Introduction

Regulatory framework and regulatory developments in 2020

As a Spanish credit institution, BBVA is subject to Directive 2013/36/EU of the European Parliament and of the Council dated June 26, 2013, on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms (the "CRD IV Directive”) amending Directive 2002/87/EC and repealing Directives 2006/48/EC and 2006/49/EC, through which the EU began implementing the capital reforms agreed under Basel III, with effect from January 1, 2014, thus establishing a period of gradual implementation of certain requirements until January 1, 2019.

The major regulation governing the solvency of credit institutions is (EU) Regulation No. 575/2013 of the European Parliament and of the Council of June 26, 2013, on the prudential requirements for credit institutions and investment firms amending (EU) Regulation No 648/2012 ("CRR" and in conjunction with Directive CRD IV and any implementing measures of CRD IV, "CRD IV"), which is complemented by several binding Regulatory Technical Standards that are directly applicable to all EU member states, without the need to implement national measures. This Regulation has been amended by Regulation 2019/876/EU (“CRR2”) and Regulation 2020/873/EU (“Quick Fix”).

The CRD IV Directive was transposed to Spanish national law by means of the Royal Decree-Law 14/2013, of November 29 ("RD-L 14/2013"), Law 10/2014, Royal Decree 84/2015, of February 13 ("RD 84/2015"), Bank of Spain Circular 2/2014 of January 31 and Circular 2/2016 of February 2 ("Bank of Spain Circular 2/2016"). During 2020, the adoption of the amendments proposed by Directive (EU) 2019/878 to the Spanish legal system began through the publication on September 4, 2020 of the proposed amendments to Law 10/2014 as well as RD 84/2015. As of the date of publication of this report, they had not yet been published in the BOE (Boletín Oficial del Estado — Spanish Official Journal).

In the Macroprudential field, Royal Decree 102/2019 was published in March 2019, establishing the Macroprudential Authority of the Financial Stability Board, establishing its legal regime. The aforementioned Royal Decree also develops certain aspects related to the macroprudential tools contained in Royal Decree-Law 22/2018. The draft Bank of Spain Circular on macroprudential tools was open for consultation during February 2021 (this was the Bank of Spain Circular amending Bank of Spain Circular 2/2016, of 2 February, to credit institutions, on supervision and solvency, which completes the adaptation of the Spanish legal system to Directive 2013/36/EU and Regulation (EU) No 575/2013.) This Circular develops measures that the Bank of Spain may decide to put in place, such as a countercyclical buffer for a particular sector, industry limits on exposure concentration, or the establishment of limits and conditions on the granting of loans and other transactions. As of the date of publication of this report, the Circular had not yet been published in the BOE (Boletín Oficial del Estado — Spanish Official Journal).

Regulatory developments in 2020

Major economic disruption caused by the COVID-19 pandemic and the exceptional containment measures have significantly impacted the economy. Businesses have faced disruptions in the supply chain, temporary closures, and reduced demand, while households have faced unemployment and declining incomes. Public authorities at the Union and Member State level have acted proactively to help households and solvent businesses to weather the intense-but-temporary slowdown in economic activity and the consequent shortage of liquidity.

With the aim of mitigating the impact of COVID-19, various bodies have made pronouncements aimed at allowing greater flexibility in terms of implementing accounting and prudential frameworks. Generally speaking, the following initiatives are notable due to their relevance:

- In its press release on 12 March in response to COVID-19, the ECB allowed banks to bring

forward the use of Additional Tier 1 or Tier 2 capital instruments to partially meet Pillar II

requirements (P2R). This measure has been bolstered by the relaxation of the countercyclical

capital buffer (CCyB) that has been announced by various national macroprudential authorities,

and by other additional measures published by the ECB that have provided institutions with flexibility by allowing them to operate below established P2G levels as well as to use capital and

liquidity buffers.

With regard to dividends, 15 December 2020 saw the ban on paying out dividends (in force since 27 March 2020) lifted, albeit under the recommendation of exercising extreme caution and limiting the maximum amount to be distributed. The ECB expects dividends and share buybacks to remain below 15% of the adjusted cumulated 2019-2020 profit attributable to the parent company, provided that they do not exceed 20 basis points of Common Equity Tier I in the fourth quarter of 2020. This recommendation is effective until 30 September 2021.

- The European Banking Authority (EBA) published guidelines on legislative and nonlegislative payment moratoria in April 2020. These guidelines set out the criteria that both public

and private legislative and non-legislative payment moratoria must meet in order to avoid the

exposures subject to these payment deferrals being automatically reclassified as forbearance

or defaulted exposures. According to the EBA's latest communication on 2 December 2020,

these guidelines remain applicable until 31 March 2021.

Regarding relevant EBA publications on prudential aspects, the guidelines on structural FX (Guidelines on the treatment of structural foreign exchange under Article 352 (2) of the CRR) that were issued on July 1, 2020, stand out. They apply as of January 1, 2022.

- The European Parliament and Council adopted Regulation 2020/873 applicable from 27 June 2020 (known as the "CRR Quick Fix"), which amends both Regulation (EU) 575/2013 (CRR) and Regulation 2019/876 (CRR2). The main amendments included in this Regulation are: the extension of the IFRS 9 transitional treatment (affects phased-in ratios only); the nondeductibility of software from CET1 capital (this entered into force on 23 December 2020 following the publication of Delegated Regulation 2020/2176 in the OJEU); the bringing forward of the application of the SME and infrastructure support factor; the possibility of applying a prudential filter that temporarily neutralises the impact on CET1 capital of variation in the value of sovereign debt instruments classified as fair value through other comprehensive income (FVOCI); the flexibilization of aspects associated with market risk (supplemented by related communications from the EBA); and the temporary exclusion of certain exposures to central banks for leverage ratio purposes (ECB Decision 2020/1306, allowing the exclusion of exposures to central banks from the Eurosystem, entered into force on 26 September 2020). With regard to ongoing regulatory changes also concerning prudential matters, the European Commission's proposal of 24 July 2020 (pending approval by the European Parliament and Council) on amendments to the securitisation framework (known as the "Securitisation Quick Fix") is noteworthy.

- On 27 March, the Basel Committee announced the deferral by one year (until 1 January 2023) to the implementation date of the Basel III reform (known as Basel IV).

The EBA published two Calls for Advice in 2020 to support the European Commission in its task of releasing a European proposal to implement this Basel III reform:

- Submission of additional analysis for the Call for Advice for the purposes of revising the own fund requirements for credit, operational, market and credit valuation adjustment risk: published on 5 March 2020.

- Basel III Reforms: Updated Impact Study: published on 15 December 2020.

With regard to public disclosure and supervisory reporting, the main new development is the publication by the EBA on 2 June 2020 of the guidelines setting out the tables to be used to perform the supervisory reporting and disclosure to the market of exposures subject to payment moratoria and public guarantees introduced by Member States in response to the COVID-19 crisis ("Guidelines on reporting and disclosure of exposures subject to measures applied in response to the COVID-19 crisis"). With regard to the measures contained in the "CRR Quick Fix," the EBA published guidelines on 11 August setting out how to report and disclose said measures ("Guidelines on supervisory reporting and disclosure requirements in compliance with the CRR quick fix" and "Guidelines amending Guidelines EBA/GL/2018/01 on uniform disclosures under Article 473a of Regulation (EU) No 575/2013 (CRR) on the transitional period for mitigating the impact of the introduction of IFRS 9 on own funds to ensure compliance with the CRR quick fix"). Finally, on November 4, 2020, the EBA published the guidelines on the specification and disclosure of systemic importance indicators, which apply from December 16, 2020 and repeal the previous revised guidelines. of February 29, 2016 (EBA / GL / 2016/01). These guidelines apply to entities whose leverage ratio exposure measure exceeds €200 billion.

Since approved regulatory developments (e.g. CRR2) are in place but apply further down the line, the EBA is in the process of reviewing current implementing technical standards (ITS) related to supervisory reporting and public disclosure to reflect changes derived from these regulations. In this sense, the EBA made the following pronouncements throughout 2020:

- 1. DPM 2.10 Framework:

- On 4 May 2020, the final document on the benchmarking of internal models for the 2021 exercise ("ITS amending Commission Implementing Regulation (EU) 2016/2070 with regard to benchmarking of internal models") was published. This document is part of the DPM 2.10 framework and to date its publication in the Official Journal of the European Union (OJEU) is pending.

- 2. DPM 3.0 Framework:

- On 24 June 2020, the final documents in terms of both reporting ("ITS on supervisory reporting requirements for institutions") and disclosure ("TS on public disclosures by institutions") were published. These documents implement the changes introduced by both the CRR2 (Regulation 2019/876) and the Regulation on the minimum loss coverage for non-performing exposures (Regulation 2019/630). Their application date is 28 June 2021, although they are yet to be published in the OJEU.

- On 3 August 2020, the final document on the reporting and disclosure of MREL and TLAC ("ITS on disclosure and reporting of MREL and TLAC") was published, which implements the changes introduced by BRRD 2 (Regulation 2019/879). Although it is yet to be published in the OJEU, the application date of the reporting requirements is 30 June 2021, while the application date for disclosure requirements varies between those for the TLAC (once the ITS entries into force) and those for the MREL (1 January 2024 at the earliest).

- 3. DPM 3.1 Framework:

- ITS on specific supervisory reporting requirements for market risk: on 4 May 2020, the final

document on reporting requirements for the new alternative standardised approach for market

risk ("FRTB-SA") was published. It proposes delaying its application date by six months until

1 September 2021. This document is yet to be published in the OJEU.

The EBA will gradually publish the documents containing the new reporting templates for the new market risk framework, this being the first publication.

- ITS amending Commission Implementing Regulation (EU) 2016/2070 with regard to benchmarking of internal models: published on 17 December 2020 and open for consultation until 15 February 2020, it introduces changes for the 2022 exercise on the benchmarking of internal models.

- ITS on specific supervisory reporting requirements for market risk: on 4 May 2020, the final

document on reporting requirements for the new alternative standardised approach for market

risk ("FRTB-SA") was published. It proposes delaying its application date by six months until

1 September 2021. This document is yet to be published in the OJEU.

With regard to the Minimum Requirement for Own Funds and Eligible Liabilities (MREL), on 20 May 2020, the Single Resolution Board (SRB) issued its MREL policy for the 2020 resolution planning cycle, which incorporates the criteria set out in BRRD 2/CRR 2 and establishes new transition periods (intermediate target in 2022 and final target in 2024). With regard to the existing binding targets (set out in the 2018 and 2019 resolution cycles), the SRB has clarified that it will adopt a forward-looking approach for banks that may face difficulties meeting those targets.

Sustainable finance: Towards integration in regulation and prudential supervision

Throughout 2020, progress continued towards ensuring that ESG criteria are integrated into the policies of companies—specifically their financial and risk departments—so that these criteria can fully permeate their actions and corporate culture. The pandemic seems to have been an accelerator in this area as well. At the global level, the Financial Stability Board (FSB) published its assessment of financial authorities' experience in including physical and transitional climate risks as part of their financial stability monitoring. The Task Force on Climate-related Financial Disclosures (TCFD), created by the FSB, has published a consultation paper to gather feedback on climate-related forward-looking metrics that are useful for financial sector decision-making. The TCFD has also published important documents on sustainability. These include its third status report, which highlights an increase in disclosures by companies in line with TCFD recommendations; guidance on the analysis of climate-related scenarios and on the integration of climate-related risks into existing risk management processes; and guidance on the analysis of climate-related scenarios for non-financial firms.

The EU continues to integrate sustainability into the financial system and to make progress on developing regulations for this purpose. To this end, the European Commission consulted on its renewed sustainable finance strategy, which is expected to be published in early 2021. It has also consulted on a possible initiative on sustainable corporate governance principles. For their part, the Commission, Council and Parliament agreed on a sustainable finance taxonomy using a common classification system applicable from the close of 2021 for adaptation and mitigation objectives. The European supervisory authorities (ESAs) published a consultation paper with a set of standards covering the disclosure of ESG information. The survey is part of EBA's work to develop a draft Implementing Technical Standard (ITS) on the disclosure of prudential information regarding ESG risks. It will also be used to monitor the short-term expectations specified in the EBA Action Plan on Sustainable Finance. The EBA has also published for consultation a document on the management and supervision of ESG risks, which covers a wide range of topics (definition of ESG risks and factors, quantitative and qualitative indicators). Lastly, the ECB published its final guidelines on its supervisory expectations regarding climate change and environmental risks at the end of the year.

Contents of the 2020 Prudential Relevance Report

Article 13 of the CRR establishes that the parent entities of the European Union are subject, based on their consolidated situation, to the disclosure requirements set by Part Eight of CRR.

This report provides the prudential information of BBVA Consolidated Group as of December 31, 2020 which has been prepared in accordance with the precepts contained in Part Eight of the CRR, complying with the guidelines published by EBA and the applicable technical implementation standards.

In addition, the main EBA guidelines that apply as of December 31, 2020 are highlighted below:

- Guidelines on materiality, proprietary information, and confidentiality, and on the frequency of disclosure of information according to Article 432, sections 1 and 2, and Article 433 of Regulation (EU) No. 575/2013 (EBA/GL/2014/14). These guidelines detail the process and the criteria to be followed regarding the principles of materiality, proprietary information, confidentiality and the right to omit information, and provide guidance for entities to assess the need to publish information more frequently than the annual one. These guidelines were adopted by the Executive Commission of the Bank of Spain in February 2015.

- Guidelines on disclosure requirements under Part Eight of Regulation (EU) No. 575/2013 (EBA/GL/2016/11). These guidelines provide guidance in relation to the information that entities must disclose in application of the corresponding articles of the Part Eight and with the presentation of said information. These guidelines were adopted by the Executive Commission of the Bank of Spain in October 2017.

- Guidelines on appropriate remuneration policies under Articles 74, Paragraph 3 and 75, Paragraph 2, of Directive 2013/36/EU and disclosure of information under Article 450 of Regulation (EU) No 575/2013 (EBA/GL/2015/22). These guidelines were adopted by the Executive Commission of the Bank of Spain in July 2016.

- Guidelines amending the EBA/GL/2018/01 guidelines regarding the uniform disclosure of information in accordance with article 473 bis of Regulation (EU) No. 575/2013 (CRR) in relation to transitional provisions to mitigate the impact on capital of the introduction of IFRS 9, to ensure compliance with the quick fix carried out in the CRR in response to the COVID-19 pandemic (EBA/GL/2020/12). These guidelines are applicable from August 11, 2020 until the end of the transitional periods set by articles 468 and 473 bis of the CRR (December 31, 2024 and December 31, 2022, respectively).

Furthermore, with the goal of promoting transparency and as a transition towards the new DPM 3.0 framework defined by the EBA (see 2020 Regulatory Developments), the BBVA Group has decided to bring forward the adaptation of certain templates with standard formats, taking into account the Implementing Technical Standards published in June 2020 concerning reporting and disclosure of public information (EBA/ITS/2020/04). These Implementing Technical Standards entry into force on 28 June 2021 and to date its publication in the Official Journal of the European Union (OJEU) is pending.

In those Implementing Technical Standards, the EBA, as mandated by the European Commission in Article 434a of the CRR2, implements the changes introduced by this regulation, integrating most of the public disclosure requirements that were issued in various guidelines and ITS published to date into a single document. In addition, these guidelines also aim to unify, as far as possible, the public information with the information reported to the Supervisor through integration in regulatory reporting and, in some cases, have involved simplifying standard templates that may contain similar information, maintaining only those templates that contain more complete and relevant information, such as those referring to the asset quality of exposures. Together with the aforementioned ITS, the EBA has also published a mapping tool for informational purposes. This document maps the quantitative data in most of the standard templates required in Pillar 3 with supervisory reporting, which has been taken into account when preparing the data in those templates that apply as of the date of the report. The table below sets out the principal changes and the legislative provisions on which they are based.

| Table 2019 | Description | ITS applicable on 2019 report | Modification | Table 2020 | ITS applicable on 2020 report |

|---|---|---|---|---|---|

| NPL1 | Credit quality of forborne exposures | EBA/GL/2018/10 | Renamed | EU CQ1 | EBA/ITS/2020/04 |

| NPL3 | Credit quality of performing and nonperforming exposures by past due dayso | EBA/GL/2018/10 | Renamed | EU CQ3 | EBA/ITS/2020/04 |

| NPL4 | Performing and non-performing exposures and related provisions | EBA/GL/2018/10 | Renamed | EU CR1 | EBA/ITS/2020/04 |

| NPL9 | Collateral obtainedd obtained by taking possesion and execution processes | EBA/GL/2018/10 | Renamed | EU CQ7 | EBA/ITS/2020/04 |

| - | Credit quality of exposures by geographic region | - | New table | EU CQ4 | - |

| - | Credit quality of loans and advances to nonfinancial corporations by sector of activity | - | New table | EU CQ5 | - |

| EU CR1-A | Credit quality of exposures by exposure class and instrument | EBA/GL/2016/11 | Dropped. Requirement covered by EU CR1 | EU CR1 | Art. 442 g), h) CRR |

| EU CR1-B | Credit quality of exposures by industry or counterparty type | EBA/GL/2016/11 | Dropped. Requirement covered by EU CQ5 | EU CQ5 | EBA/GL/2018/10 |

| EU CR1-C | Credit quality of exposures by geographic | EBA/GL/2016/11 | Dropped. Requirement covered by EU CQ4 | EU CQ4 | EBA/GL/2018/10 |

Annex VI to this report contains the correspondence to the articles of Part Eight of the CRR, which apply on the date of the report, with the different headings of the document (or other public documents) where the required information can be found.

The aforementioned annex, together with the other annexes and the tables of this Report, are included in an editable document in order to facilitate its analysis, following the recommendations of the EBA Guidelines. This document is called “Pillar III 2020 – Tables & Annexes”, which is available in the section of financial reports on the Group's Shareholders and Investors website.

It must be pointed out that the data published in the Prudential Relevance Report (Pillar 3) was prepared in accordance with internal control processes described in the "Standard for the preparation of periodic public information of Banco Bilbao Vizcaya Argentaria, S.A. and BBVA Group". These policies ensure that the information disclosed in Pillar 3 is subject to the internal control framework defined by the Group, as well as adequate internal and external revision (by an independent expert), in compliance with the aforementioned Implementing Technical Standards.

Composition of Capital

Regulatory capital requirements

In this regard, Article 92 of the CRR establishes that credit institutions must maintain the following own funds requirements at all times:

- a) Common Equity Tier 1 capital ratio of 4.5%, calculated as Common Equity Tier 1 capital expressed as a percentage on the total amount of risk-weighted assets.

- b) Tier 1 capital ratio of 6%, calculated as the level of tier capital 1 expressed as a percentage of the total amount of risk-weighted assets.

- c) Total capital ratio of 8%, calculated as the total own funds expressed as a percentage of the total amount of risk-weighted assets.

Notwithstanding the application of the Pillar 1 requirement, CRD IV allows competent authorities to require credit institutions to maintain a level of own funds higher than the requirements of Pillar 1 to cover types of risk other than those already covered by the Pillar 1 requirement (this power of the competent authority is commonly referred to as "Pillar 2").

Furthermore, in accordance with CRD IV, credit institutions must comply with the combined requirement of capital buffers at all times, as of 2016. This additional capital requirement has incorporated five new capital buffers: (i) the capital conservation buffer, (ii) the buffer for global systemically important banks (the "G-SIB" buffer), (iii) the entity-specific countercyclical capital buffer, (iv) the buffer for other systemically important banks ("D-SIB" buffer) and (v) the systemic risk capital buffer. The “combined capital buffer requirement” must be met with Common Equity Tier 1 capital (“CET1”) to cover both minimum capital required by “Pillar 1” and “Pillar 2".

Both the capital conservation buffer and the G-SIB buffer (where appropriate) will apply to credit institutions as it establishes a percentage greater than 0%.

The buffer for global systemically important banks applies to those institutions on the list of global systemically important banks, which is updated annually by the Financial Stability Board (“FSB”). Considering the fact that BBVA has not appeared on the said list since November 2015 (effective January 1, 2017), the G-SIB buffer does not apply to BBVA.

For more details on the quantitative indicators for assessing global systemically important entities, see “Annex V – G-SIB indicators".

The Bank of Spain has extensive discretionary powers as regards the countercyclical capital buffer specific to each bank, the buffer for other systemically important financial institutions (which are those institutions considered to be systemically important domestic financial institutions “D-SIB”) and the buffer against systemic risk (to prevent or avoid systemic or macroprudential risk). The European Central Bank (ECB) has the powers to issue recommendations in this respect following the entry into force on November 4, 2014 of the Single Supervisory Mechanism (SSM).

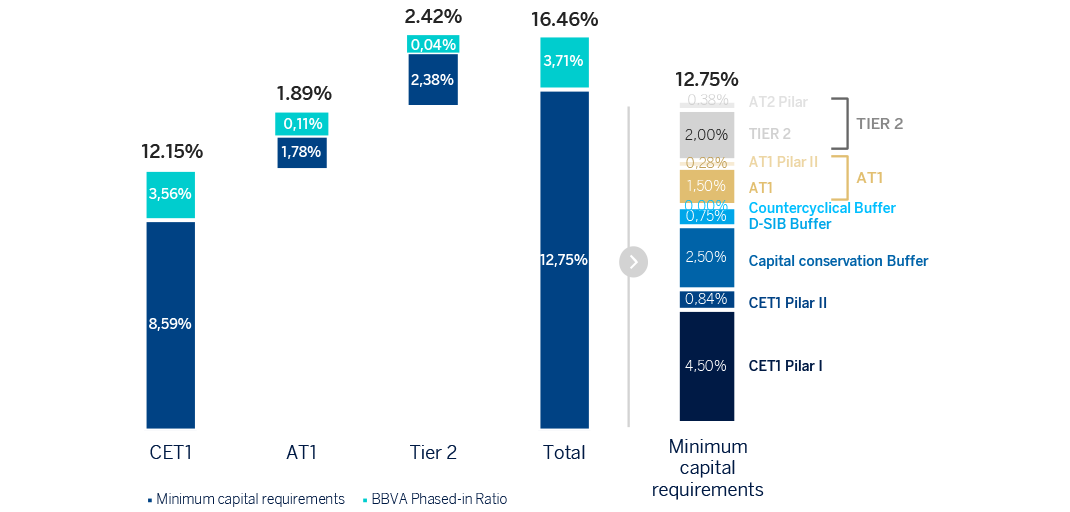

With regard to minimum capital requirements, the ECB, in its announcement on 12 March 2020, has allowed banks to use Additional Tier 1 and Tier 2 capital instruments to comply with the Pillar II (P2R) requirements, which is known as "Pillar 2 tiering." This measure is reinforced by the relaxation of the Countercyclical Capital Buffer (CCyB) announced by various national macroprudential authorities and by other complementary measures published by the ECB. Furthermore, the BBVA Group received its SREP (Supervisory Review and Evaluation Process) results in December 2020. Through this letter, the ECB informed the Group that, as from 1 January 2021, the Pillar 2 requirement would be maintained at 1.5%, to be distributed according to the aforementioned Pillar 2 tiering. All this has resulted in a lower fully-loaded CET1 requirement of 66 basis points for BBVA, whereby said requirement stands at 8.59% and the requirement at the total ratio level stands at 12.75%.

Then, the consolidated overall capital requirement includes: i) the minimum capital requirement of Common Equity Tier 1 (CET1) of Pillar 1 (4.5%); ii) the capital requirement of Additional Tier 1 (AT1) of Pillar 1 (1.5%); iii) the capital requirement of Tier 2 of Pillar 1 (2%); iv) the CET1 requirement of Pillar 2 (0.84%), v) the capital requirement of Additional Tier 1 (AT1) of Pillar 2 (0.28%); vi) the capital requirement of Tier 2 of Pillar 2 (0.38%); vii) the capital conservation buffer (2.5% of CET1); and viii) the capital buffer for Other Systemically Important Institutions (O-SIIs) (0.75% of CET1).

As of 2021, the BBVA Group has set an objective to maintain a fully-loaded CET1 ratio of between 11.5% and 12.0%, increasing the target distance from the minimum requirement (currently 8.59%) to 291–341 basis points. At the end of financial year 2020, the fully-loaded CET1 ratio falls within this target management range (+314 basis points).

CET1 phased-in ratio reach 12.15% which represents +315 basis points over the mínimum requirement of 8.59%.

Capital Requirements and capital ratios (phased-in)

The following table shows the CET1 ratio that would trigger restrictions on capital distribution and the capital ratios as of December 2020.

Capital distribution constraints

| CET1 capital tatio that would trigget capital distribution constraints (%) | Current CET1 capital ratio (%) | |

|---|---|---|

| Minimum CET1 phased-in capital requirement plus Basilea III buffers (excluding capital used in order to meet other minimum capital requirements) | 8.59% | 12.15% |

| CET1 phased-in capital requirement plus Basilea III buffers (including capital used in order to meet other minimum capital requirements) | N/A | N/A |

The Group has not made use of CET1 phased-in capital to meet other minimum capital requirements other than the CET1 minimum capital requirements plus Basel III capital buffers.

Leverage ratio

In order to provide the financial system with a metric that serves as a backstop to capital levels, irrespective of the credit risk, a measure complementing all the other capital indicators has been incorporated into Basel III and transposed to the solvency regulations. This measure, the leverage ratio, can be used to estimate the percentage of assets and off-balance sheet items financed with Tier 1 capital.

Although the book value of the assets used in this ratio is adjusted to reflect the bank's current or potential leverage with a given balance sheet position, the leverage ratio is intended to be an objective measure that may be reconciled with the financial statements.

As of December 31, 2020, the Group had a leverage ratio (fully loaded) of 6.49% and a phased-in ratio of 6.69%, above the minimum required ratio of 3% and continuing to compare very favorably with the rest of the peer group. This ratio does not include the impact of the sale of BBVA USA, which, according to the current estimate and taking December 2020 as a reference, would place the leverage ratio at 7.74%.