In the second quarter of 2012, the difficult economic situation in some countries in the euro zone continued to weigh on stock markets.

Up 3.7%, the BBVA share outperformed the Ibex 35 index (down 11.3%) between April and June.

| Share performance ratios | |

|---|---|

| P/E (Price/earnings ratio; times) | 8,9 |

| Dividend yield (Dividend/price; %) | 7,5 |

| The BBVA share | |

|---|---|

| Number of shareholders: | 1.044.129 |

| Market capitalization (million euros): | 30.296 |

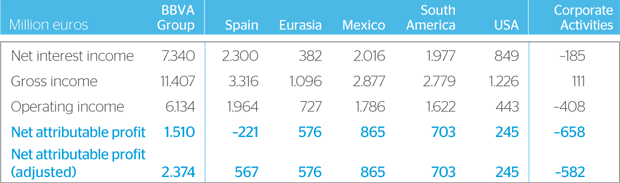

In the first six-month period of the year, operating income was €6,134m, up 9.8% year-on-year.

Revenue continues to grow strongly and generate profits.

Excellent solvency, liquidity and efficiency figures for the first half of the year.

|

Called-up share capital:

|

||

EBA Ratio 9,2% |

EBA since Sep. 2011 up €6.9bn |

Δ Called-up share capital 1H12 up 50 bp |

Liquidity: |

Improvement of internal ratios |

Risks: |

|

NPA ratio 4% |

Coverage ratio up 5 pp |

Efficiency: |

Efficiency ratio 46.2% |

Income statement by business area

Launch of BBVA Suma, a digital collective funding platform for donations to emerging economies and solidarity causes.

BBVA Sustainability Indices.