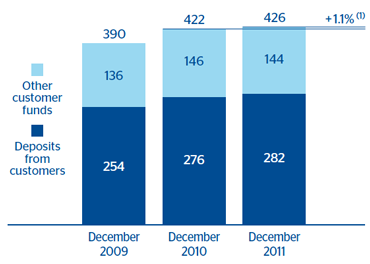

Total customer funds amounted to €426 billion at the close of December 2011, with a slight increase of 1.1% over the year.

On-balance-sheet customer funds totaled €282 billion, a year-on-year increase of 2.3% (up 2.9% at constant exchange rates). By categories, within the domestic sector, there was a notable increase in lower-cost deposits, such as current and savings accounts, which were up 2.3% year-on-year. Time deposits remained stable, thanks to the high percentage of renewals of deposits gathered in 2010. These renewals were made at a significantly lower cost. However, over the quarter time deposits fell 4.1% as a result of the sale of €3,711m promissory notes by the retail network in Spain. These promissory notes are included in the debt certificates heading. Finally, the lowest-cost customer funds in the non-domestic sector, i.e. current and savings accounts, increased notably.

Off-balance sheet customer funds amounted to €144 billion as of 31-Dec-2011, 1.3% down on the figure for the same date last year, but up 5.1% on the close of the previous quarter. Of these funds, 35% (€50 billion) are located in Spain, a year-on-year fall of 4.0%, although the figure is practically the same as at the close of the third quarter. This can largely be explained by the reduction in the value of the assets under management, mainly in mutual funds (down 12.2% year-on-year), and by customer preference for other savings products such as time deposits and promissory notes. It is worth pointing out that according to the latest data from October 2011, the effect of this fall in BBVA is much less significant than in the rest of the system, given the more conservative profile of its mutual funds. Pension funds totaled €17 billion (up 2.5% year-on-year and 2.9% quarter-on-quarter). BBVA has maintained its position as the leading pension fund manager in Spain, with a market share of 18.7% (September 2011 data, the latest available).

In the rest of the world, off-balance-sheet customer funds totaled €94 billion, with a year-on-year increase of 0.2% at current exchange rates. These were also affected by the fall in the value of assets under management.