From the point of view of the markets, the quarter started with a positive general mood and a drastic reduction in the perception of risks for the euro zone.

The general European Stoxx 50 index closed March with a quarterly gain of 4.7%. In contrast, the Ibex 35 and the euro zone banking index, Euro Stoxx Banks, closed down for the quarter.

The BBVA share gained more than 12.0% at the start of 2013 on the close of 2012, but following the recent events in Cyprus, finally closed the quarter at €6.76.

| Share performance ratios | |

|---|---|

| P/E (Price/earnings ratio; times) | 8.7 |

| Dividend yield (Dividend/price; %) | 6.2 |

| The BBVA share | |

|---|---|

| Number of shareholders: | 990,113 |

| Market capitalization (million euros): | 36,851 |

BBVA pays a dividend of €0.121 per share in April 2013 using the "dividend option" formula.

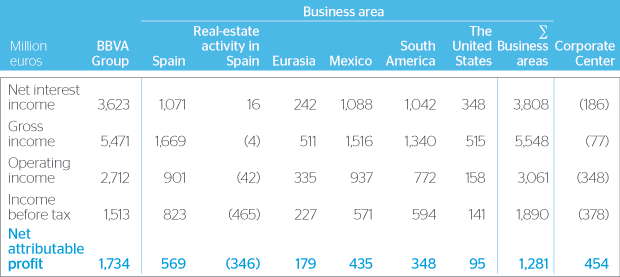

BBVA had a net attributable profit of €1,734m in the first three months of 2013, 72.6%up on the same period in 2012. The keys were strong, resilient revenue and the divestment of non-strategic assets, such as the life insurance portfolio in Spain and the pension business in Mexico.

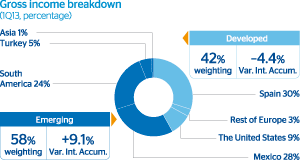

Gross income remained high, with emerging markets acting as the driver of growth.

Capital: |

BIS II Ratio

11.2% |

BIS II ratio increase

+ 42 b. p. |

Liquidity: |

Active liquidity management |

Risks: |

NPA ratio 5.3% |

Coverage ratio 71% |

|

Efficiency: |

Efficiency ratio 50.4% |

Income statement by business area.

BBVA holds its Annual General Meeting on March 15, with the approval of all the items on the agenda and a voting attendance of 66.5%.

BBVA allocates €60m to new social programs, including the “Yo Soy Empleo” (I'm Employment) plan and the “Tu solidaridad vale el doble” (Your solidarity is worth double) initiative.

BBVA Sustainability Indices.