At the close of the first half of 2013, South America continues to show a high rate of year-on-year growth in its volume of business, both in terms of its loan book and above all in customer funds.

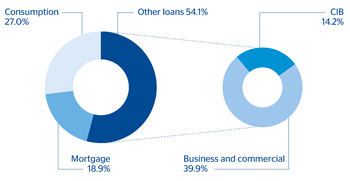

Performing loans as of 30-Jun-2013 amounted to €45,929m, a rise of 17.3% on the figure posted the same date last year. Once more, lending to the retail segment performed outstandingly well, particularly consumer finance (up 24.1%), credit cards (up 37.1%) and to a lesser extent, mortgage lending (up 16.7%).

As lending activity has grown, the strict risk admission policies in place have maintained the main risk indicators practically unchanged: at the close of June the NPA ratio stood at 2.2% and the coverage ratio at 136%.

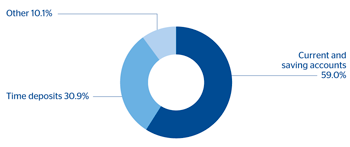

Customer deposits under management, which closed in June 2013 at €55,560m, picked up their year-on-year rate of growth in the second quarter to 28.9%, so the liquidity gap in the area improved in the period. Current and savings accounts posted the biggest rise (up 37.5%) and a gain in market share of 33 basis points in the last 12 months, according to the data available at the close of April 2013. After including mutual funds under management by banks in the region, total customer funds amounted to €58,592m.

The highlights of banking activity by country are as follows:

- In Argentina the loan book has performed outstandingly, with a rise of 28.1% on the figure for June 2012, thanks to the notable rise in consumer finance (up 12.1%) and credit cards (up 42.8%), with a year-on-year gain in market share for these two items of 17 basis points, according to the latest available information for April. On-balance-sheet customer funds grew by 22.7%, with good performance of both current and savings accounts and time deposits.

- Chile has posted moderate increases in lending, with a year-on-year growth of 7.6%. By portfolios, consumer finance, credit cards and mortgage loans continue to grow at rates above the market average, with a year-on-year gain in market share of 5 basis points in consumer finance and credit cards and 39 basis points in mortgage lending. On-balance-sheet customer funds have increased by 14.2%, boosted by current and savings accounts, which grew by 19.8% and gained 67 basis points in market share since April 2012.

- Activity in Colombia remains very strong, with a 16.7% year-on-year rate of growth in lending and 37.3% in deposits. There was also a positive performance of consumer finance and credit cards (up 23.7%) and current and savings accounts (up 36.6%), with gains in market share since April 2012 of 105 and 117 basis points respectively.

- In Peru, lending has grown by 14.1% during the same period thanks to the positive performance of residential mortgages (up 22.2%) and consumer finance plus credit cards (up 8.0%), in this latter case above the average for the system. As a result, the market share over the last 12 months increased by 46 basis points. On-balance-sheet customer funds performed well (up 15.6%), above all those of lower-cost (current and savings accounts), with year-on-year rises of 10.6% and a gain of 27 basis points in market share.

- Lastly, activity in Venezuela is still as strong as at the start of 2013. This is reflected in a year-on-year rise of 43.6% in the loan book, focused mainly on consumer finance (up 45.0%) and credit cards (up 67.4%). On-balance-sheet customer funds have grown at 64.9%, faster than lending, thanks to the boost from current and savings accounts.

South America. Performing loans breakdown(June 2013) |

South America. Deposits from customers breakdown(June 2013) |

|---|---|

|

|