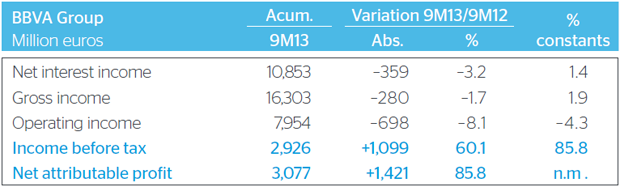

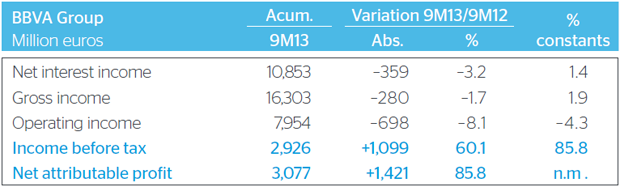

BBVA earned €3,077 million in the first nine months of the year (up 85.8% year-on-year) thanks to strong revenue and the sale of non-strategic assets.

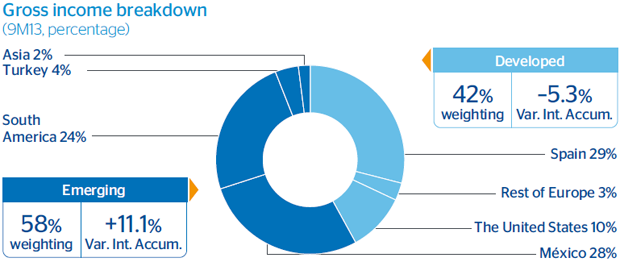

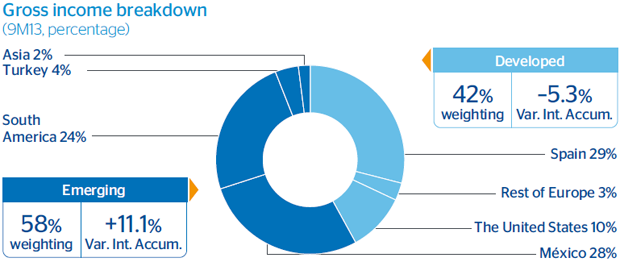

The income statement shows the sustainability of revenue, with over €5,000 million each quarter, despite the difficult environment. BBVA's diversified model and the strong activity in emerging markets (Mexico, South America and Turkey), which contributed 58% of the gross income generated by the BBVA business areas, strengthened the Group's margins.

Geographical diversification

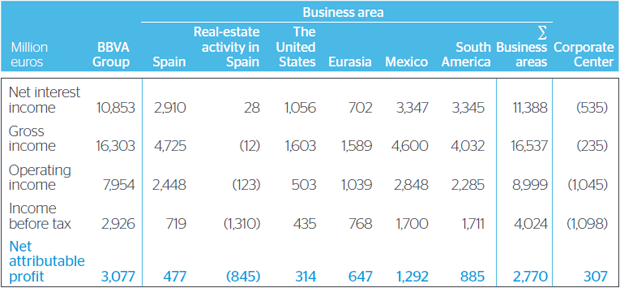

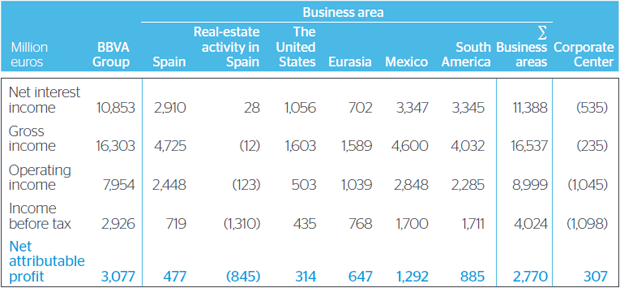

Spain: Revenue was affected by the elimination of the floor clauses. BBVA increased its market share in both lending (70 bp) and deposits (105 bp). The NPA ratio stands at 6.2% and the coverage ratio at 41%, following the reclassification of refinanced loans.

Real-estate activity in Spain: Property sales grew at a good rate, with 9,747 units sold as of September, while net exposure to the developer sector continued to decline (down 17.9% since December 2011). Net attributable profit to September was a negative €845 million, compared with a negative €2,715 million one year earlier.

Main items on the income statement by business area (1H13)

United States: Increase in activity, with margins affected by low interest rates and lower income from fees and commissions. The NPA ratio stands at 1.5% and the coverage ratio at 120%. United States earned €314 million (up 1.8% at constant rates).

Eurasia: Turkey has consolidated its position as a driver of growth thanks to the boost provided by Garanti, the leading bank in this market. The area posted a cumulative net attributable profit of €647 million (down 20%), due partly to the devaluation of the Turkish lira and the lower contribution from the Chinese bank CNCB as a result of the higher provisions required by local regulations.

Mexico: Strong growth in both lending (up 9.9%) and customer funds (up 8%). Gross income grew 6.4% year-on-year. The NPA ratio remains at 4.1%, with a coverage ratio of 105%. The area earned €1,292 million (3.7% at constant exchange rates).

South America: Two-digit growth in lending (16.7%) and customer funds (26%). Gross income grew more than 20%. The NPA ratio remains at 2.2%, with a coverage ratio of 137%. Net attributable profit totals €855 million, up 12.8% in constant euros on the same period the previous year.

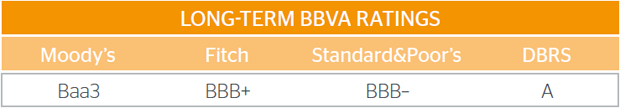

Solvency and liquidity

The BBVA Group continues to strengthen its solvency. The core capital ratio increased to 11.4% according to current Basel standards. Organic capital generation, around 19 bp, decreased due in part to the unfavorable effect of exchange rates.

The ratio does not include the impact of the sales of the pension business in Chile, the 5.1% stake in China CITIC Bank Corporation Limited and the franchise in Panama. The effect on the fully-loaded Basel III ratio represents an increase of approximately one percentage point.

BBVA's proactive policy in managing its liquidity and proven ability to access the markets, even in difficult environments. BBVA improved its liquidity structure, with a gap reduction of €22,000 million to September 2013.

This quarter, BBVA reclassified as doubtful loans €3,864 million in refinanced loans in Spain. This has led to an additional provision of €600 million in the third quarter. The Group's NPA ratio, excluding the real estate business in Spain, stands at 4.6%, and that for the banking business in Spain is 6.2%. 41% of the balance of those non-performing loans in the banking business in Spain are up-to-date with their payments.