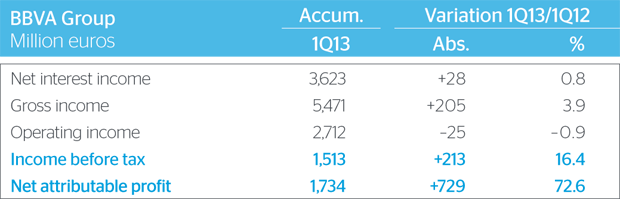

The BBVA Group's net attributable profit stood at €1,734 million in the first quarter of 2013. This figure exceeded the net attributable profit for the entire year 2012 and was 72.6% higher than the figure registered between January and March 2012.

The income statement shows the resilience and strength of revenue, despite the difficult economic environment after five years of financial crisis. The capital gains from the sale of non-strategic assets in Spain and Mexico also contributed to earnings.

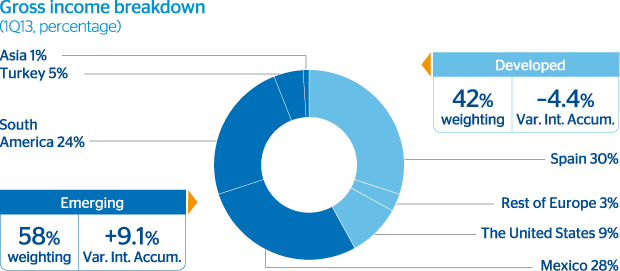

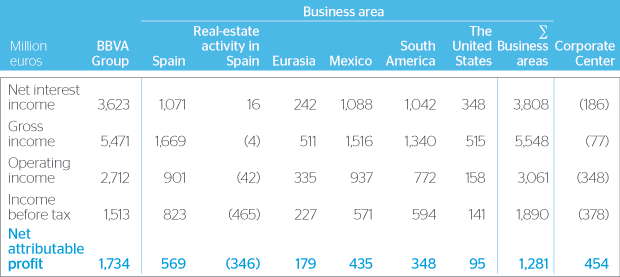

Spain: Banking activity in Spain continues to be affected by the process of deleveraging in the economy, the sector's restructuring and pressure on margins. In customer funds, BBVA won 184 basis points in loan market share. The NPA ratio, excluding the real estate sector, was 4.3%, with a 50% coverage ratio. Net attributable profit in Spain was €569 million, up 53.9% in year-on-year terms.

Real-estate business in Spain: The net real-estate exposure of the BBVA Group, according to Bank of Spain data, continued to fall to €15,404 million, including foreclosed real-estate assets and loans to developers. Since December 2011, BBVA's real-estate exposure has declined by 14.5%.

Eurasia: Turkey continued to drive growth in the area. Gross income totaled €511 million, 4.5% less than the previous year, while the net attributable profit was down 40.2% to €179 million. The reduced contribution from the Chinese bank CNCB, due to regulatory requirements, explains this decline.

Mexico: Strong rate of growth in business activity in both the loan book (up 7.1%) and in customer funds (up 6.2%). All revenue lines grew between 5% and 6%. Risk indicators remained stable: the NPA ratio dropped one decimal point to 3.7% while the coverage ratio increased to 117%. Net attributable profit in Mexico stood at €435 million, down 0.7% in constant euros on March 2012.

South America: Double-digit growth in the loan book (up 15.3%) and customer funds (up 23.9%). Margins also grew at very high rates, above 14%. Asset quality was once again excellent, with an NPA ratio of 2.2% and a coverage ratio of 143%. Net attributable profit totaled €348 million, down 1.3% in constant euros on the same period last year.

United States: The loan book in BBVA Compass increased 8.4% and customer funds were up 10.6%. The risk indicators improved in the business area, with the NPA ratio down to 1.8% and the coverage ratio at 109%, 34 percentage points higher than the figure for the previous year. United States earned €95 million, down 12.3% year-on-year in constant euros.

The BBVA Group's solvency continues to strengthen. The highest-quality capital increased by 42 basis points to a core capital ratio of 11.2% under Basel II. This improvement has to do with the sale of the pensions business in Mexico last January and the organic generation of capital arising from the bank's business.

BBVA took advantage of the first months of the year to optimally manage its liquidity structure. It placed €4,500 million in debt issues on several markets and reduced the liquidity gap by more than €9,000 million on the euro balance sheet.

The BBVA Group's NPA ratio increased two decimal points to 5.3% between December and March, with a coverage ratio of 71%, 11 percentage points more than the figure for the previous year. This negative performance, in line with forecasts, was due primarily to the increase in non-performing loans in the business segment in Spain.