Shareholders, trading and share price

The main trends seen in the global economy in previous quarters have consolidated: Recovery of the U.S. economy, beginning of the gradual withdrawal of monetary stimuli by the Federal Reserve (Fed) and policy rate cut by the European Central Bank. The improvement of the macroeconomic fundamentals of emerging markets is worth noting.

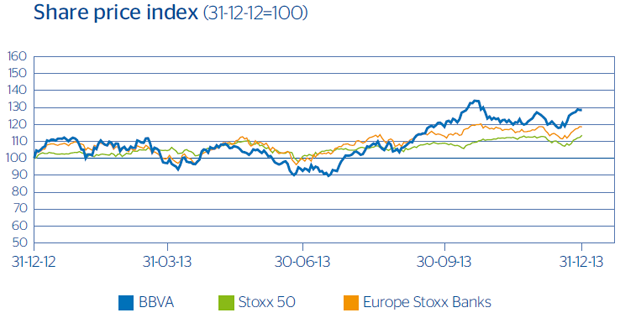

In the financial markets, the general European index, the Stoxx 50, rose 5.2% in quarterly terms at the close of December, while the Ibex 35 and the Eurozone banking index (Euro Stoxx Banks) were up 8.0% and 12.4%, respectively.

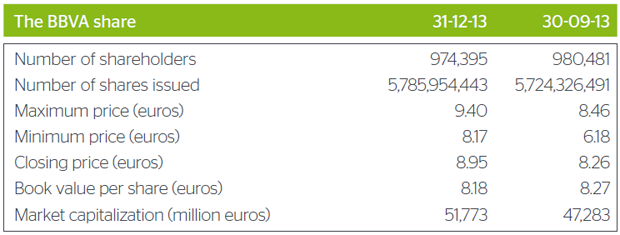

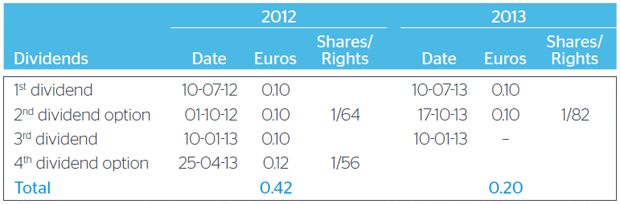

Most analysts continue to rate BBVA as the best investment option for making the most of the opportunities arising from the imminent economic recovery in Spain. At the close of December, the share price had risen 8.3% in quarterly terms, while the accumulated increase since the end of 2012 was 28.6% to €8.95 per share. This price is equivalent to a market capitalization of €51,773 million and represents a price/book value of 1.1, a P/E (calculated on the BBVA Group's net attributable profit for 2013) of 23.2 and a dividend yield (obtained from the new shareholder remuneration policy announced by BBVA on 10-25-2013) of 4.1%.