Pressure on the markets in the fourth quarter of 2011 had a notable impact on fixed-income and the European financial sector. One feature of this period has been that the focus of the investment community has moved beyond the intervened countries and those in the south of Europe, such as Spain and Italy, to Belgium or France.

In this context, equity markets were in general more stable than in the previous quarter. The Ibex 35 closed practically flat (+0.2%), while the Stoxx 50 gained 9.7%. The US market performed better than the European, with the S&P 500 index recovering 11.2%, boosted by expectations of an improvement in US macroeconomic indicators.

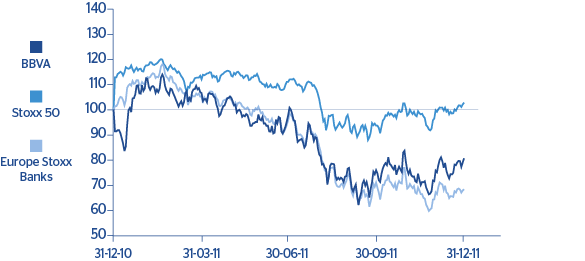

The European banking sector continued to be affected by uncertainty regarding the resolution of the crisis. High sovereign risk premiums kept capital markets effectively closed, thus making bank funding difficult. In this environment, the Euro Stoxx Banks index lost 4.7%, while Stoxx Banks closed practically flat. BBVA was one of the best stock-market performers among European banks, and recovered 8.1% on the close of the previous quarter. The market has valued BBVA’s comfortable liquidity position and the advantages of a retail model that is less dependent on wholesale funding.

BBVA’s results for the third quarter of 2011 were received positively by analysts, who stressed the factors that set the Bank apart from its peers: above all, the potential of its international businesses, its capacity to generate capital organically and thus the Group’s high levels of solvency. The figures for the net interest income were very positively valued. This is particularly true for the emerging markets, where there was a notable growth in business volume. In Spain, the consistently robust indicators of credit quality were also positively valued. The analysts once more highlighted the strength of results in South America and Mexico.

The BBVA share was up 8.1% in the quarter, closing at €6.68 per share, resulting in a market capitalization of €32,753m. The price/book value stood at 0.8 the P/E (calculated on the attributable profit for the Group in 2011) at 10.9, and the dividend yield (calculated according to the average dividends per share estimated by the analysts for 2011 and the share price as of December 30) at 6.3%. BBVA’s share price increased far above the Ibex 35 index and was also clearly better than the figures for the sector in the euro zone. In summary, in the current environment of tension and macroeconomic weakness, the market has once more valued the Group’s sound capital position and its recurring earnings.

The average daily trading volume in the fourth quarter was 47 million shares, with an average value of €283m.

With respect to shareholder remuneration, payment of an interim dividend for 2011 was announced on December 20, at €0.10 per share. This implies an increase of 11% on the same payment last year. The amount was paid on January 10, 2012. Additionally, the Board of Directors approved the exchange of preference shares for Mandatory Subordinated Bonds convertible into newly issued ordinary shares of BBVA, for a maximum amount of €3,475m. There has been a very positive take-up on the offer, at 98.7% of investors holding preference shares, making the operation a big success. These subordinated bonds will be considered as core capital under the EBA rules.