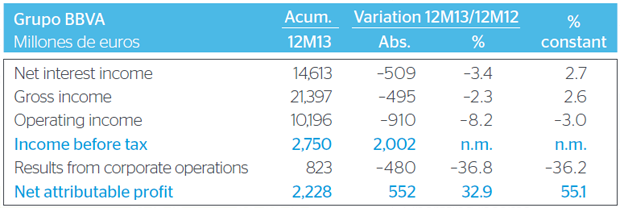

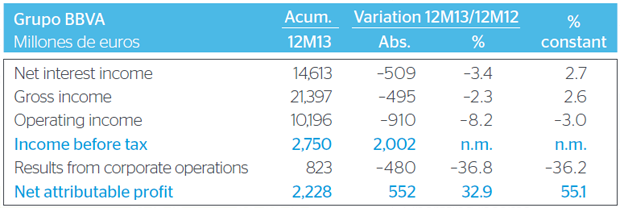

BBVA closed 2013 with very sound earnings, despite the complex environment. The Group's geographical diversification and the positive business dynamics drove the income statement. Net attributable profit was up 32.9% on the previous year to €2,228 million.

The more recurring revenue (net interest income plus fees and commissions) amounted to €19,044 million, up 3.5% year-on-year not taking into account foreign currency fluctuations (down 2.2% at current exchange rates).

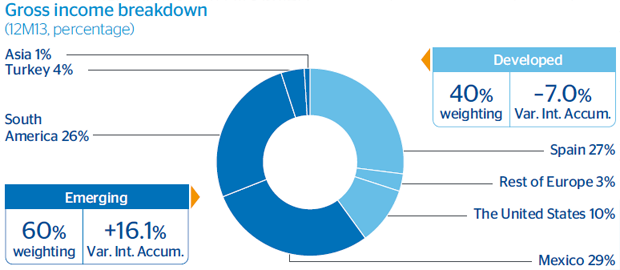

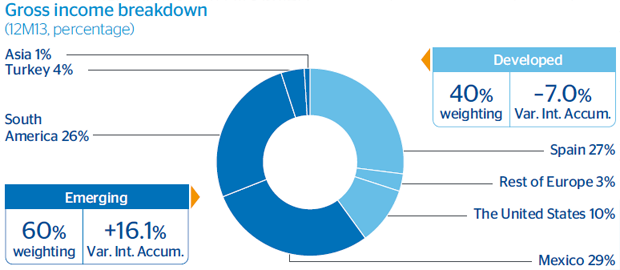

Geographical diversification

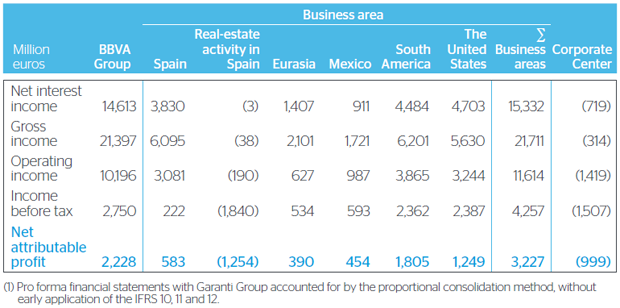

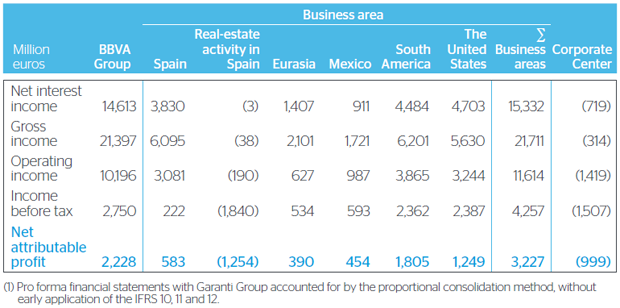

Spain: Revenue was affected by the elimination of floor clauses and the exceptional contribution to the Deposit Guarantee Fund. BBVA increased its market share in both lending and deposits. The NPA ratio stood at 6.4% and the coverage ratio at 41%, following the classification of refinanced loans.

Real-estate activity in Spain: Net exposure to the sector continued to decline (down 19.1% since December 2011) and the pace of property sales gathered speed. Over the year as a whole, 14,390 units were sold (up 43.2%), in addition to the 6,993 operations completed on behalf of third parties.

Main items on the income statement by business area (2013)

United States: Strong activity, despite the environment of low interest rates. BBVA Compass posted increases in both lending (up 12.8%) and customer deposits (up 4.0%). Exceptional asset quality (1.2% NPA ratio and 134% coverage ratio). It earned €390 million, 8.8% less than in 2012 at constant exchange rates.

Eurasia: The Turkish bank Garanti performed well in both revenue generation and credit quality. In China, BBVA signed an agreement with the CITIC Group that includes the sale of 5.1% of its stake in China CITIC Bank (CNCB). The area reported net attributable profit of €454 million (up 20.7% at constant exchange rates).

Mexico: Strong business activity, in both lending and customer deposits, reflected in all its margins. Risk indicators have improved to 3.6% NPA ratio and 110% coverage ratio. This franchise generated a net attributable profit of €1.805 million (up 7.2% in constant euros).

South America: The extremely strong business activity led to double-digit growth in revenue. Gross income was up 25.3% and net operating income 27.0%, in constant euros. The NPA ratio was 2.1% and the coverage ratio 141%. The sale of BBVA Panama and of AFP Provida in Chile was closed. The net attributable profit was €1.249 million, up 22.6% on the previous year in constant euros.

Solvency and liquidity

BBVA's solvency continues to improve. Core capital, according to Basel II, increased by 82 basis points over the year to 11.6%. In addition, the fully-loaded core capital ratio according to Basel III, which assumes all the future impacts of the regulation, stood at 9.8%, well above the minimum regulatory levels.

The Group's liquidity and the commercial gap improved once again, especially on the euro balance sheet, whose gap was reduced by €11 billion over the last 3 months (€3 billion over the year). The increased proportion of retail deposits continued to allow the Group to strengthen its liquidity position and to improve its funding structure.

Risk indicators tend to stabilize. Excluding the real-estate activity in Spain, the BBVA Group's NPA ratio stood at 4.6%, with a coverage ratio of 59%. The improvement in gross additions to NPA has been confirmed. Non-performing balances were down in Spain in the fourth quarter.

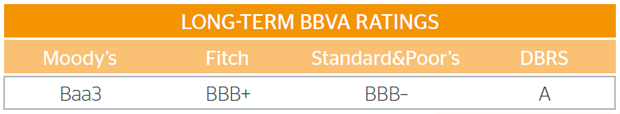

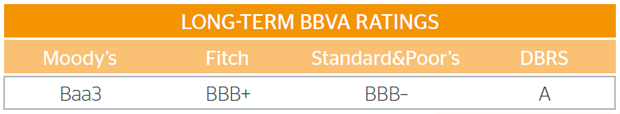

Credit rating agencies

Highlights of the quarter