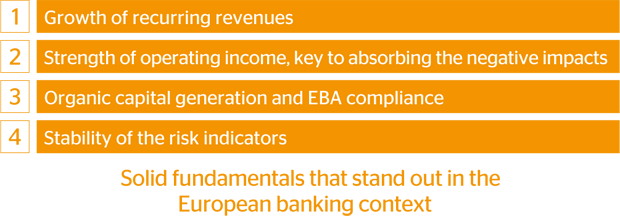

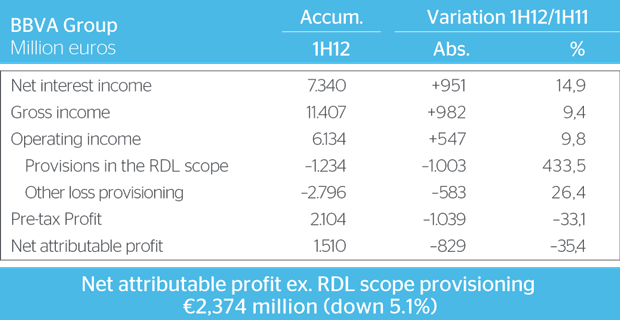

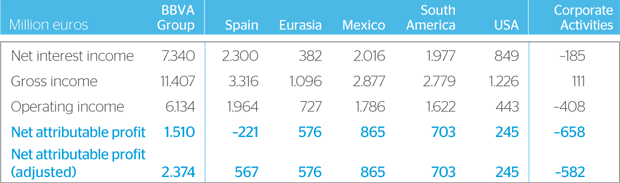

BBVA earned €1,510m in the first half of the year, 35.4% less than the previous year, due in large part to the impact of the financial reform undertaken in Spain affecting real estate portfolios and assets.As of June, and in line with international accounting criteria, BBVA has provisioned €1,434m of the quantified needs according to the new regulations. Not considering the provisions made in the scope of the new regulation, the net attributable profit reached €2,374m (down 5.1%).

BBVA revenue continues to grow strongly and generate profits. In June, the net interest income reached €7,340, up 14.9% on the previous year, as a result of a balanced diversification between emerging markets (56% of the Group's net interest income) and developed markets (44%).

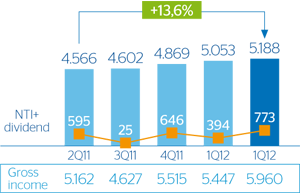

The more recurring income (gross income excluding net trading income (NTI) and dividends) stood at €5,188m in the quarter, up 13.6% year-on-year, and grew faster than expenses. This resulted in improved efficiency (ratio at 46.2%).

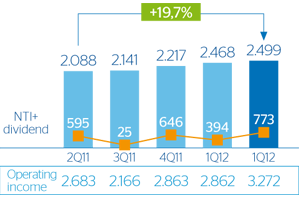

The recurring operating income, excluding NTI and dividends, grew in the quarter to reach €2,499m, up 19.7% year-on-year. In the first six-month period of the year, operating income was €6,134m, up 9.8% year-on-year.

Spain: This business area offset the weak banking activity and adverse environment through adequate price management. The NPA ratio stood at 5.1%, with a higher coverage ratio (50%). The net attributable profit was negative (down €221 million) as a result of the provisions related to the financial reform. Excluding these provisions, the net attributable profit was €567m.

Eurasia: The contributions of the Turkish bank Garanti and the Chinese CNCB boosted the net attributable profit 28.9% to €576m.

Mexico: In the last year, BBVA Bancomer attracted two million new customers. The leader of the Mexican financial sector achieved record quarterly earnings. It posted a net attributable profit of €865m, up 2.4% at constant exchange rates.

South America: This area earned €703m (up 24.8% at constant exchange rates) thanks to the strength of business (up 23.7% in investment and funds) and earnings. The region also presented improved efficiency and the best risk indicators for the entire BBVA Group.

United States: The net attributable profit of the U.S. franchise amounted to €245m (up 24.2% at constant exchange rates), with an improvement in risk indicators.

In terms of solvency, BBVA continues to comply with the capital recommendations of the European Banking Authority (EBA). It closed the quarter with 9.2% of core capital according to EBA criteria, or 10.8% under Basel II.

In terms of credit needs, BBVA enjoys a sound liquidity position, with the 2012 and 2013 debt maturities covered and extensive collateral available to absorb potential shocks in the markets.

For the tenth quarter in a row, BBVA presented excellent stability in terms of risks, unlike the Spanish banking sector as a whole. The NPA ratio remained at 4%, with a higher coverage ratio (66%) due to the greater provisions made.

BBVA has allocated €1,434m to provisions stipulated in the financial reform (RDL 2/2012 and RDL 18/2012), nearly a third of the total needed (€4,637m).

Rating agencies have downgraded Spanish sovereign debt, which has resulted in actions in the Spanish banking sector with downgrades of debt ratings.