and related provisions, NPL9 –Collateral obtained by taking possession and execution processes)2. The Group has a non-performing loan ratio of less than 5%, therefore not all of the NPLs' templates apply.

In addition, the EBA in October 2019 published a consultative document until January 2020 entitled “ITS on public disclosures by institutions” that integrates all disclosure requirements issued in a segregated manner over the past few years into a single document, with the aim of helping banks comply with market discipline.

This consultation includes relevant modifications to disclosure requirements to adapt them to changes introduced by CRR2 and maintaining appropriate consistency with the disclosure formats established by the Basel framework that allow comparability among internationally active banks, except for the TLAC/MREL disclosure requirements which are addressed in another document in consultation phase published in November 2019 (“ITS on disclosure and reporting of MREL and TLAC ”) and the following requirements, which will be consulted in the near future:

- Disclosure of information on interest rate risk in the banking book (IRRBB)

- Disclosure of indicators of entities of global systemic importance

- Disclosure of information on environmental, social and corporate governance risks

It should be noted that in these consultations, the EBA also includes traceability between the information reported to the Supervisor and the information published under the framework of Pillar 3 as one of the strategic objectives to ensure consistency and integration between both sets of information.

The proposed implementation date for the first consultation is June 28, 2021 and June 30, 2021 for the consultation of the disclosure of information on TLAC/MREL.

Sustainable Finance Developments: In December 2019, the EBA launched its action plan in the field of sustainable finance, consisting of the publication (between 2019 and 2025) of several documents (RTS/ITS, Reports, Guidelines, EC Council) related to environmental, social and corporate governance (ESG). The EBA recommends that entities act proactively to incorporate these factors into both their risk management and strategy.

2 These guidelines replace the templates EU CR1-D Ageing of past-due exposures and EU CR1-E Non-performing exposures and forborne exposures set by the EBA in the Guidelines on information disclosure requirements under the Eighth Part of the CRR (EBA/GL/2016/11)

Contents of the 2019 Prudential Relevance Report

Article 13 of the CRR establishes that the parent entities of the European Union are subject, based on their consolidated situation, to the disclosure requirements set by Part Eight of CRR.

This report provides the prudential information of BBVA Consolidated Group as of December 31, 2019 which has been prepared in accordance with the precepts contained in Part Eight of the CR, complying with the guidelines published by EBA and the applicable technical implementation standards.

In this regard, Annex V of this report, available on the Group's website, gathers the correspondence of the articles of Part Eight of the CRR with the different sections of the document (or other public documents) where the required information is located.

In addition, the main EBA guidelines that apply as of December 31, 2019, as well as the standard formats used to disclose the information recommended by the various regulators are highlighted below:

- Guidelines on materiality, proprietary information, and confidentiality, and on the frequency of disclosure of information according to Article 432, sections 1 and 2, and Article 433 of Regulation (EU) No. 575/2013 (EBA/GL/2014/14). These guidelines detail the process and the criteria to be followed regarding the principles of materiality, proprietary information, confidentiality and the right to omit information, and provide guidance for entities to assess the need to publish information more frequently than the annual one. These guidelines were adopted by the Executive Commission of the Bank of Spain in February 2015.

- Guidelines on disclosure requirements under Part Eight of Regulation (EU) No. 575/2013 (EBA/GL/2016/11). These guidelines provide guidance in relation to the information that entities must disclose in application of the corresponding articles of the eighth part and with the presentation of said information. These guidelines were adopted by the Executive Commission of the Bank of Spain in October 2017.

- Guidelines on disclosure of the liquidity coverage ratio in order to complement the information on liquidity risk management in accordance with Article 435 of Regulation (EU) No. 575/2013 (EBA/GL/2017/01). These guidelines specify the general framework for the disclosure of information on risk management under Article 435 of Regulation (EU) No. 575/2013 in relation to liquidity risk, establishing a harmonized structure for the disclosure of the information required by Article 435, paragraph 1 of said Regulation. These guidelines were adopted by the Executive Commission of the Bank of Spain in July 2017.

- Guidelines on the disclosure of information on encumbered and unencumbered assets in accordance with Article 443 of Regulation (EU) No. 575/2013 (EBA/GL/2014/03), adopted by the Executive Commission of the Banco de España in September 2014 and that serve as the basis for the Delegated Regulation 2017/2295 of September 4 of technical rules of regulation concerning the disclosure of information on encumbered and unencumbered assets.

- Guidelines on the uniform disclosure of information under Article 473-bis of Regulation (EU) No.575/2013 with regard to the transitional provisions for mitigating the impact on Shareholders’ funds from the introduction of IFRS 9 (EBA/GL/2018/01). These guidelines were adopted by the Executive Commission of the Bank of Spain in February 2018.

- Guidelines on appropriate remuneration policies under Articles 74, Paragraph 3 and 75, Paragraph 2, of Directive 2013/36/EU and disclosure of information under Article 450 of Regulation (EU) No 575/2013 (EBA/GL/2015/22). These guidelines were adopted by the Executive Commission of the Bank of Spain in July 2016.

- Guidelines for the disclosure of information on non-performing loan exposures and forborne exposures (EBA/GL/2018/10). These guidelines were adopted by the Executive Commission of the Bank of Spain in July 2019, where the first date of application was December 31, 2019.

It must be pointed out that the data published in the Prudential Relevance Report (Pillar 3) was prepared in accordance with internal control processes described in the "Standards for Preparing Annual Information for BBVA Group". These policies ensure that the information disclosed in Pillar 3 is subject to the internal control framework defined by the Group, as well as adequate internal and external revision (by an independent expert), in compliance with the Guidelines on disclosure requirements under Part Eight of Regulation (EU) No.575/2013 (EBA/GL/2016/11).

Disclosure requirements

| Template | Countercyclical capital buffer - Commission Delegated Regulation (EU) 2015/1555 | IRP Section |

|---|---|---|

| Geographical breakdown of relevant credit exposures for the calculation of the countercyclical capital buffer | Introduction | |

| Amount of entity-specific countercyclical capital buffer | Introduction | |

| Template | Disclosure requirements of the Third Pilar - Consolidated and enhanced framework- BCBS | IRP Section |

| CC1 | Composition of regulatory capital | Pillar III Annexes |

| CC2 | Reconciliation of regulatory capital to balance sheet | 1.1.4 |

| Template | ITS on disclosure for Own Funds by institutions (EBA/ITS/2013/01) | IRP Section |

| Capital instruments main features template | Pillar III Annexes | |

| Own funds disclosure template | Pillar III Annexes | |

| Template | Guidelines on uniform disclosure of IFRS 9 transitional arrangements (EBA/GL/2018/01) | IRP Section |

| IFRS 9 - FL | Comparison of institutions’ own funds and capital and leverage ratios with and without the application of transitional arrangements for IFRS 9 or analogous ECLs | 2,3 |

| Template | Guidelines on disclosure requirements EBA/GL/2016/11 | IRP Section |

| EU-OV1 | Overview of RWAs | 2,5 |

| EU-LI1 | Differences between the accounting and regulatory scopes of consolidation and the mappping of financial statement categories with regulatory risk categories | 1.1.4 |

| EU-LI2 | Main sources of the differences between the regulatory exposure amounts and carrying values in financial statements | 1.1.4 |

| EU-LI3 | Outline of the differences in the scopes of consolidation (entity by entity) | Pillar III Annexes |

| EU-CR1-A | Credit quality of exposures by exposure class and instrument (excludes counterparty credit risk) | 3.2.3.4 |

| EU-CRB-B | Total and average net amount of exposures (includes counterparty credit risk) | 3.2.3.2 |

| EU-CRB-C | Geographical breakdown of exposures (includes counterparty credit risk) | 3.2.3.3 |

| EU-CR1-C | Credit quality of exposures by geography (excludes counterparty credit risk) | 3.2.3.3 |

| EU-CRB-D | Concentration of exposures by industry or counterparty types (excludes counterparty credit risk) | 3.2.3.5 |

| EU-CR1-B | Credit quality of exposures by industry or counterparty types (excludes counterparty credit risk) | 3.2.3.5 |

| EU-CRB-E | Maturity of exposures (excludes counterparty credit risk) | 3.2.3.6 |

| EU-CR2-A | Changes in the stock of general and specific credit risk adjustments | 3.2.3.8 |

| EU-CR2-B | Changes in the stock of defaulted and impaired loans and debt securities | 3.2.3.8 |

| EU-CR4 | Standardised approach: credit risk exposure and credit risk mitigation effects | 3.2.4.3 |

| EU-CR5 | Standardised approach | 3.2.4.3 |

| EU-CR6 | IRB approach: credit risk exposures by exposure class and PD range | 3.2.5.2 |

| EU-CR9 | IRB approach: backtesting of PD per exposure class | 3.2.5.2 |

| EU-CR8 | RWA flow statements of credit risk and counterparty exposures under the IRB approach | 3.2.5.2 |

| EU-CR10 (1) | IRB: specialized lending | 3.2.5.4 |

| EU-CR10 (2) | IRB: equity | 3.2.5.5 |

| EU-CCR5-A | Impact of netting and collateral held on exposure values | 3.2.6.2 |

| EU-CCR1 | Analysis of counterparty credit risk exposures by approach | 3.2.6.2 |

| EU-CCR3 | Standardised approach: counterparty credit risk exposures by regulatory portfolio and risk | 3.2.6.2.1 |

| EU-CCR4 | IRB approach: counterparty credit risk exposure by portfolio and PD scale | 3.2.6.2.2 |

| EU-CCR5-B | Composition of collateral for exposures to counterparty credit risk | 3.2.6.2.3 |

| EU-CCR6 | Credit derivatives exposures | 3.2.6.2.4 |

| EU-CCR7 | RWA flow statements of CCR exposures under the IMM | N/A |

| EU-CCR2 | Credit valuation adjustment (CVA) capital charge | 3.2.6.3 |

| EU-CCR8 | Exposures to central counterparty clearing houses | 3.2.6.4 |

| EU-CR3 | Credit risk mitigation techniques overview | 3.2.8.3 |

| EU-MR1 | Market risk under the standardised approach | 3.3.3 |

| EU-MR3 | IMA values for trading portfolios | 3.3.4.2.2 |

| EU-MR2-A | Market risk under the internal model approach (IMA) | 3.3.4.2.2 |

| EU-MR2-B | RWA flow statements of market risk exposures under the IMA approach | 3.3.4.2.2 |

| EU-MR4 | Trading book. Validation of the Market Risk Measurement Model | 3.3.4.2.3 |

| Template | Guidelines on disclosure of non-performing and forborne exposures (EBA/GL/2018/10) | IRP Section |

|---|---|---|

| NPL 1 | Credit quality of forborne exposures | 3.2.3.4 |

| NPL 3 | Credit quality of performing and non-performing exposures by past due days | 3.2.3.3 |

| NPL 4 | Performing and non-performing exposures and related provisions | 3.2.3.3 |

| NPL 9 | Collateral obtained by taking possession and execution processes | 3.2.3.4 |

| Template | Disclosure requirements for the Third Pillar – Consolidated and enhanced framework | IRP Section |

|---|---|---|

| SEC1 | Securitization exposures in the banking book | 3.2.7.5 |

| SEC4 | Securitization exposures in the banking book and associated capital requirements – bank acting as investor | 3.2.7.6 |

| SEC3 | Securitization exposures in the banking book and associated regulatory capital requirements – bank acting as originator or as sponsor | 3.2.7.7.2 |

| Template | Guidelines on prudent valuation adjustments (EBA/RTS/2014/06) | IRP Section |

|---|---|---|

| Prudent Valuation Adjustments | 3.3.4.2.1 | |

| Template | Guidelines on disclosure of liquidity information (EBA/GL/2017/01) | IRP Section |

|---|---|---|

| EU-LIQ1 | LCR disclosure template | 3.7.5 |

| Template | Encumbered and unencumbered assets - Commission Delegated Regulation (EU) 2017/2295 | IRP Section |

|---|---|---|

| Template A | Encumbered and unencumbered assets | 3.7.6 |

| Template B | Collateral received | 3.7.6 |

| Template C | Sources of encumbrance | 3.7.6 |

| Template | Leverage Ratio - Commission Implementing Regulation (EU) 2016/200 | IRP Section |

|---|---|---|

| LRSum | Summary reconciliation of accounting assets and leverage ratio exposures | 4.1 |

| LRCom | Leverage ratio common disclosure | Pillar III Annexes |

| LRSpl | Split-up of on balance sheet exposures (excluding derivatives, SFTs and exempted exposures) | Pillar III Annexes |

| Template | Guidelines on remuneration policies (EBA/GL/2015/22) | IRP Section |

|---|---|---|

| Total remuneration of Identified Staff in 2019 | 5,8 | |

| Extraordinary remuneration of the Identified Staff in 2019 | 5,8 | |

| Deferred variable remuneration from periods prior to 2019 | 5,8 | |

| Remunerations of the identified staff in 2019 by activity areas | 5,8 | |

| Number of individuals with total remuneration in excess of €1 million in 2019 | 5,8 | |

Composition of Capital

Regulatory capital requirements

In this regard, Article 92 of the CRR establishes that credit institutions must maintain the following own funds requirements at all times:

- a) Common Equity Tier 1 capital ratio of 4.5%, calculated as Common Equity Tier 1 capital expressed as a percentage on the total amount of risk-weighted assets.

- b) Tier 1 capital ratio of 6%, calculated as the level of tier capital 1 expressed as a percentage of the total amount of risk-weighted assets.

- c) Total capital ratio of 8%, calculated as the total own funds expressed as a percentage of the total amount of risk-weighted assets.

Notwithstanding the application of the Pillar 1 requirement, CRD IV allows competent authorities to require credit institutions to maintain higher level of own funds than the requirements of Pillar 1 to cover types of risk other than those already covered by the Pillar 1 requirement (this power of the competent authority is commonly referred to as "Pillar 2").

Furthermore, in accordance with CRD IV, credit institutions must comply with the combined requirement of capital buffers at all times, as of 2016. This additional capital requirement has incorporated five new capital buffers: (i) the capital conservation buffer, (ii) the buffer for global systemically important banks (the "G-SIB" buffer), (iii) the entity-specific countercyclical capital buffer, (iv) the buffer for other systemically important banks ("D-SIB" buffer) and (v) the systemic risk capital buffer. The “combined capital buffer requirement” must be met with Common Equity Tier 1 capital (“CET1”) to cover both minimum capital required by “Pillar 1” and “Pillar 2".

Both the capital conservation buffer and the G-SIB buffer (where appropriate) will apply to credit institutions as it establishes a percentage greater than 0%.

The buffer for global systemically important banks applies to those institutions on the list of global systemically important banks, which is updated annually by the Financial Stability Board (“FSB”). Considering the fact that BBVA has not appeared on the said list since November 2015 (effective January 1, 2017), the G-SIB buffer does not apply to BBVA.

For more details on the quantitative indicators for assessing global systemically important entities, see the document "G-SIBs Information" in the Shareholders and Investors / Financial Information section of the Group's website.

The Bank of Spain has extensive discretionary powers as regards the countercyclical capital buffer specific to each bank, the buffer for other systemically important financial institutions (which are those institutions considered to be systemically important domestic financial institutions “D-SIB”) and the buffer against systemic risk (to prevent or avoid systemic or macroprudential risk). The European Central Bank (ECB) has the powers to issue recommendations in this respect following the entry into force on November 4, 2014 of the Single Supervisory Mechanism (SSM).

In December 2015, the Bank of Spain agreed to set the countercyclical capital buffer that applies to credit exposure in Spain at 0% as of January 1, 2016. These percentages will be reviewed every quarter, as the Bank of Spain decided in December 2019 to keep the countercyclical capital buffer at 0% for the first quarter of 2020.

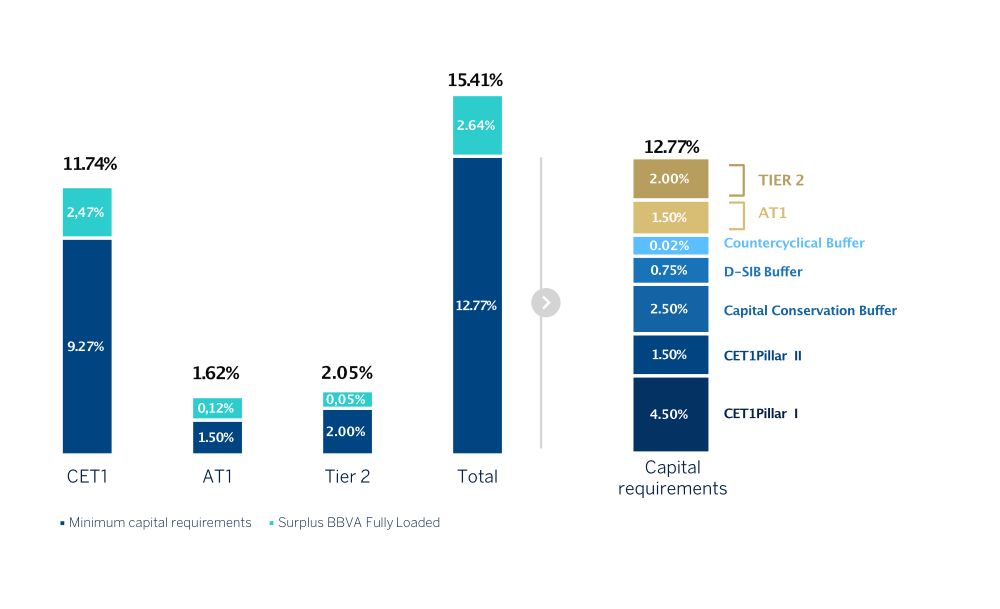

After the supervisory review and evaluation process (“SREP”) conducted by the ECB, the BBVA Group was notified in December 2019 that, as of January 1, 2020, they would need to maintain a phased-in and fully loaded ratio (i) CET1 of 9.27% at the consolidated level and 8.53% at the individual level and (ii) a total capital ratio of 12.77% at the consolidated level and 12.03% at the individual level.

The consolidated overall capital requirement includes: i) the minimum capital requirement of Common Equity Tier 1 (CET1) of Pillar 1 (4.5%); ii) the capital requirement of Additional Tier 1 (AT1) of Pillar 1 (1.5%); iii) the capital requirement of Tier 2 of Pillar 1 (2%); iv) the CET1 requirement of Pillar 2 (1.5%), which remains at the same level as established after the last SREP; v) the capital conservation buffer (2.5% of CET1); vi) the capital buffer for Other Systemically Important Institutions (O-SIIs) (0.75% of CET1); and vii) the countercyclical capital buffer (0.02% of CET1).

Capital Requirements and capital ratios (fully loaded)

As of December 31, 2019, BBVA maintains a CET1 ratio and a fully loaded total ratio of 11.74% and 15.41%, respectively (in phased-in terms, CET1 and a total ratio of 11.98% and 15.92%, respectively) reinforcing its capital position in the Group this year.

Leverage ratio

In order to provide the financial system with a metric that serves as a backstop to capital levels, irrespective of the credit risk, a measure complementing all the other capital indicators has been incorporated into Basel III and transposed to the solvency regulations. This measure, the leverage ratio, can be used to estimate the percentage of assets and off-balance sheet items financed with Tier 1 capital.

Although the book value of the assets used in this ratio is adjusted to reflect the bank's current or potential leverage with a given balance sheet position, the leverage ratio is intended to be an objective measure that may be reconciled with the financial statements.

As of December 31, 2019, the Group had a leverage ratio (fully loaded) of 6.68 % and a phased-in ratio of 6.80 %, above the minimum required ratio of 3% and continuing to compare very favorably with the rest of the peer group.