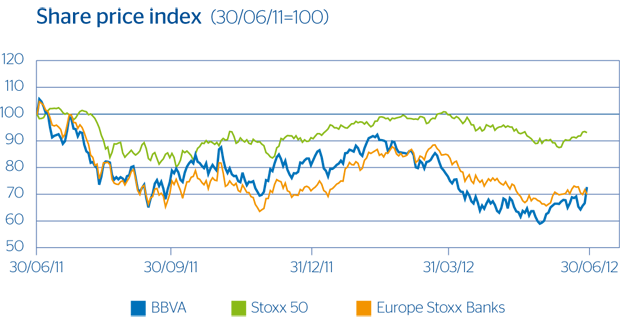

In the second quarter of 2012, the difficult economic situation in some countries in the euro zone continued to weigh on stock markets. The risk premium for the 10-year Spanish sovereign bond reached all-time highs in the quarter and shares in the European banking sector continued to hit record price lows (Stoxx Banks down 11.1% in the quarter, compared with a fall of 3.2% for Stoxx 50).

Although the BBVA Group was punished severely by the markets due to the sovereign risk situation in 2011 and the first quarter of 2012, it outperformed the sector in the second quarter. The market recognizes its differential strength, and the BBVA share only lost 3.7% between April and June, outperforming the Ibex 35 (down 11.3%). The share is listed at a price/book value ratio of 0.7, a P/E of 8.9 (calculated on the average profit for 2012 estimated by the consensus of Bloomberg analysts) and a dividend yield of 7.5% (also calculated according to the average dividend per share estimated by analysts for 2012 compared with the share price as of June 29, 2012).

The payment of an interim dividend of €0.10 per share against 2012 results was announced on June 27, and paid out in July 10. The fact that the dividend amount is the same as that of the previous year has sent a clear message of confidence from the Bank’s management team, despite the difficult environment.