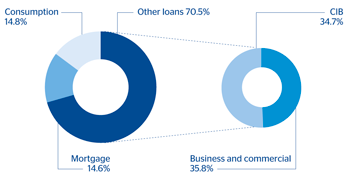

At the close of June, the volume of performing loans in the area amounted to €29,374m, a year-on-year decline of 11.6% and a quarterly fall of 1.2%. As mentioned at the start of this chapter, this decline is highly conditioned by the limited level of development of the wholesale banking business in the region and the negative impact of the depreciation in the Turkish lira over recent months (down 9.4% year-on-year and 7.9% quarter-on-quarter). This has reduced the positive impact of the performance of lending in Garanti, particularly related to the retail sector.

In fact, excluding the negative exchange-rate effect, Garanti has increased its lending activity in liras by 9.8% over the quarter (compared with a figure of 8.8% for the sector) and 17.3% since 31-Dec-2012 (compared with 14.9% in the sector). As we have just mentioned, this progress is mainly due to retail products such as mortgages (up 10.2% in the quarter), credit cards (up 8.9% in the quarter) and personal or general-purpose loans (up 7.6%).

Moreover, the increase is not leading to a worsening in the area’s risk indicators, which as of 30-Jun-2013 remain at levels similar to those at the close of the previous quarter, with an NPA ratio of 3.0% and a coverage ratio of 88%. In Garanti, the NPA ratio is only 1.9% (down from the 2.3% at the close of March) due to the lower volume of gross additions to NPA, the good level of recoveries and the effect of the sale of a NPL portfolio.

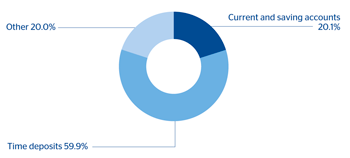

Customer deposits under management amounted to €16,510m at the close of June, a decline of 13.9% on the same date in 2012 and 8.0% since 31-Mar-2013. As in the case of loans, this decline has been influenced significantly by the depreciation of the Turkish lira in recent months. Excluding the exchange-rate effect, deposits in liras in Garanti increased by 7.1% on the close of March, above the figure for the rest of the sector, and by 19.5% since 31-Dec-2012 (up 7.5% in the sector as a whole). Lastly, it is worth highlighting that Garanti’s sources of funding remain diversified between deposits, repos and issuance.

Eurasia. Performing loans breakdown(June 2013) |

Eurasia. Deposits from customers breakdown(June 2013) |

|---|---|

|

|

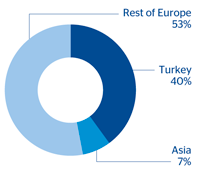

Eurasia. Lending breakdown by geography(30-06-13) |

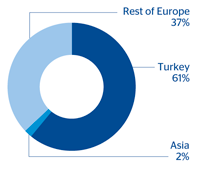

Eurasia. On-balance sheet customer funds breakdown by geography(30-06-13) |

|---|---|

|

|